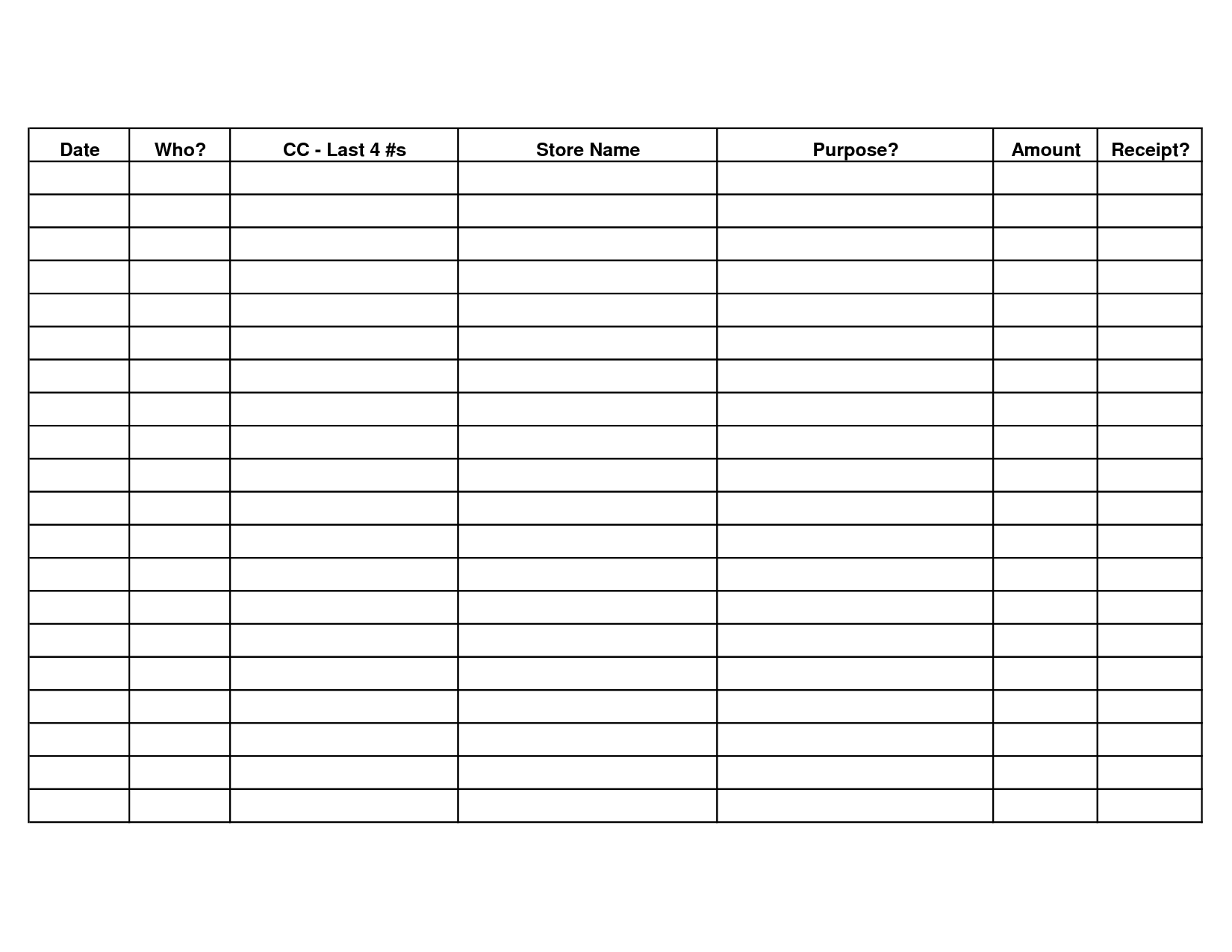

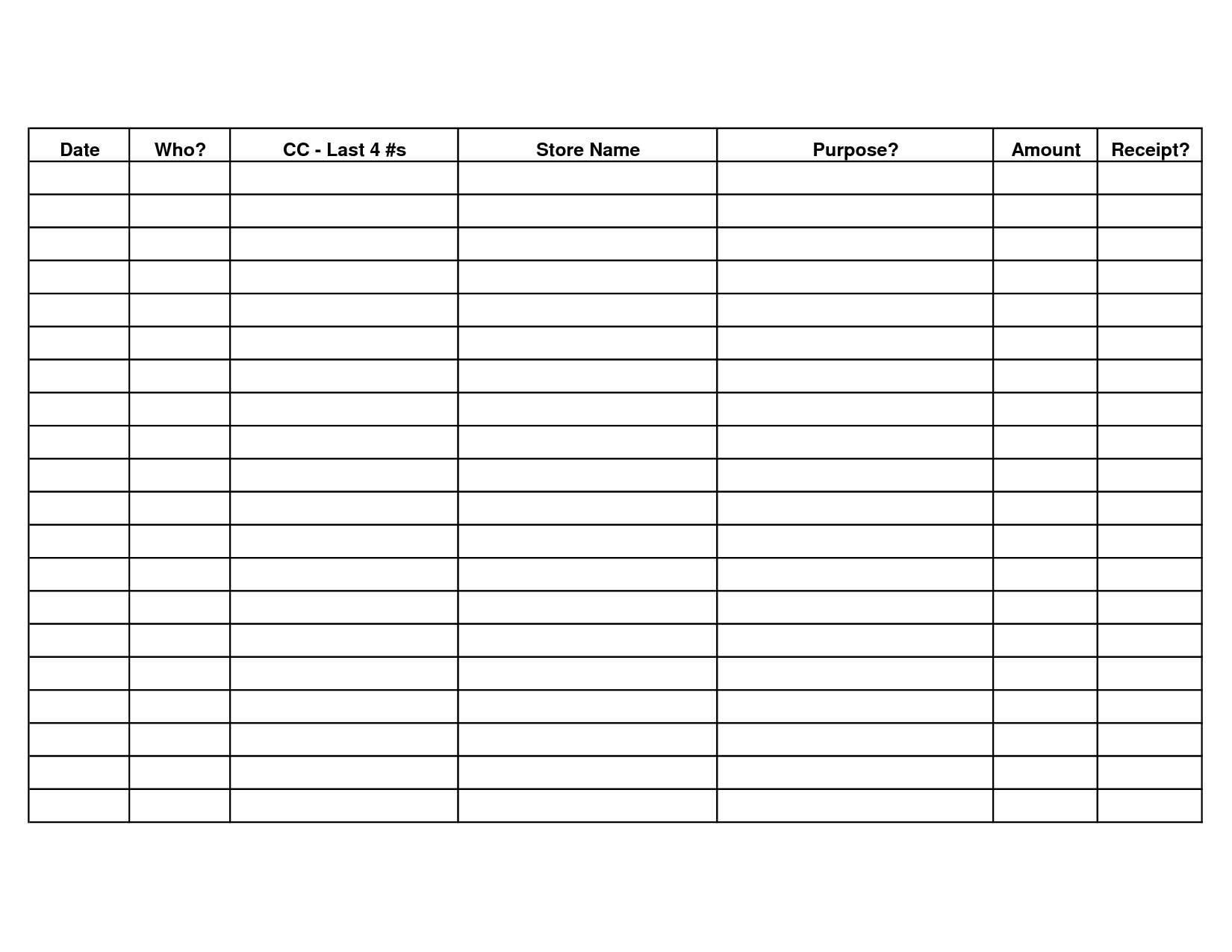

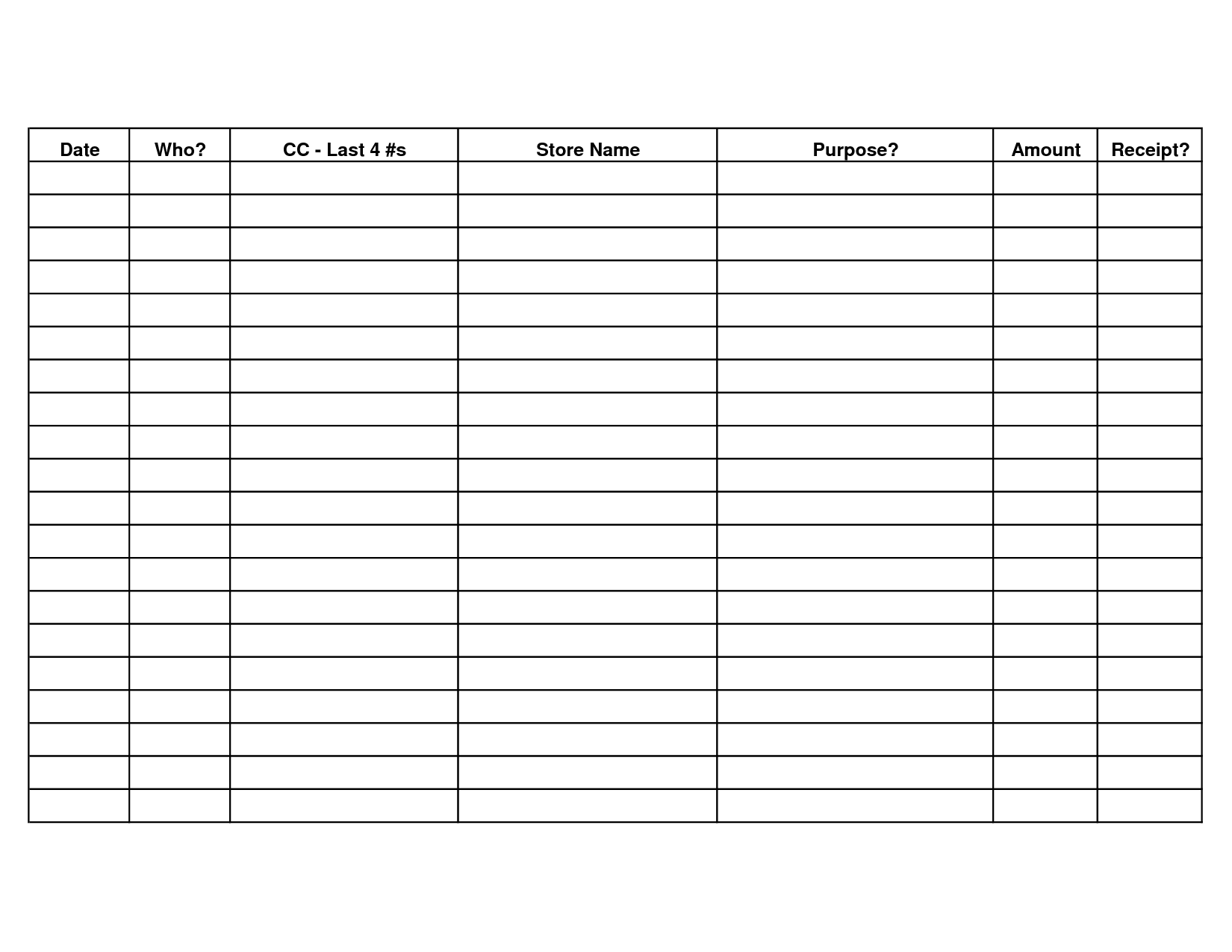

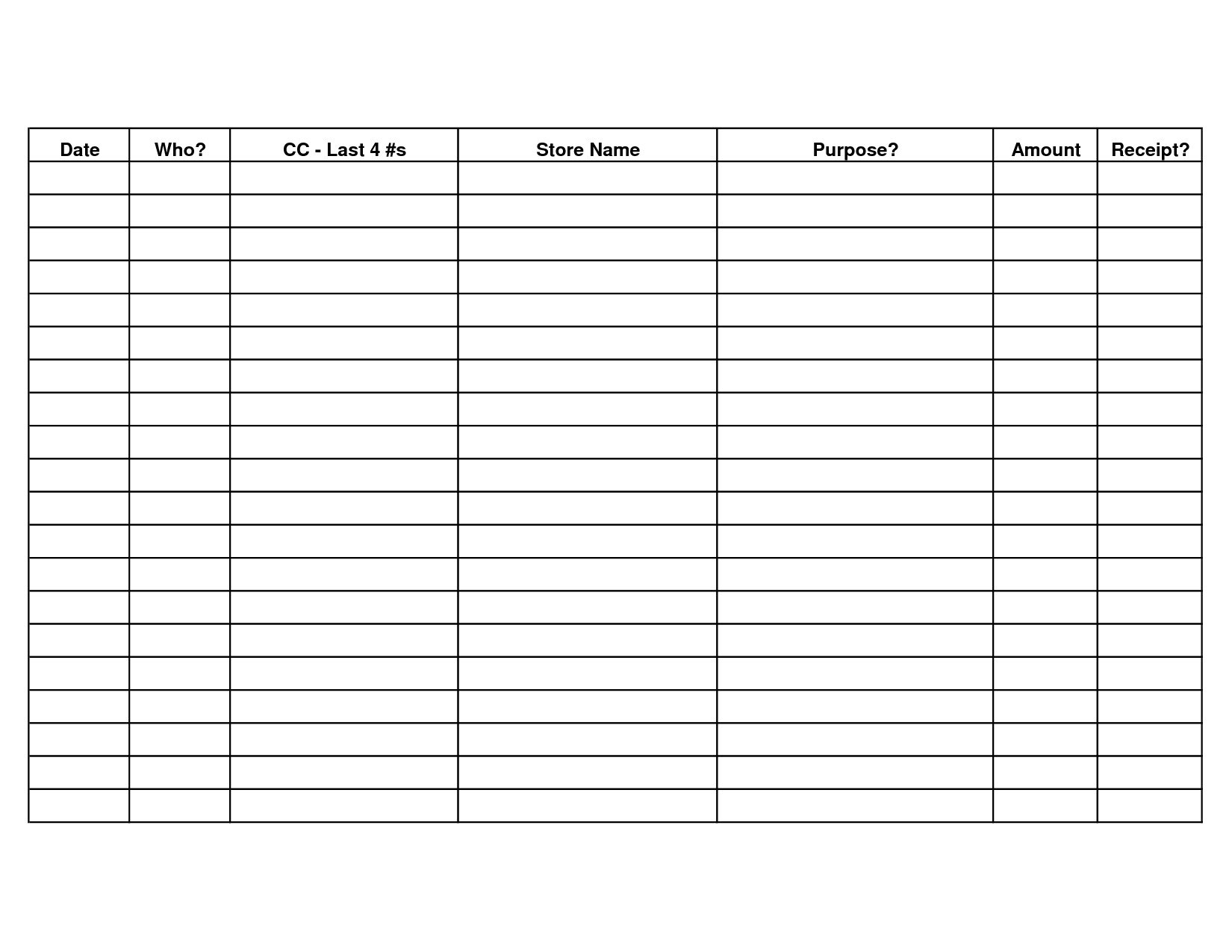

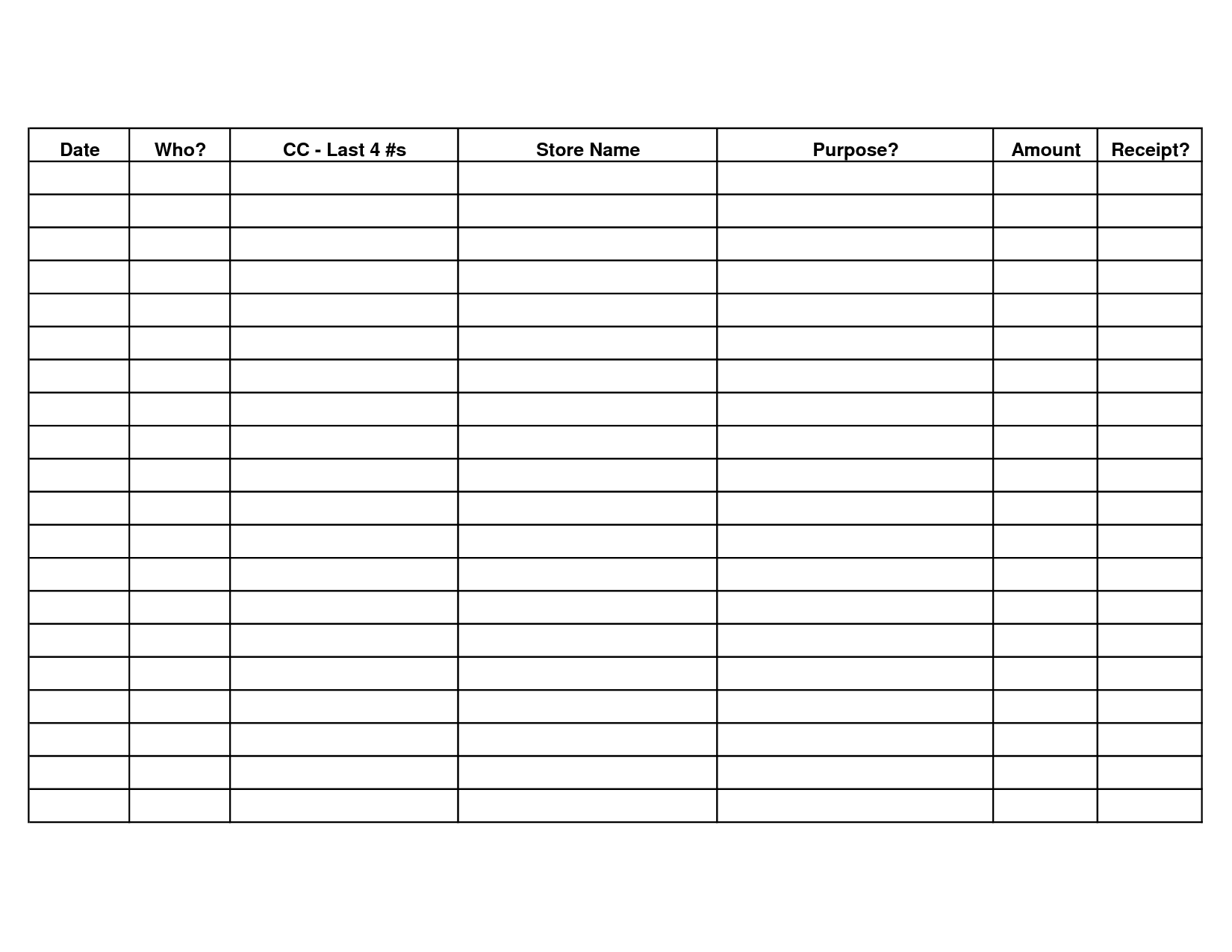

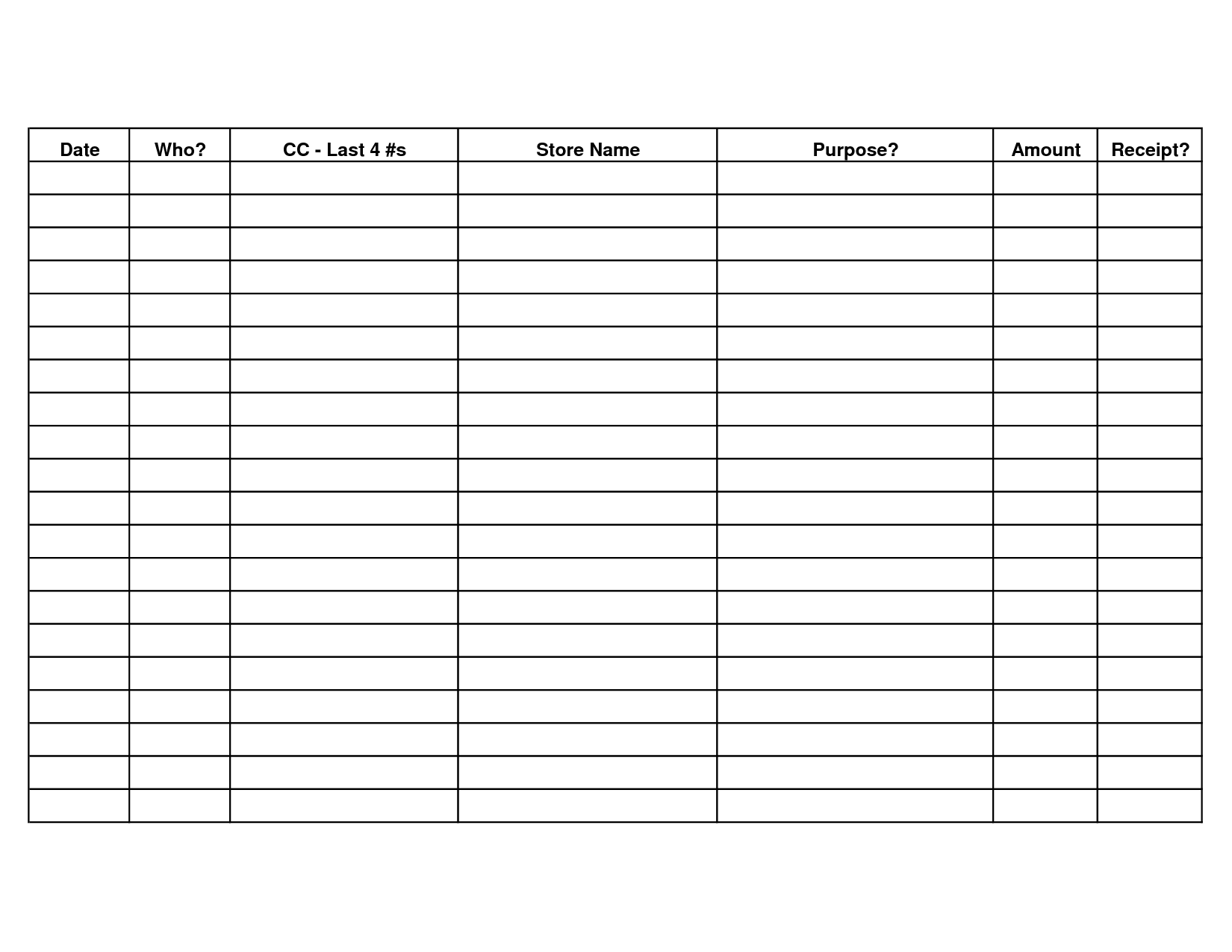

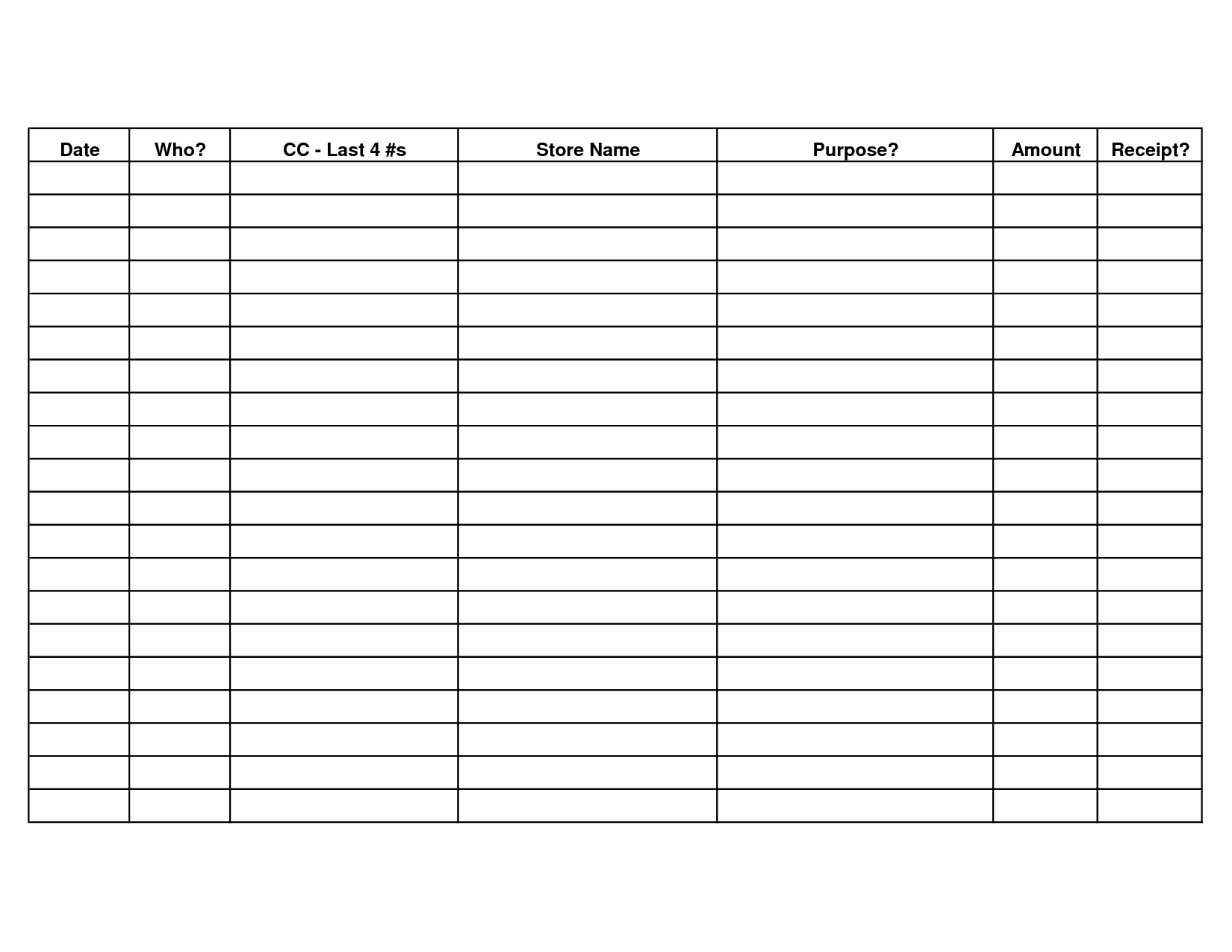

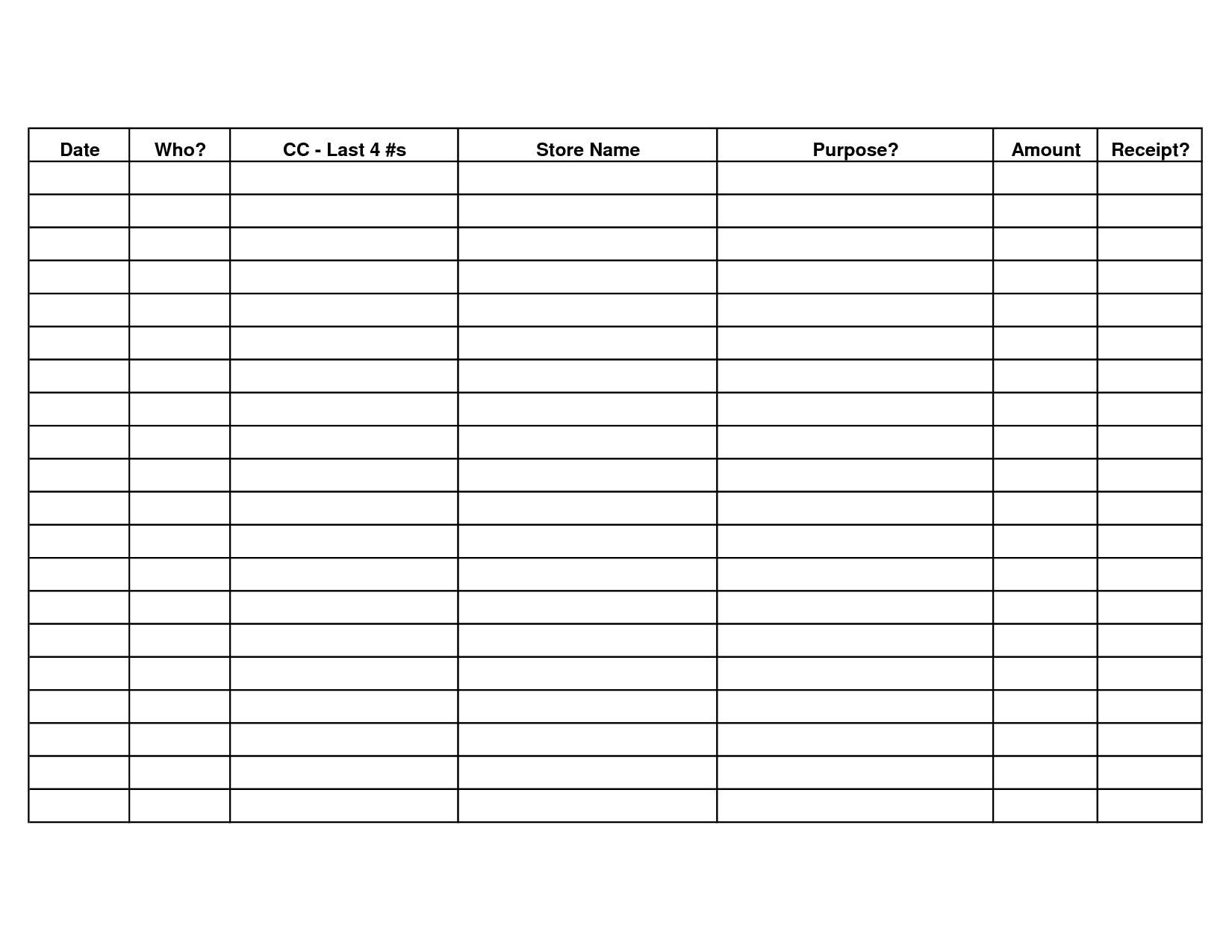

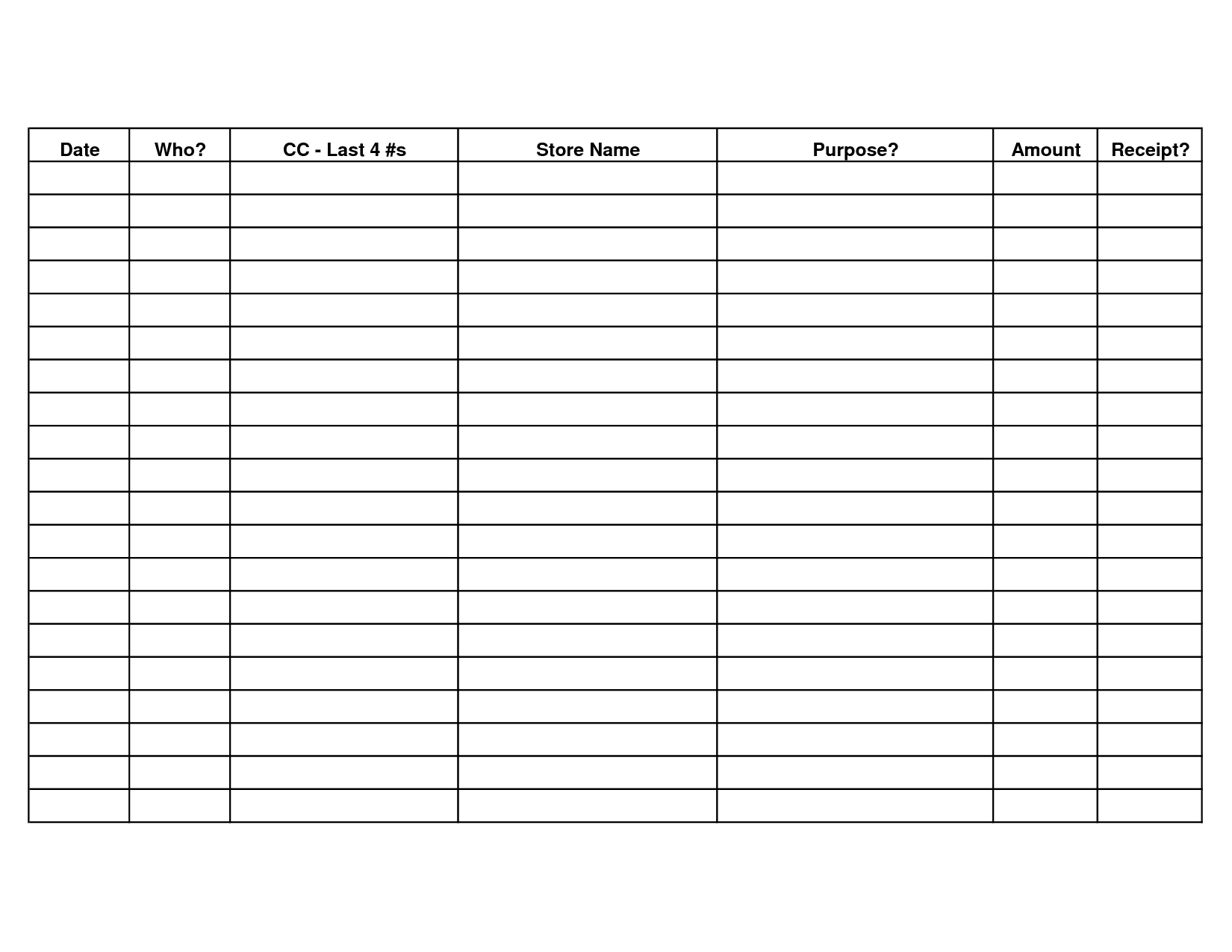

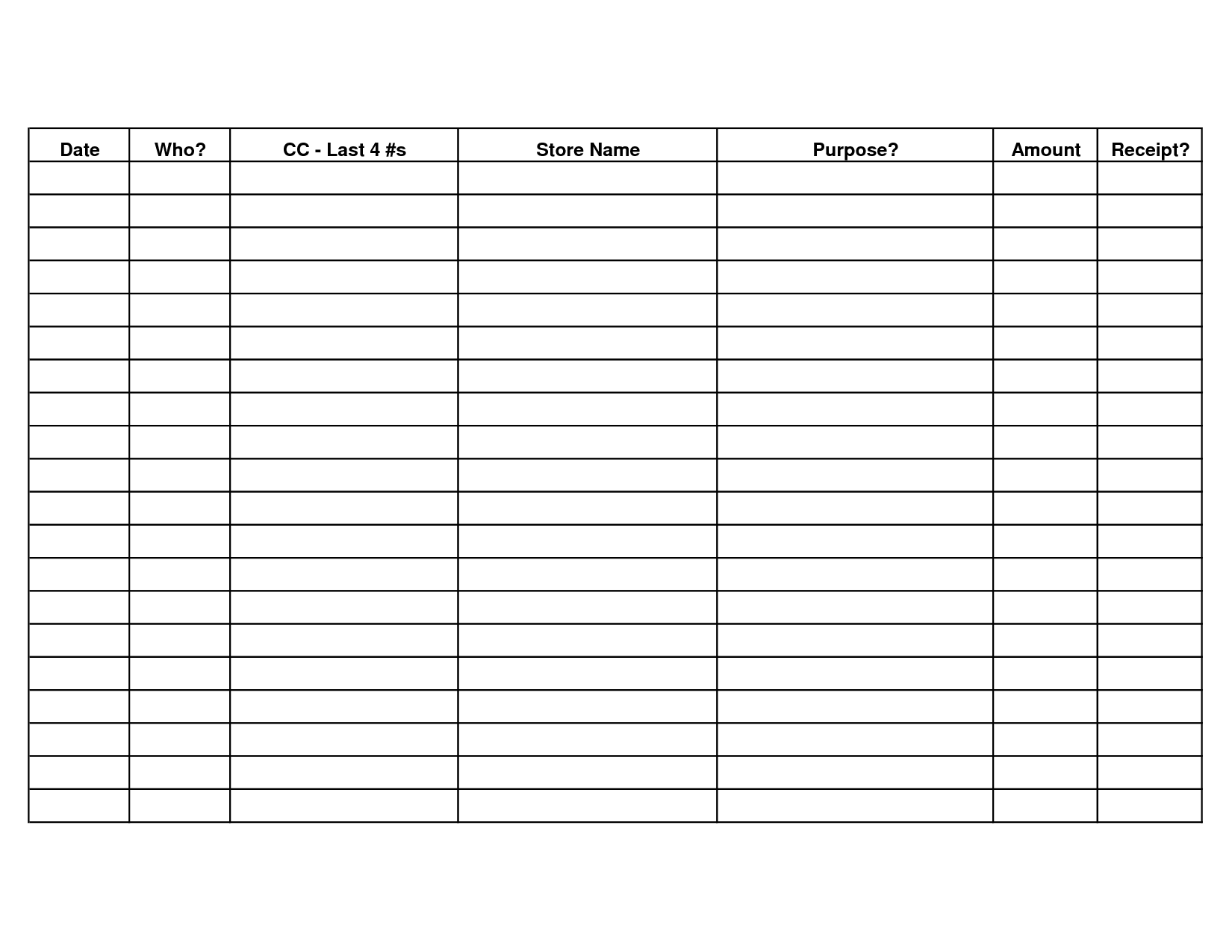

Pay Off Debt Printable Worksheet

Are you searching for an effective way to track and manage your debt? Look no further than our Pay Off Debt printable worksheet. Designed for individuals who are determined to take control of their financial obligations, this worksheet provides a clear and organized platform to monitor and prioritize your debts. Whether you are a budget-conscious millennial, a single parent trying to make ends meet, or anyone wanting to achieve financial freedom, this worksheet is the perfect tool to help you achieve your goals.

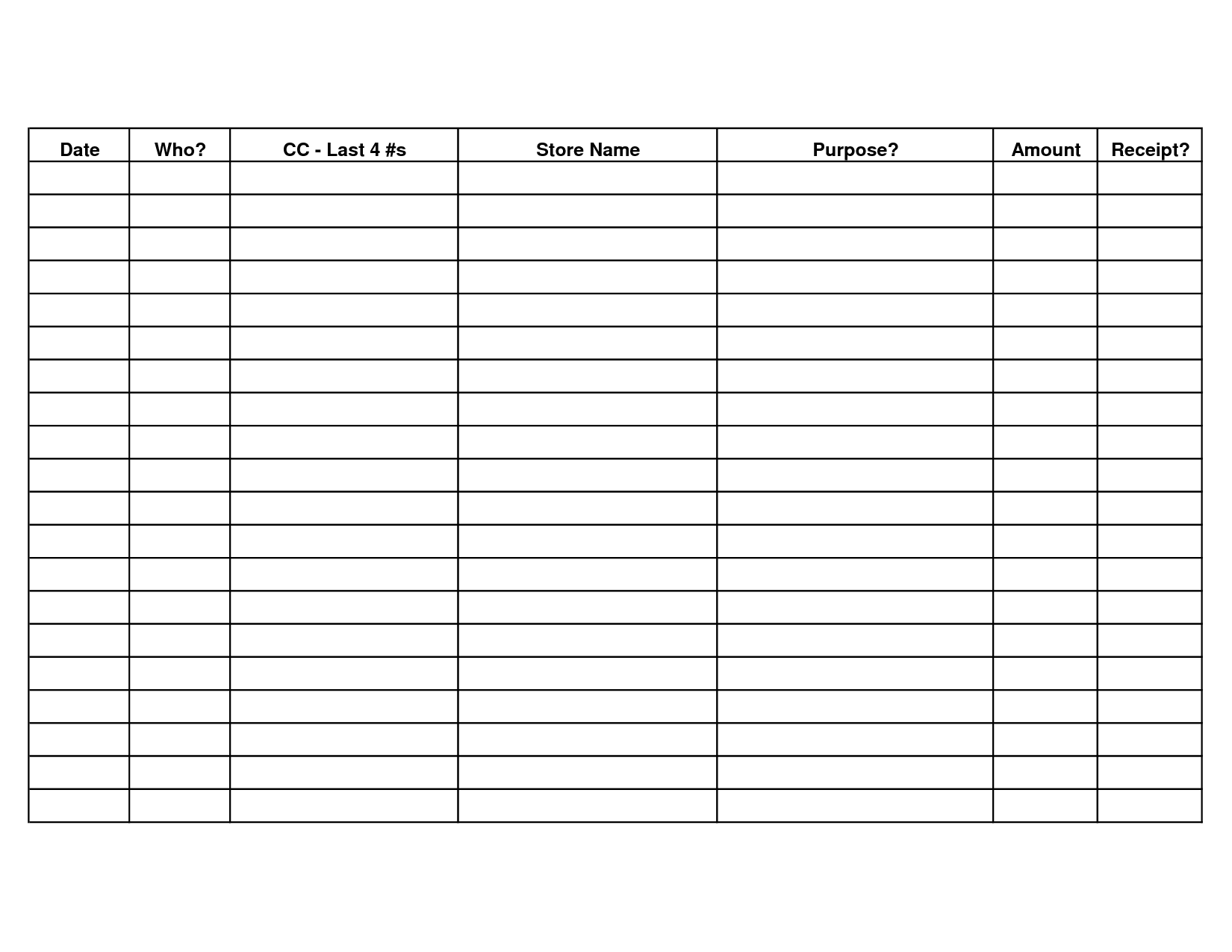

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is the purpose of the Pay Off Debt Printable Worksheet?

The purpose of the Pay Off Debt Printable Worksheet is to help individuals track and manage their debt repayment progress. It provides a visual representation of their debt balances, interest rates, minimum payments, and repayment goals, helping them create a plan to pay off debts efficiently and stay organized in the process.

How does the worksheet help individuals track their debt?

Worksheets help individuals track their debt by providing a structured format to list all debts including amounts owed, interest rates, minimum payments, and due dates. By organizing this information in one place, individuals can see the full picture of their debt situation, prioritize payments, and create a repayment plan to efficiently reduce debt over time.

What are the different sections included in the worksheet?

Worksheets typically include various sections such as a title area for the worksheet name or topic, column and row labels to organize data, data cells to input information or perform calculations, a footer area for additional notes or references, and potentially sections for instructions, charts, and analysis summaries depending on the purpose and complexity of the worksheet.

How does the worksheet assist in setting financial goals?

Worksheets assist in setting financial goals by helping individuals track their current financial situation, identify areas of improvement, and calculate an effective plan to reach their desired goals. By listing income, expenses, debts, and savings, individuals can gain a clear understanding of their financial habits and make necessary adjustments to prioritize their goals. Worksheets also allow individuals to break down larger financial goals into smaller, manageable steps, making the overall goal more attainable and easier to track progress towards.

How does the worksheet help prioritize debt repayment?

Worksheets help prioritize debt repayment by listing all debts with their corresponding interest rates, outstanding balances, and minimum monthly payments. It allows individuals to see a clear picture of their debts and prioritize them based on factors such as interest rates, total balances, or which debts are costing the most in interest. By organizing and visualizing this information, individuals can create a strategic plan to pay off debts efficiently and in a way that saves them the most money in the long run.

What information should be recorded under each debt entry?

Under each debt entry, you should record the name of the debtor, the amount of the debt, the date the debt was incurred, the terms of repayment, any interest rate applied, any collateral pledged, and any payment history. This information is essential for tracking and managing each debt effectively.

How does the worksheet calculate the total debt amount and interest paid?

The worksheet calculates the total debt amount by summing up all the principal amounts borrowed and any additional fees or charges. For interest paid, it multiplies the initial loan amount by the interest rate to determine the annual interest, which is then multiplied by the number of years or months the loan is outstanding. This total interest amount is added to the principal to arrive at the total payment by the borrower.

What strategies does the worksheet offer for debt reduction?

The worksheet offers various strategies for debt reduction including creating a budget to track expenses and prioritize payments, negotiating with creditors for lower interest rates or payment plans, considering debt consolidation to combine multiple debts into one payment with a lower interest rate, and increasing income or cutting expenses to allocate more towards debt repayment. It also emphasizes the importance of setting financial goals, sticking to a repayment plan, and seeking professional help if needed.

How can the worksheet be used to track progress over time?

To track progress over time using a worksheet, you can create different columns or rows to input data at different time intervals or stages. By regularly updating the worksheet with new information, such as measurements, achievements, or milestones, you can track changes and progress over time. Utilizing charts, graphs, or formulas within the worksheet can also help visualize trends and improvements, making it easier to monitor and analyze progress over time.

What are the additional benefits of using a Pay Off Debt Printable Worksheet?

In addition to helping to track and organize your debt payments, a Pay Off Debt Printable Worksheet can also serve as a visual reminder of your progress, providing motivation and accountability. It can help you prioritize your debts, set clear goals, and create a tangible action plan to tackle your debts effectively. Additionally, filling out a worksheet can increase your awareness of your spending habits and financial behaviors, allowing you to make more informed decisions about managing your debts and finances overall.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments