Monthly Budget Worksheets

Are you struggling to keep track of your finances each month? Look no further than monthly budget worksheets. These handy tools are designed to help you gain control over your spending and savings by providing a clear and organized way to document your income and expenses. Whether you're a young professional looking to build financial stability or a family seeking to manage your household budget, these worksheets are the perfect solution for anyone hoping to take charge of their finances.

Table of Images 👆

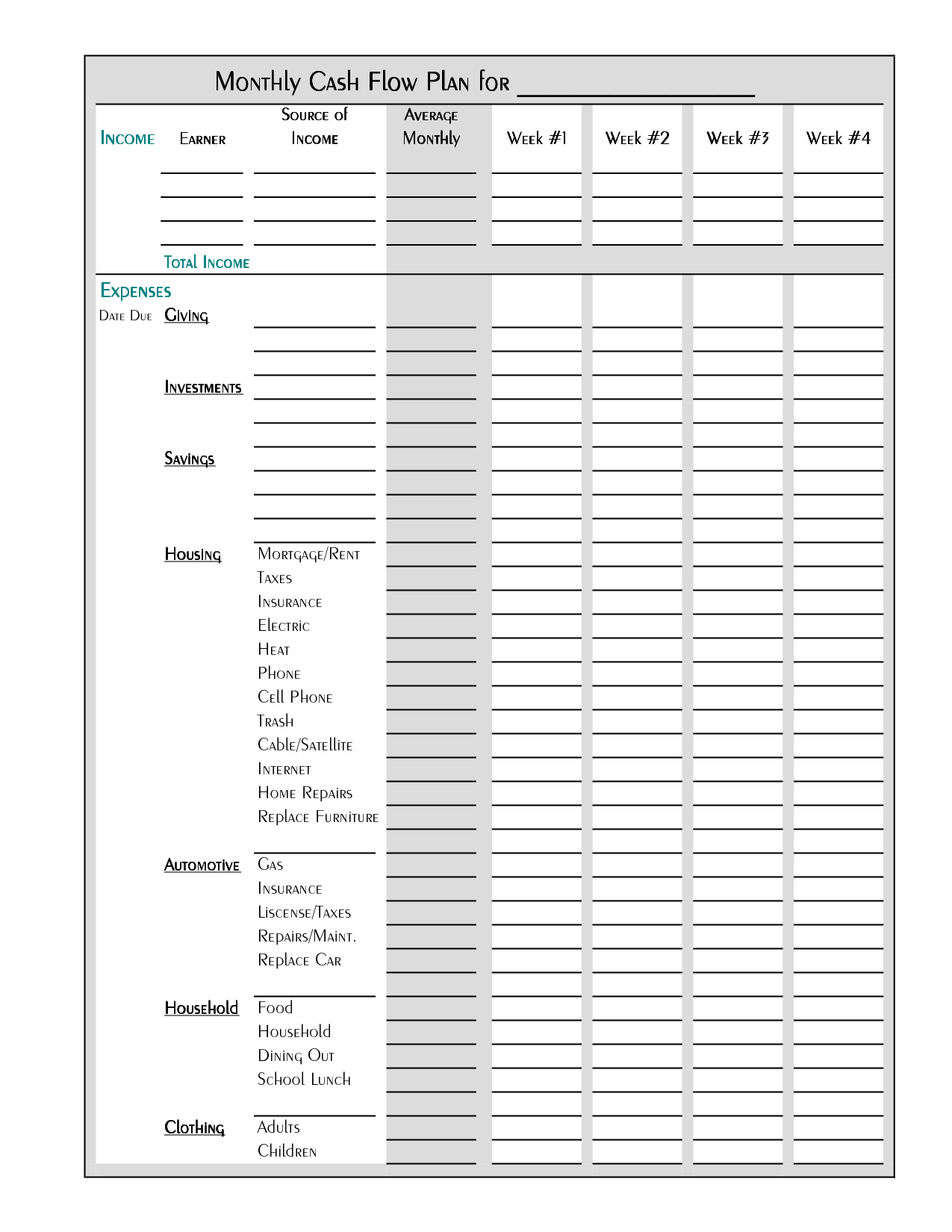

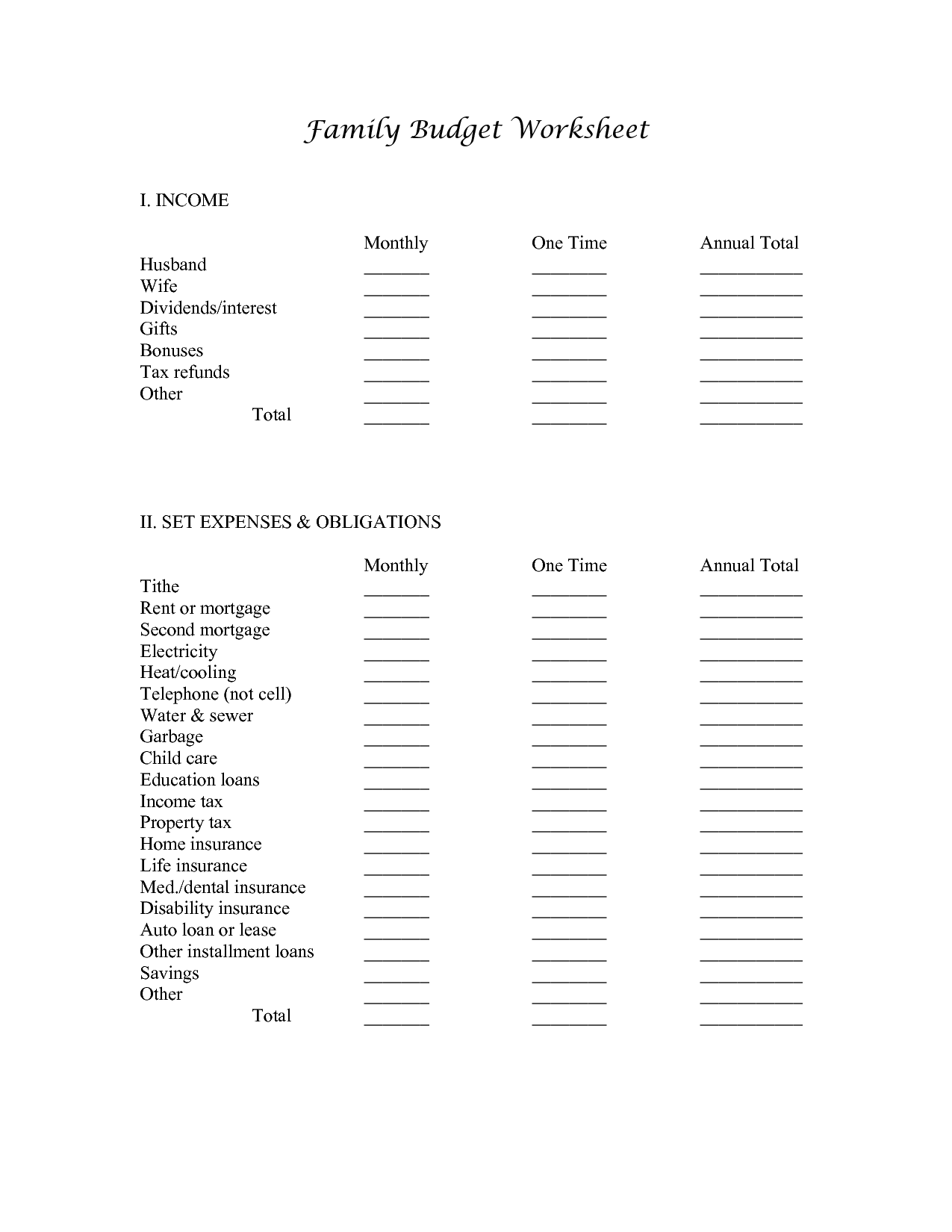

- Free Printable Monthly Budget Worksheet

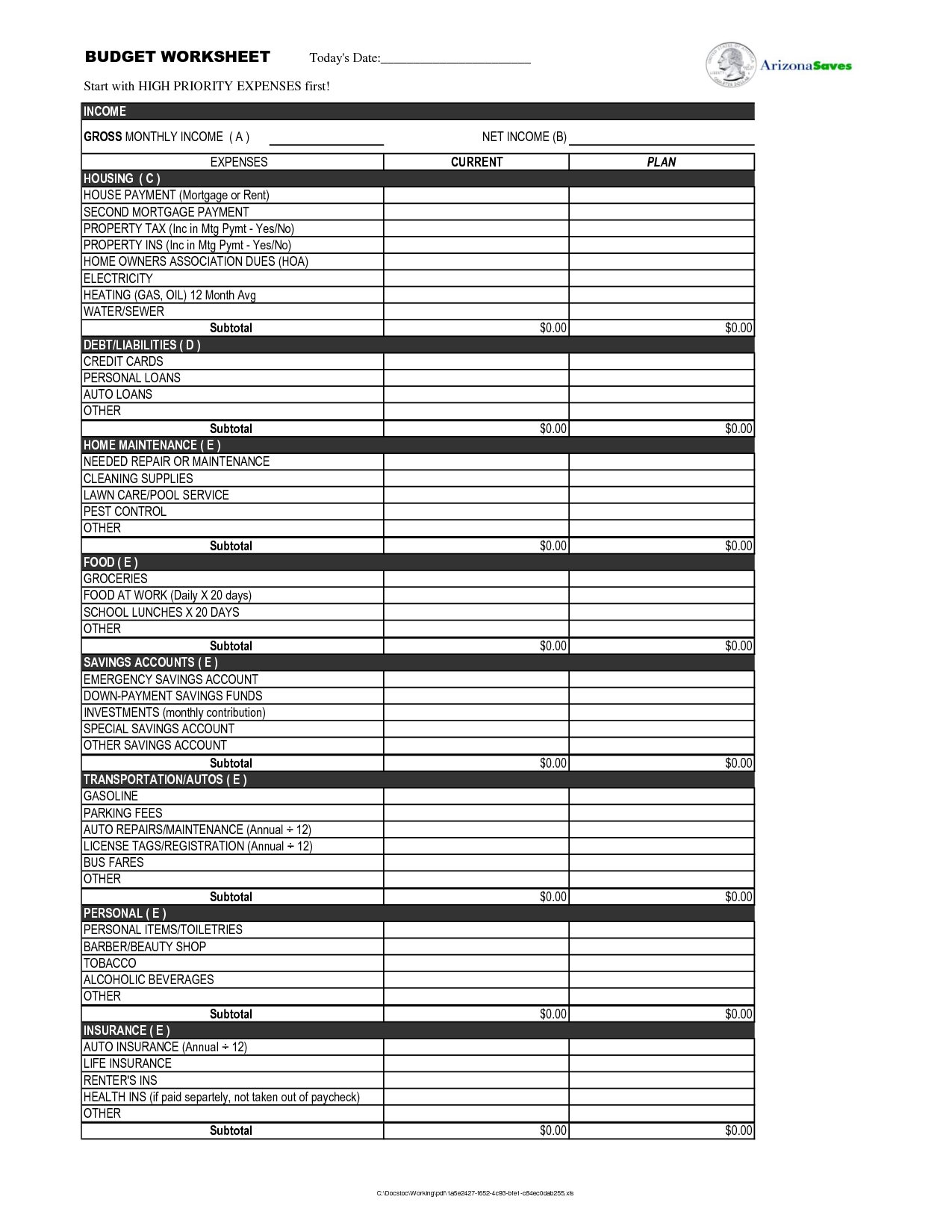

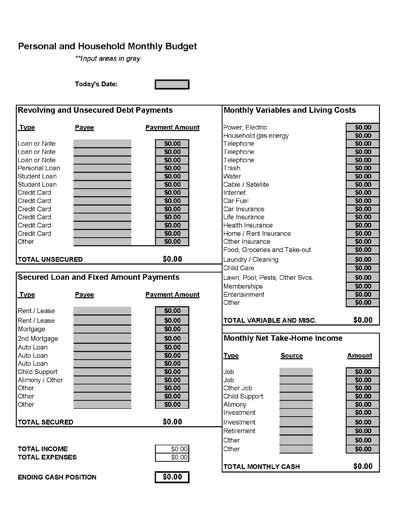

- Free Printable Budget Worksheet Template

- Monthly Income Expense Worksheet

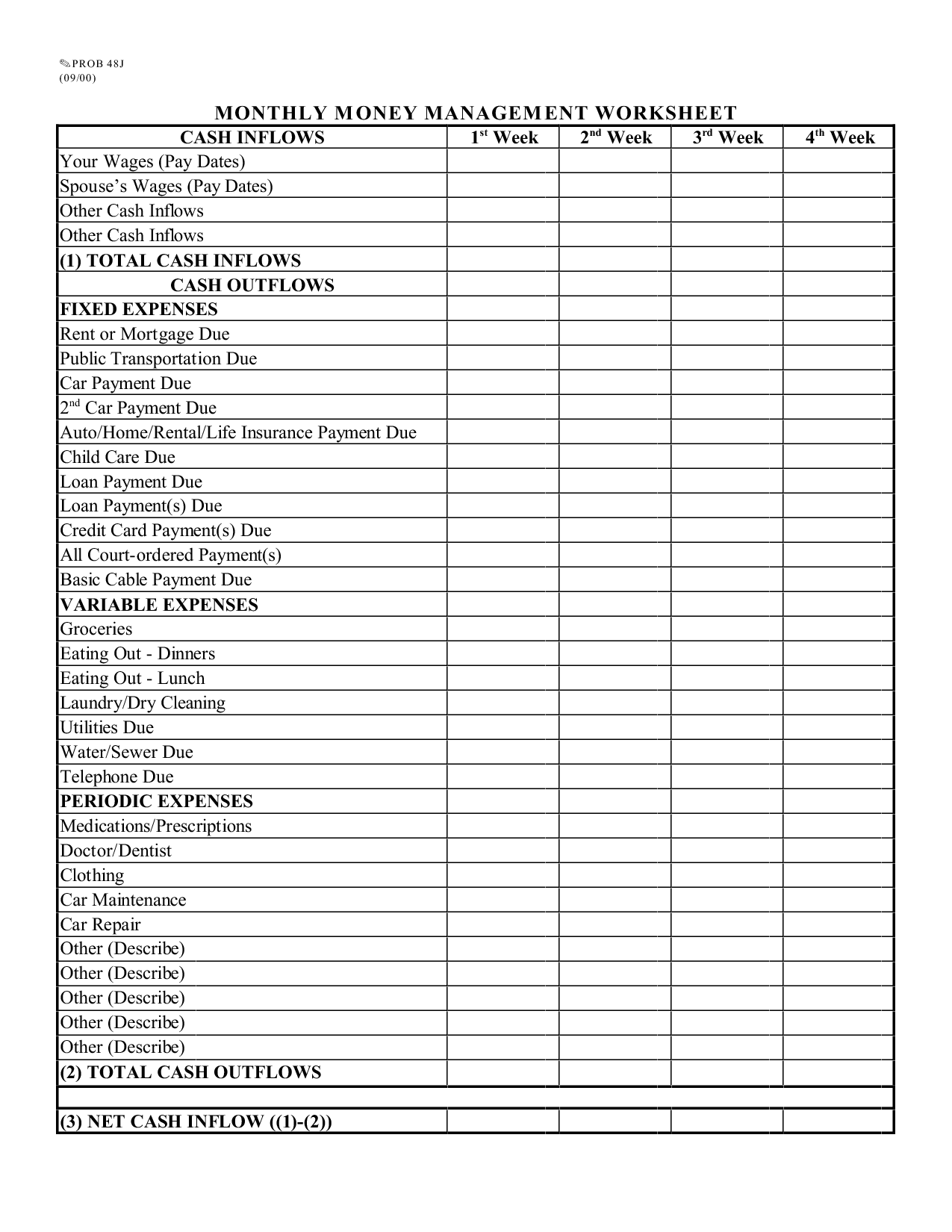

- Monthly Money Management Worksheet

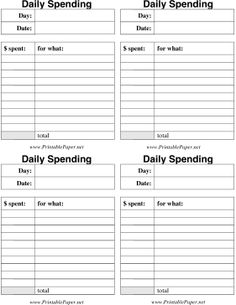

- Daily Spending Budget Worksheet

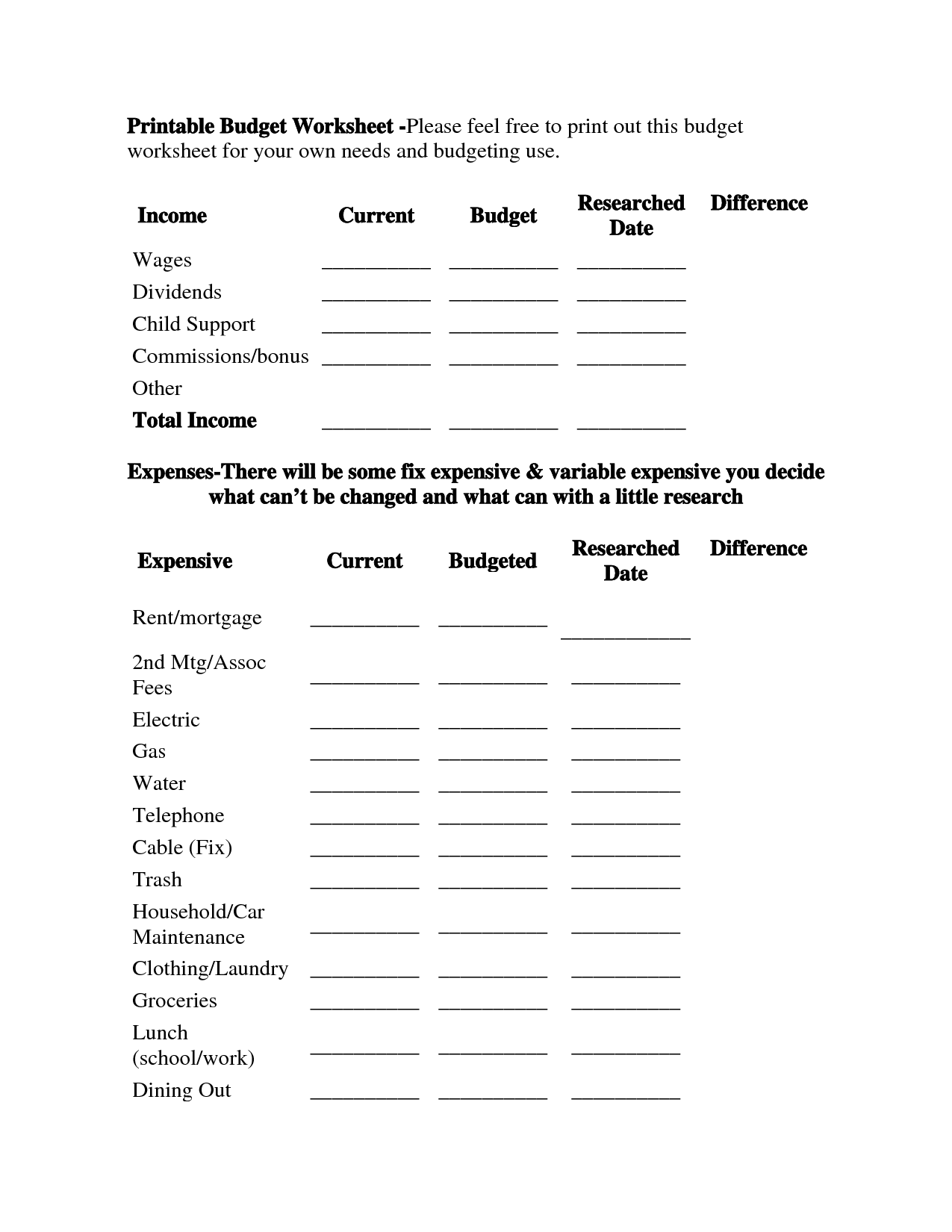

- Free Printable Blank Budget Worksheet

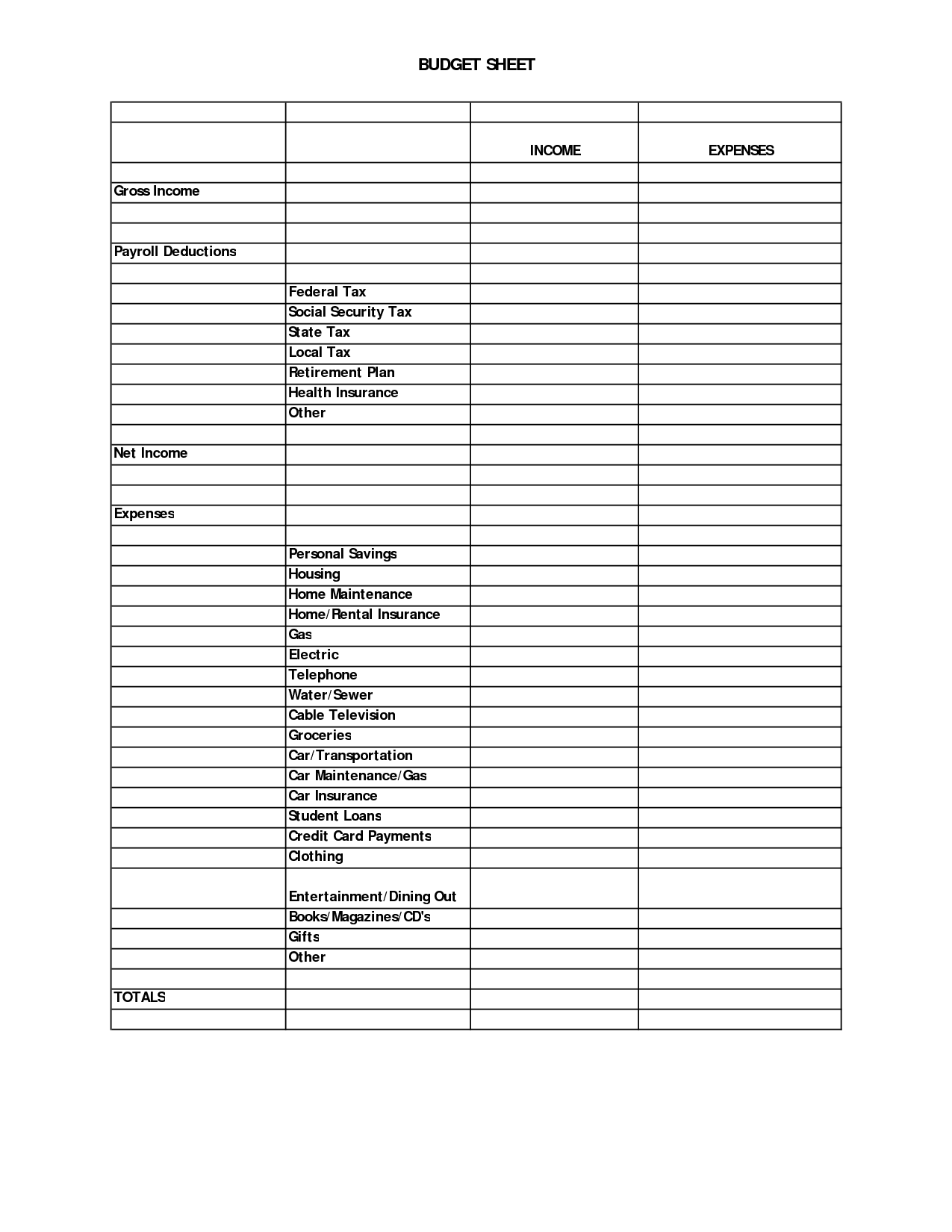

- Printable Blank Worksheet Budget Sheet

- Blank Monthly Budget Template

- Free Printable Budget Worksheets

- Short-Term Financial Goals Worksheet

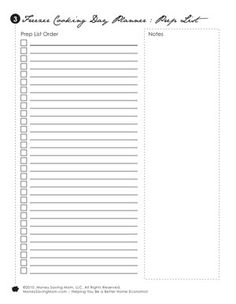

- Freezer List Template

- Monthly Household Budget Worksheet

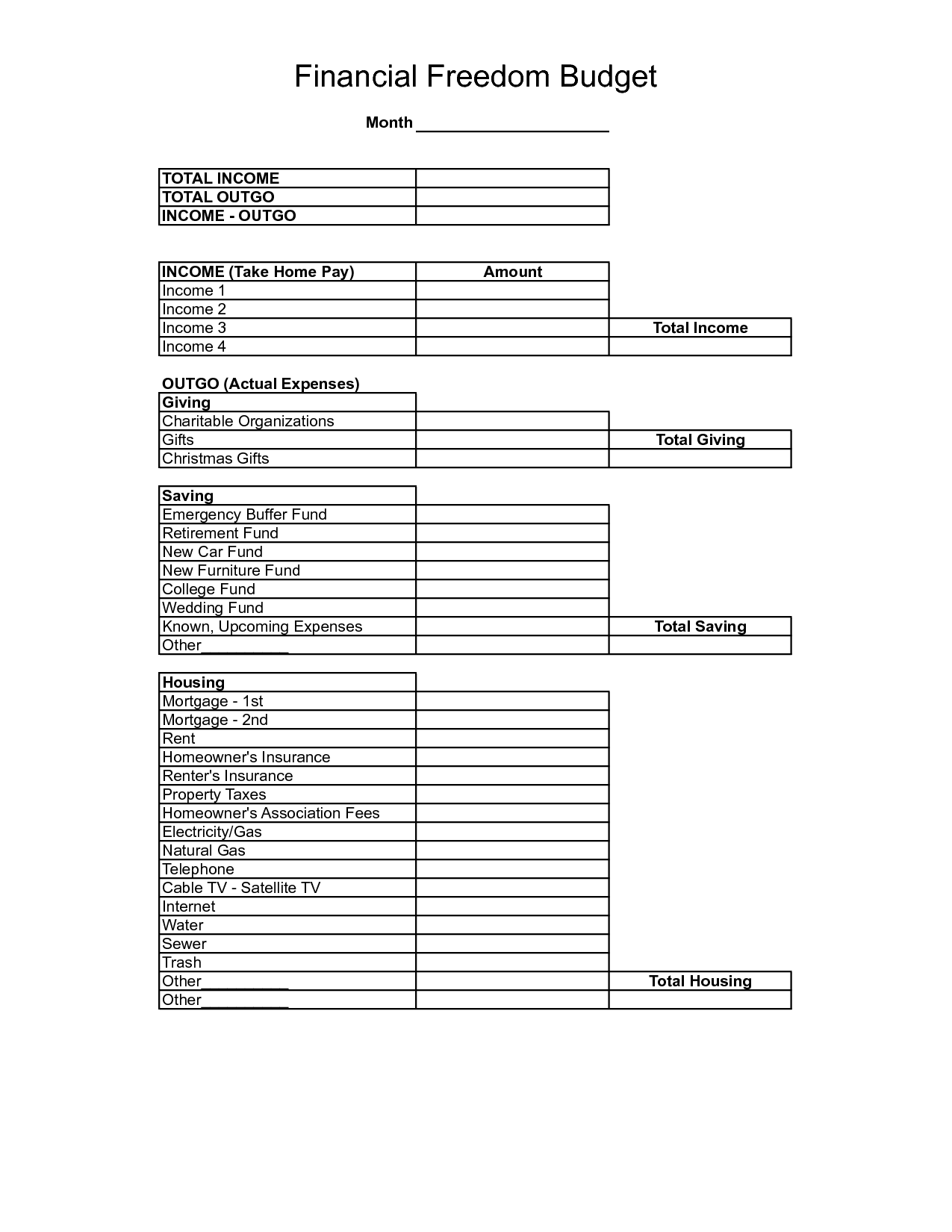

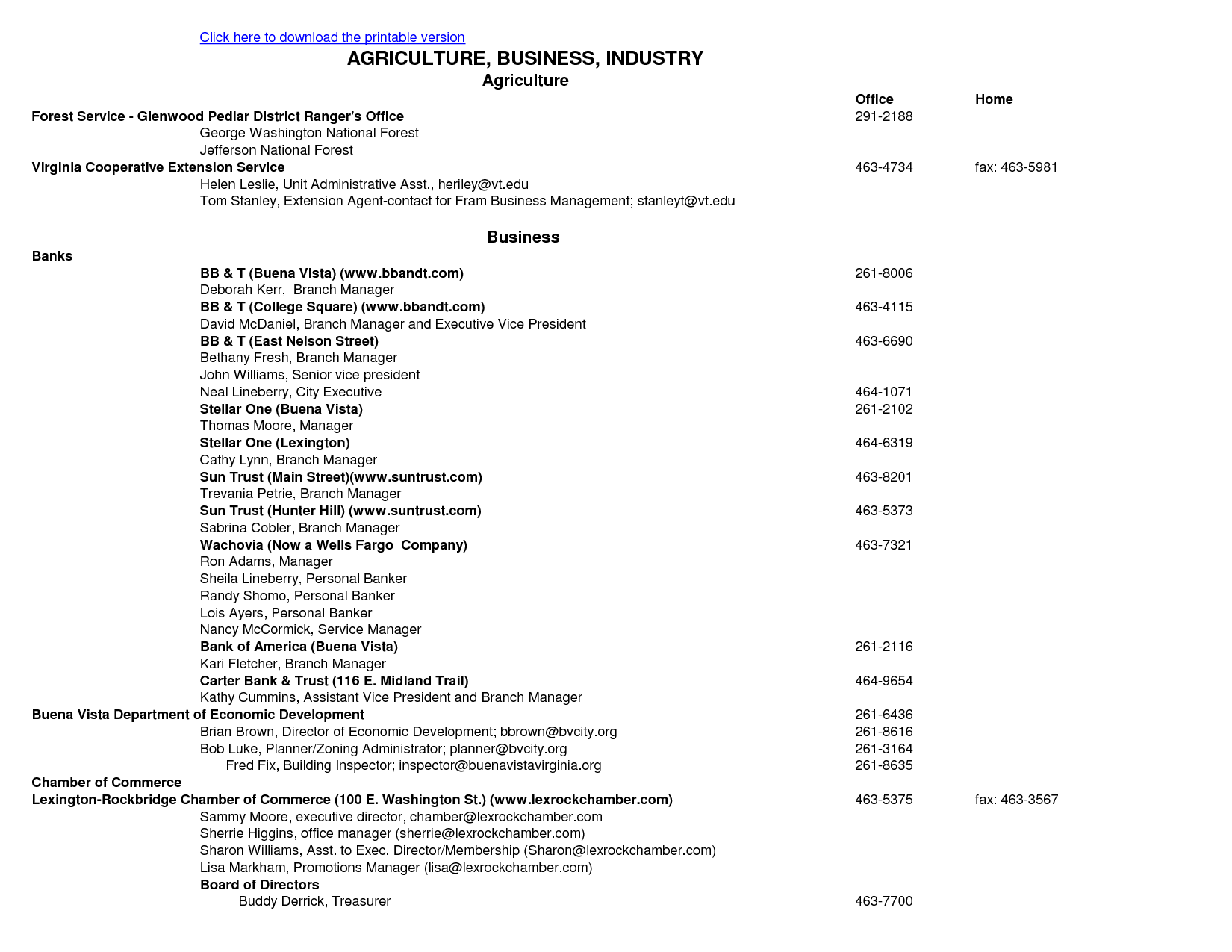

- Dave Ramsey

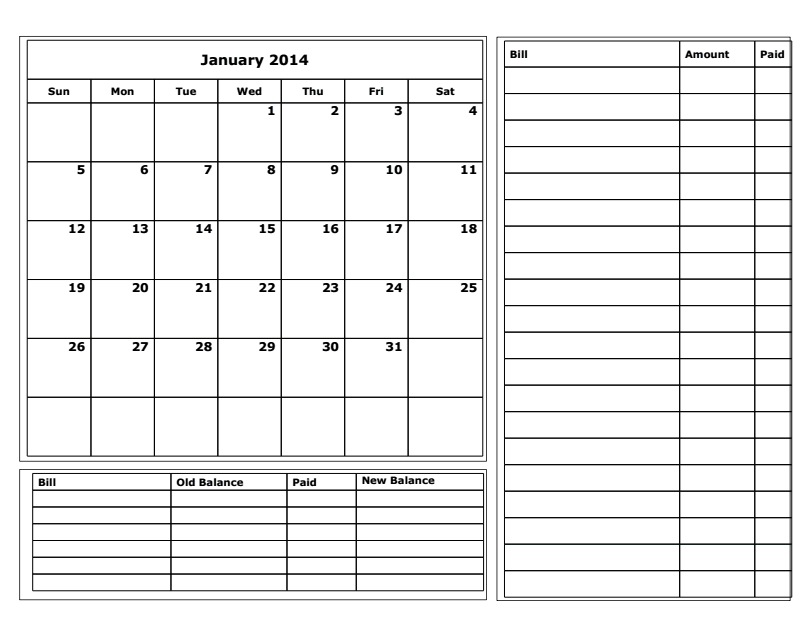

- Free Printable Budget Calendar 2014

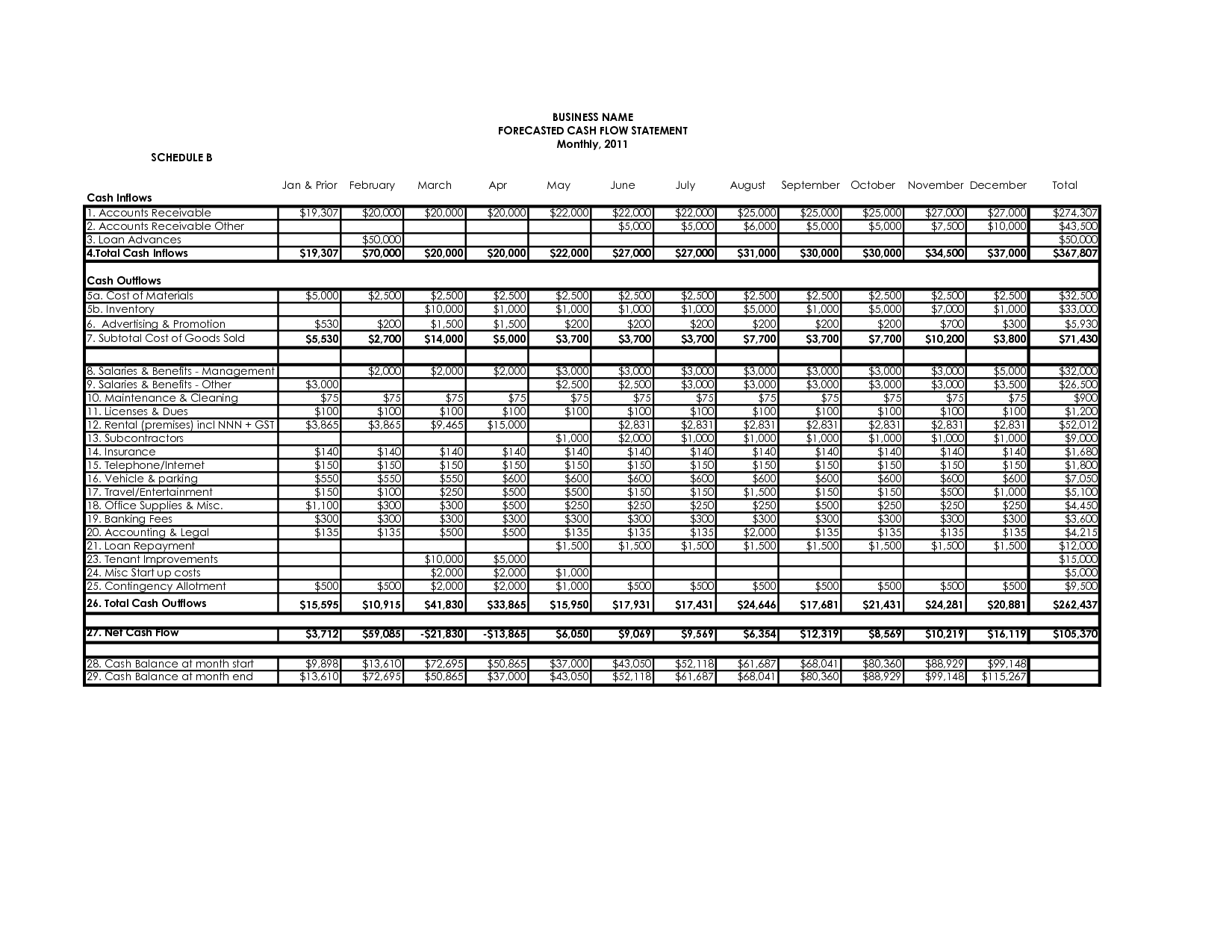

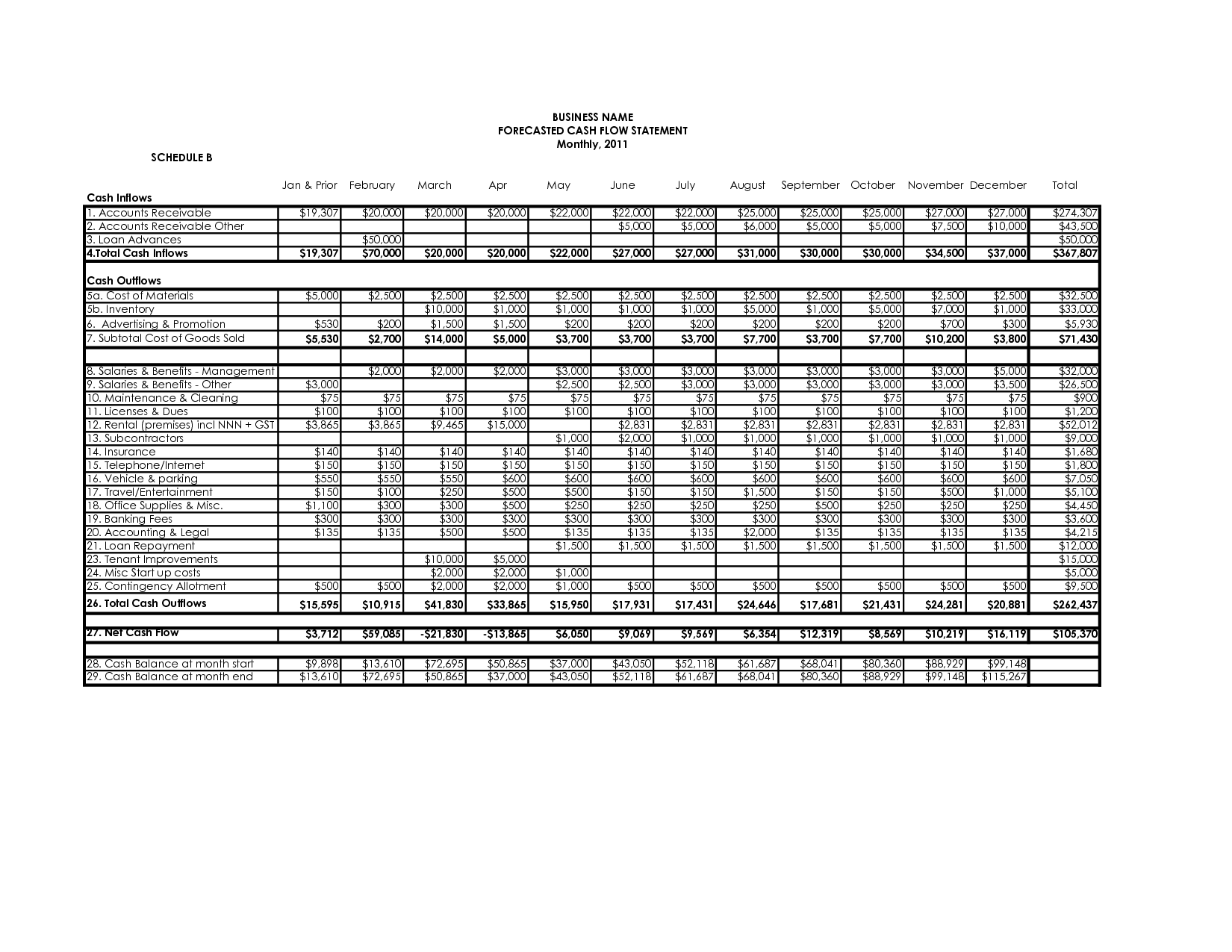

- Cash Flow Analysis Template Excel

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a monthly budget worksheet?

A monthly budget worksheet is a tool used to track income, expenses, and savings over the course of a month. It typically includes categories for various expenses such as housing, transportation, groceries, and entertainment, allowing individuals to monitor their spending and make adjustments as needed to stay within their budget. This worksheet helps to visualize where money is being allocated and can aid in making informed financial decisions.

How do you create a monthly budget worksheet?

To create a monthly budget worksheet, start by listing all sources of income. Next, list all expenses including fixed (rent, utilities) and variable (groceries, dining out). Subtract total expenses from income to determine surplus or deficit. Allocate funds for savings and emergency expenses. Review and adjust monthly to track spending habits and achieve financial goals. Utilize software or online budgeting tools for convenience and accuracy.

Why is it important to have a monthly budget worksheet?

Having a monthly budget worksheet is important because it helps you track your income and expenses, enabling you to see where your money is going and where you may need to make adjustments. It also helps you stay organized and accountable for your financial goals, such as saving for emergencies, paying off debt, or investing for the future. By creating and sticking to a budget, you can better manage your finances, avoid overspending, and work towards achieving long-term financial stability.

What types of expenses should be included in a monthly budget worksheet?

A monthly budget worksheet should include all essential expenses such as rent/mortgage, utilities, groceries, transportation, insurance, debt payments, and healthcare costs. It should also account for discretionary spending like entertainment, dining out, and shopping. Additionally, setting aside savings and emergency funds should be factored into the budget to ensure financial preparedness. Tracking and categorizing expenses accurately can help in identifying areas for potential savings and improving overall financial health.

How can a monthly budget worksheet help in identifying spending patterns?

A monthly budget worksheet can help in identifying spending patterns by providing a clear overview of income and expenses for each month. By tracking and categorizing expenses, individuals can see where their money is being spent most frequently and identify any areas of overspending or opportunities for saving. This can help in making informed decisions on adjusting spending habits and creating a more realistic and effective budget plan for the future.

What are the benefits of tracking income and expenses with a monthly budget worksheet?

Tracking income and expenses with a monthly budget worksheet provides numerous benefits such as helping individuals better understand their financial situation, identify areas for potential savings, prioritize spending on necessities, avoid overspending, and work towards achieving financial goals. It also allows for better decision-making, monitoring progress towards financial objectives, and preparing for unexpected expenses or emergencies by building a savings buffer. Ultimately, a monthly budget worksheet serves as a valuable tool for effective financial planning and management.

How often should a monthly budget worksheet be reviewed and updated?

A monthly budget worksheet should ideally be reviewed and updated at least once a month to ensure accuracy and alignment with current financial circumstances. Regularly revisiting and adjusting your budget can help you stay on track with your financial goals, identify any changes in income or expenses, and make any necessary adjustments to your spending habits.

Are there any strategies for effectively using a monthly budget worksheet?

To effectively use a monthly budget worksheet, start by accurately tracking all income and expenses, including fixed costs like rent and bills as well as variable expenses like entertainment or dining out. Set specific financial goals and allocate funds accordingly, prioritizing essentials over non-essentials. Regularly review and adjust your budget to stay on track with your financial objectives. Consider using budgeting tools or apps to automate tracking and help you stick to your budget. Finally, be disciplined and mindful of your spending habits to ensure the effectiveness of your budgeting efforts.

What are some common challenges faced when using a monthly budget worksheet?

Some common challenges faced when using a monthly budget worksheet include accurately tracking all expenses, sticking to set budget limits, dealing with unexpected expenses, remembering to update the worksheet regularly, and prioritizing financial goals. Additionally, it can be challenging to account for fluctuating income, such as irregular paychecks or seasonal work. Despite these challenges, staying organized and disciplined with a budget worksheet can help manage finances effectively.

Can a monthly budget worksheet help in achieving financial goals?

Yes, a monthly budget worksheet can definitely help in achieving financial goals by providing a clear overview of income and expenses, allowing to identify areas where adjustments can be made, and helping to track progress towards financial objectives. By consistently managing and monitoring finances using a budget worksheet, individuals can develop good financial habits, make informed decisions, and stay on track towards reaching their goals.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments