IRS Schedule C Worksheet

Are you a small business owner looking for an effective tool to organize your income and expenses? Look no further than the IRS Schedule C Worksheet. Designed specifically for self-employed individuals filing their taxes, this worksheet is both informative and easy to use. By providing an organized format to track your business income and deductions, it ensures accurate reporting of your financial information to the IRS. Whether you're a freelancer, a sole proprietor, or a contractor, this worksheet is the perfect entity for helping you stay on top of your tax obligations.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is the purpose of the IRS Schedule C Worksheet?

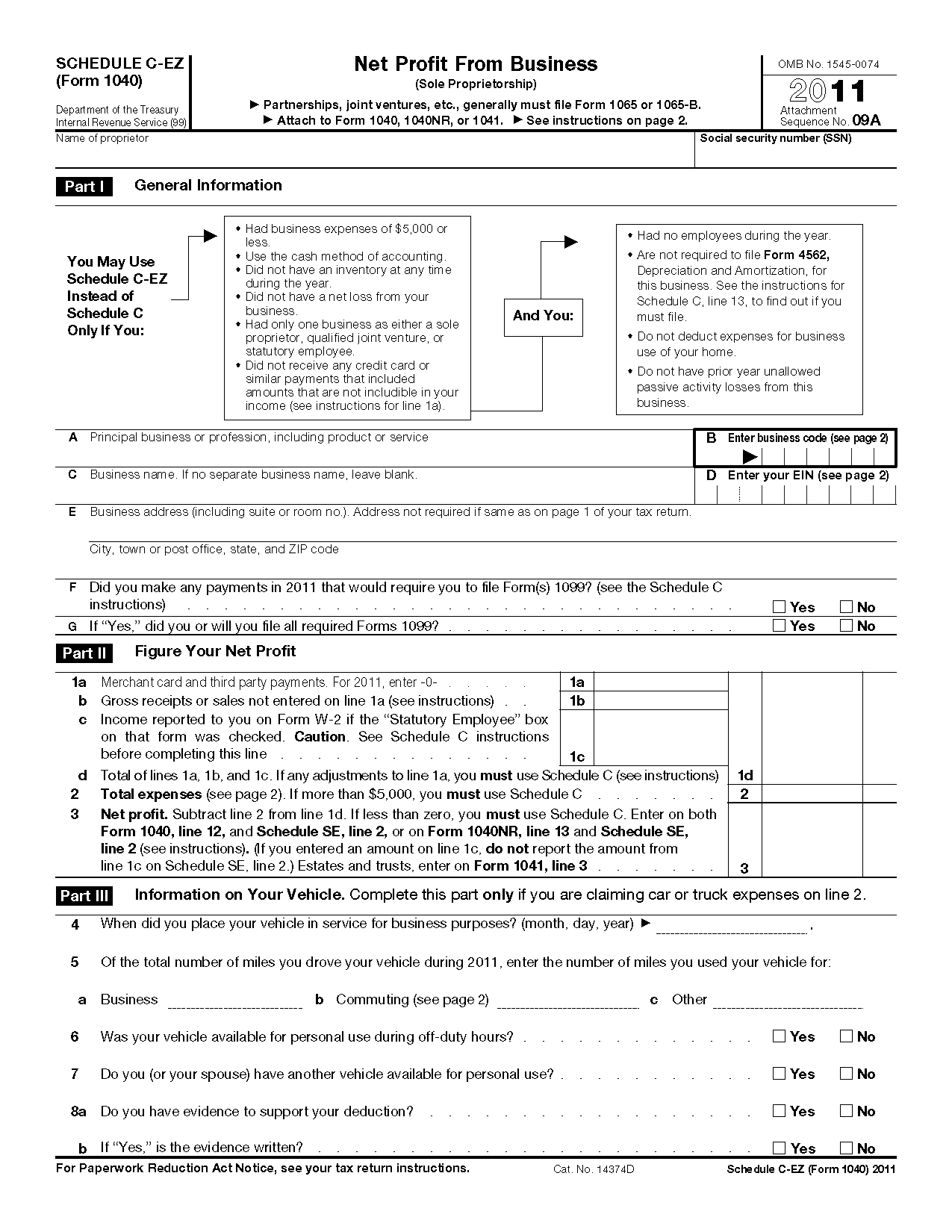

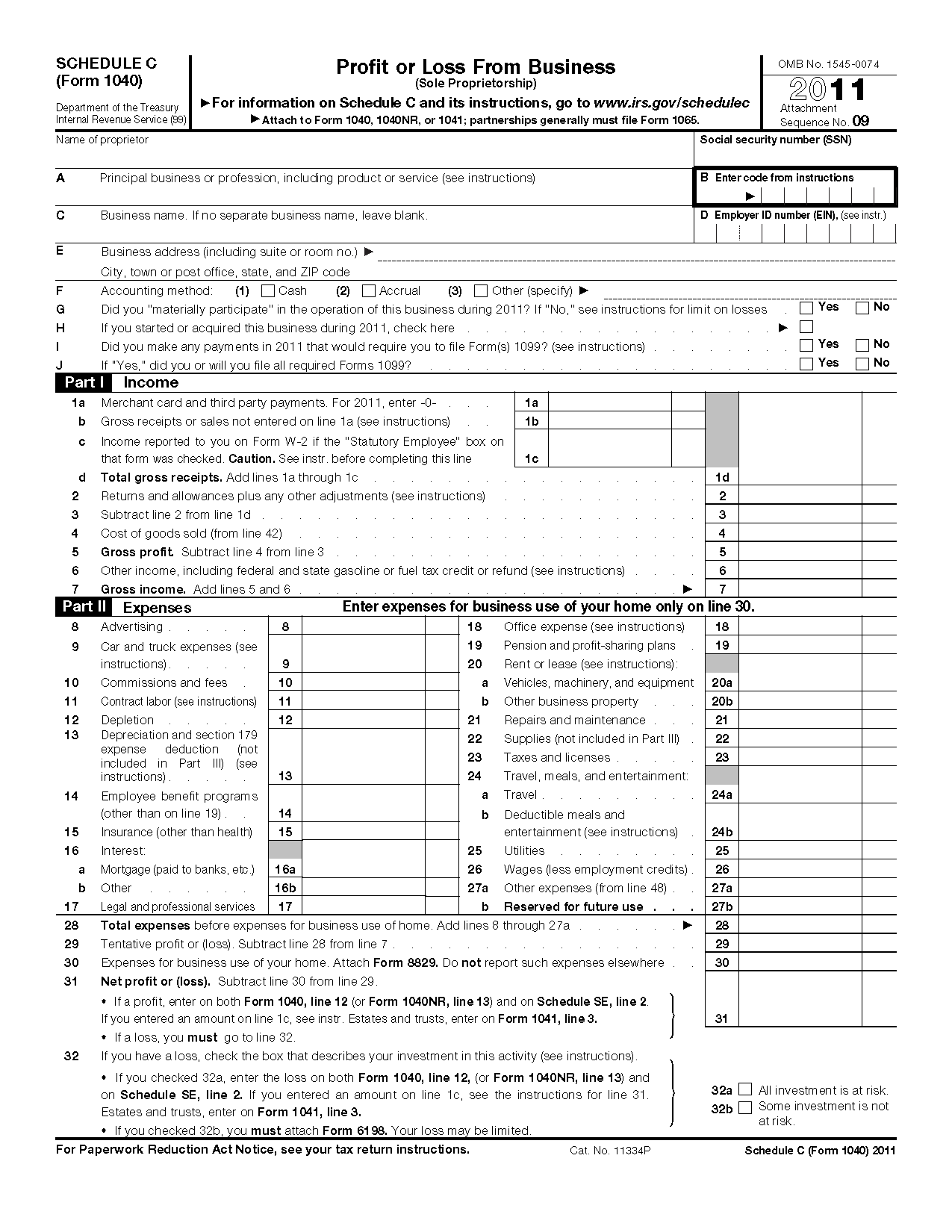

The purpose of the IRS Schedule C Worksheet is to help sole proprietors calculate their net profit or loss from their business operations. This worksheet is used in conjunction with the Schedule C form to report business income and expenses for tax purposes. It assists in organizing and categorizing income and expenses to determine the overall profitability of the business.

How do you calculate gross income on the Schedule C Worksheet?

To calculate gross income on the Schedule C Worksheet, you need to add up all your business's total income for the year. This includes sales, services, and any other revenue generated by your business activities. Once you have totaled up all these sources of income, you have your gross income for the year, which is the starting point for determining your net profit or loss on Schedule C.

What expenses can be deducted on the Schedule C Worksheet?

Some common expenses that can be deducted on the Schedule C Worksheet include costs related to supplies, equipment, advertising, travel, meals and entertainment, utilities, rent or home office expenses, insurance, professional fees, and any other costs directly related to running your business. It is important to keep accurate records and receipts for all deductions claimed.

How do you determine the cost of goods sold on the Schedule C Worksheet?

To determine the cost of goods sold on the Schedule C Worksheet, you need to calculate the total cost of the goods or products that were sold during the tax year. This includes the cost of materials, labor, and overhead expenses directly related to the production or purchase of the items that were sold. Subtract the beginning inventory value from the sum of purchases and production costs, then add in the ending inventory value to arrive at the total cost of goods sold for your business.

What types of deductions can be claimed for a home office on the Schedule C Worksheet?

You can claim deductions for a home office on the Schedule C Worksheet if you use part of your home regularly and exclusively for business purposes. This can include a portion of your mortgage interest, property taxes, utilities, homeowners insurance, and depreciation. Additionally, you can deduct expenses related to the upkeep and maintenance of your home office space, such as repairs, cleaning, and office supplies. However, it's important to ensure that your home office meets the IRS requirements for claiming these deductions.

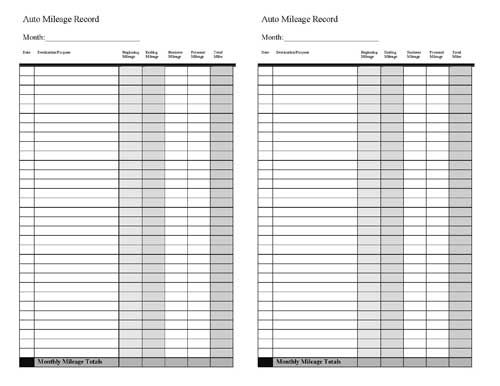

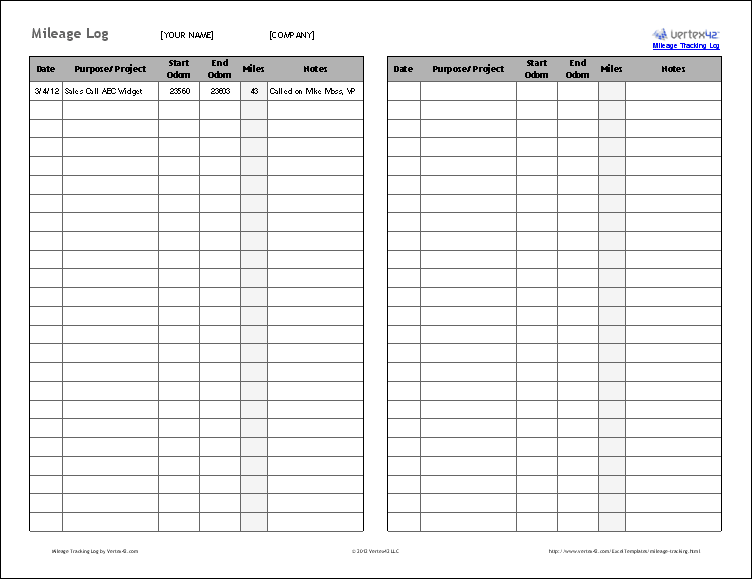

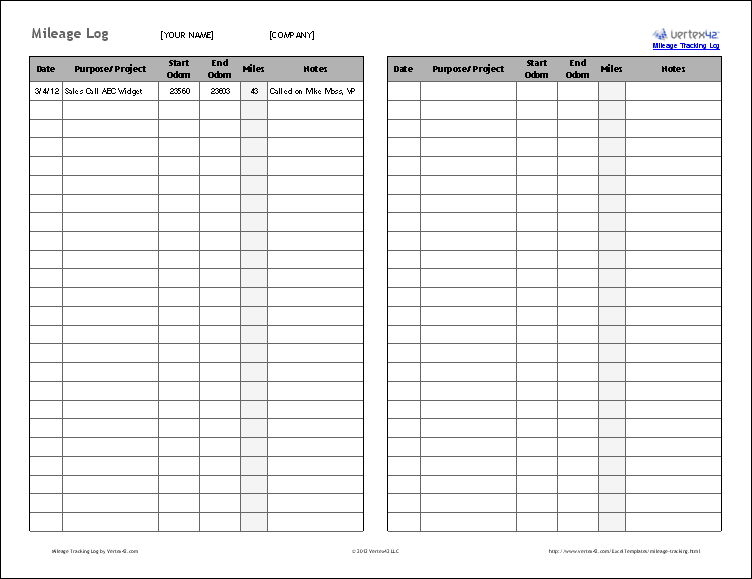

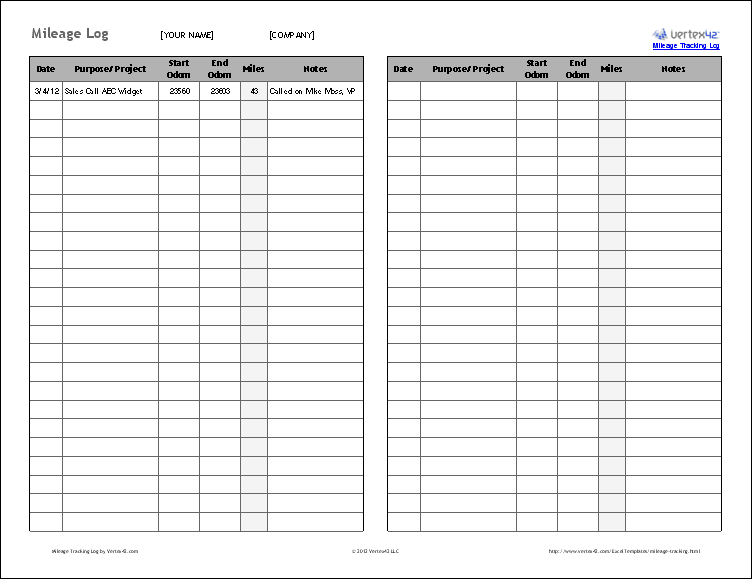

Can you claim vehicle expenses on the Schedule C Worksheet?

Yes, you can claim vehicle expenses on the Schedule C Worksheet if you use your vehicle for business purposes. This includes expenses such as gas, maintenance, insurance, and depreciation. Make sure to keep detailed records of your business mileage and expenses to accurately report them on your tax return.

How does depreciation work on the Schedule C Worksheet?

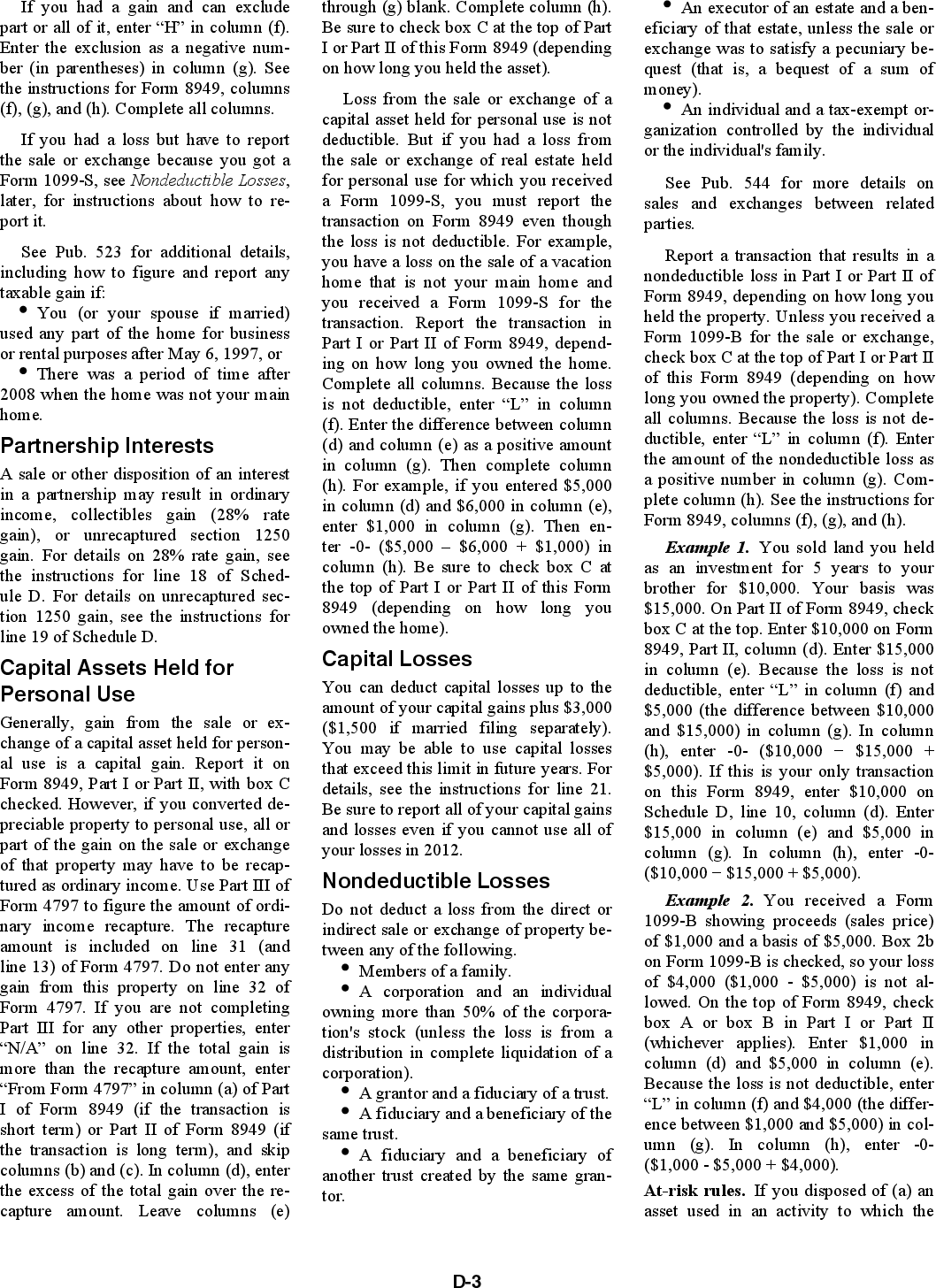

Depreciation on the Schedule C Worksheet is calculated by using the Modified Accelerated Cost Recovery System (MACRS) method for tangible property such as equipment, vehicles, or other assets used for business purposes. The MACRS method allows you to deduct a portion of the asset's cost each year over its useful life, based on predetermined depreciation rates set by the IRS. This deduction helps spread the cost of the asset over its useful life and reduces taxable income for each year of the asset's depreciation schedule.

Are there any specific requirements for reporting income from rental property on the Schedule C Worksheet?

Yes, when reporting income from rental property on the Schedule C Worksheet, it is important to accurately record all rental income earned during the tax year. Additionally, expenses related to the rental property should be properly reported to determine the taxable income generated from the property. It is essential to keep detailed records of all income and expenses to support the figures reported on the Schedule C Worksheet.

What are the guidelines for reporting self-employment taxes on the Schedule C Worksheet?

When reporting self-employment taxes on the Schedule C Worksheet, ensure to accurately calculate and report your net profit from self-employment activities after deducting business expenses. It's crucial to provide detailed information about your sources of income and expenses for the IRS to review. Keep thorough records of all transactions related to your self-employment work to substantiate your figures. Lastly, make sure to follow the IRS guidelines and consult with a tax professional if necessary to ensure correct reporting and compliance with tax laws.

How do you calculate the net profit or loss on the Schedule C Worksheet?

To calculate the net profit or loss on Schedule C Worksheet, subtract the total expenses from the total income. List all income sources under the income section and all expenses under the expenses section. Then subtract the total expenses from the total income to determine whether you have a profit or loss. If the result is positive, it represents the net profit, while if it's negative, it indicates a net loss. This final figure is what you would report on your tax return.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments