Insurance Business Planning Worksheet

Creating an effective insurance business plan requires careful analysis of various factors and the identification of key entities and subjects. A well-structured worksheet serves as a valuable tool in this process, allowing insurance professionals to efficiently organize data, define goals, and develop effective strategies. Whether you are a seasoned insurance agent looking to enhance your current business or a newcomer eager to establish a thriving insurance practice, utilizing a comprehensive worksheet can significantly contribute to your success.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is the purpose of an Insurance Business Planning Worksheet?

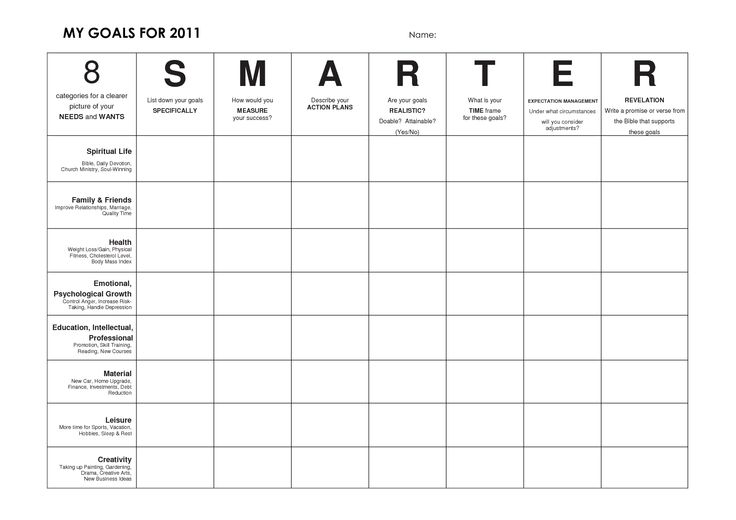

The purpose of an Insurance Business Planning Worksheet is to help insurance agents or agencies plan and strategize their business operations effectively. It typically includes sections for identifying goals, analyzing the market, setting objectives, defining target customers, evaluating resources, detailing marketing and sales strategies, and outlining financial projections. By using this worksheet, insurance professionals can create a comprehensive business plan that identifies opportunities for growth and success while also mitigating risks and challenges.

What types of information should be included in an Insurance Business Planning Worksheet?

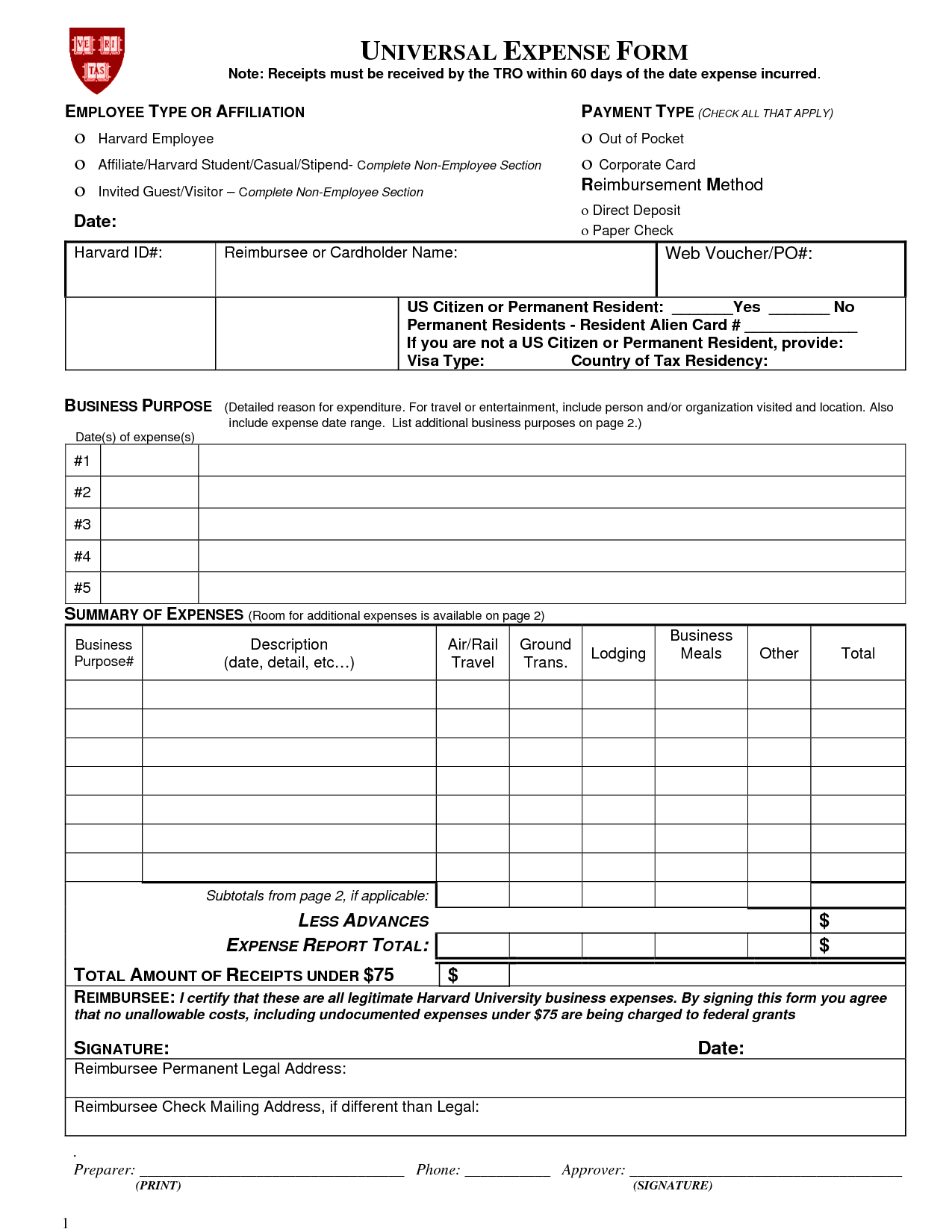

A comprehensive Insurance Business Planning Worksheet should include information such as detailed financial projections, market research data, competitor analysis, target market demographics, strategic goals and objectives, marketing and sales strategy, staffing requirements, operational plan, risk management strategies, and contingency plans. It is crucial to have a detailed and well-thought-out plan in place to guide the growth and success of an insurance business.

How is an Insurance Business Planning Worksheet typically organized?

An Insurance Business Planning Worksheet is typically organized by dividing sections related to key aspects of the insurance business, such as revenue projections, expenses, sales and marketing strategies, target market analysis, competitive analysis, operational plans, risk management strategies, and financial projections. Each section includes detailed information and data relevant to that specific aspect, providing a comprehensive overview of the business's current status and future trajectory.

Who is responsible for creating an Insurance Business Planning Worksheet?

Insurance agents or brokers are typically responsible for creating an Insurance Business Planning Worksheet. This tool helps them assess their current business situation, set goals, and outline strategies to achieve those goals. It is an important document that guides their business operations and helps them track their progress over time.

How often should an Insurance Business Planning Worksheet be updated?

An Insurance Business Planning Worksheet should typically be updated annually to reflect any changes in the business environment, market conditions, regulations, goals, and strategies. Regular updates ensure that the business plan remains relevant and aligned with the organization's objectives, helping to guide decision-making and optimize performance.

What are some common goals and objectives that may be included in an Insurance Business Planning Worksheet?

Common goals and objectives that may be included in an Insurance Business Planning Worksheet include increasing market share, expanding into new markets or product lines, improving customer service and satisfaction, enhancing operational efficiency and profitability, retaining and attracting top talent, achieving regulatory compliance and risk management goals, and staying ahead of technological advancements to better serve customers and adapt to industry changes.

How can an Insurance Business Planning Worksheet help measure financial performance?

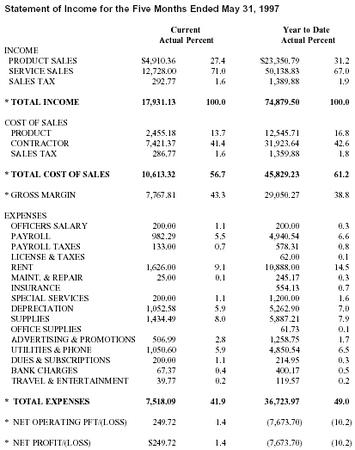

An Insurance Business Planning Worksheet can help measure financial performance by providing a comprehensive overview of key financial metrics such as revenue, expenses, profits, and return on investment. By tracking and analyzing these metrics regularly through the worksheet, insurance businesses can monitor their financial health, identify trends, and make informed decisions to improve their overall performance and profitability. The worksheet can also assist in setting realistic financial goals, budgeting effectively, and adjusting strategies as needed to achieve long-term success.

What external factors should be considered when creating an Insurance Business Planning Worksheet?

External factors to consider when creating an Insurance Business Planning Worksheet include market trends, regulatory changes, economic conditions, competitive landscape, technological advancements, and customer preferences. These factors can impact the demand for insurance products, pricing strategies, distribution channels, and overall business operations, thus it is crucial to analyze and incorporate them into the planning process to ensure the business remains competitive and sustainable in the long run.

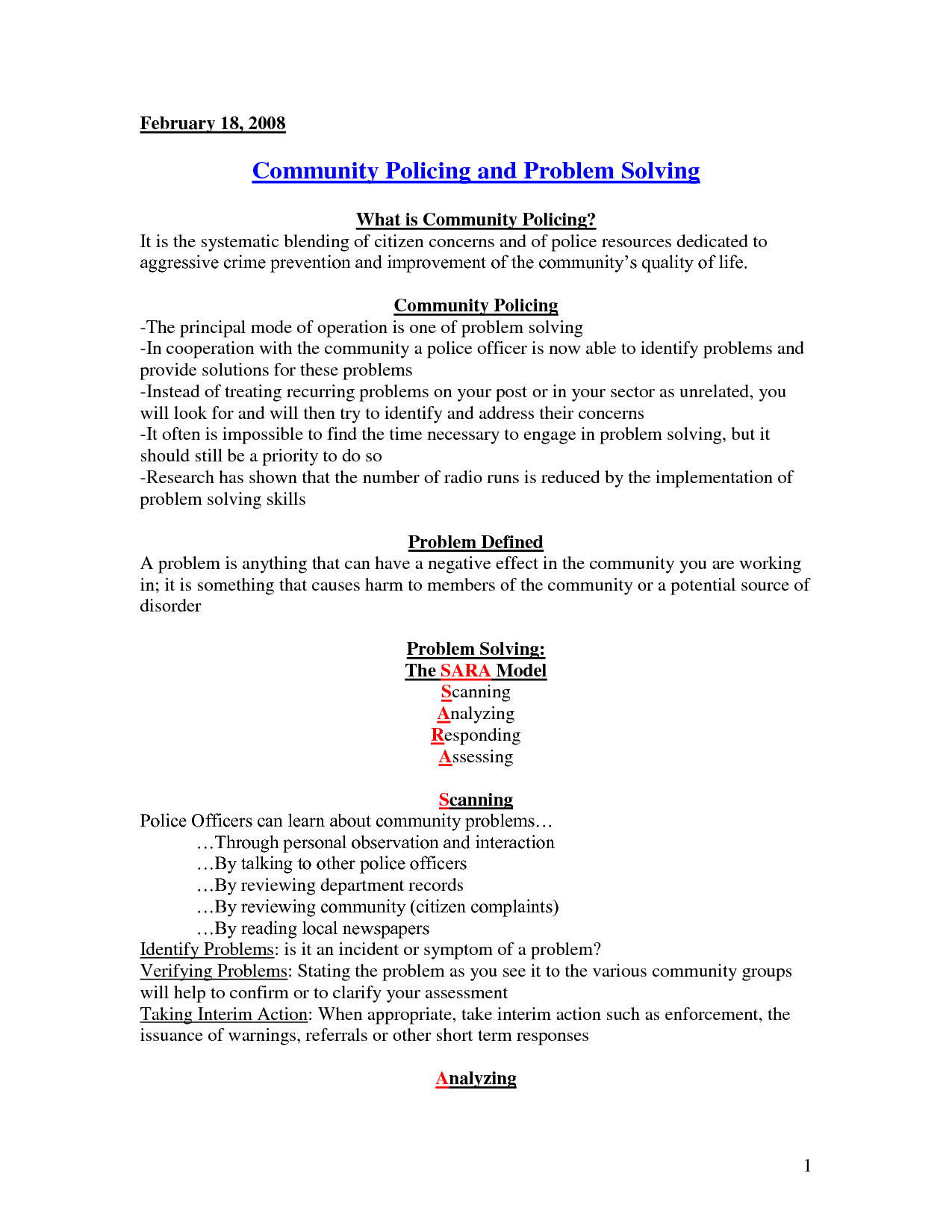

How can an Insurance Business Planning Worksheet help identify and manage risks?

An Insurance Business Planning Worksheet can help identify and manage risks by analyzing various aspects of the business, such as operations, assets, liabilities, and financials. By systematically outlining potential risks and their impacts on the business, it allows for a proactive approach in developing risk mitigation strategies. The worksheet can also help in prioritizing risks based on their likelihood and severity, enabling the business to allocate resources efficiently to address high-priority risks. Additionally, regular review and updates of the worksheet can ensure that the business stays agile in responding to emerging risks and changing circumstances.

What are some best practices for creating and using an Insurance Business Planning Worksheet?

When creating an Insurance Business Planning Worksheet, it is essential to clearly outline your business goals, objectives, and strategies. Define key performance indicators to track your progress and make necessary adjustments. Identify your target market, analyze competitors, and evaluate potential risks. Ensure that your worksheet includes financial projections, such as revenue forecasts, expenses, and profit margins. Regularly review and update your business planning worksheet to stay agile and responsive to market changes. Additionally, seek input from team members and experts to ensure a comprehensive and realistic planning tool for your insurance business.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments