Money Comparison Worksheets

Money comparison worksheets are a valuable tool for individuals seeking a practical and organized way to manage their finances. By providing a structured layout and simple format, these worksheets allow users to compare and analyze various financial aspects, helping them make informed decisions. Whether you are a budget-conscious individual, a small business owner, or a student learning about money management, money comparison worksheets can be a beneficial resource.

Table of Images 👆

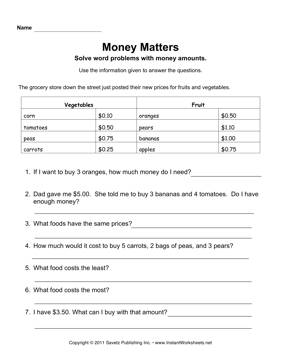

- Money Word Problem Worksheets

- Math Estimation Word Problems 2nd Grade

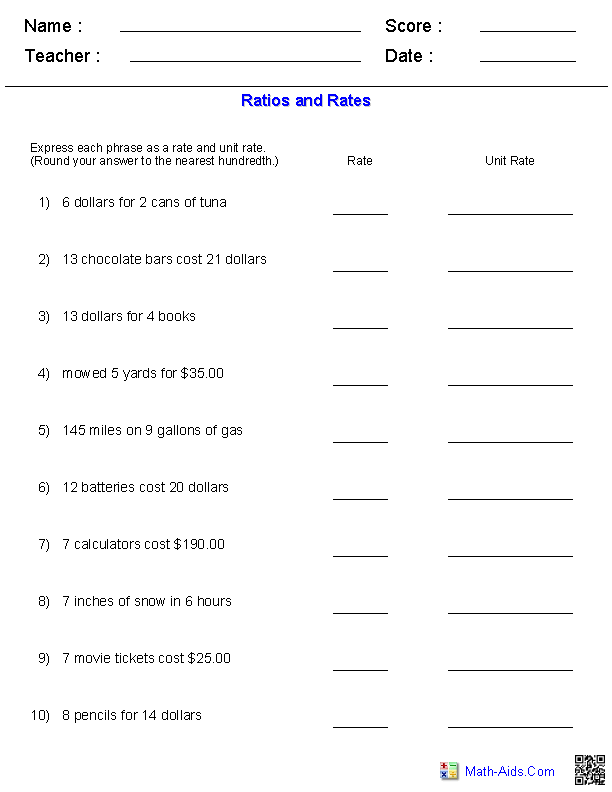

- Unit Rates Worksheet 6th Grade Math

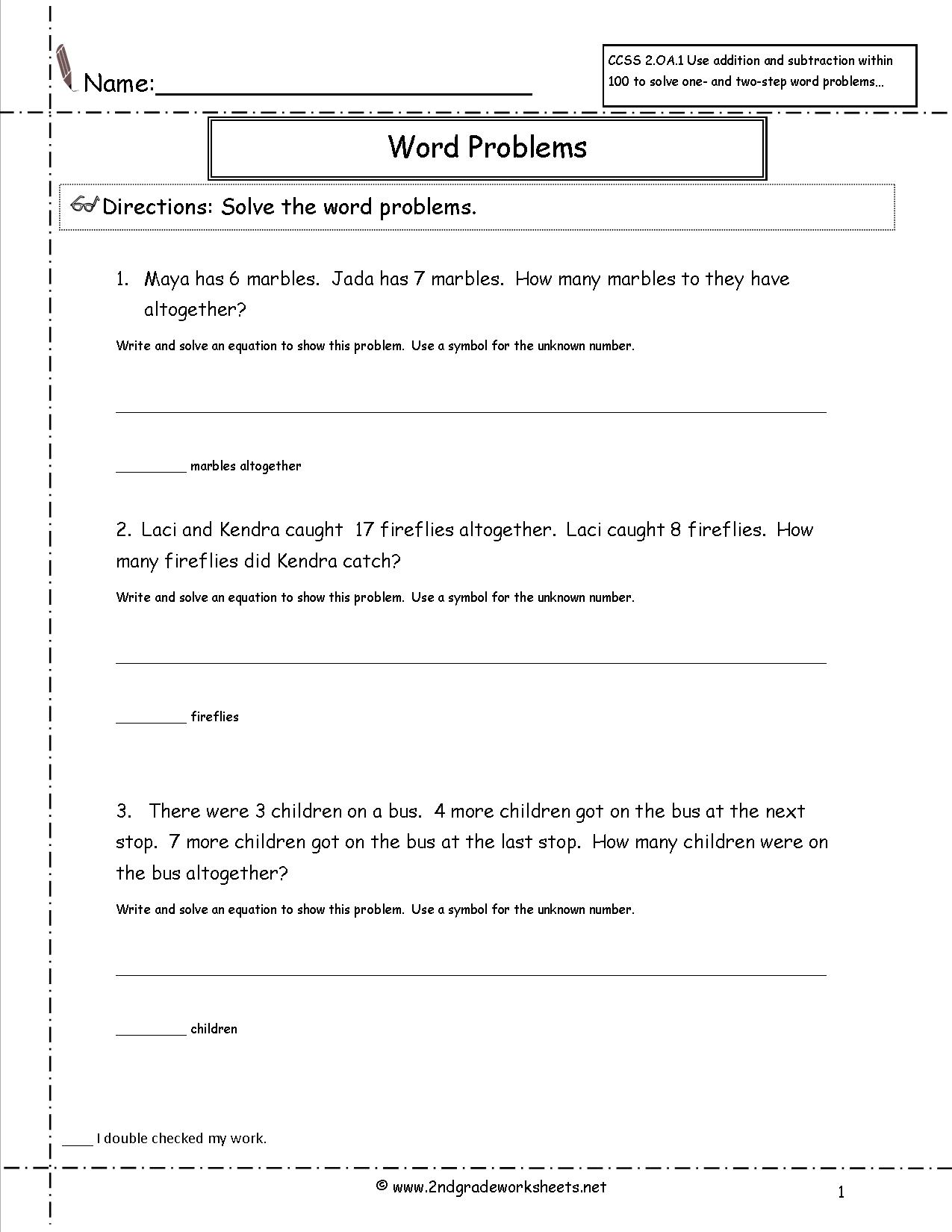

- 2nd Grade Math Word Problems Worksheets

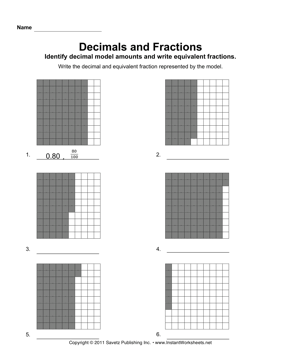

- Decimal Models Worksheets

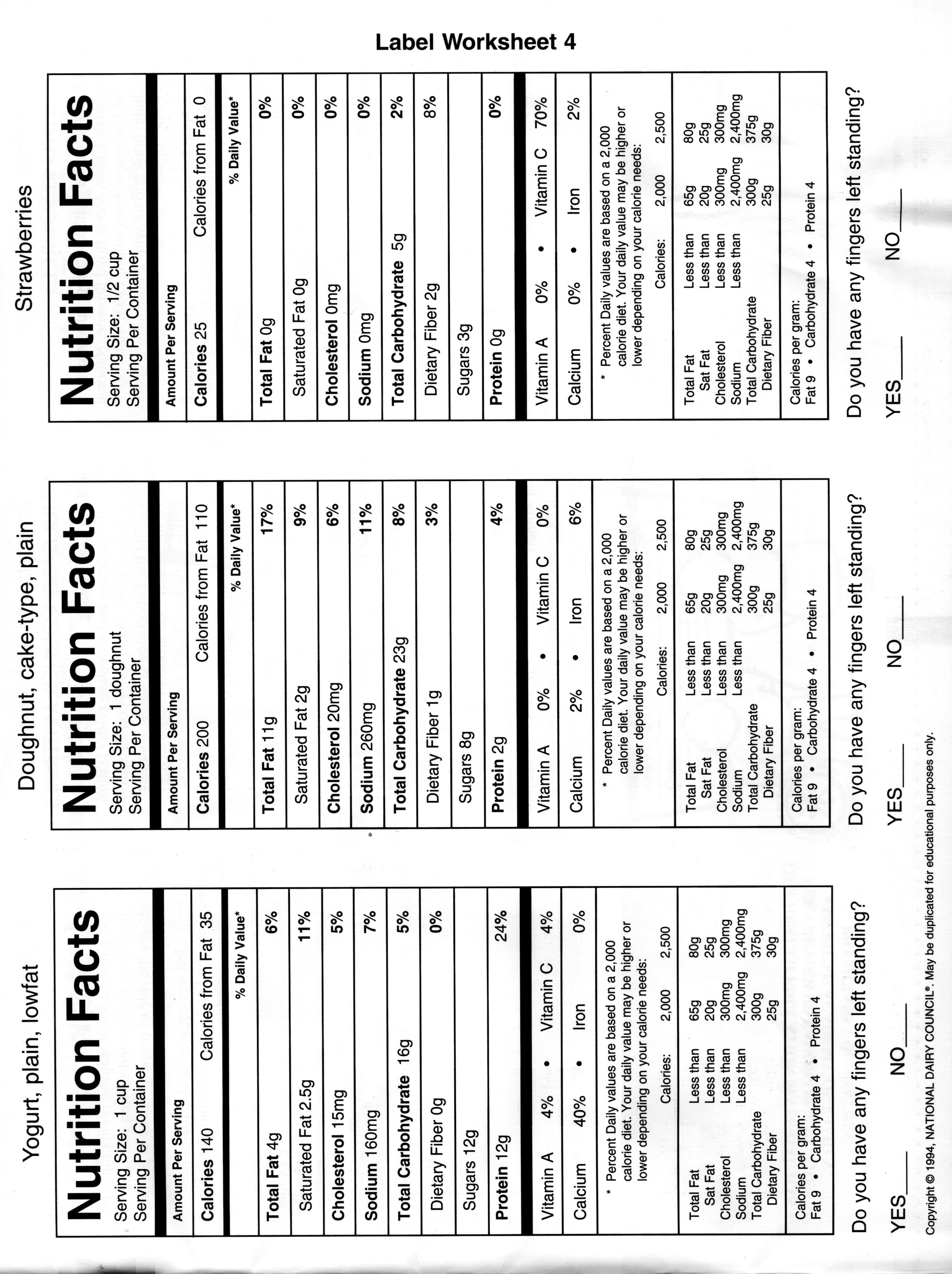

- Food Nutrition Labels Worksheet

- Pictograph Worksheets

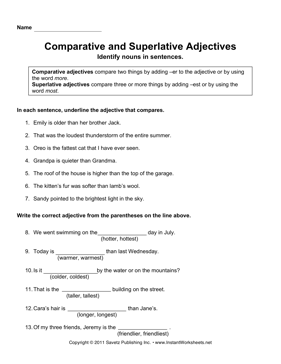

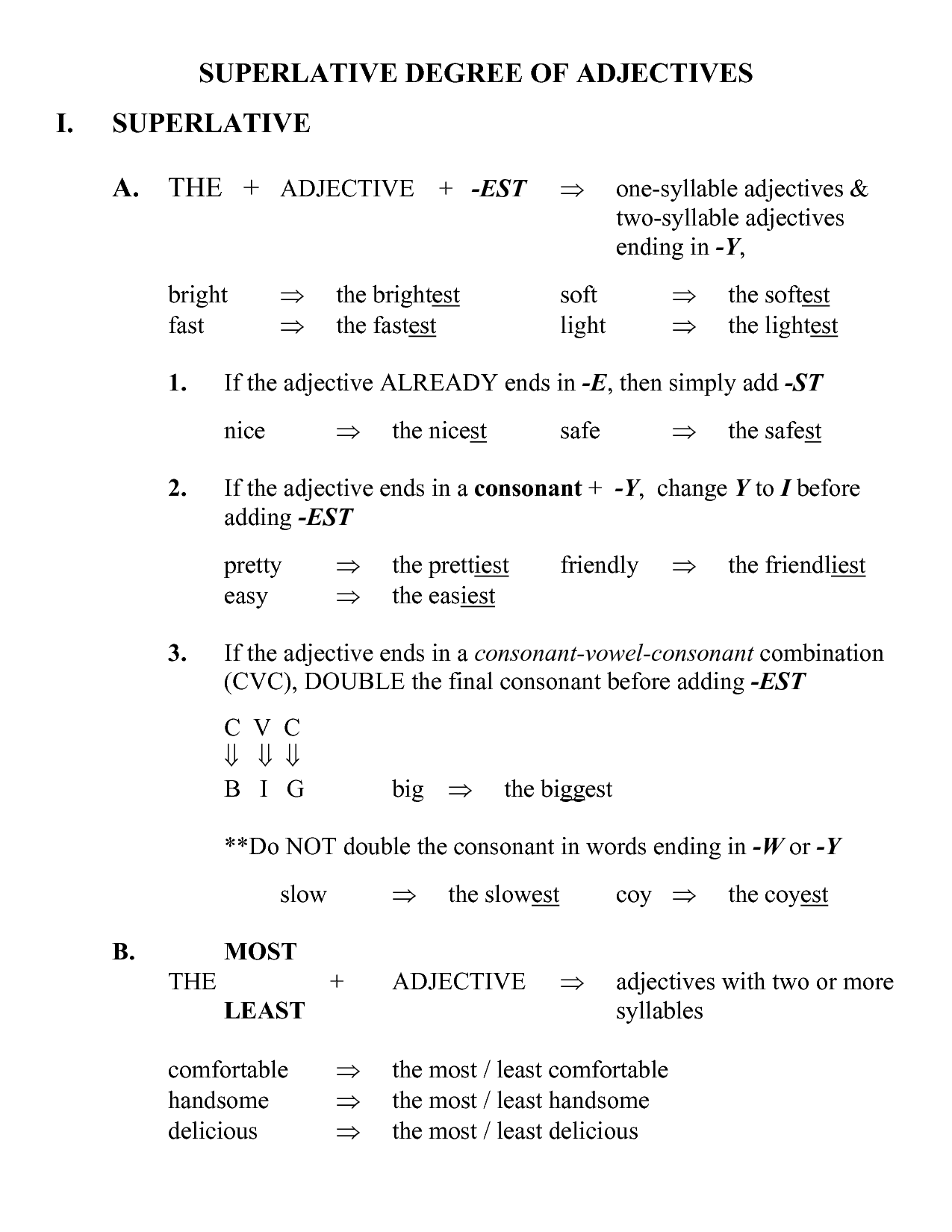

- Comparative and Superlative Adjectives

- Flag for Africa Worksheet Color

- Fraction Pattern Worksheet

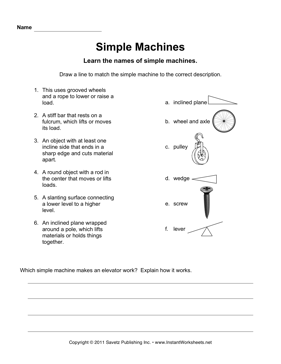

- Simple Machines Worksheet

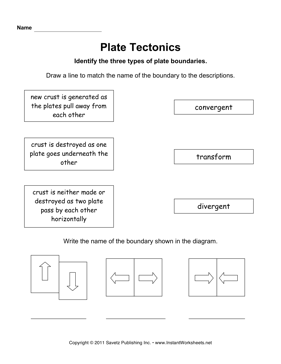

- Plate Tectonics Worksheets

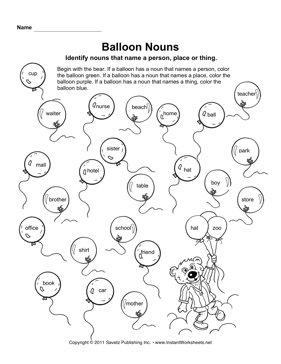

- Nouns Coloring Worksheets Printable

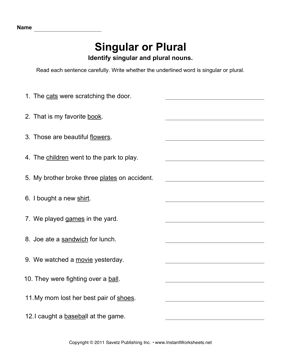

- Singular and Plural Nouns Worksheets

- Adjective Comparative Degree

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a money comparison worksheet?

A money comparison worksheet is a tool used to compare different financial options or products, such as loans, credit cards, or savings accounts. It typically includes detailed information about the terms, fees, interest rates, and potential benefits of each option, allowing individuals to make informed decisions about their finances based on their specific needs and preferences.

How can a money comparison worksheet help with financial planning?

A money comparison worksheet can help with financial planning by allowing individuals to track their income sources, expenses, and savings goals in one place. By organizing this information, individuals can easily see where their money is going, identify areas where they can cut costs or increase savings, and make informed decisions about their financial priorities. This tool can provide a clear overview of their financial situation, helping them set realistic goals and create a solid plan for managing their money more effectively.

What are the main sections or categories typically included in a money comparison worksheet?

A money comparison worksheet typically includes sections like income sources, expenses (such as housing, utilities, groceries, transportation, and leisure), savings goals, debt repayment plans, and a summary section showing the total income, total expenses, savings, and net income. It is important to have these categories to track and understand where money is being allocated, make adjustments as needed, and work towards financial goals effectively.

What types of financial information should be included in a money comparison worksheet?

A money comparison worksheet should include detailed information on income sources, expenses, savings goals, debt obligations, and investment accounts. It is fundamental to outline all sources of income, such as salaries, bonuses, or rental income, and list out all expenditures, including fixed expenses like rent or utilities and variable expenses like groceries or entertainment. Furthermore, including information about debts like credit card balances or loans, savings targets for short-term and long-term goals, and details on investment accounts or retirement savings accounts will provide a comprehensive overview of an individual's financial health.

How can a money comparison worksheet help identify areas of overspending or unnecessary expenses?

A money comparison worksheet can help identify areas of overspending or unnecessary expenses by allowing individuals to track their income and expenses in an organized manner. By comparing their budgeted amounts with actual expenses, individuals can quickly see where they are overspending or where unnecessary expenses are occurring. This comparison can highlight where adjustments need to be made to reduce spending and increase savings, ultimately helping to improve financial health and reach financial goals.

What are some common tips or strategies for using a money comparison worksheet effectively?

To use a money comparison worksheet effectively, start by clearly defining your financial goals and the specific factors you want to compare, such as interest rates, fees, or terms. Gather accurate information from various financial institutions or providers to ensure a comprehensive comparison. Organize the data in a clear and logical manner on the worksheet, making it easy to compare and analyze. Consider factors like total costs, potential savings, and any potential risks before making a decision. Regularly update the worksheet as rates or terms may change over time, and use it as a tool to track progress towards your financial goals.

How often should a money comparison worksheet be updated or reviewed?

A money comparison worksheet should be updated or reviewed at least once a month to ensure that it accurately reflects your current financial situation and goals. However, it is a good idea to review it more frequently, such as weekly or bi-weekly, especially if you have significant changes in your income, expenses, or financial goals. Regularly updating and reviewing your money comparison worksheet will help you make informed financial decisions and stay on track towards achieving your financial objectives.

Can a money comparison worksheet be used for both personal and business finances?

Yes, a money comparison worksheet can be used for both personal and business finances. It can help individuals and businesses to track and compare their expenses, income, and financial goals in order to make informed decisions and manage their finances effectively. The worksheet can be personalized to include specific categories and metrics relevant to both personal and business financial activities, making it a versatile tool for budgeting and financial planning purposes.

Are there any important calculations or formulas that should be used in a money comparison worksheet?

When creating a money comparison worksheet, it is essential to include calculations such as determining the total cost of items by summing up individual costs, calculating average costs, finding percentage differences between values for comparison, and calculating savings or discounts for various items. Additionally, formulas for calculating currency conversions, interest rates, and return on investment can also be useful in a money comparison worksheet to provide a comprehensive analysis of financial data.

How can a money comparison worksheet help individuals or businesses make more informed financial decisions?

A money comparison worksheet can help individuals or businesses make more informed financial decisions by providing a clear overview of different options, such as products or services, costs, interest rates, and terms. By comparing all relevant factors side-by-side, users can easily identify the most cost-effective or suitable option for their needs. This tool allows for a more systematic and thorough evaluation, enabling informed decisions that can lead to saving money, reducing risks, and achieving financial goals efficiently.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments