Making a Monthly Budget Worksheet

Creating a monthly budget worksheet can be an effective way to track your income and expenses, helping you gain a better understanding of your financial situation. By organizing and categorizing your income and expenses, you can have a clearer picture of where your money is going and identify areas where you can potentially save. Whether you are a student, a young professional starting out, or someone who wants to improve their financial management skills, a monthly budget worksheet can be a valuable tool to achieve your financial goals.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

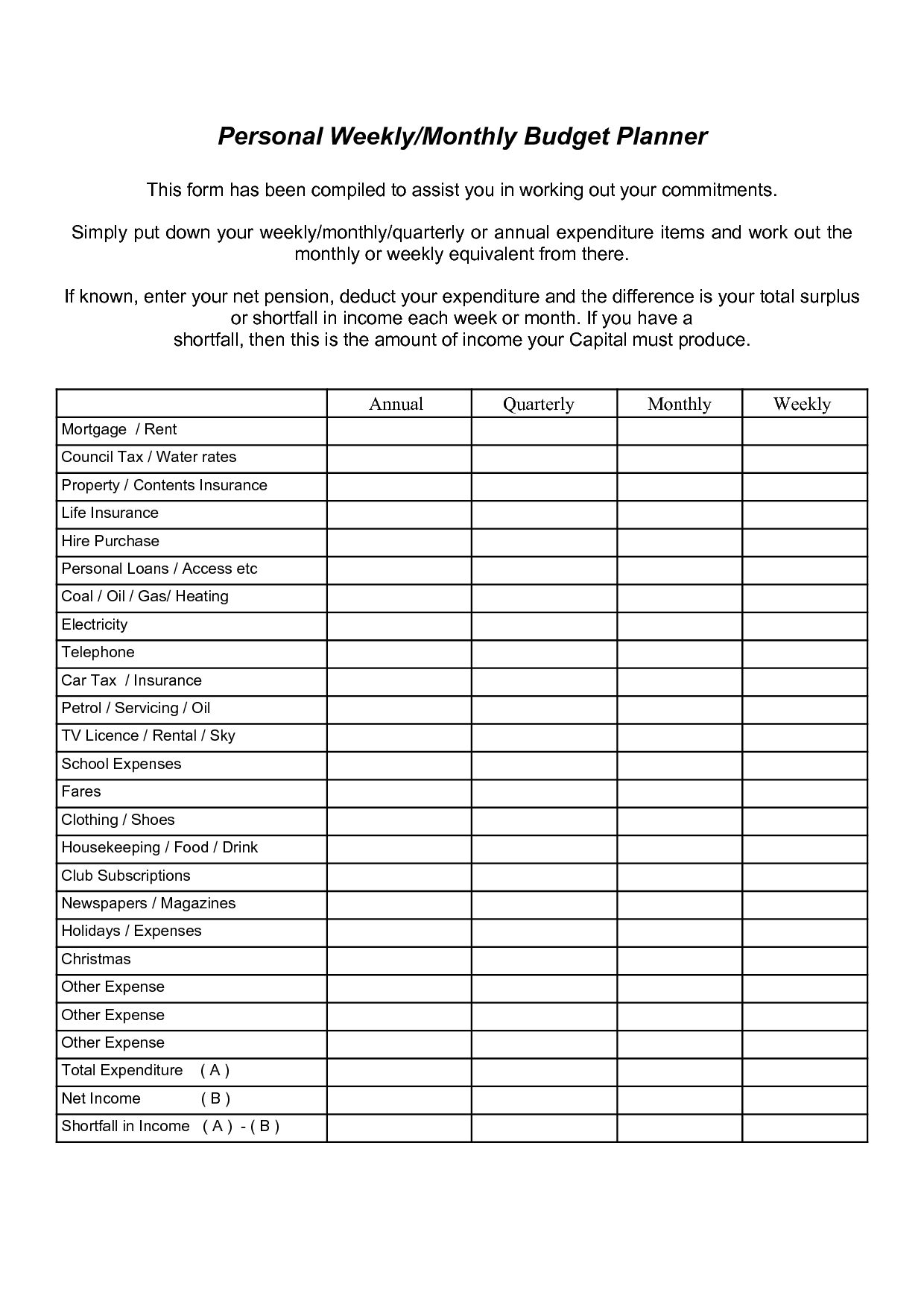

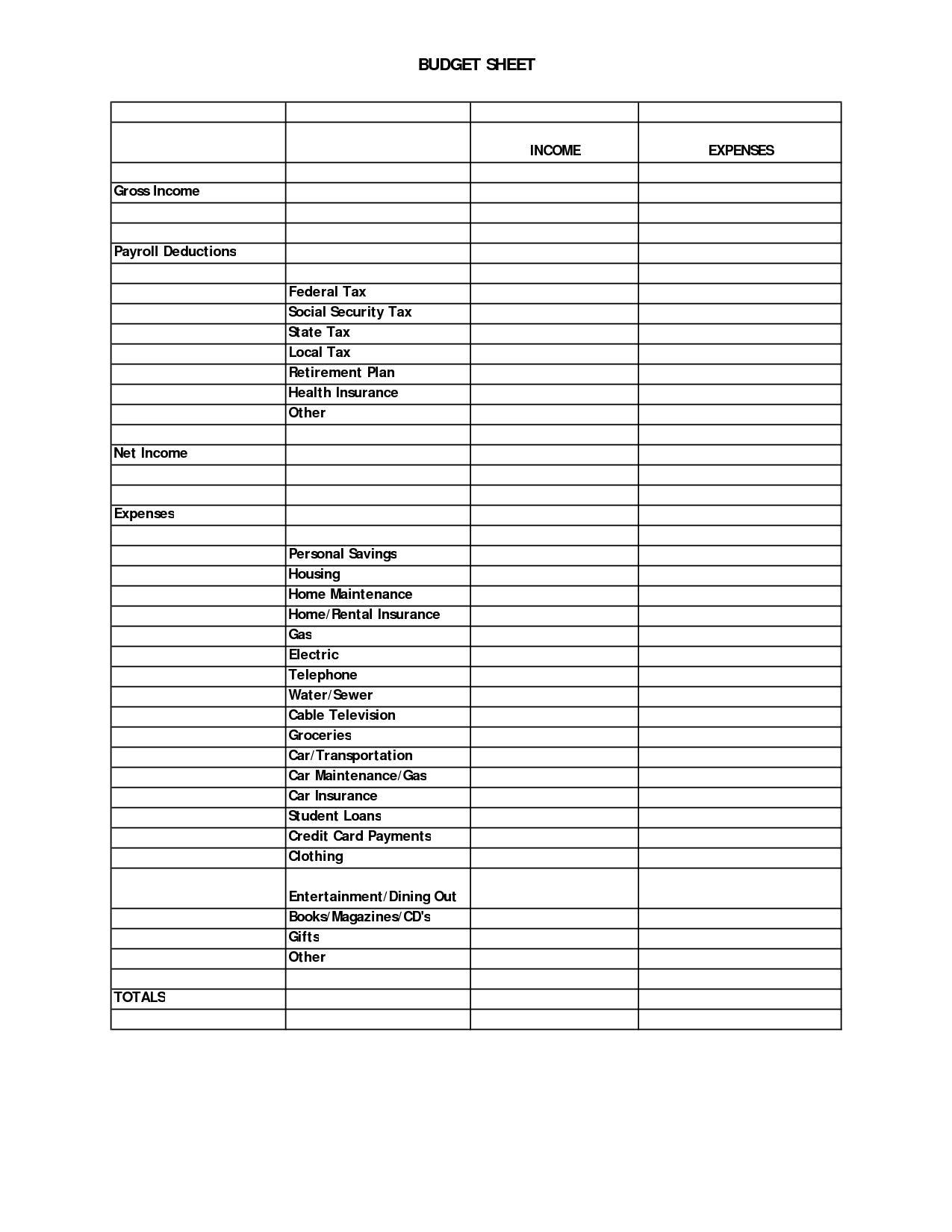

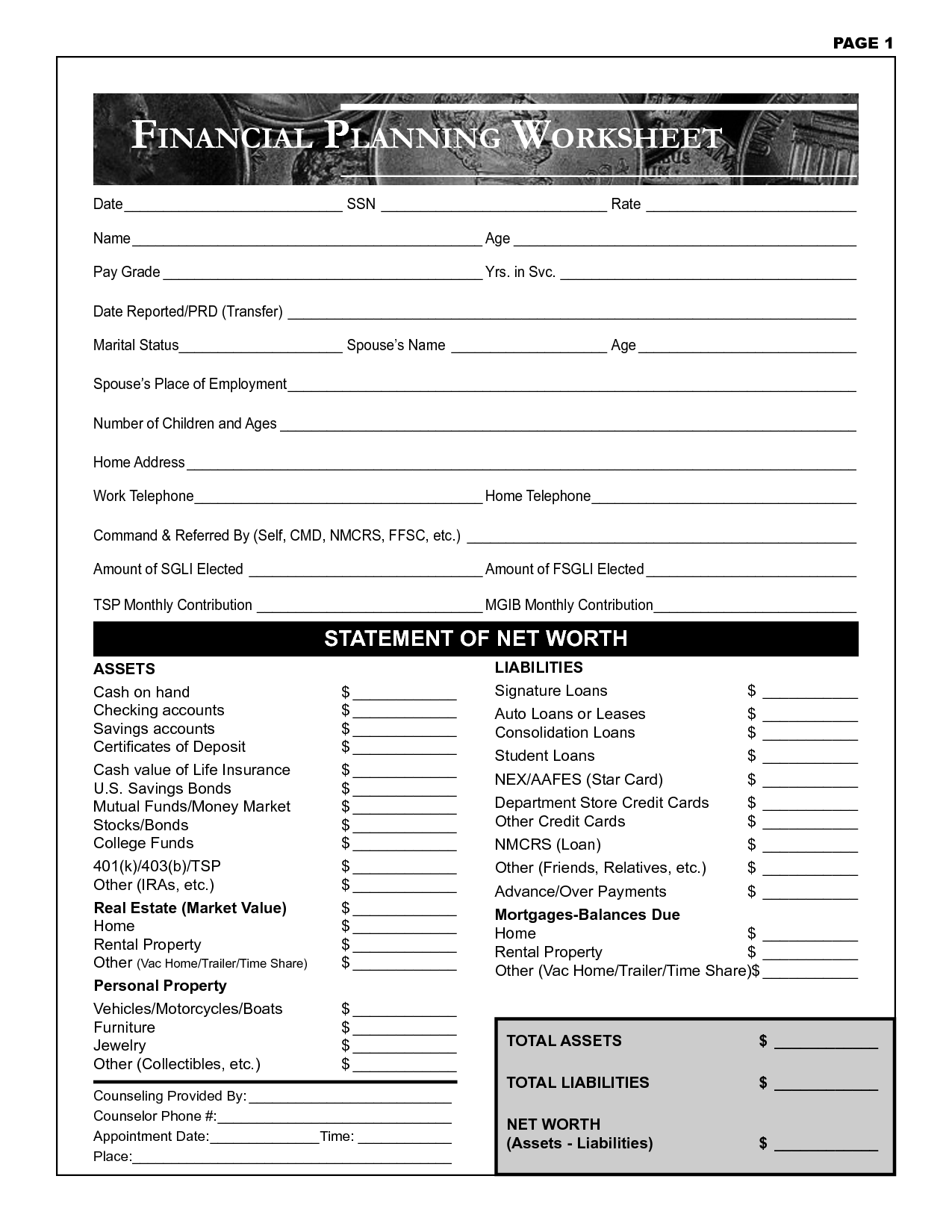

What is a monthly budget worksheet?

A monthly budget worksheet is a tool used to track and manage income and expenses for a specified time period, typically a month. It helps individuals or households allocate funds to different categories such as housing, transportation, food, and savings, allowing them to monitor spending habits and identify areas where adjustments may be needed to meet financial goals.

Why is it important to create a monthly budget?

Creating a monthly budget is important because it helps to track and manage your finances effectively. It allows you to prioritize your spending, set financial goals, and save for future needs. By having a budget in place, you can better control your expenses, avoid overspending, and make informed decisions about where your money should go each month, ultimately helping you to achieve financial stability and security.

What are the key components of a monthly budget worksheet?

A monthly budget worksheet typically includes key components such as income sources, expenses categories (such as housing, transportation, groceries, etc.), planned allocations for each category, actual expenses incurred, savings goals, and a section for tracking any financial adjustments or unexpected costs. These components help individuals or households effectively monitor and manage their finances on a month-to-month basis.

How do you track your income on a monthly budget worksheet?

To track your income on a monthly budget worksheet, you should list all sources of income you expect to receive for the month, such as wages, freelance payments, or any other form of earnings. Ensure to accurately record the specific amount for each income source. Total these amounts to calculate your projected monthly income. Make sure to update this information as you receive income throughout the month and compare it against your budgeted expenses to stay on top of your finances.

How do you track your expenses on a monthly budget worksheet?

To track your expenses on a monthly budget worksheet, you can start by creating categories for your expenses such as rent, utilities, groceries, transportation, entertainment, and so on. Write down your estimated budget for each category at the beginning of the month. As you make purchases or payments throughout the month, record the amount and category in the worksheet. At the end of the month, compare your actual spending to the budgeted amounts to see where you may need to adjust and where you can potentially save money.

What are some common categories to include in a monthly budget worksheet?

Some common categories to include in a monthly budget worksheet are income, housing expenses (rent or mortgage), utilities (electricity, water, etc.), groceries, transportation (car payment, gas, public transportation), insurance (health, car, etc.), debt payments, savings, entertainment, personal care (haircuts, toiletries), and miscellaneous expenses. It's important to customize your budget worksheet based on your unique financial situation and spending habits.

How do you calculate your monthly savings on a budget worksheet?

To calculate your monthly savings on a budget worksheet, you simply subtract your total monthly expenses from your total monthly income. The result will be the amount you are able to save each month. This calculation helps you monitor your financial health and identify areas where you can potentially adjust your spending to increase your savings.

Should you include a section for miscellaneous or unexpected expenses on your monthly budget worksheet?

Yes, it is important to include a section for miscellaneous or unexpected expenses on your monthly budget worksheet. These types of expenses can often pop up unexpectedly and can derail your budget if not accounted for. By setting aside funds each month for such expenses, you can be better prepared and avoid financial stress when these situations arise.

How often should you update your monthly budget worksheet?

It is generally recommended to update your monthly budget worksheet at least once a month. This allows you to track your expenses accurately and make any necessary adjustments to stay on top of your financial goals. However, you may choose to update it more frequently if you have a fluctuating income or expenses to ensure that your budget remains relevant and effective.

What are some tips for effective budgeting using a monthly budget worksheet?

To effectively budget using a monthly budget worksheet, start by tracking all sources of income and expenses meticulously, including fixed costs like rent and variable costs like groceries. Set realistic financial goals and allocate funds accordingly, prioritizing essential expenses over discretionary spending. Review and adjust your budget regularly to stay on track, identify areas for savings, and avoid overspending. Consider using categories or envelopes to manage different spending areas more efficiently. Remember to account for unexpected costs by including a buffer in your budget and saving for emergencies.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments