Income and Expense Worksheet Template

Managing your finances effectively is essential for everyone, whether you are a busy professional, a student on a budget, or a stay-at-home parent. Keeping a track of your income and expenses is a crucial step towards financial stability. With an easy-to-use income and expense worksheet template, you can efficiently monitor your finances and ensure that you are staying within your budget.

Table of Images 👆

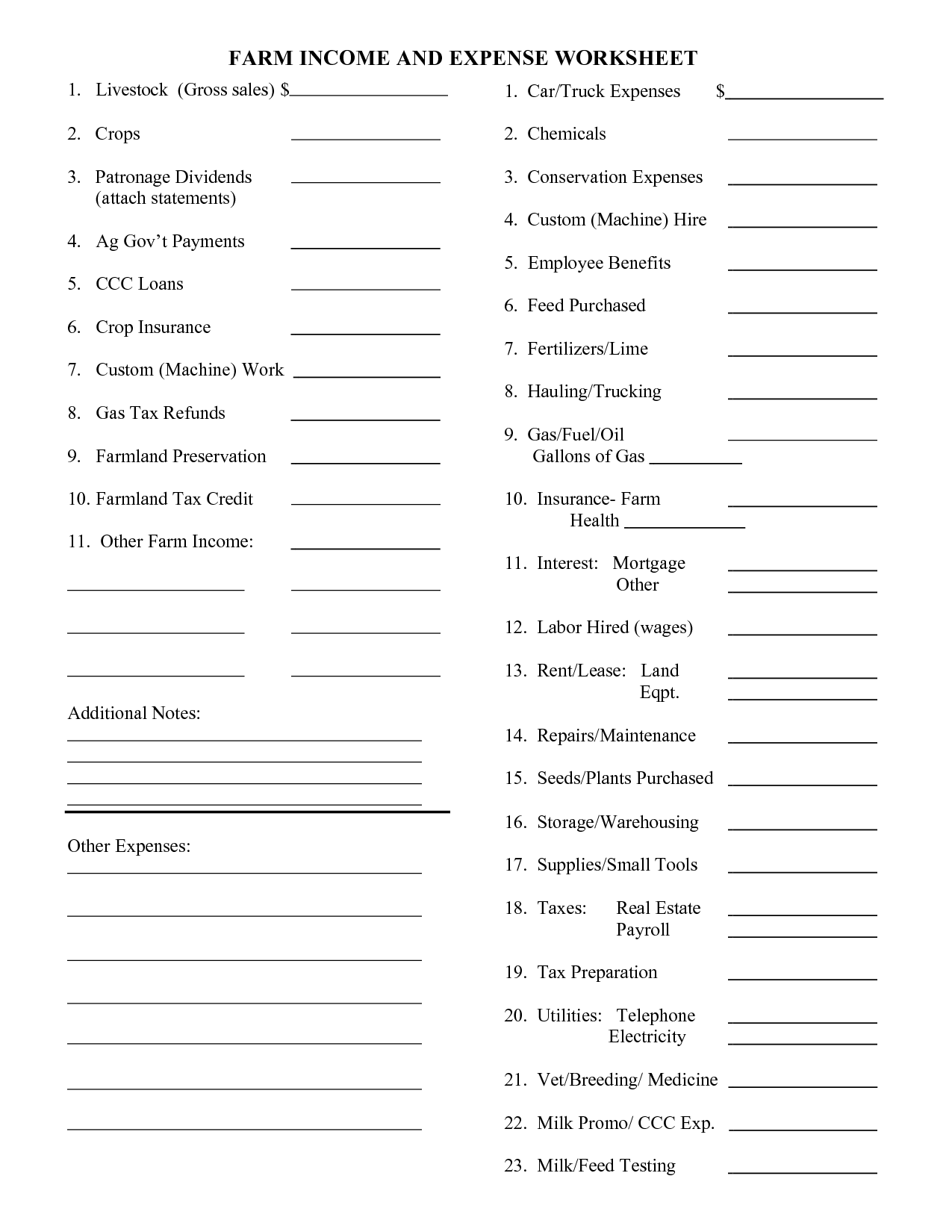

- Printable Income and Expense Worksheet

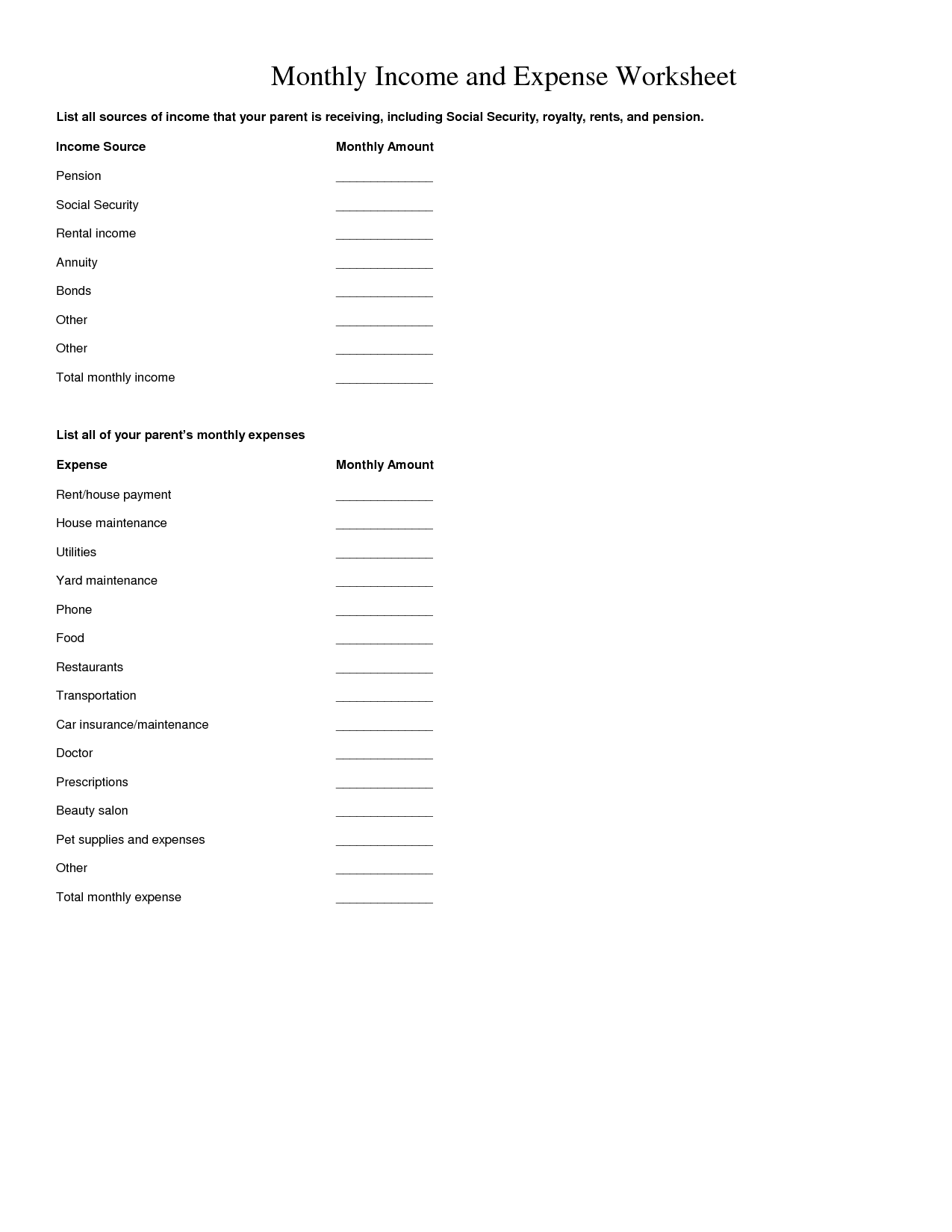

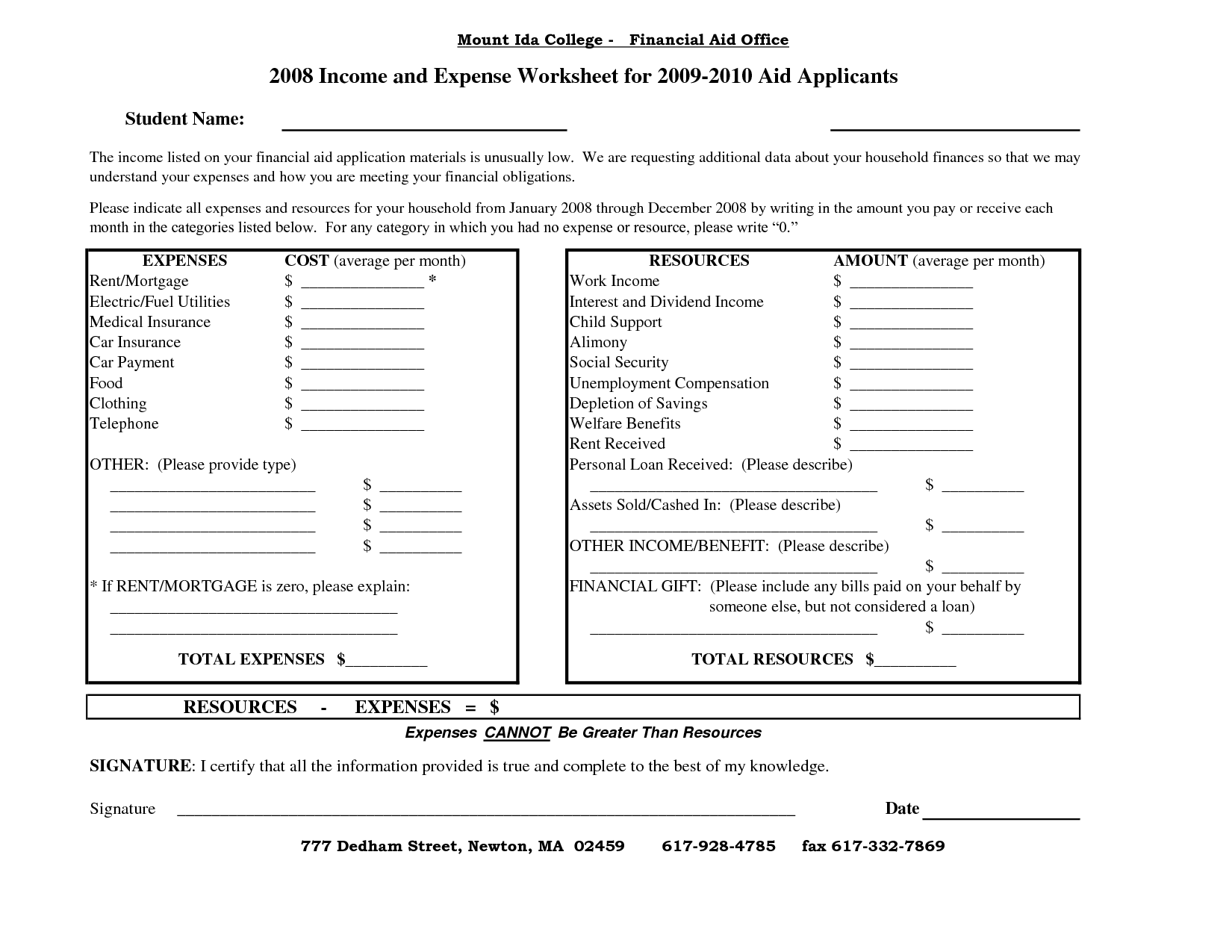

- Monthly Income Expense Worksheet Template

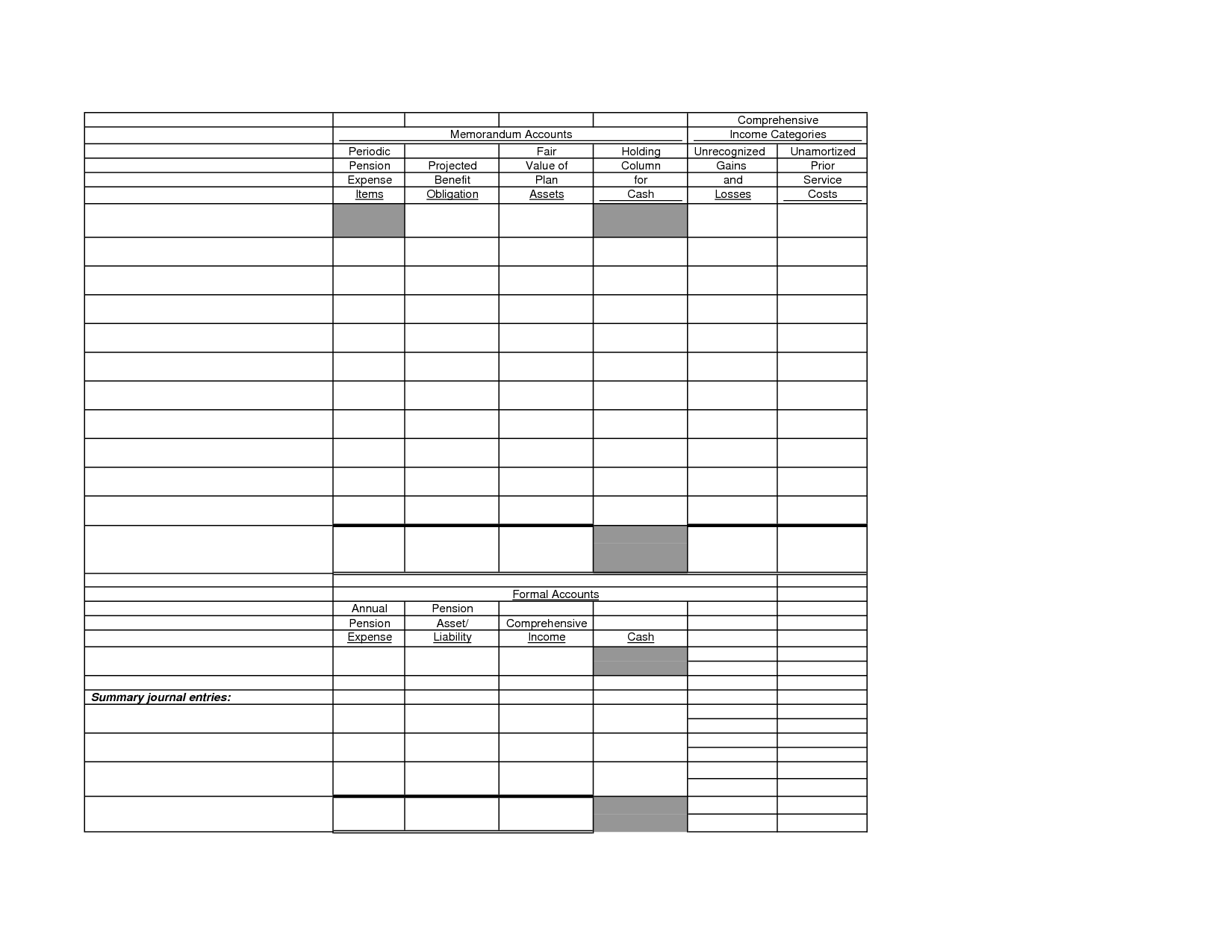

- Pension Worksheet Template

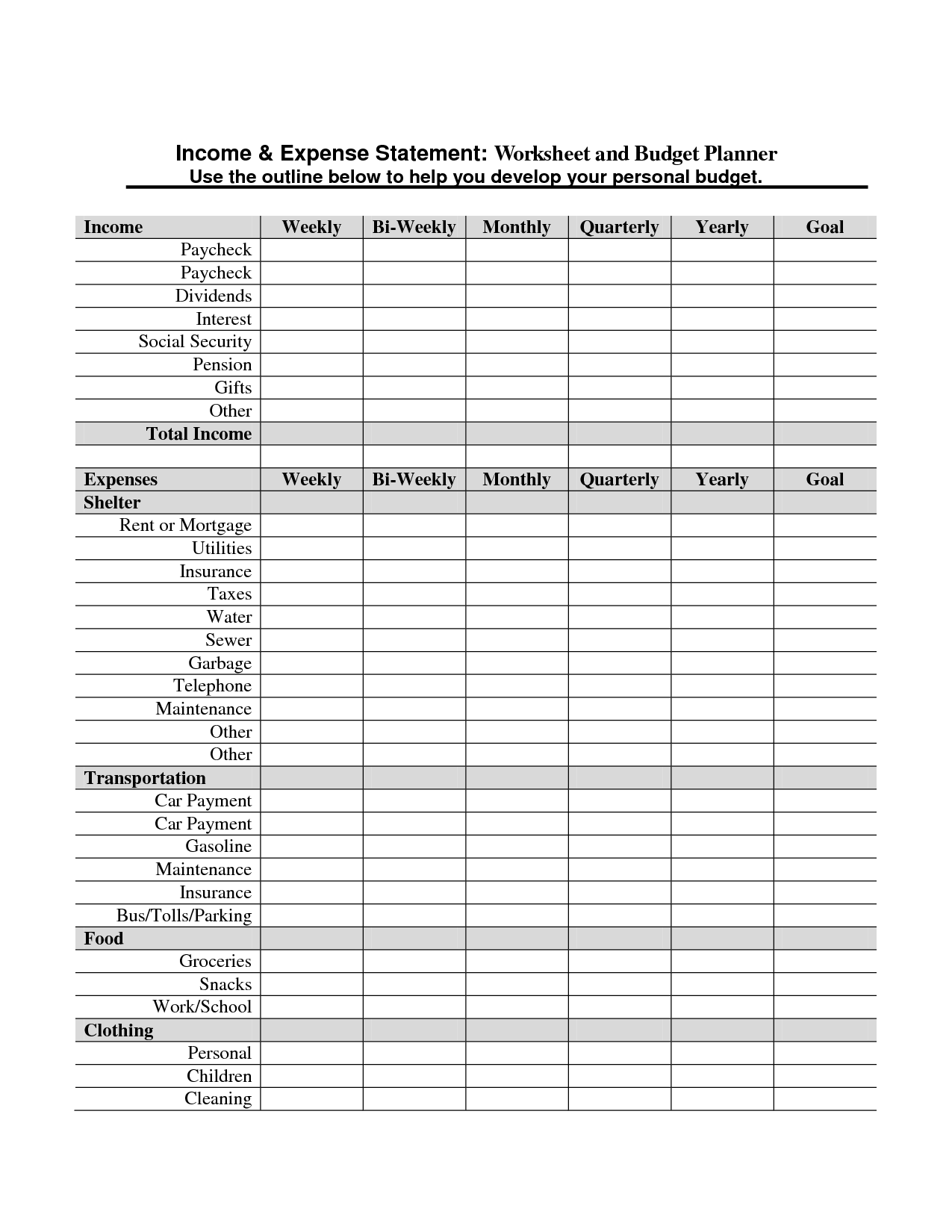

- Income and Expense Statement Template

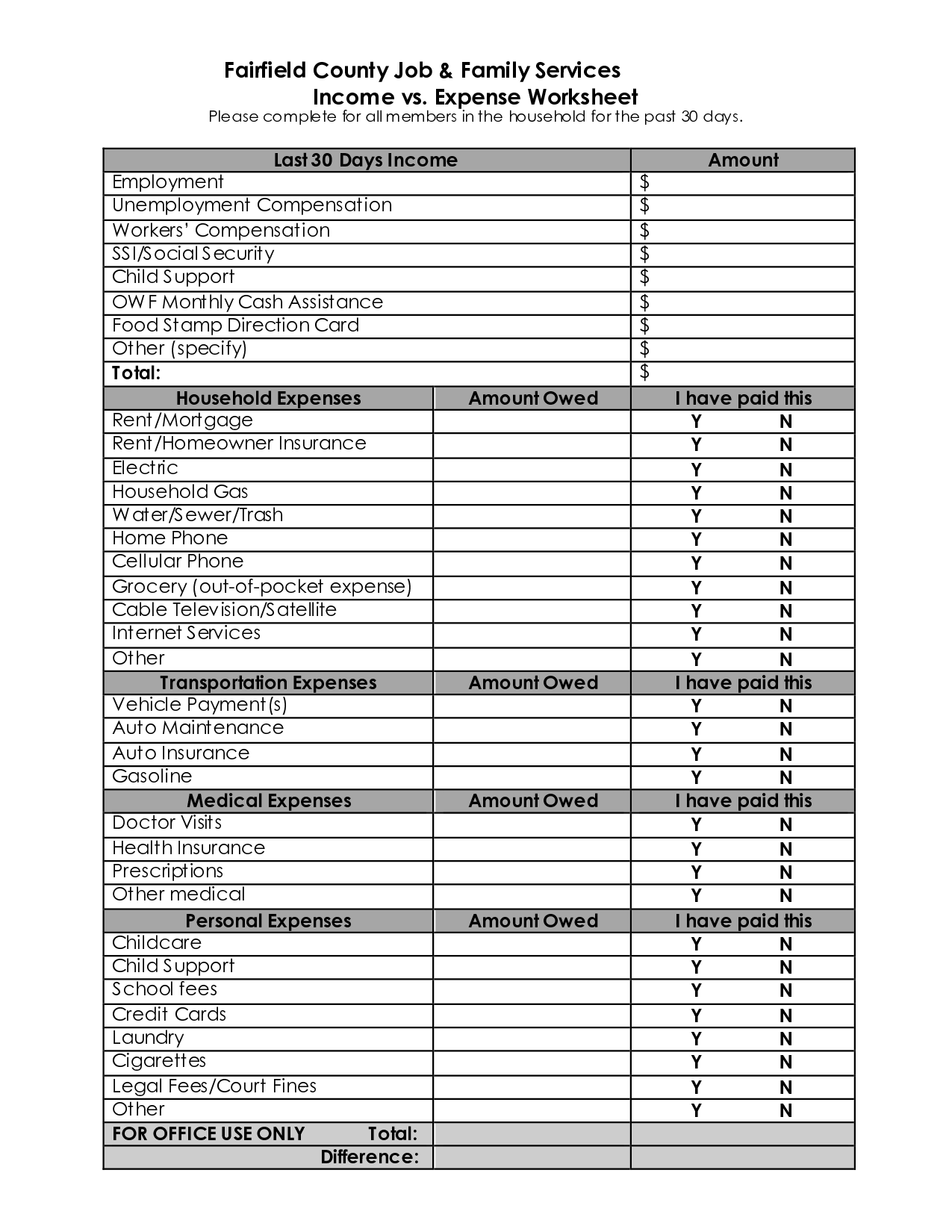

- Income vs Expense Worksheet

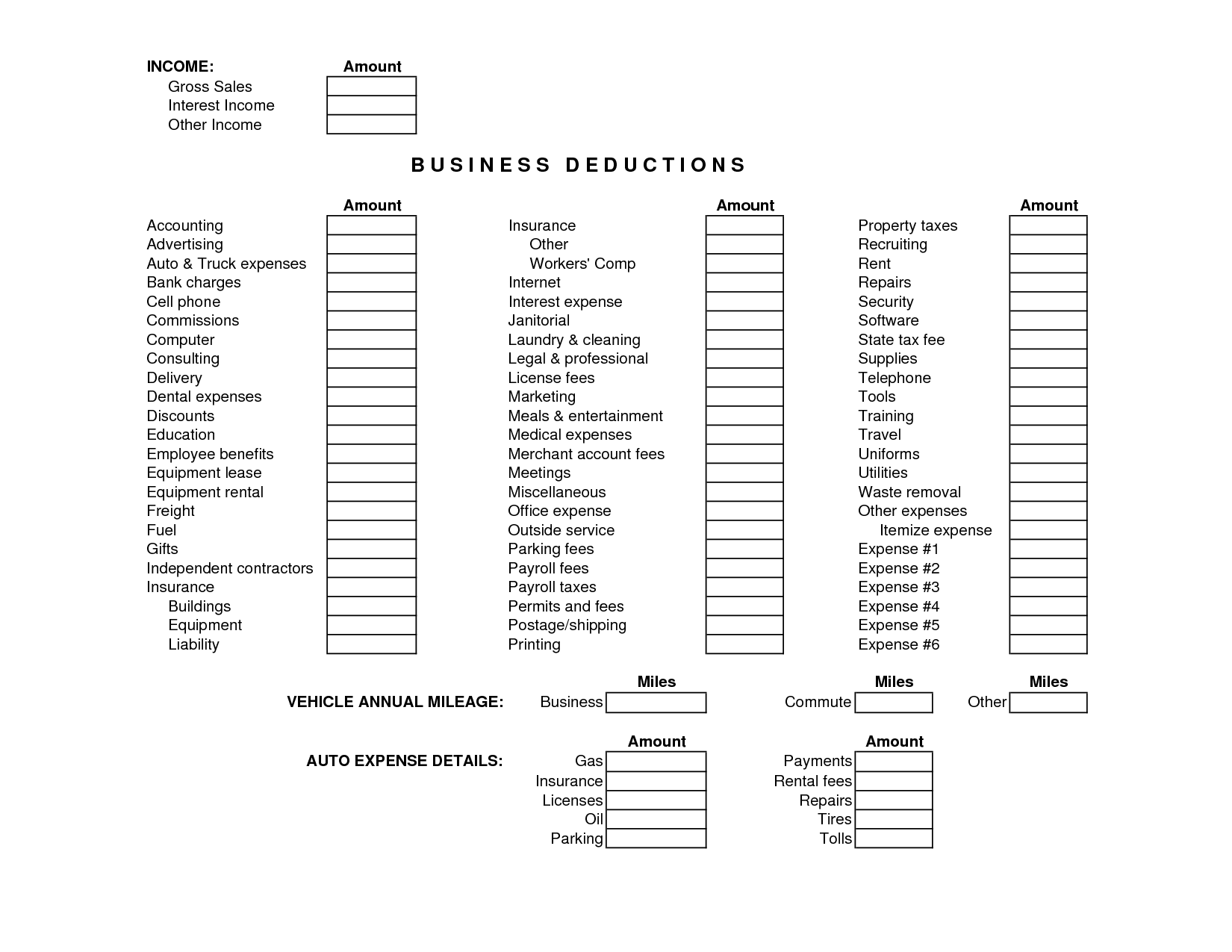

- Business Income and Expense Worksheet

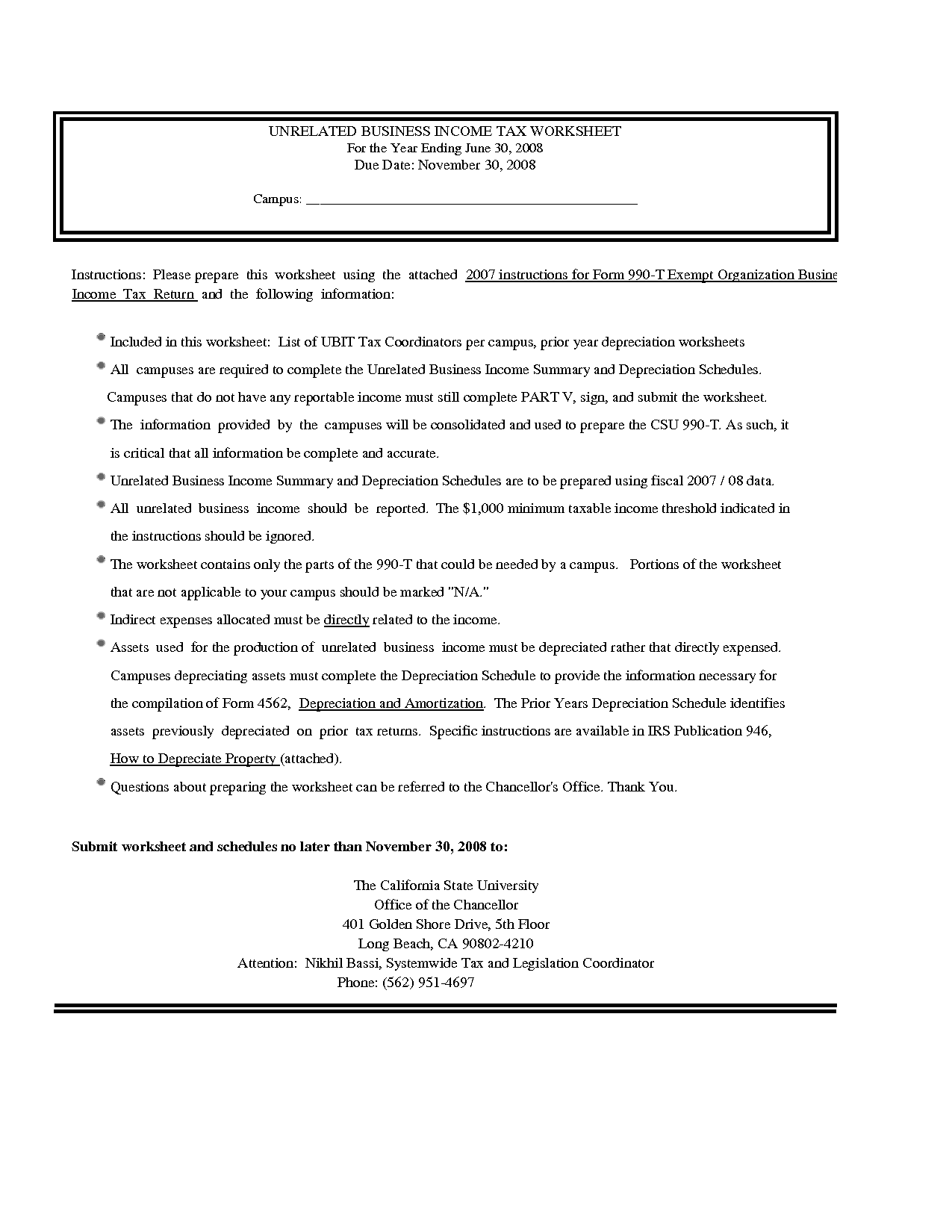

- Unrelated Business Income Tax

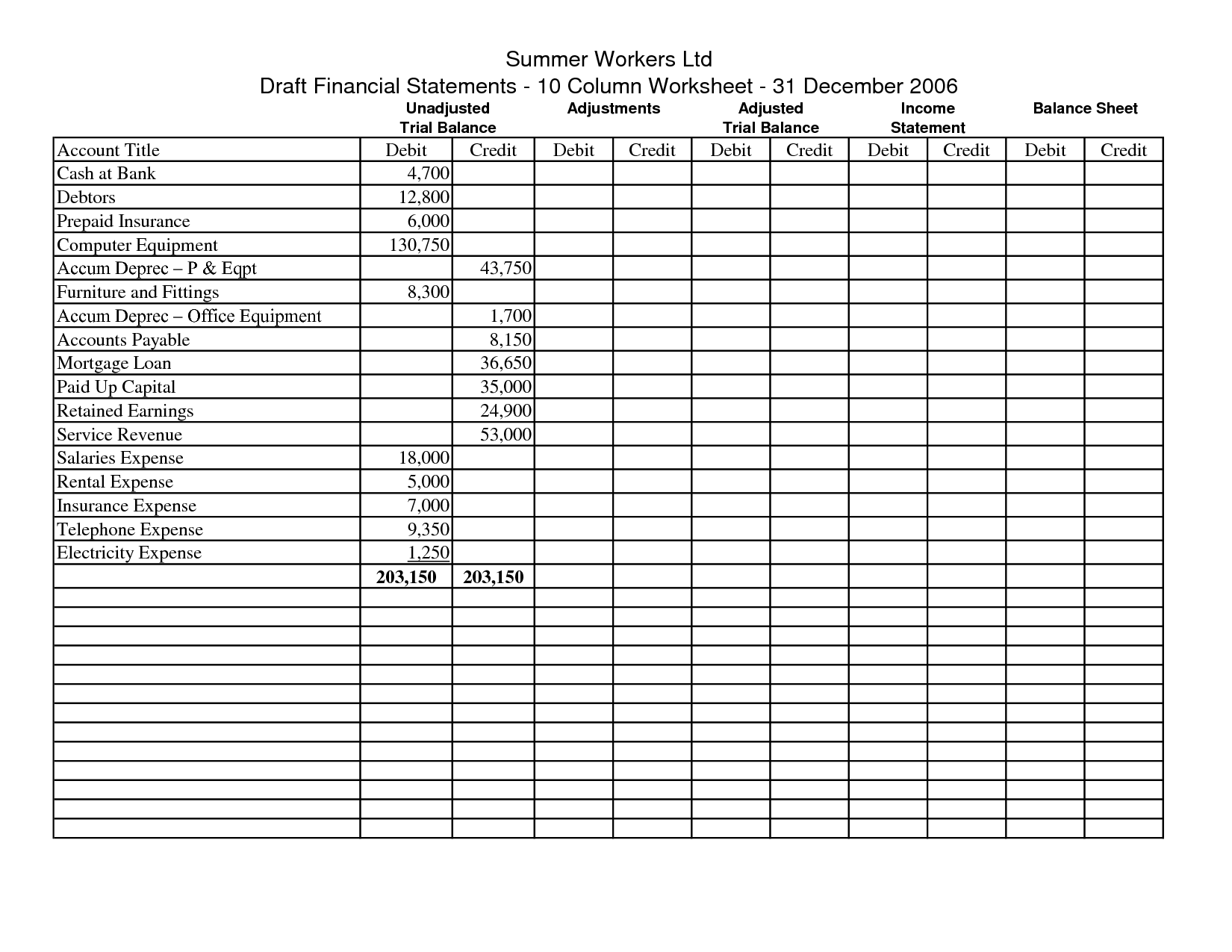

- Blank 10 Column Accounting Worksheet Template

- Business Expense Tax Worksheet

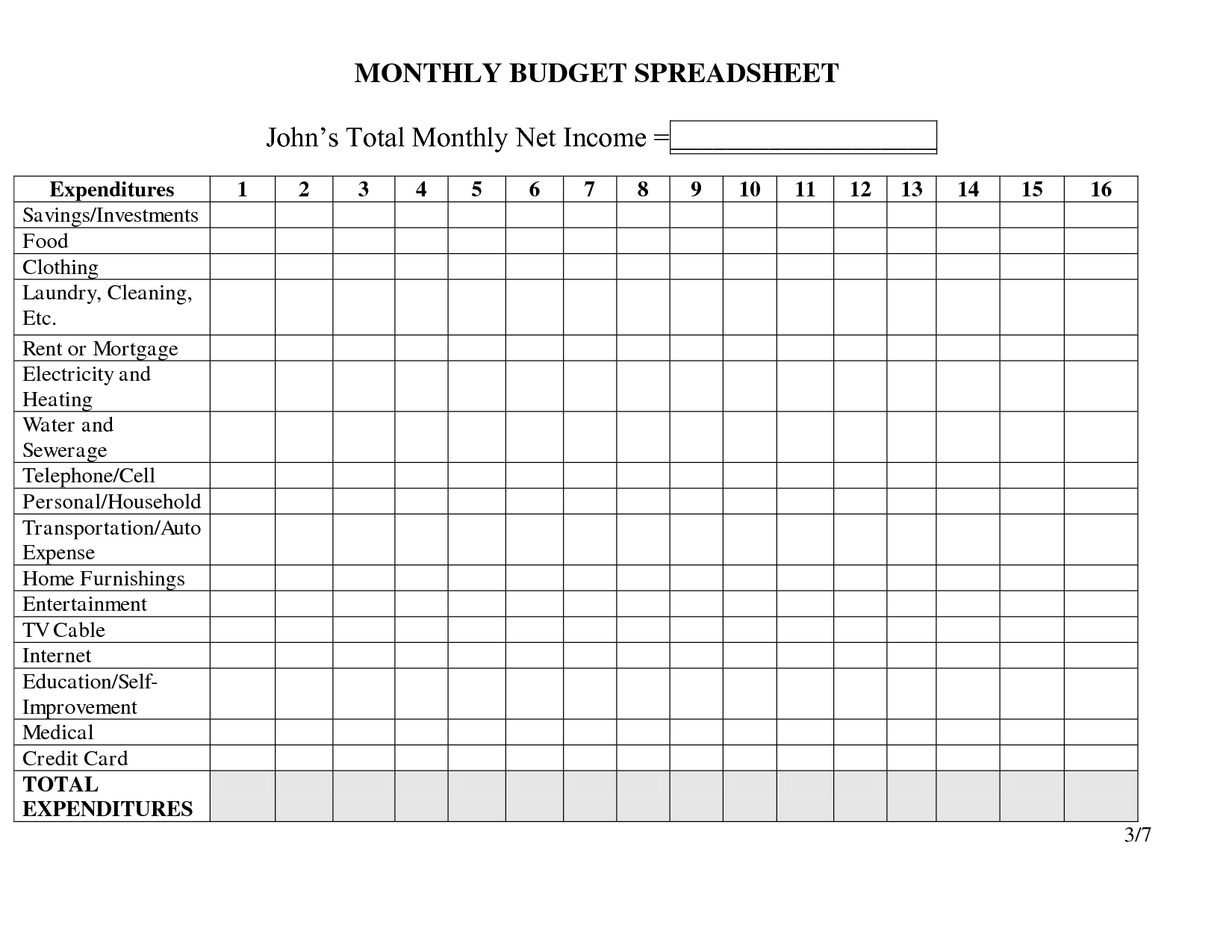

- Blank Monthly Budget Spreadsheet

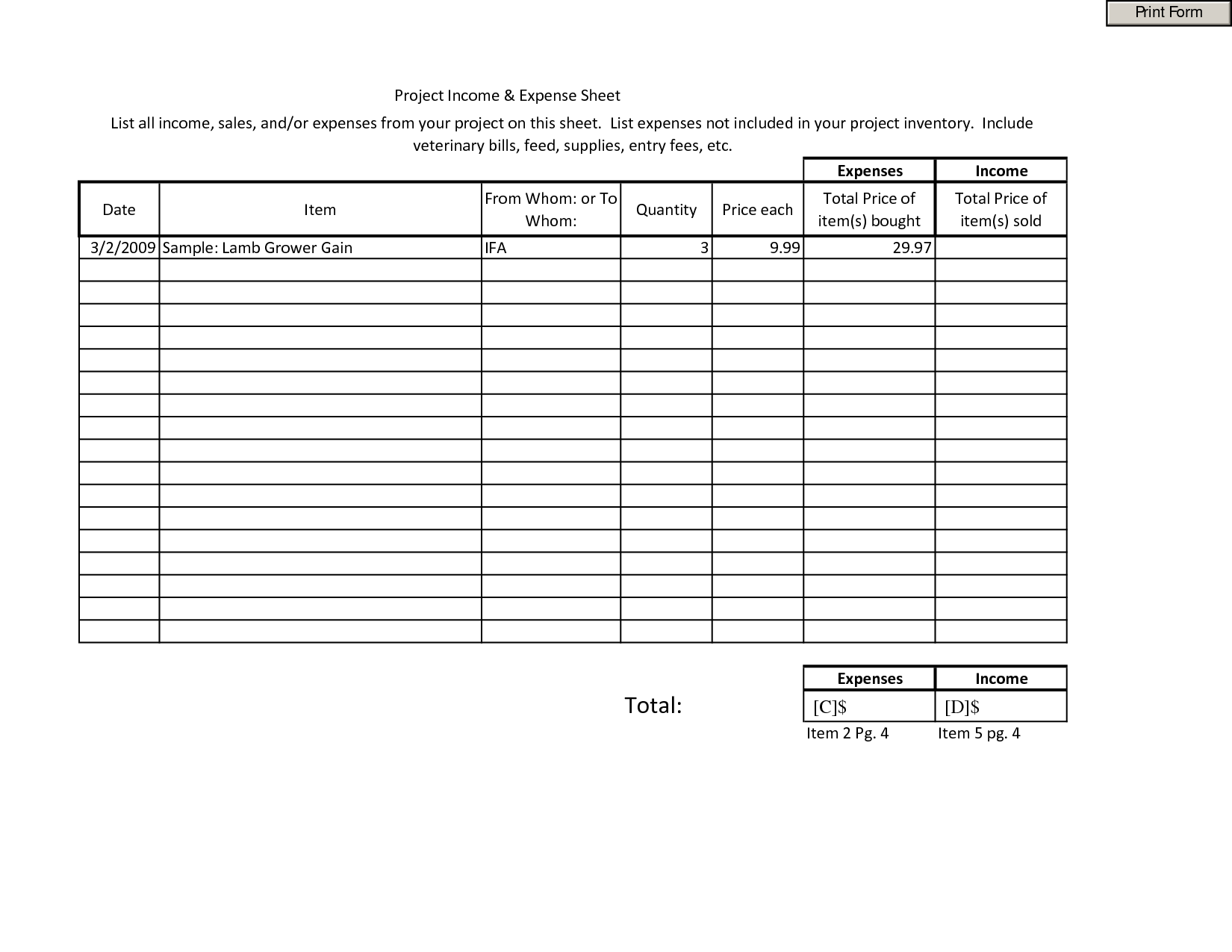

- Income and Expense Sheet Printable

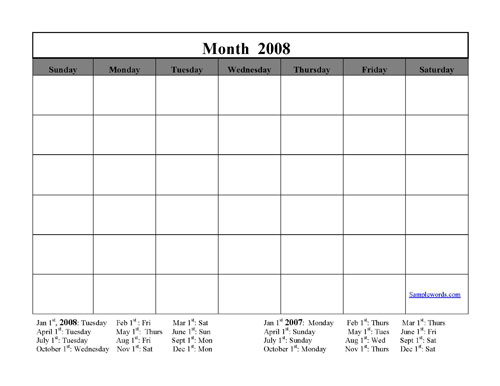

- Blank Monthly Calendar Print Out Templates

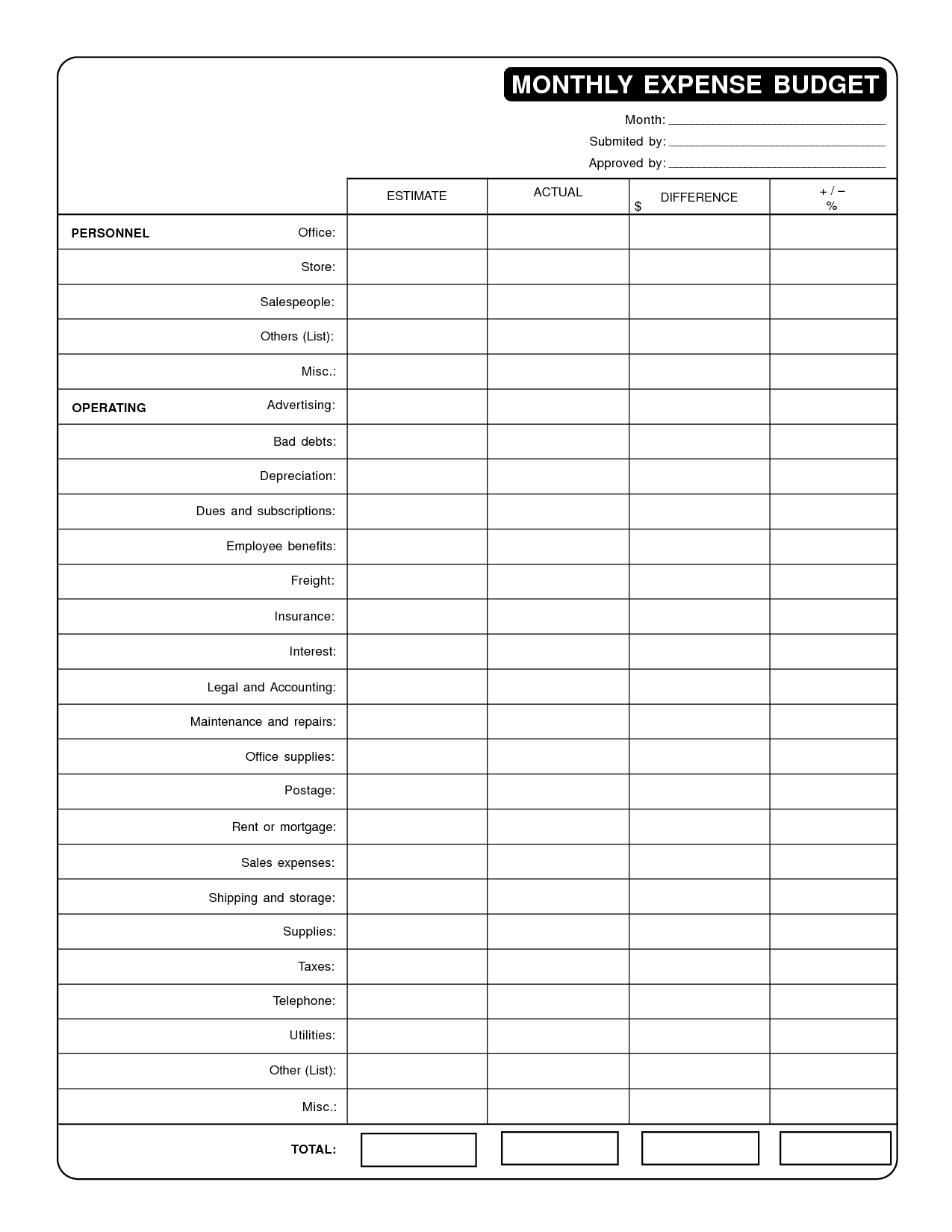

- Monthly Budget Expense Worksheet

- Expense Tracking Spreadsheet Template

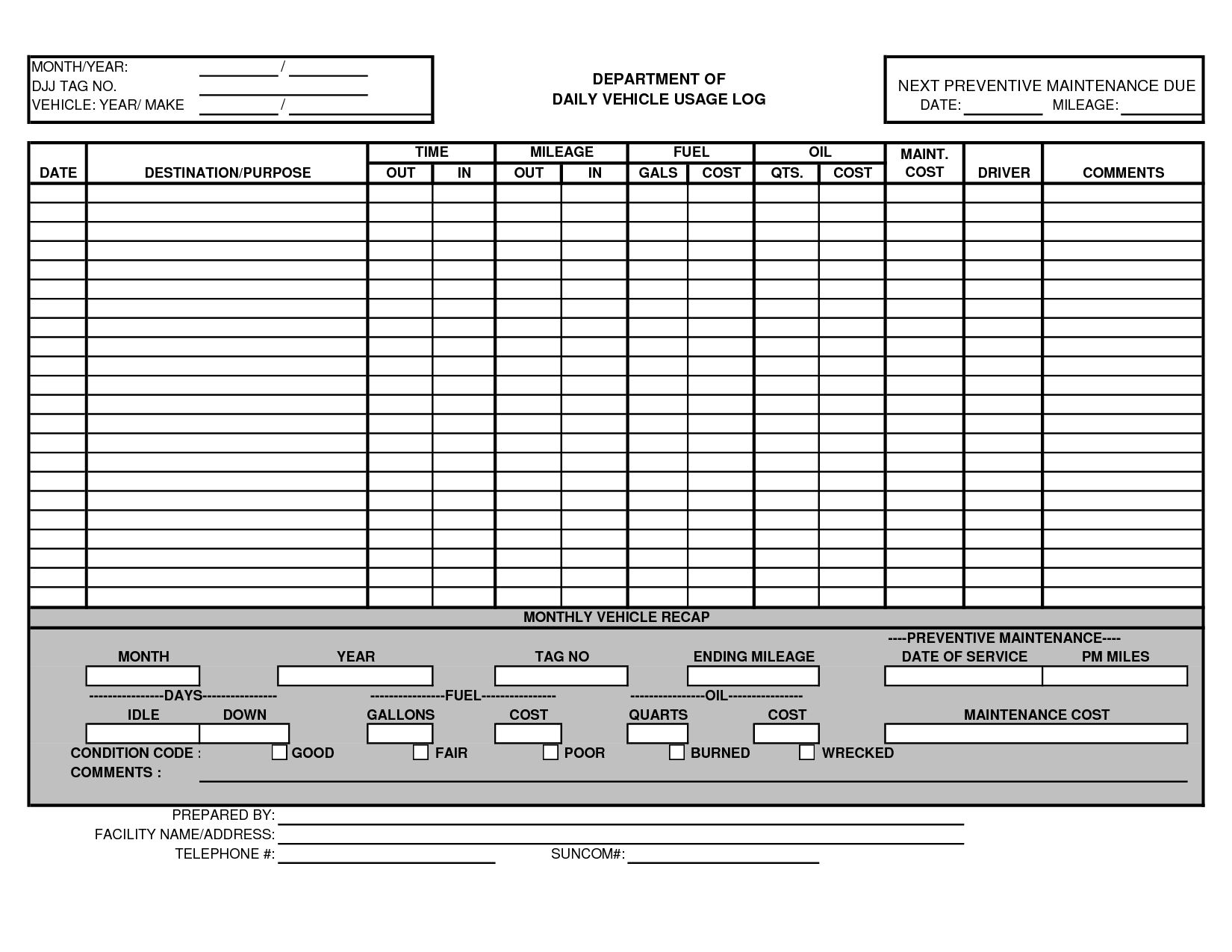

- Vehicle Log Sheet Template Excel

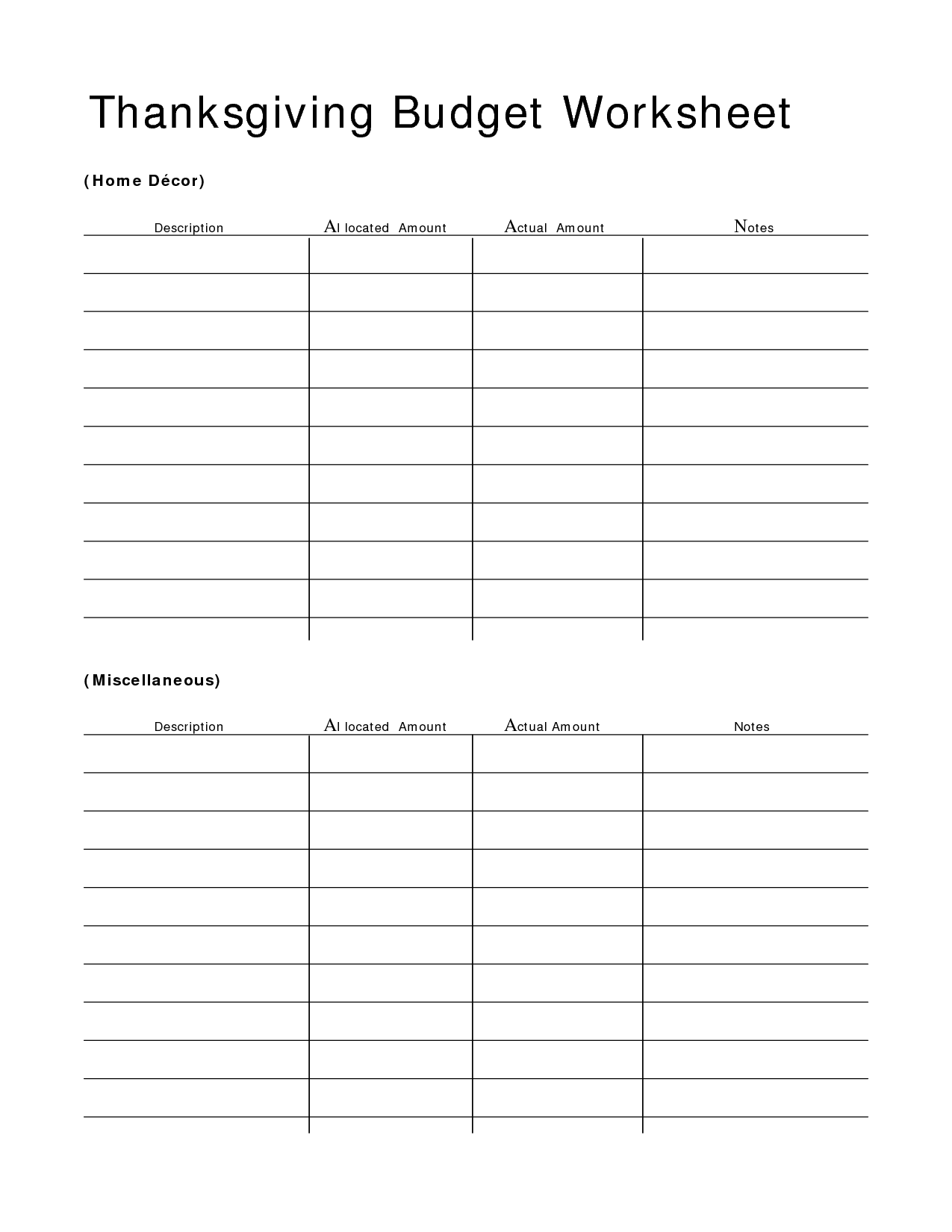

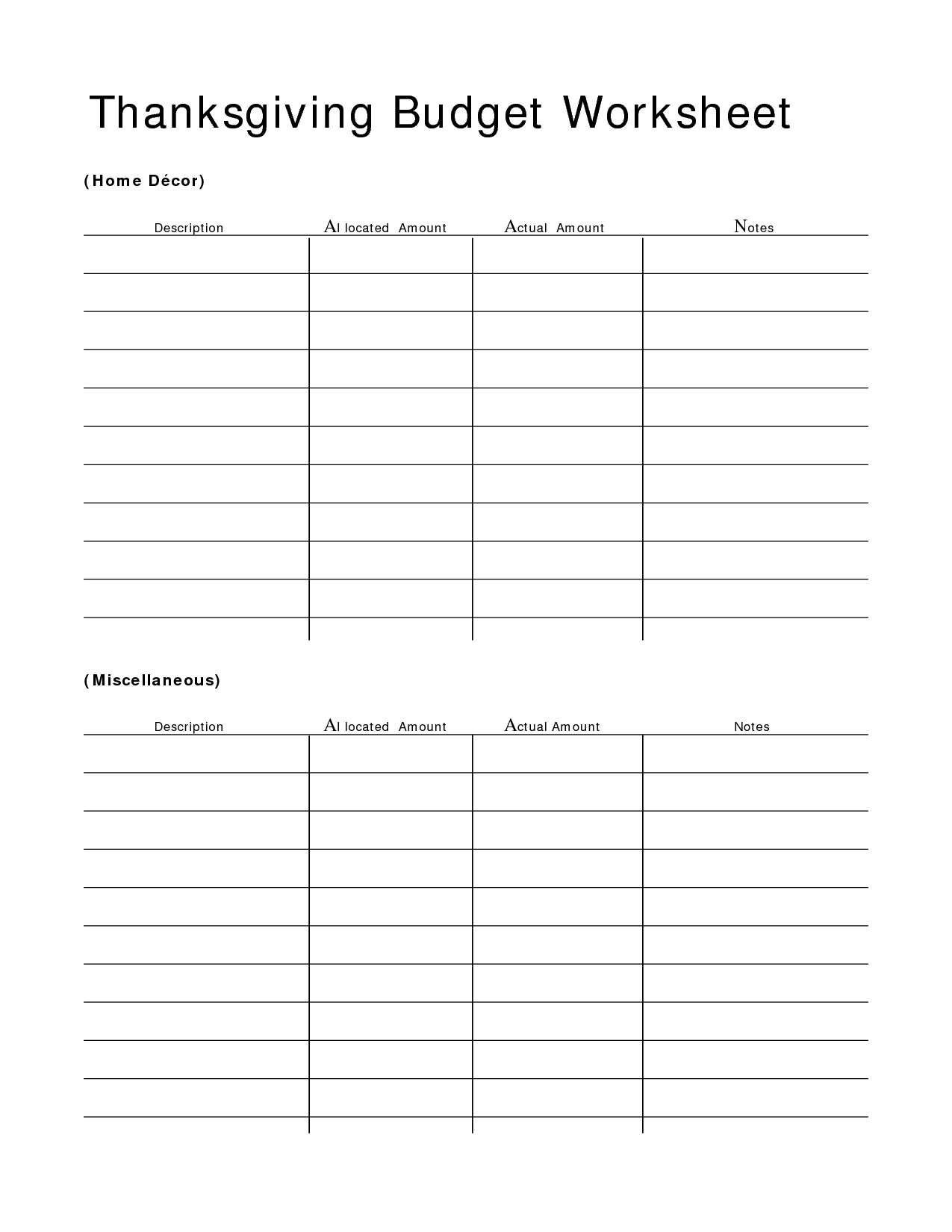

- Free Church Budget Worksheet

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

How do you calculate total income?

To calculate total income, you simply add up all sources of income received during a specific period of time. This can include wages, salaries, dividends, interest, rental income, and any other money earned. Once you have a total sum of all these income sources, you have calculated your total income.

What are some common sources of income?

Some common sources of income include salaries from employment, profits from business activities, rental income from properties, interest from savings or investments, dividends from stocks or other equity investments, royalties from intellectual property, and income from gigs or freelancing.

How do you determine fixed expenses?

To determine fixed expenses, you need to identify and list all the regular, predictable costs that remain constant each month regardless of the level of business activity. Examples of fixed expenses include rent, mortgage payments, insurance premiums, subscription fees, and salaries. By categorizing and summing up these expenses, you can calculate your total fixed expenses.

What are some examples of variable expenses?

Variable expenses are costs that fluctuate based on usage or activity. Examples include groceries, dining out, entertainment, clothing, transportation costs like gas and tolls, utilities bills that change monthly based on usage, and variable subscriptions or memberships like gym memberships or streaming services where the monthly cost can vary.

How do you calculate net income?

To calculate net income, you start by subtracting total expenses from total revenue. This is done to determine the profit or loss of a business after accounting for all costs incurred in generating revenue. The formula for calculating net income is: Net Income = Total Revenue - Total Expenses. By calculating net income, businesses can evaluate their financial performance and determine their profitability.

How can you track monthly expenses using the worksheet template?

To track monthly expenses using a worksheet template, you can create different categories such as rent, utilities, groceries, etc., and input your expenses for each category every month. Update the template regularly, categorize your expenses accurately, and sum up the totals to track your monthly spending. You can also use formulas to automatically calculate totals and analyze your spending patterns over time. Additionally, make sure to save your updated worksheet for future reference and comparison.

What information should be included in the income section?

In the income section, you should include all sources of your earnings such as salaries, wages, bonuses, commissions, rental income, investment income, alimony, and any other forms of income you receive regularly. It is important to provide accurate and detailed information about all sources of income to ensure that your financial situation is properly assessed.

How can you accurately track irregular income using the template?

To accurately track irregular income using a template, you can create categories for different sources of income and allocate them accordingly. Ensure to update the template each time you receive income from irregular sources, noting the date, source, and amount received. This will provide you with a clear overview of your finances and help you budget effectively despite the irregular income flow. Regularly reviewing and adjusting the template will enable you to stay on top of your financial situation and make informed decisions based on your income patterns.

What benefits does using an income and expense worksheet template provide?

Using an income and expense worksheet template provides several benefits, including accurately tracking income and expenses, organizing financial information in a clear and systematic way, enabling better budgeting and financial planning, highlighting areas for potential cost-savings or increased income, and facilitating tax preparation by keeping all relevant financial data in one place. Ultimately, a well-designed income and expense worksheet template can help individuals or businesses manage their finances more effectively and make informed decisions about their money.

How often should you update the worksheet to ensure accurate financial tracking?

It is recommended to update the worksheet regularly, preferably on a weekly or bi-weekly basis, to ensure accurate financial tracking. This will help you stay on top of your finances, monitor any changes or trends, and make informed decisions based on up-to-date information.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments