Monthly Savings Plan Worksheet

Are you trying to find a useful tool to help you organize your monthly savings? Look no further! Introducing the Monthly Savings Plan Worksheet, a simple and effective way to track your savings progress and work towards your financial goals. Designed for individuals or families who want to take control of their finances, this worksheet provides a clear layout to record your income, expenses, and allocate funds to different savings categories. Whether you're saving for a vacation, a down payment on a house, or just building an emergency fund, this worksheet will help you stay on track and achieve your savings goals.

Table of Images 👆

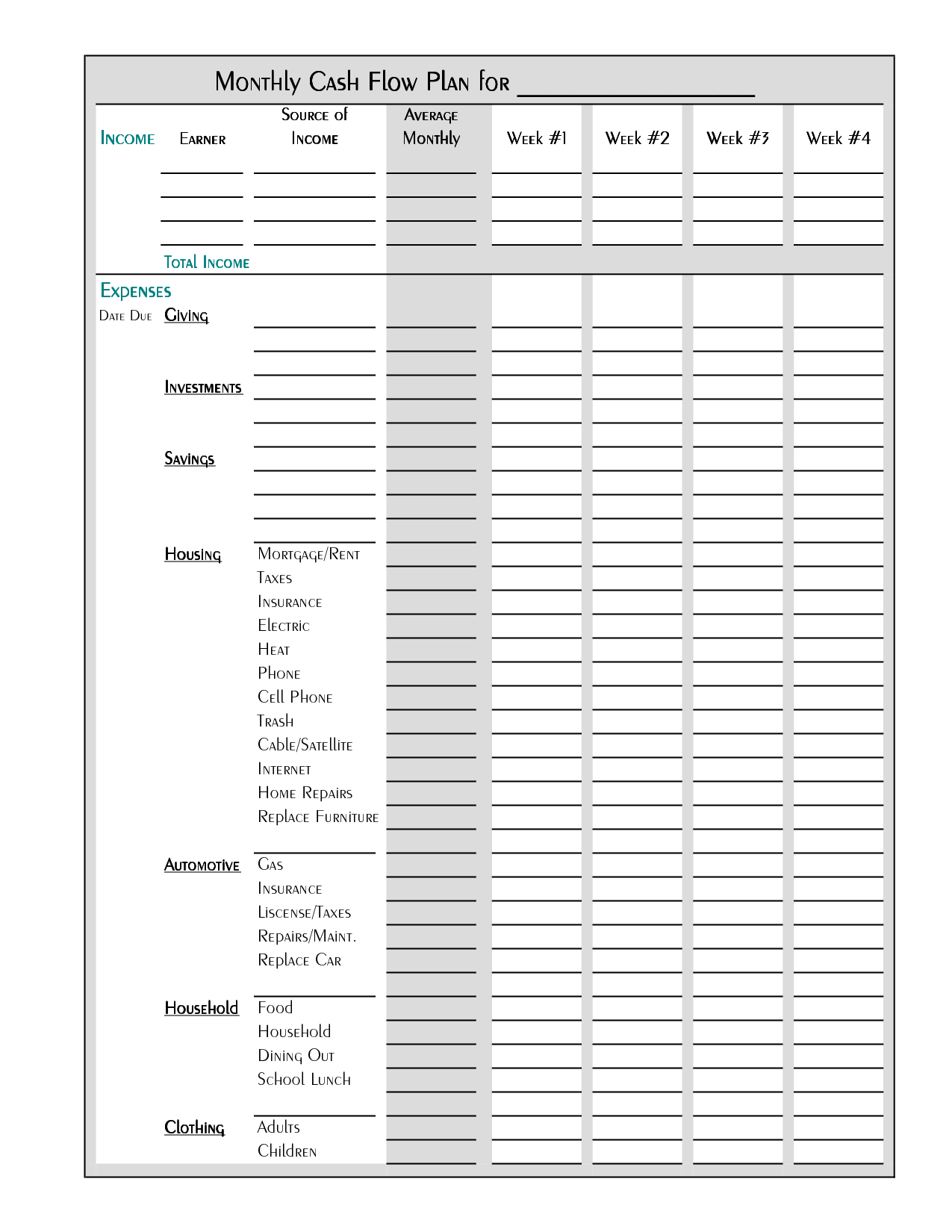

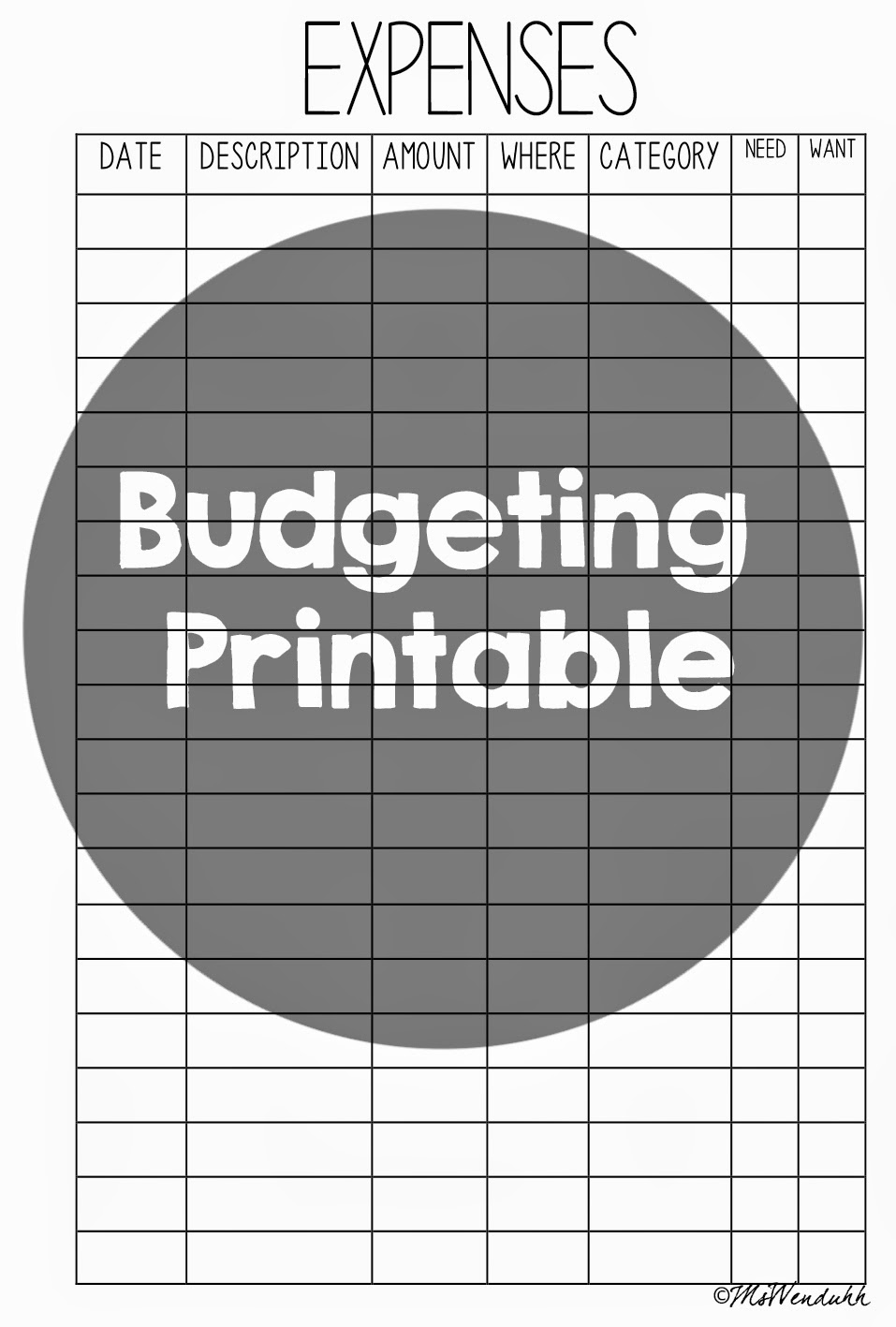

- Free Printable Budget Worksheet Template

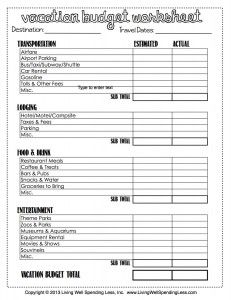

- Vacation Budget Worksheet Printable

- Insurance Claim Adjuster Reports

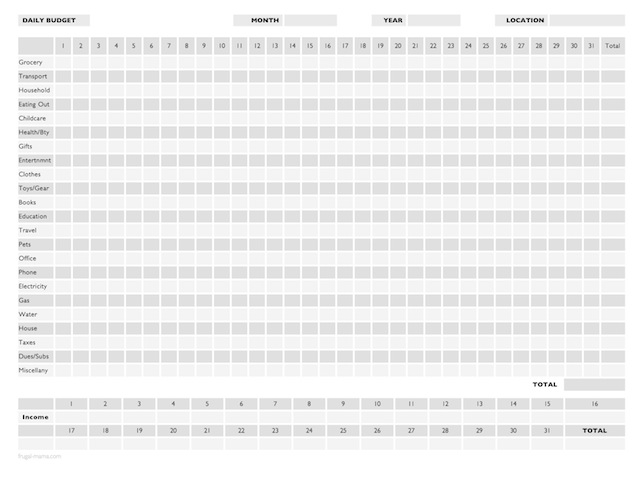

- Daily Budget Worksheet Printable

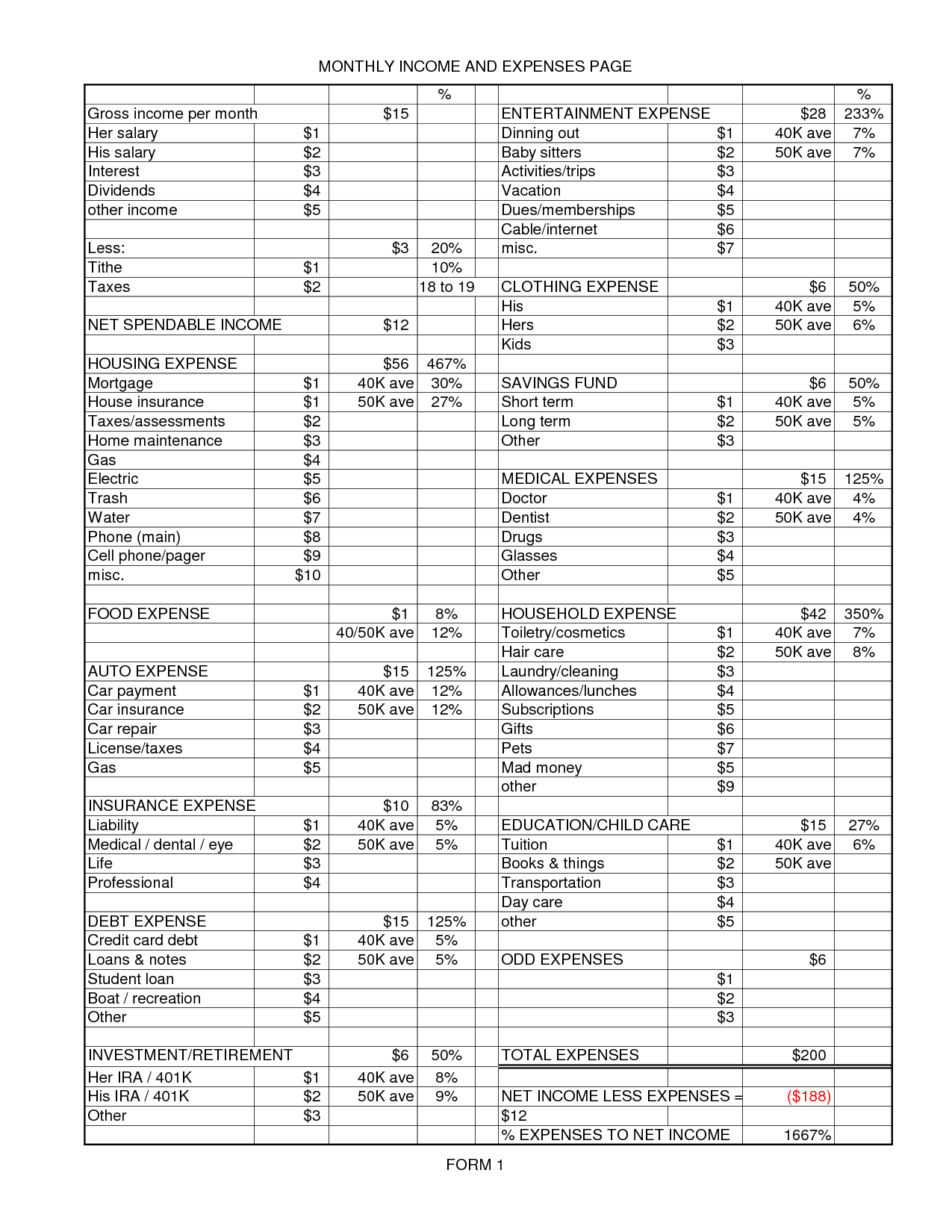

- Income and Expense Budget Template

- Printable Monthly Budget Planner

- Sample Church Budget Worksheet

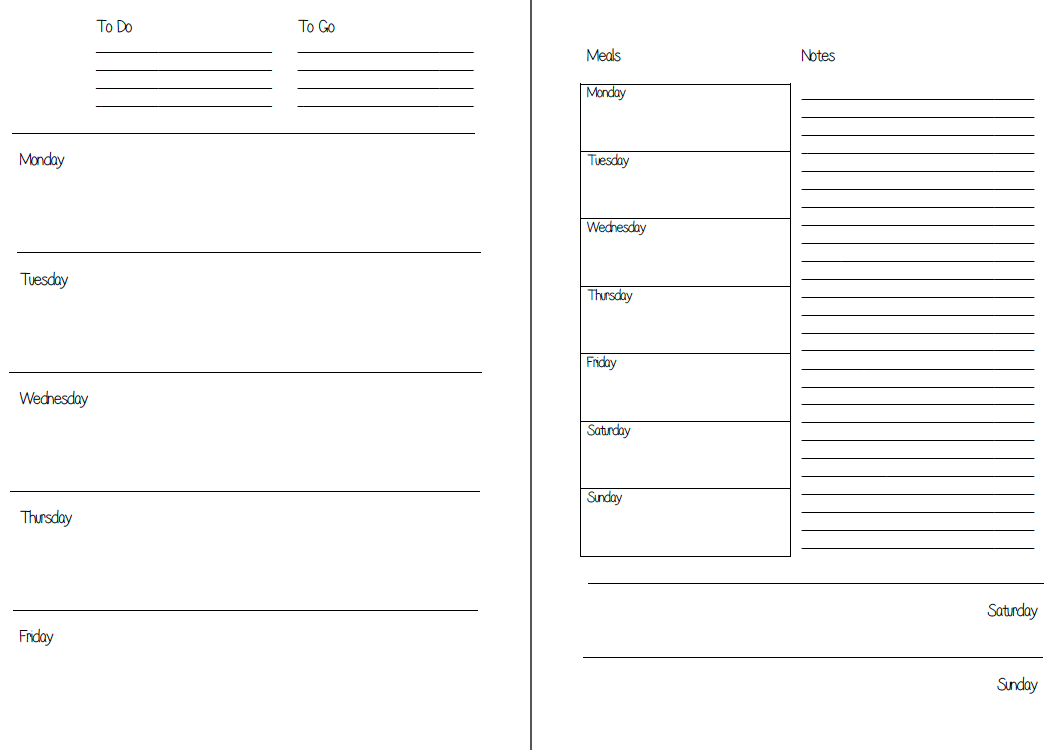

- Free Printable Weekly Planner Inserts

- Free Printable Personal Planner Inserts

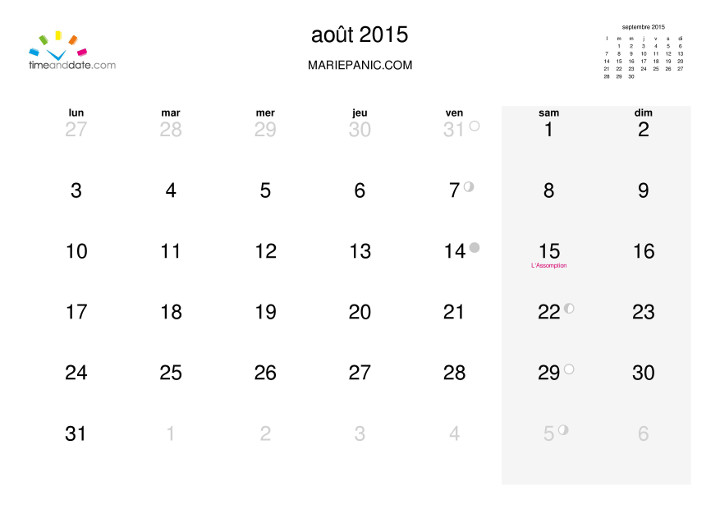

- Julian Date Calendar 2015 Printable

- A5 Free Printable to Do List

- Employee Data Sheet

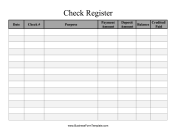

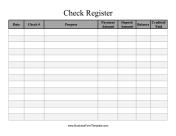

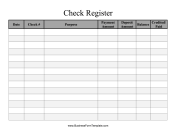

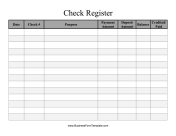

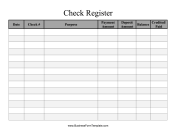

- Large Check Register Template

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a Monthly Savings Plan Worksheet?

A Monthly Savings Plan Worksheet is a tool used to track and plan your savings goals on a monthly basis. It typically includes sections for listing your income, expenses, and savings goals for the month, allowing you to allocate funds towards saving for specific objectives. By regularly updating and using this worksheet, you can monitor your progress, adjust your savings strategy as needed, and stay on track with your financial goals.

Why is it important to have a Monthly Savings Plan Worksheet?

Having a Monthly Savings Plan Worksheet is important because it helps individuals track their income, expenses, and savings goals in an organized manner. It allows them to create a detailed plan for allocating funds towards savings, making it easier to monitor progress, adjust spending habits, and stay on track towards reaching financial objectives. By having a tangible document that outlines their savings strategy, individuals are more likely to adhere to their goals and make informed decisions about their finances.

How can a Monthly Savings Plan Worksheet help track and manage personal finances?

A Monthly Savings Plan Worksheet can help track and manage personal finances by providing a structured way to set savings goals, budget expenses, track income, and monitor progress over time. By outlining expected expenses and income each month, individuals can identify areas for potential savings, plan for future expenses, and adjust their budget as needed. This tool can also serve as a visual reminder of financial goals, helping to stay motivated and on track towards achieving long-term savings objectives.

What are the key components of a Monthly Savings Plan Worksheet?

A Monthly Savings Plan Worksheet typically includes sections for recording monthly income, expenses, savings goals, and actual savings amount. It helps individuals track their finances by listing all sources of income, itemizing expenses, setting specific savings targets, and comparing those goals with the actual amount saved each month. These components provide a structured approach to budgeting, monitoring, and adjusting savings to meet financial goals effectively.

How often should a Monthly Savings Plan Worksheet be updated?

A Monthly Savings Plan Worksheet should ideally be updated at least once a month to track progress and make necessary adjustments to savings goals and allocations. However, it can also be beneficial to review and update it more frequently, such as biweekly or weekly, if there are significant changes in income, expenses, or financial goals. Regular updates ensure that the savings plan remains relevant and effective in helping achieve financial objectives.

What types of expenses should be included in a Monthly Savings Plan Worksheet?

A Monthly Savings Plan Worksheet should typically include all regular monthly expenses such as rent/mortgage, utilities, groceries, transportation, insurance, healthcare, debt payments, and other essential bills. Additionally, it is advisable to factor in occasional expenses like entertainment, dining out, personal care, and savings goals. It's important to have a comprehensive view of all expenses to accurately plan and budget for saving money each month.

How can a Monthly Savings Plan Worksheet help identify areas for potential savings?

A Monthly Savings Plan Worksheet helps identify areas for potential savings by providing a structured framework to track and categorize expenses, income, and savings goals. By listing all sources of income and documenting expenses across various categories, individuals can better understand where their money is going each month. This visibility allows them to identify areas where spending can be reduced or eliminated, thereby freeing up more funds to allocate towards savings goals. Additionally, setting specific savings goals on the worksheet provides a clear target to work towards and motivates individuals to prioritize saving money over unnecessary expenses, ultimately helping them create a more sustainable financial future.

What factors should be considered when creating a Monthly Savings Plan Worksheet?

When creating a Monthly Savings Plan Worksheet, factors to consider include setting specific savings goals, taking into account monthly income and expenses, identifying potential areas for cutting costs to boost savings, incorporating any irregular or one-time expenses, allocating funds for emergencies or unexpected expenses, revisiting and adjusting the plan regularly, and considering the timeframe and purpose of the savings goal. Additionally, it is important to track progress, stay disciplined in following the plan, and seek advice from financial experts if needed.

How can a Monthly Savings Plan Worksheet be used to set financial goals?

A Monthly Savings Plan Worksheet can be used to set financial goals by providing a structured way to track income, expenses, and savings on a month-to-month basis. By filling out the worksheet with details of your current financial situation, you can analyze your spending habits, identify areas where you can cut back, and allocate a specific amount of money towards savings each month. This helps you to create a realistic budget, visualize your progress towards your savings goals, and make adjustments as needed to stay on track towards achieving your financial objectives.

What are the benefits of using a Monthly Savings Plan Worksheet to track savings progress?

Using a Monthly Savings Plan Worksheet can help track savings progress by providing a clear overview of income, expenses, and savings goals each month. It allows you to set specific targets, monitor spending habits, identify areas for potential savings, and stay on track towards your financial goals. Additionally, it can help you track your progress over time, make adjustments as needed, and stay motivated to save consistently.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments