Monthly Financial Budget Worksheet

A monthly financial budget worksheet is an essential tool for individuals and families looking to gain control over their finances. This resource provides a comprehensive overview of income, expenses, and savings, allowing individuals to track their spending and make strategic decisions about their financial future. Whether you are just starting your journey towards financial independence or looking to refine your existing budgeting system, a monthly financial budget worksheet can provide the structure and organization needed to effectively manage your money.

Table of Images 👆

- Personal Budget Worksheet Template

- Free Printable Monthly Budget Worksheet

- Non-Profit Budget Worksheet

- Blank Monthly Budget Spreadsheet

- Monthly Money Management Worksheet

- Monthly Expense Worksheet

- Personal Financial Statement Template

- Sample Household Budget Worksheet

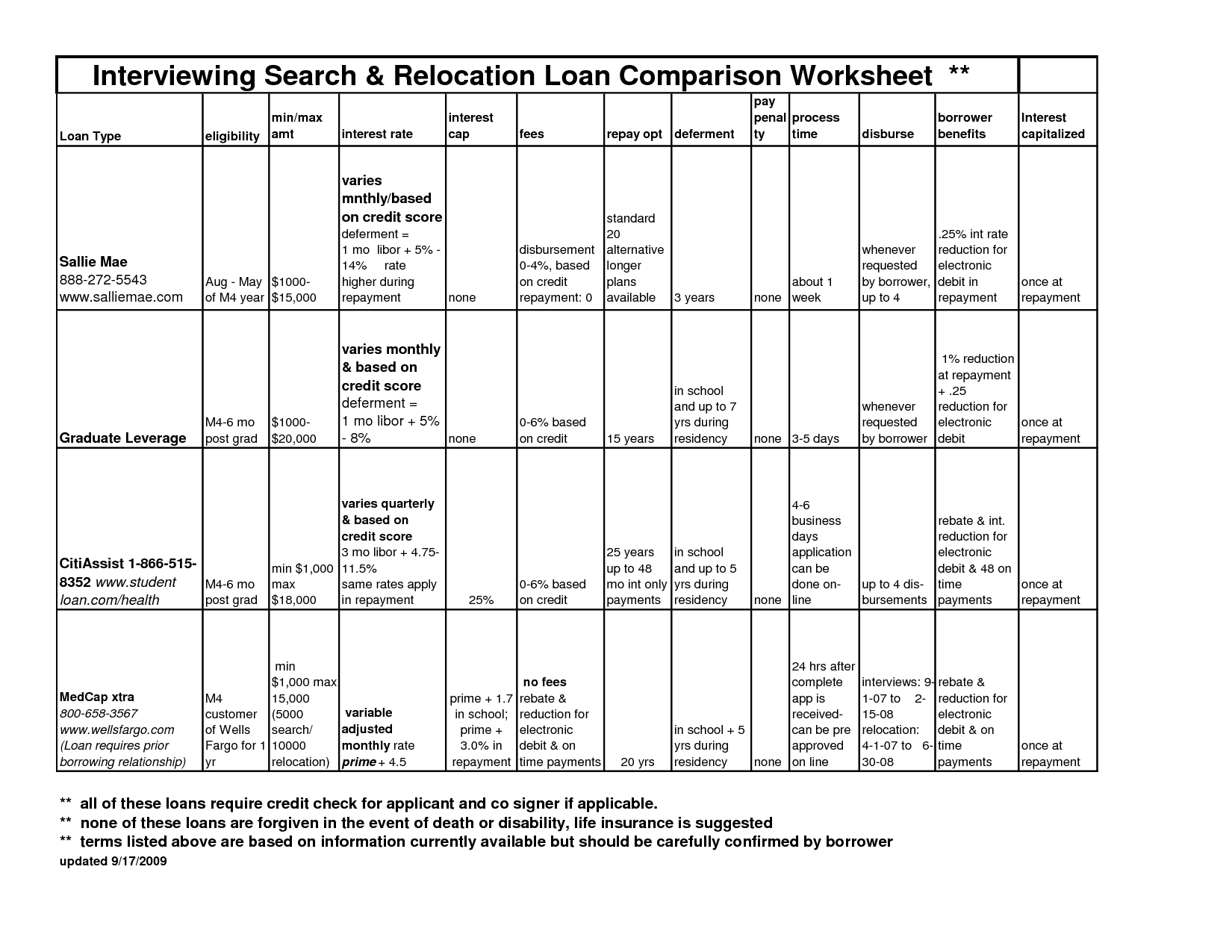

- Monthly Financial Worksheet Wells Fargo

- Blank Worksheet Budget Sheet

- Free Printable Budget Worksheets

- Printable Money Budget Worksheets

- Free Monthly Budget Planner Template

- Free Printable Weekly Monthly Budget Worksheet

- Free Printable Budget Worksheet Template

- Blank Personal Monthly Budget Worksheet

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a monthly financial budget worksheet?

A monthly financial budget worksheet is a tool used to track and manage personal income and expenses on a monthly basis. It typically includes categories for income, such as salary and other sources of revenue, as well as expenses like rent, utilities, groceries, and transportation. By inputting all financial data into the worksheet, individuals can gain a clear understanding of their overall financial situation, identify areas where they can cut costs or save more money, and make informed decisions to achieve their financial goals.

How can a monthly financial budget worksheet help in managing personal finances?

A monthly financial budget worksheet can help in managing personal finances by providing a clear overview of income and expenses, enabling individuals to track where their money is being spent and identify areas where they can cut back or save more. It allows for setting specific financial goals, such as saving for a vacation or paying off debt, and helps to prioritize spending accordingly. By regularly monitoring and updating the budget worksheet, individuals can stay on top of their finances, avoid overspending, and work towards achieving their financial objectives.

What are the key components of a monthly financial budget worksheet?

A monthly financial budget worksheet typically includes key components such as income sources, expenses (fixed and variable), savings goals, debt repayments, and miscellaneous costs. It also usually contains sections for tracking actual income and expenses against budgeted amounts, as well as space for noting any deviations and making adjustments accordingly. Additionally, categories for emergency funds, investments, and retirement contributions may also be included in a comprehensive monthly financial budget worksheet to provide a holistic view of an individual's financial health and goals.

How does a monthly financial budget worksheet track income and expenses?

A monthly financial budget worksheet tracks income and expenses by listing all sources of income and categorizing expenses into various categories such as groceries, utilities, and entertainment. Users can input their expected income for the month and list out all planned expenses. By subtracting expenses from income, the worksheet calculates the difference to show whether the user is within their budget or if adjustments need to be made. It helps individuals understand where their money is coming from and where it is going, enabling better financial management and decision-making.

What are some common categories included in a monthly financial budget worksheet?

Some common categories included in a monthly financial budget worksheet are income, expenses (such as rent/mortgage, utilities, groceries, transportation, entertainment), savings, debt repayment (such as credit card bills, student loans), and miscellaneous expenses (like clothing, gifts, dining out). Tracking these categories can help individuals have a clear overview of their financial situation and make informed decisions regarding their spending and saving habits.

How can a monthly financial budget worksheet help identify areas for potential savings?

A monthly financial budget worksheet can help identify areas for potential savings by providing a detailed breakdown of income and expenses, allowing individuals to see where their money is being spent each month. By tracking expenses closely, individuals can identify patterns or habits that are costing them money unnecessarily. This visibility can highlight areas where spending can be reduced or eliminated, enabling individuals to redirect those funds towards savings goals.

Can a monthly financial budget worksheet help in setting financial goals?

Yes, a monthly financial budget worksheet can definitely help in setting financial goals. By tracking income, expenses, and savings each month, individuals can gain a better understanding of their financial situation and identify areas where they can improve or save money. This analysis can then be used to set specific, measurable financial goals that align with their overall financial objectives.

How often should a monthly financial budget worksheet be reviewed and updated?

A monthly financial budget worksheet should ideally be reviewed and updated at least once a month. This allows you to track your expenses, income, and financial goals regularly, making necessary adjustments as needed to stay on track with your budget and financial plan.

Are there any effective strategies for sticking to a monthly financial budget?

To stick to a monthly financial budget, it is effective to first track and categorize your expenses regularly, set specific financial goals, prioritize essential spending, allocate a portion of your income for savings and emergency funds, limit discretionary spending, avoid impulse purchases, revisit and adjust your budget as needed, and seek support or accountability from a friend or financial advisor. Consistency, discipline, and flexibility are key in successfully adhering to a financial plan.

Are there any online tools or apps available for creating and maintaining a monthly financial budget worksheet?

Yes, there are several online tools and apps available for creating and maintaining a monthly financial budget worksheet. Some popular options include Mint, YNAB (You Need a Budget), Personal Capital, and EveryDollar. These tools allow you to track your income and expenses, set financial goals, and monitor your spending patterns to help you stay on track with your budget. It's recommended to explore different options and choose one that best fits your needs and preferences.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments