Monthly Bills Expense Worksheet

Keeping track of monthly bills and expenses is a crucial task for anyone striving for financial stability and organization. With our Monthly Bills Expense Worksheet, you can efficiently organize your finances and stay on top of your expenses. This worksheet is designed for individuals or families who want to manage their monthly bills and ensure they never miss a payment.

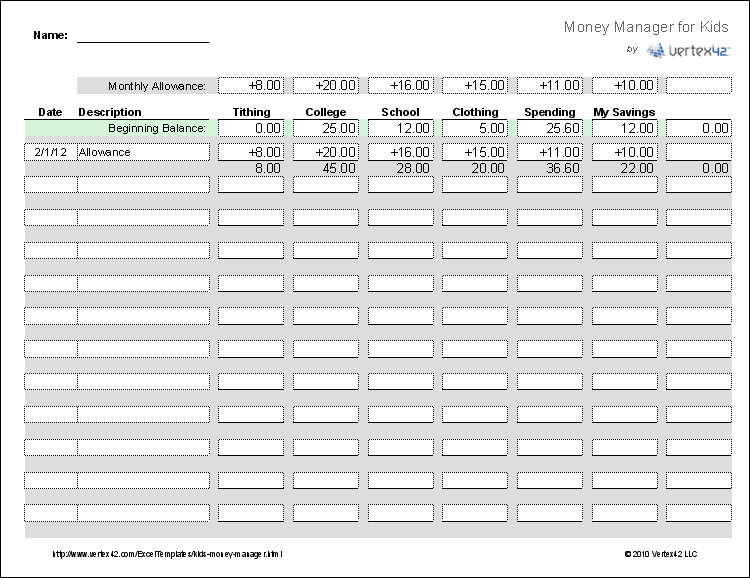

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a Monthly Bills Expense Worksheet?

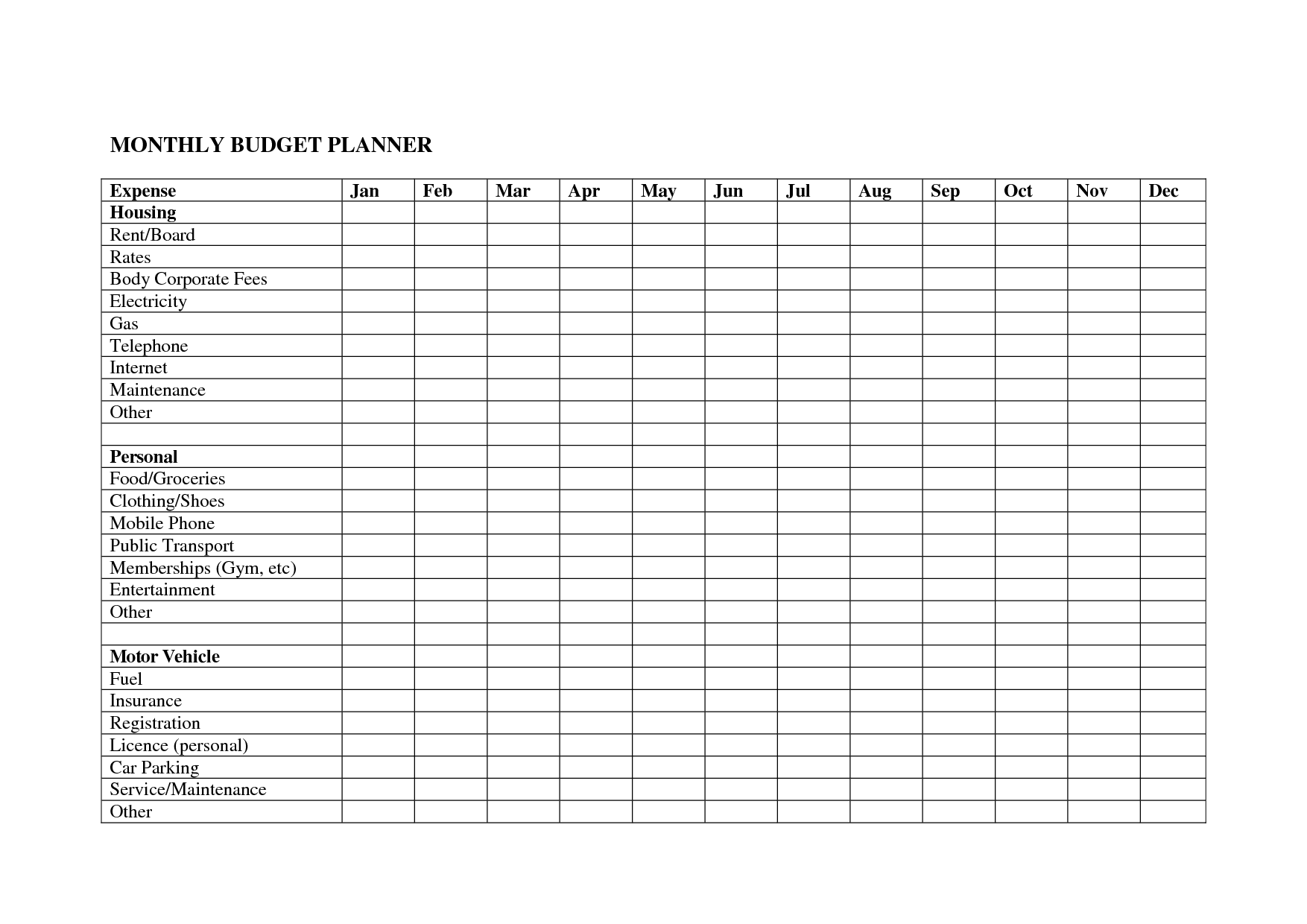

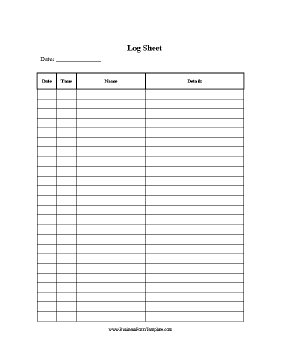

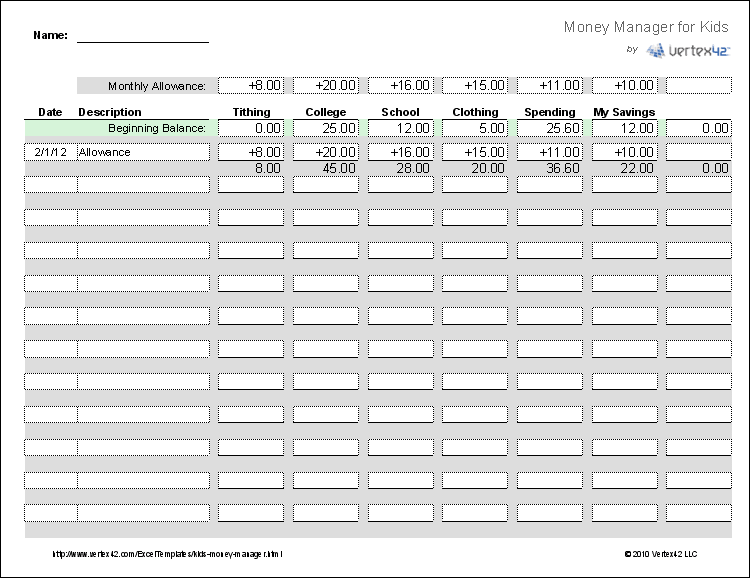

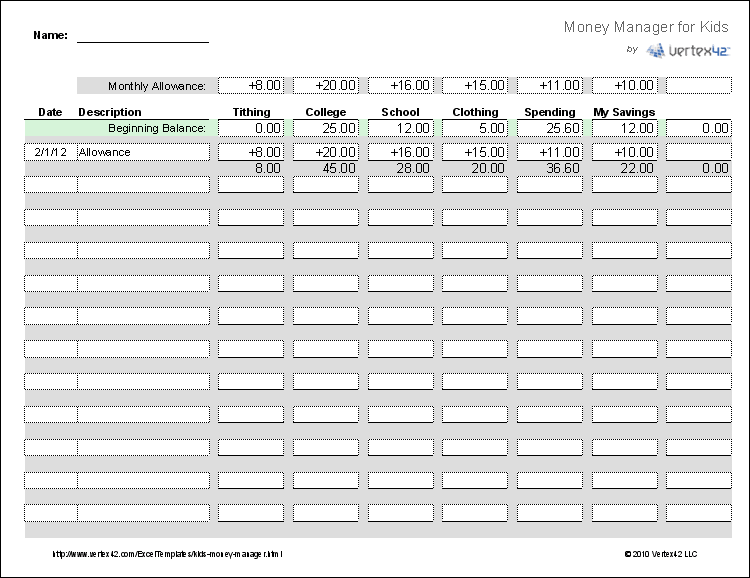

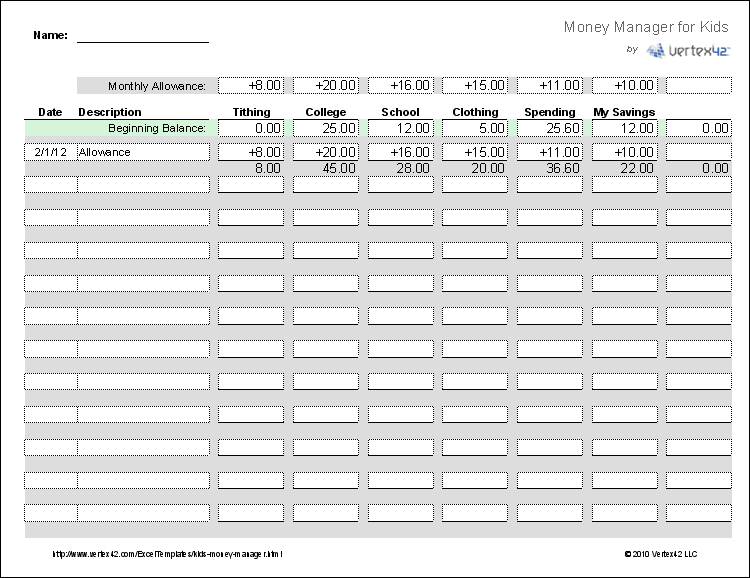

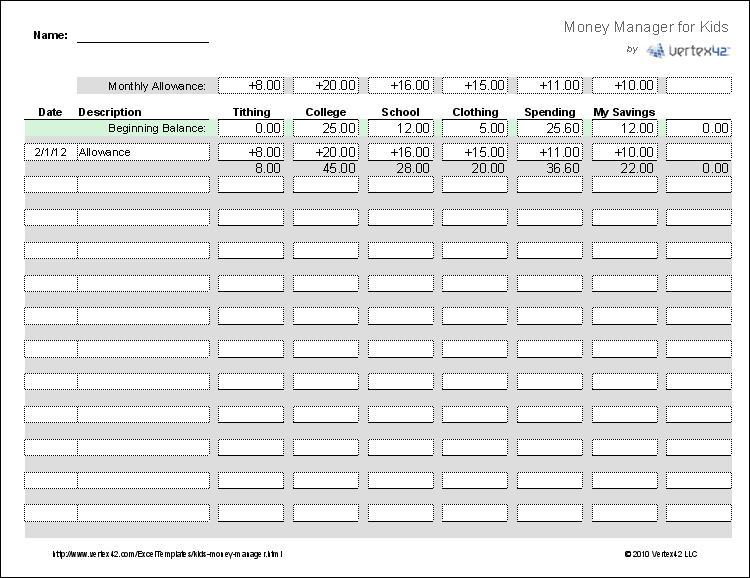

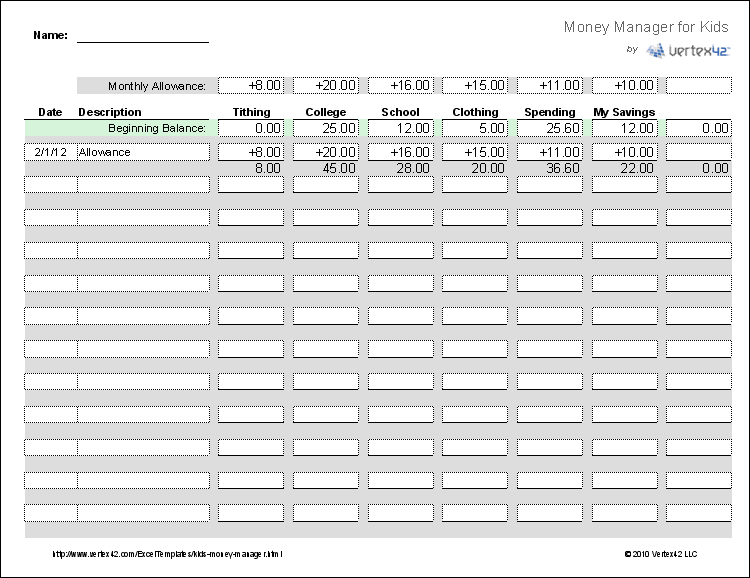

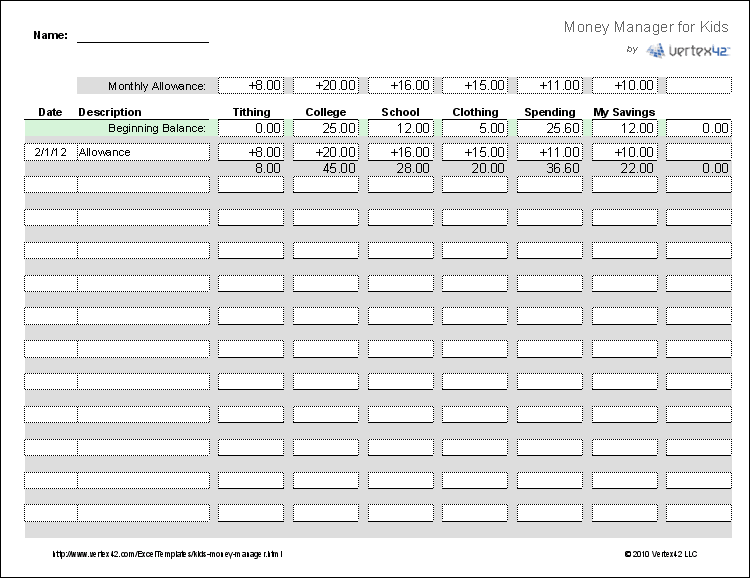

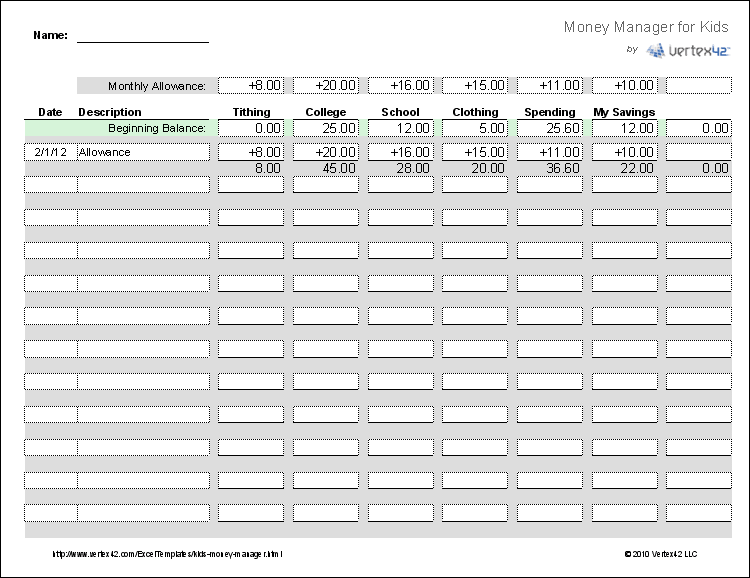

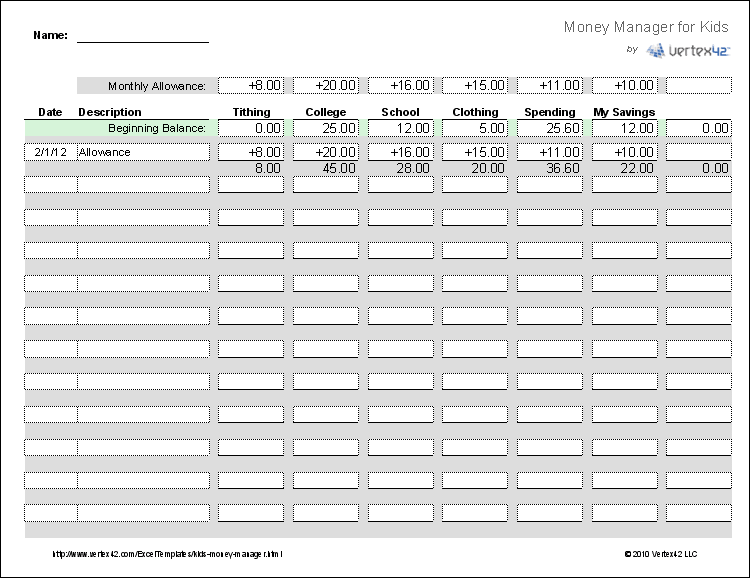

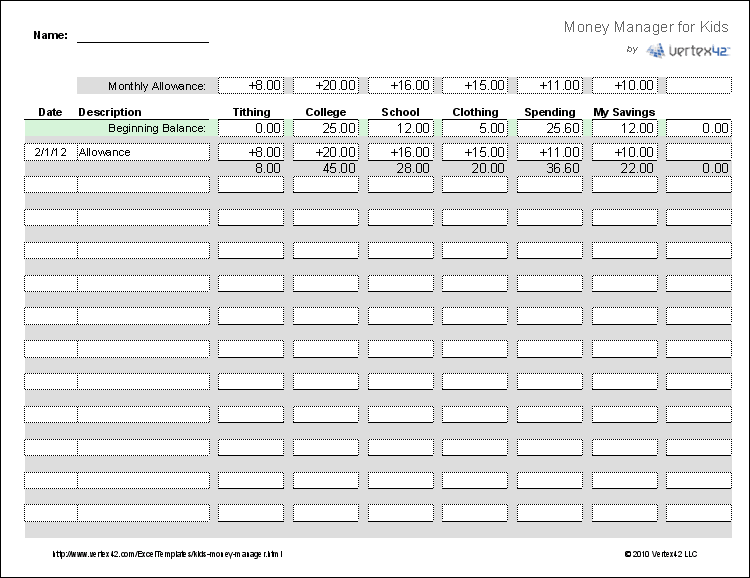

A Monthly Bills Expense Worksheet is a tool used to track and organize all the various bills and expenses that need to be paid on a monthly basis. It typically includes columns for listing the name of the expense, the due date, the amount owed, and whether it has been paid. This worksheet can help individuals or households stay organized, budget effectively, and ensure that all bills are paid on time.

How can a Monthly Bills Expense Worksheet help with personal finance management?

A Monthly Bills Expense Worksheet can help with personal finance management by providing a structured way to track and organize all recurring expenses, allowing individuals to have a clear overview of their financial obligations. By listing and categorizing bills, such as rent, utilities, and subscriptions, individuals can better understand their spending patterns and identify areas where they can potentially cut costs or reallocate funds. This tool can also help in planning ahead for upcoming expenses, setting budgets, and ensuring that all bills are paid on time, ultimately aiding in creating a more effective and sustainable financial plan.

What kind of information should be included in a Monthly Bills Expense Worksheet?

A Monthly Bills Expense Worksheet should include essential details such as the names of all recurring bills (such as rent/mortgage, utilities, insurance, etc.), the billing cycle due dates, the amount due for each bill, any notes or comments related to the bill, the method of payment, and whether the bill has been paid or not. It is important to have a clear and organized layout to track and manage monthly expenses effectively.

How often should a Monthly Bills Expense Worksheet be updated?

A Monthly Bills Expense Worksheet should be updated at least once a month, ideally at the beginning of each new month. This ensures that all expenses for the previous month are recorded accurately and allows for proper budgeting and planning for the upcoming month. Regularly updating the worksheet helps in tracking expenses, identifying any discrepancies, and staying on top of your financial situation.

What are some common categories or sections on a Monthly Bills Expense Worksheet?

Common categories or sections on a Monthly Bills Expense Worksheet may include utilities (such as electricity, water, gas), rent or mortgage payments, insurance (such as health, car, home), phone and internet services, transportation expenses (such as gas, public transportation), groceries, dining out, entertainment, subscription services, and any other regular monthly expenses.

How can a Monthly Bills Expense Worksheet help track spending habits?

A Monthly Bills Expense Worksheet can help track spending habits by providing a clear overview of all recurring expenses for each month, such as rent, utilities, subscriptions, and loan payments. By inputting these expenses into the worksheet alongside income information, individuals can see how much they are spending versus how much they are earning each month. This tracking can help identify areas where expenses can be reduced, highlight patterns in spending, and ultimately help individuals make more informed financial decisions to better manage their money.

Is it necessary to prioritize expenses on a Monthly Bills Expense Worksheet?

Yes, it is important to prioritize expenses on a Monthly Bills Expense Worksheet to ensure that essential bills such as rent or mortgage, utilities, and insurance are paid on time. By prioritizing expenses, individuals can effectively manage their finances, avoid missing crucial payments, and maintain financial stability.

Can a Monthly Bills Expense Worksheet help identify areas to cut back on expenses?

Yes, a Monthly Bills Expense Worksheet can definitely help identify areas where you can cut back on expenses. By tracking all of your bills and expenses, you can see where your money is going each month and identify any areas of overspending or areas where you can make adjustments to reduce costs. This can help you create a more efficient budget and make informed decisions about where to cut back on expenses to better manage your finances.

How can a Monthly Bills Expense Worksheet help with budgeting and saving money?

A Monthly Bills Expense Worksheet can help with budgeting and saving money by providing a clear overview of all recurring expenses, allowing you to see where your money is going each month. By tracking your expenses, you can identify areas where you may be overspending and make adjustments to save more efficiently. This worksheet can also help you prioritize which bills are essential and which expenses can be reduced or eliminated to free up more savings. Overall, it promotes financial awareness and accountability, leading to better money management and increased savings over time.

Are there any digital tools or apps available for creating and managing a Monthly Bills Expense Worksheet?

Yes, there are several digital tools and apps available for creating and managing a Monthly Bills Expense Worksheet. Some popular options include Microsoft Excel, Google Sheets, Mint, Tiller Money, and EveryDollar. These tools allow you to input your monthly expenses, track payments, set reminders for due dates, and even create visual representations of your spending habits. Choose the one that best fits your needs and start managing your bills more efficiently.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments