Household Budget Planning Worksheet

Creating a successful household budget requires careful consideration of your income and expenses. You need a reliable tool that clearly outlines every financial entity and subject. A household budget planning worksheet is an excellent solution for individuals or families looking to take charge of their finances. By utilizing this simple and effective tool, you can easily track your income sources, categorize your expenses, and gain a comprehensive view of your overall financial health.

Table of Images 👆

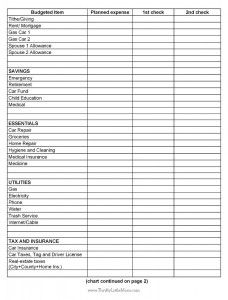

- Free Printable Budget Worksheets for Young Adults

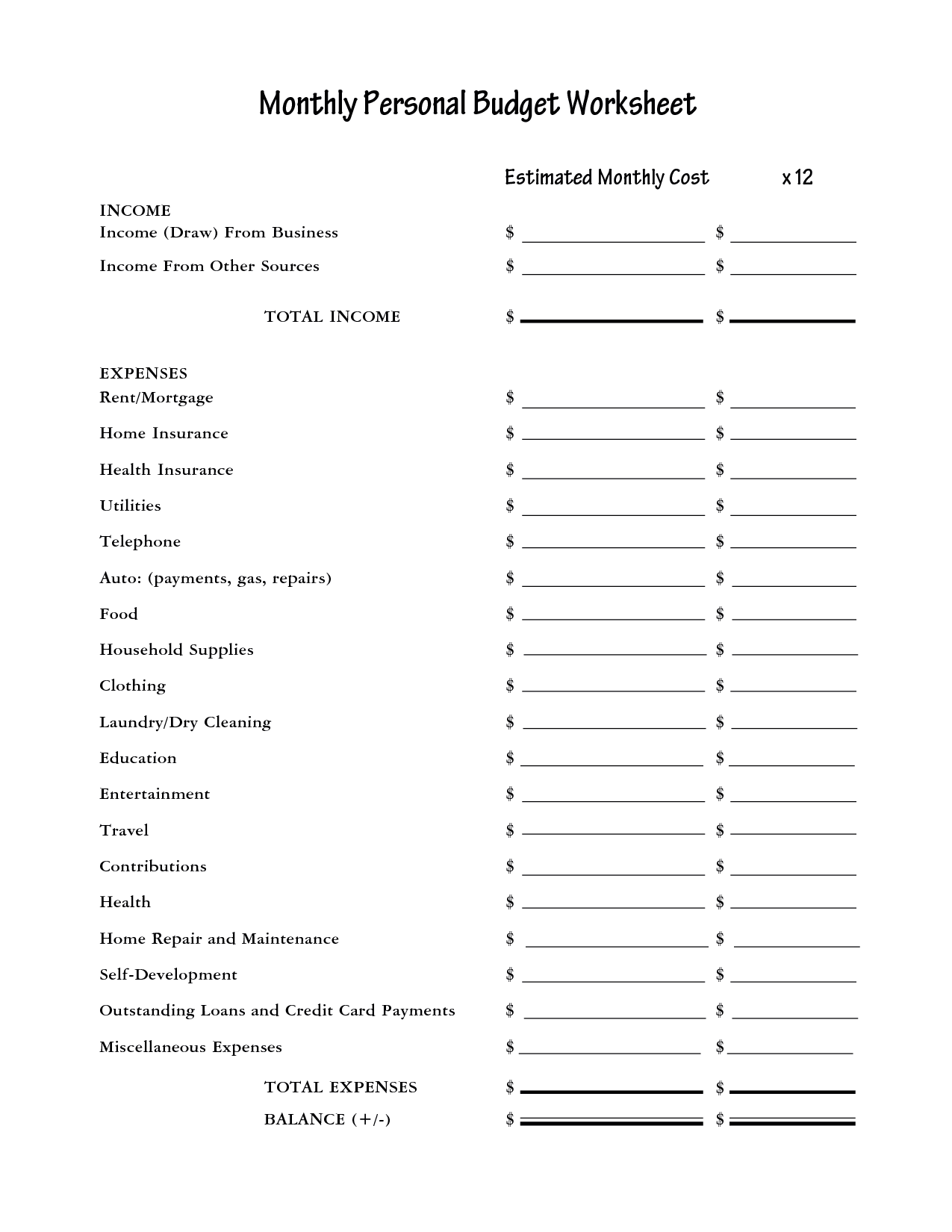

- Blank Personal Monthly Budget Worksheet

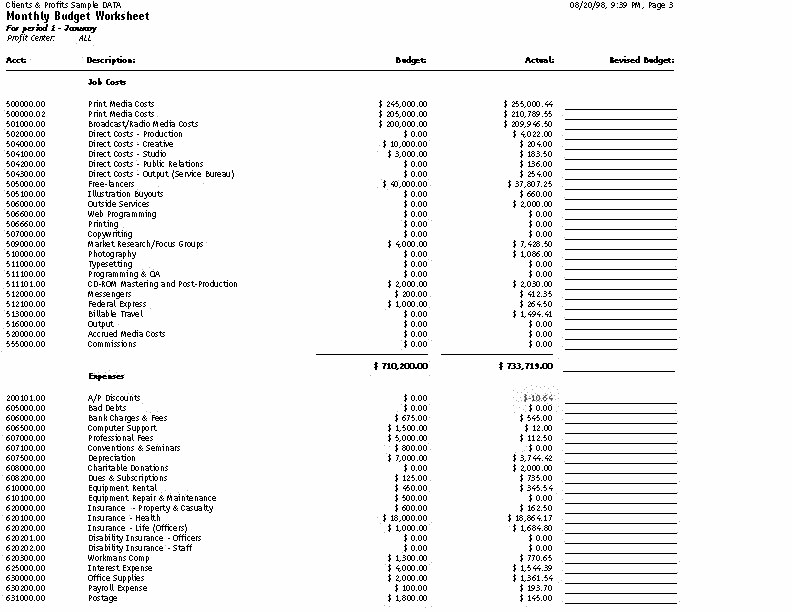

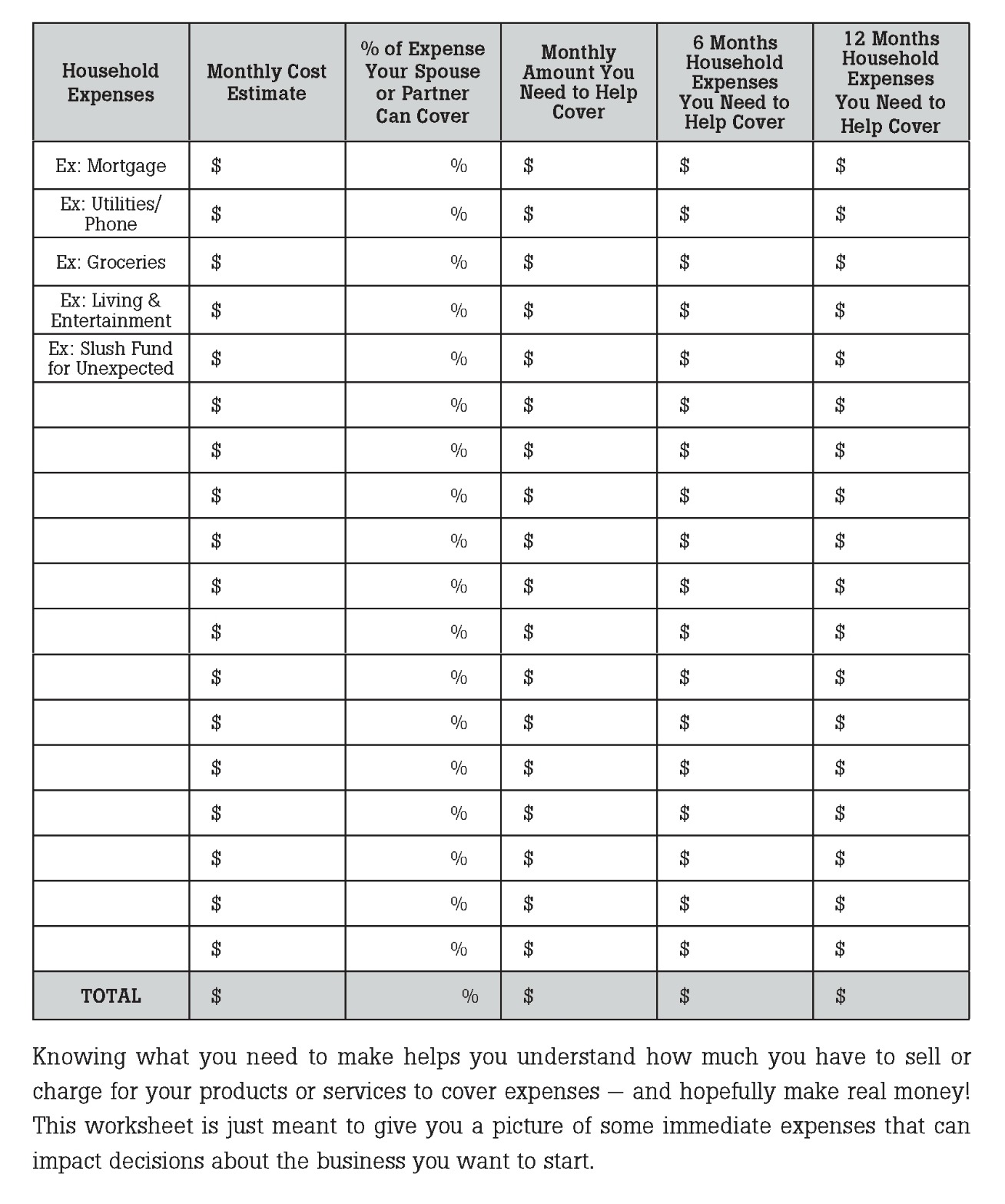

- Budget and Debt Worksheet

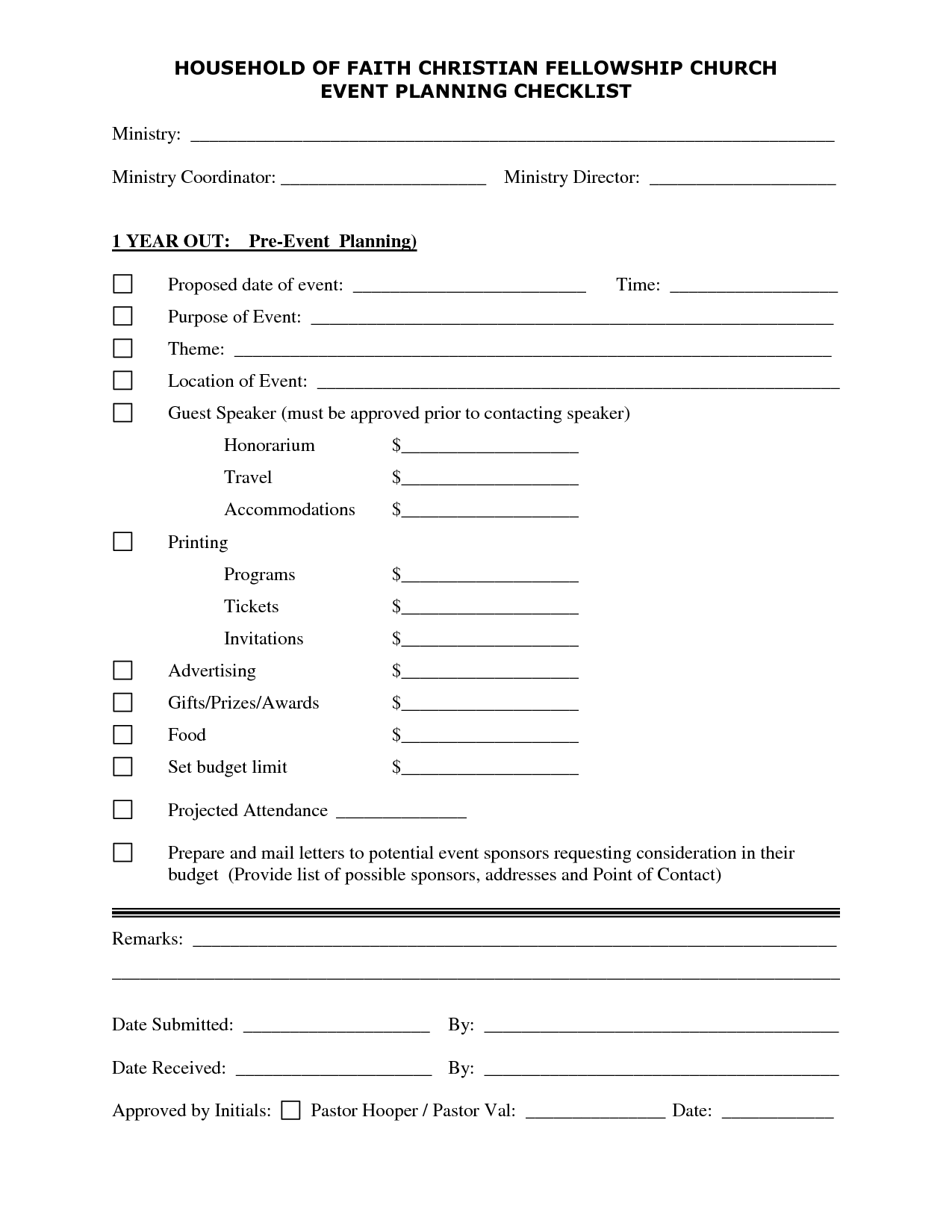

- Church Event Planning Checklist Template

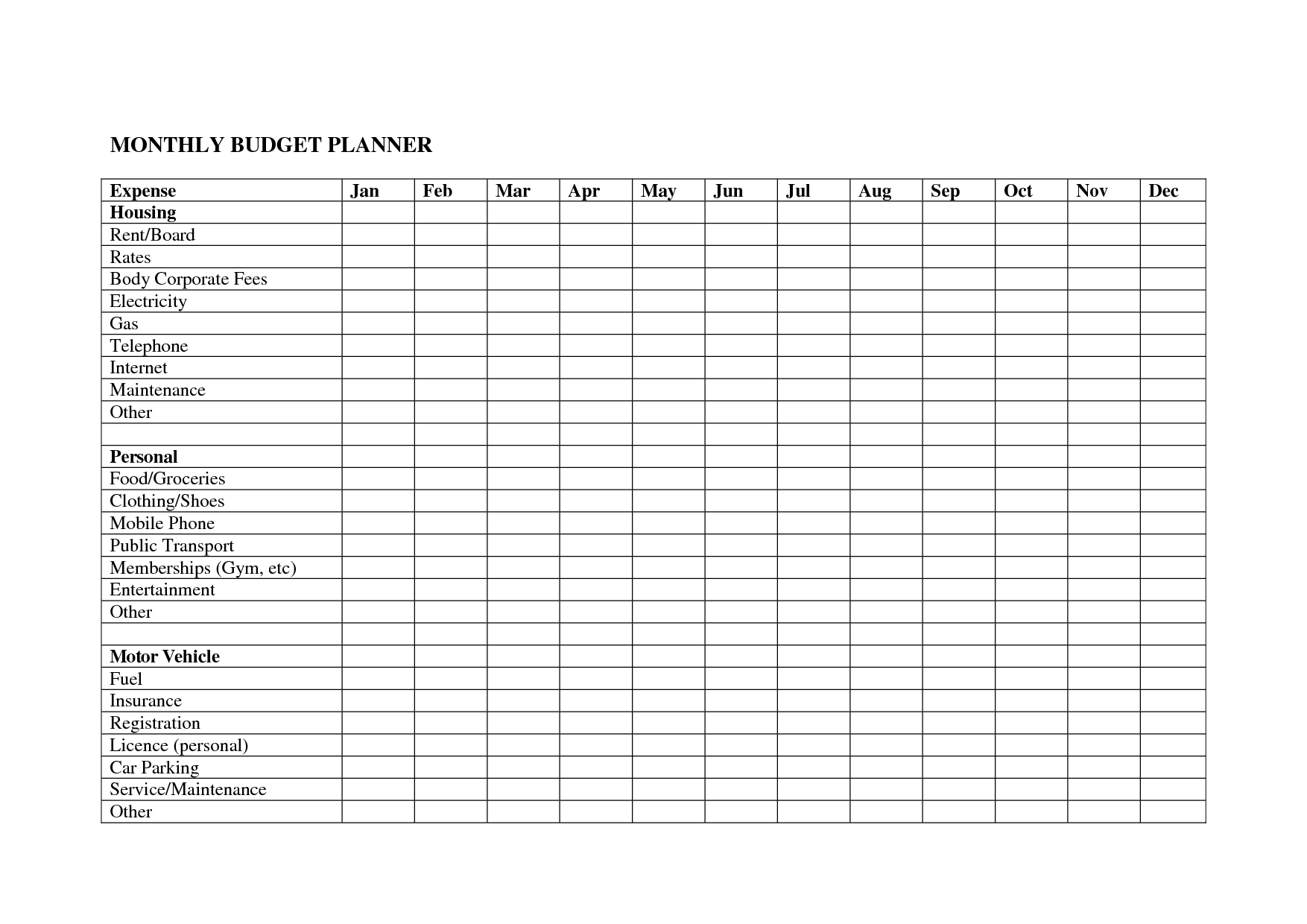

- Blank Monthly Budget Worksheet

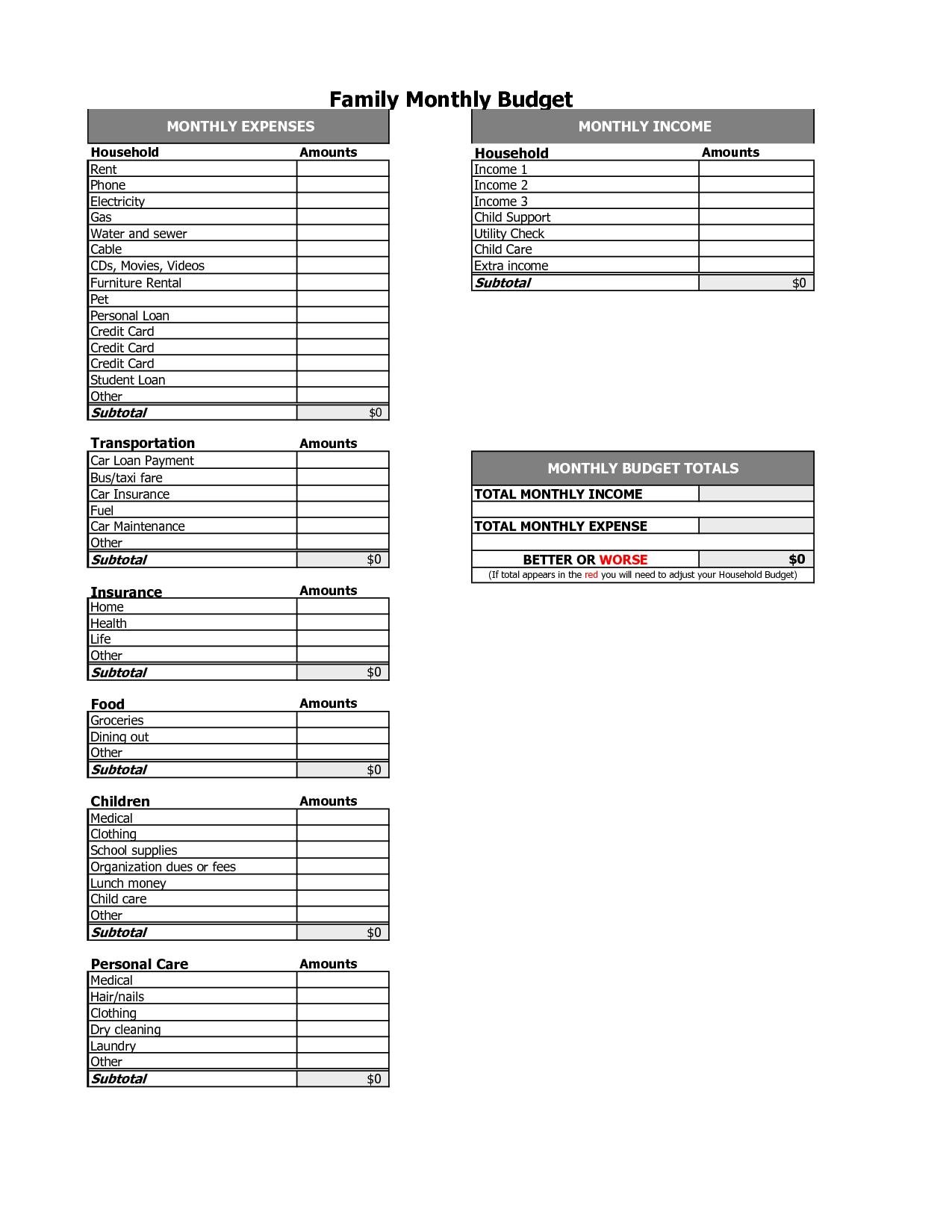

- Family Monthly Budget Planner Excel

- Make a Budget Worksheet

- Blank Monthly Budget Spreadsheet

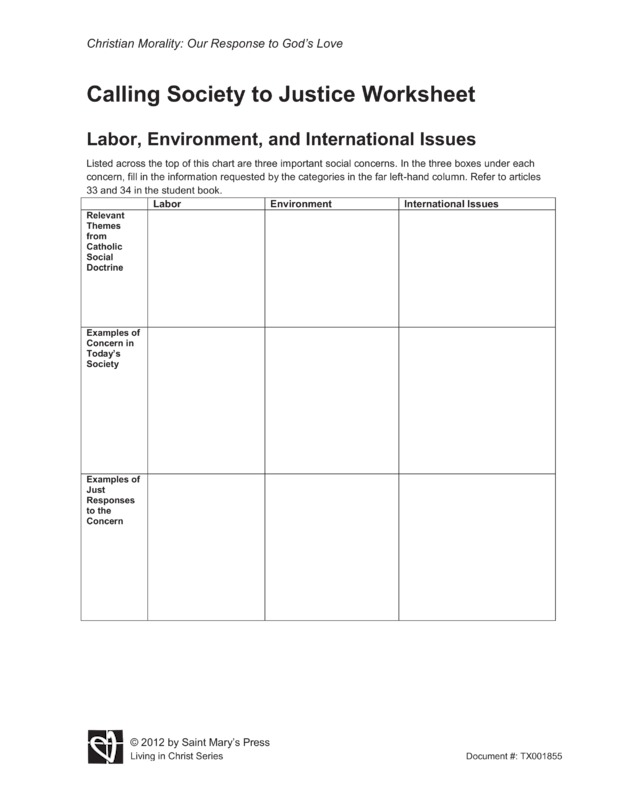

- Social Justice Worksheets

- Printable Personal Financial Statement Form

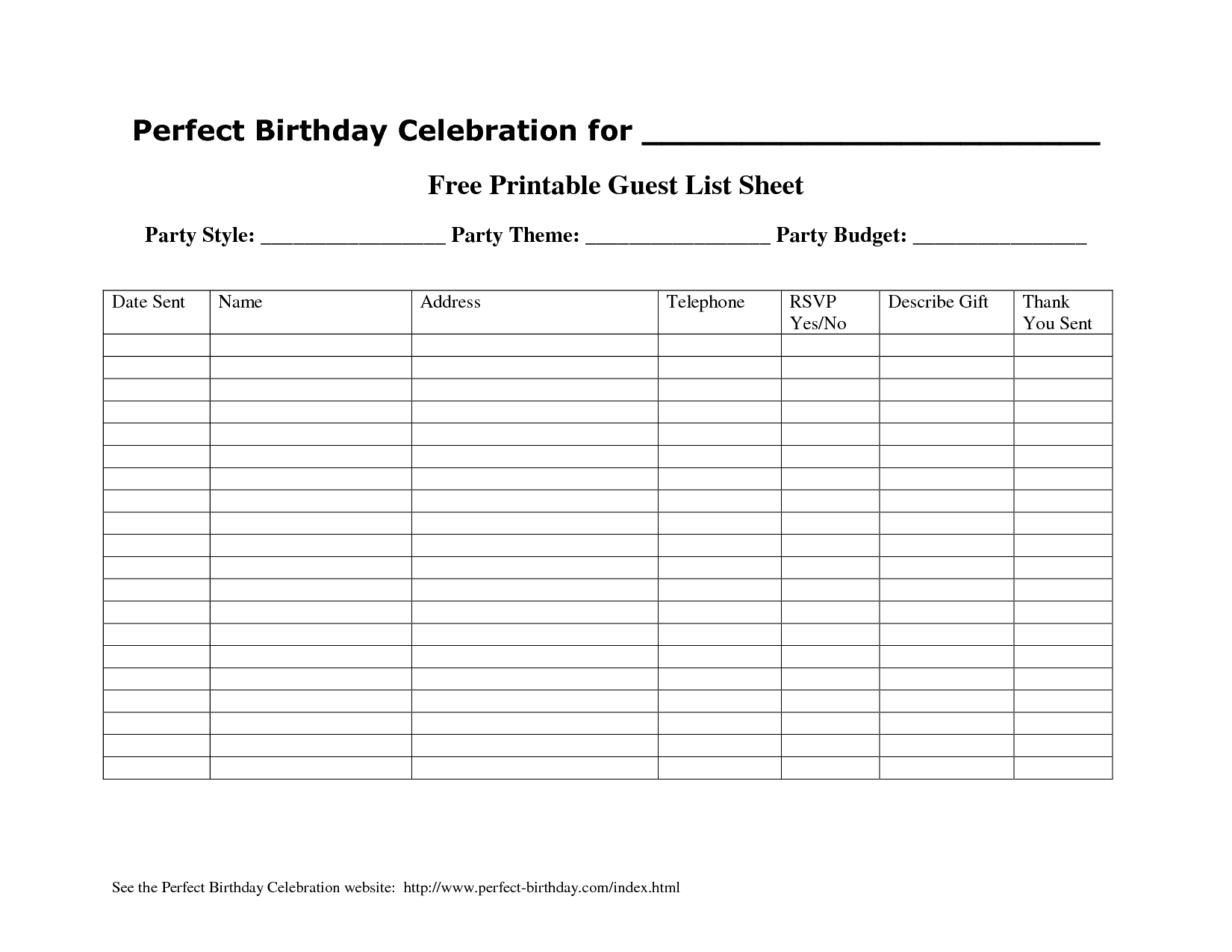

- Free Printable Guest List Template

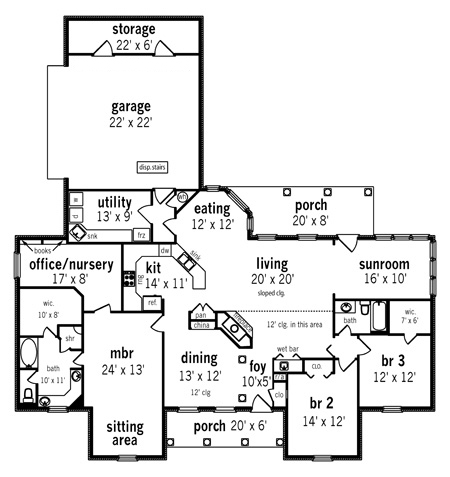

- Open Floor Plans

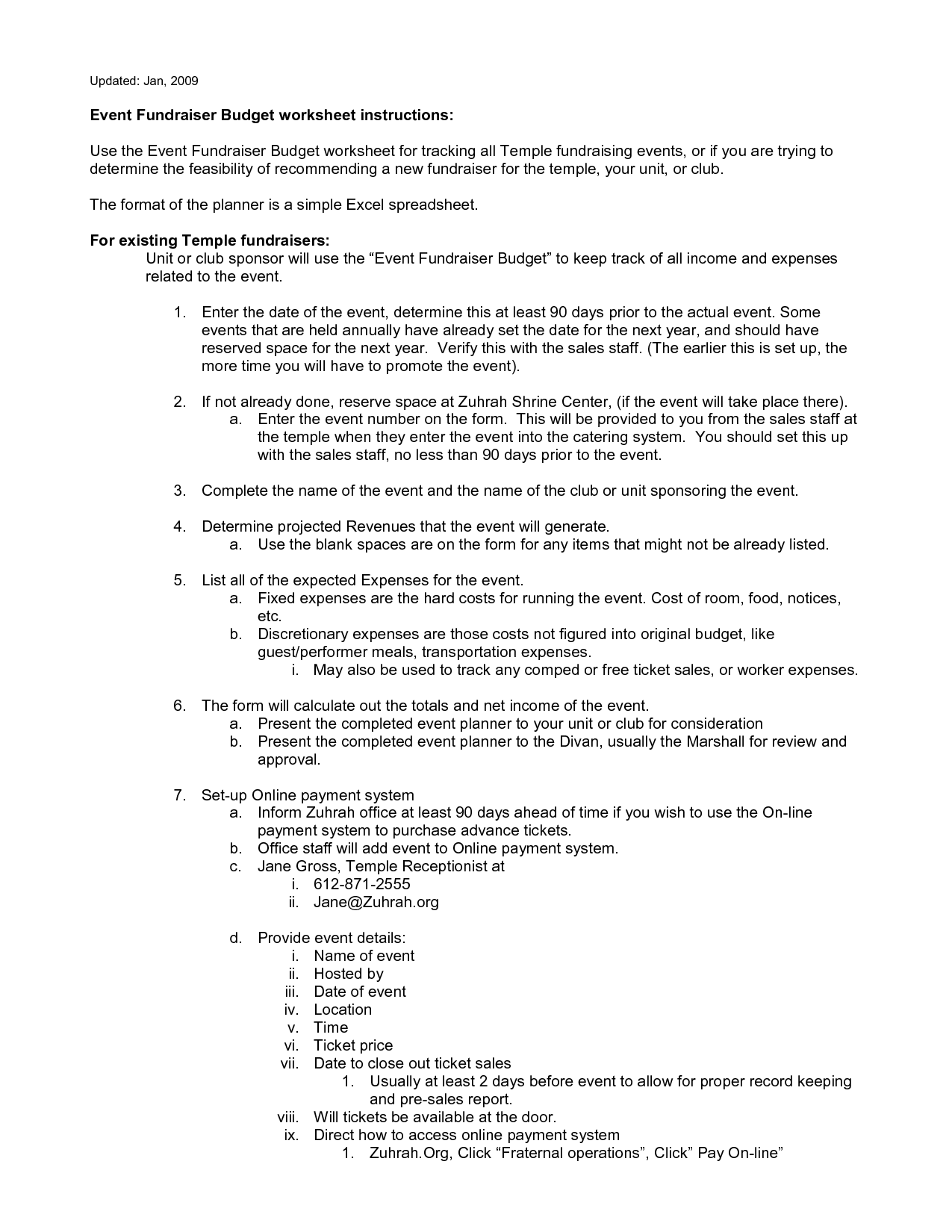

- Fundraising Event Budget Worksheet

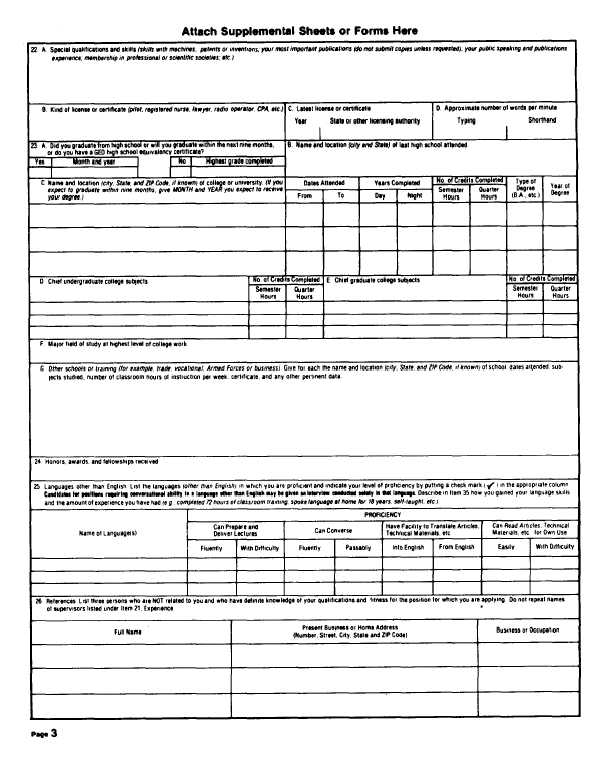

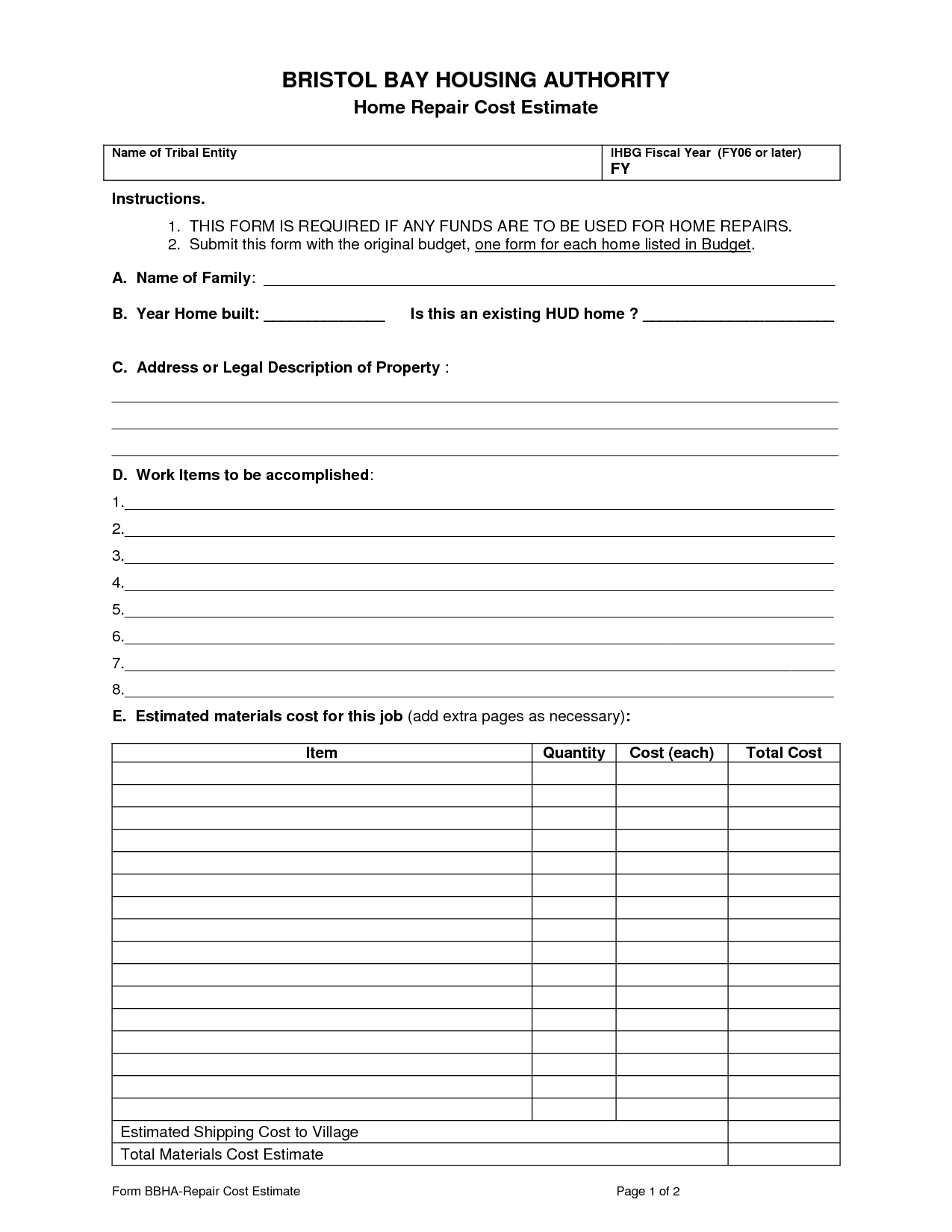

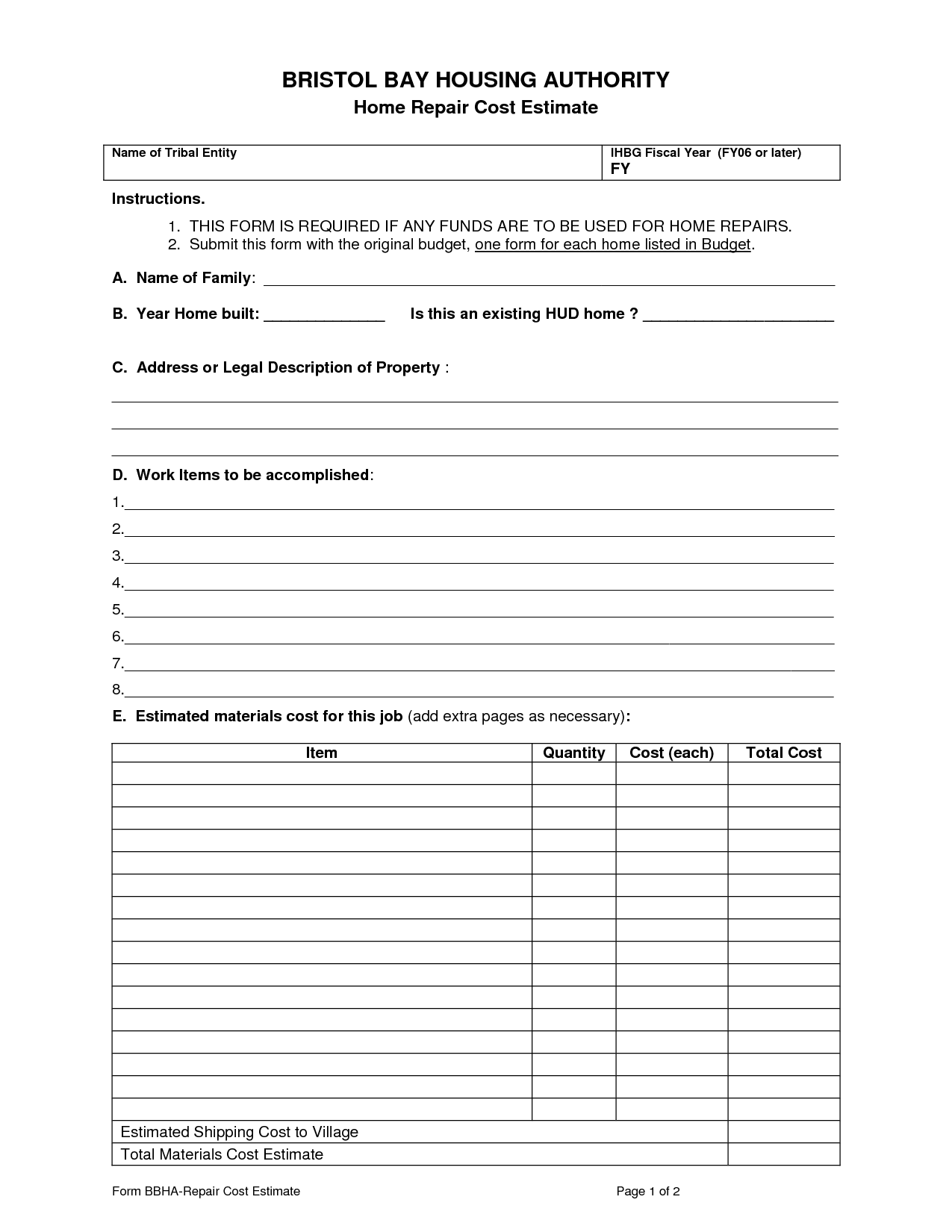

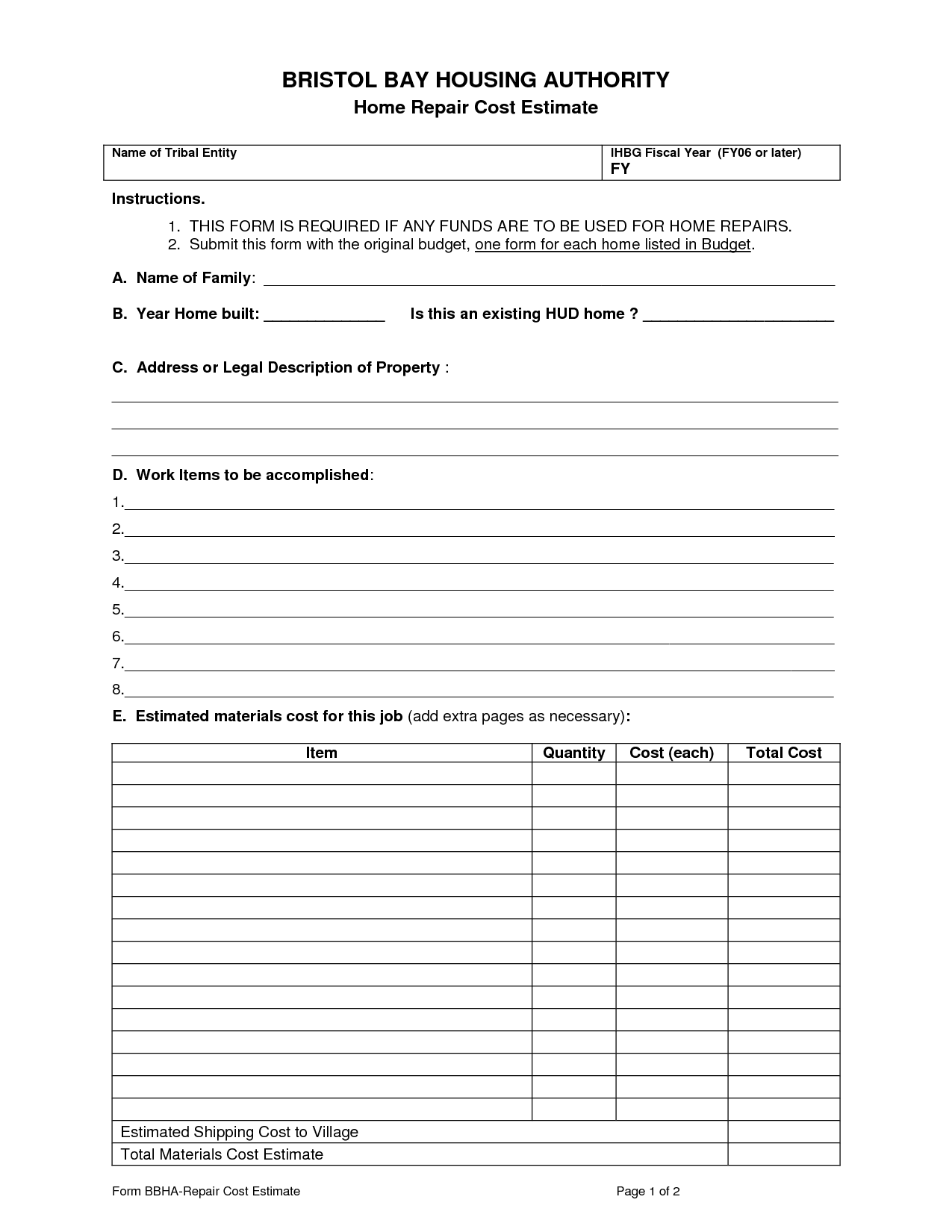

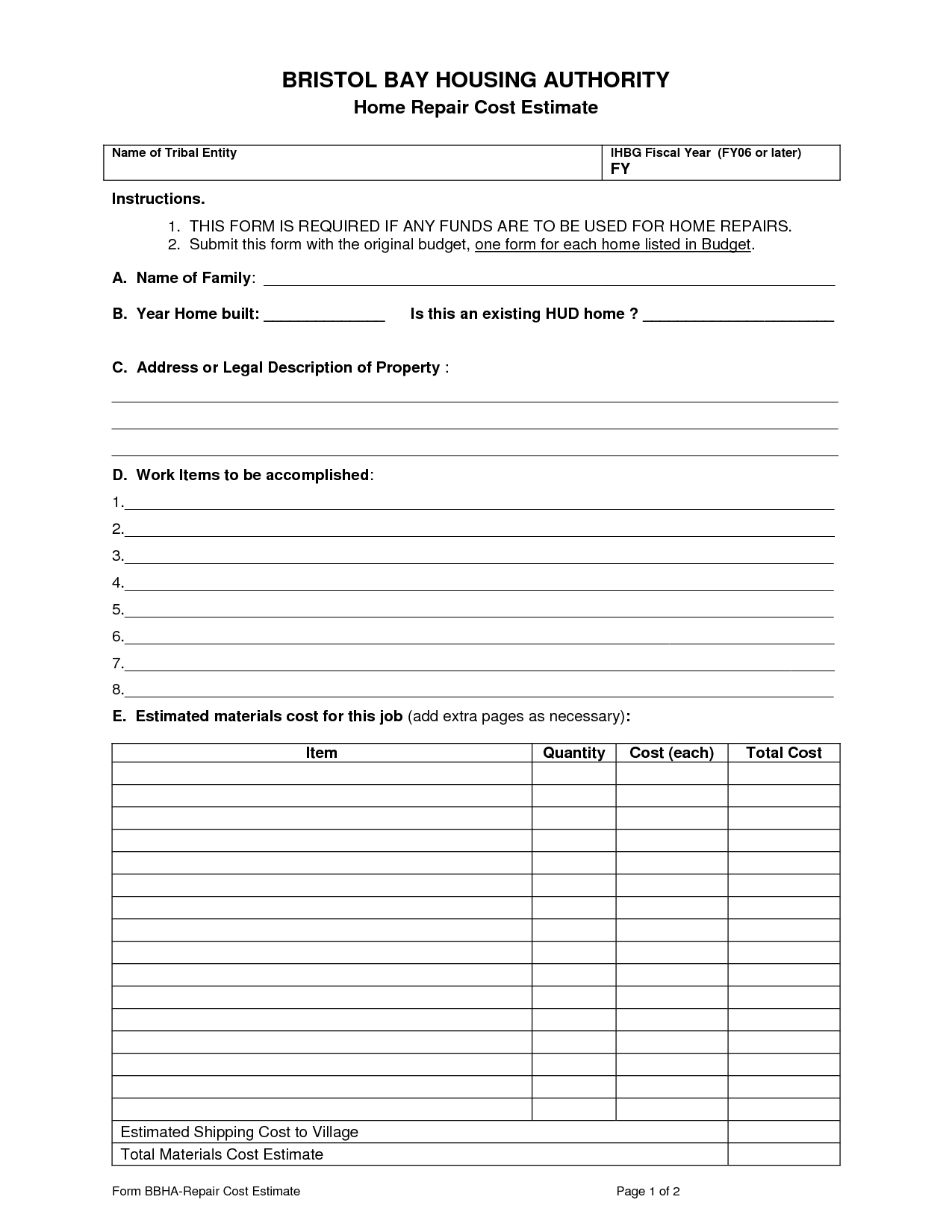

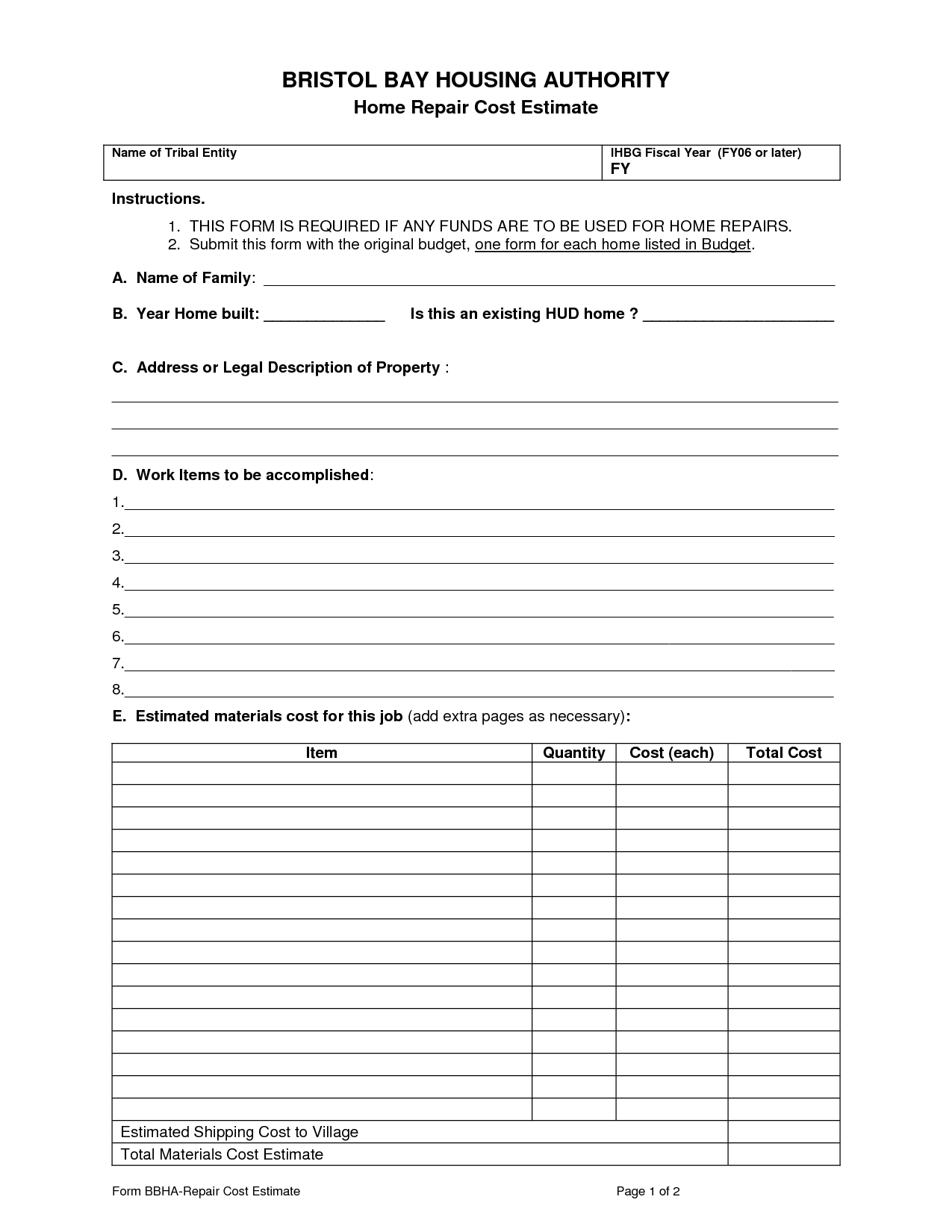

- Repair Estimate Form Template

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a Household Budget Planning Worksheet?

A Household Budget Planning Worksheet is a tool used to track and manage income, expenses, and savings within a household. It typically includes sections for listing monthly income sources, fixed and variable expenses, savings goals, and any outstanding debts. By detailing all financial aspects, individuals can create a realistic budget, identify areas for improvement, and make informed decisions to achieve their financial goals.

Why is it important to have a Household Budget Planning Worksheet?

A Household Budget Planning Worksheet is important because it helps individuals and families track their income and expenses, allowing them to understand their financial situation and make informed decisions about how to allocate their resources. By creating a budget plan, individuals can prioritize their spending, save for the future, and avoid accumulating debt. It also helps in identifying areas where expenses can be reduced and allows for better financial planning and goal setting.

What are the main sections or categories included in a Household Budget Planning Worksheet?

A Household Budget Planning Worksheet typically includes sections or categories such as income (including regular and irregular sources), expenses (divided into fixed, variable, and discretionary expenses), savings and investments, debt payments, emergency fund contributions, and miscellaneous expenses. Other categories may include housing costs, transportation, utilities, groceries, entertainment, health care, and personal care expenses.

How can a Household Budget Planning Worksheet help in organizing and tracking expenses?

A Household Budget Planning Worksheet helps in organizing and tracking expenses by allowing you to categorize your income and expenditures, clearly outlining where your money is going. By detailing your monthly expenses and income, you can identify areas where you can cut back or save money, helping you to stay within your budget. Regularly updating and reviewing the worksheet assists in monitoring spending patterns and financial goals, enabling you to make informed decisions to manage your finances effectively.

How does a Household Budget Planning Worksheet assist in setting financial goals?

A Household Budget Planning Worksheet assists in setting financial goals by providing a clear overview of income, expenses, debts, and savings. By tracking and organizing financial data, individuals can identify areas where they can cut back on expenses or increase savings, thus helping to prioritize and set realistic financial goals. The worksheet serves as a tool to visualize the current financial situation and make informed decisions on how to allocate funds towards achieving specific objectives, whether it be saving for a big purchase, paying off debts, or building an emergency fund.

What are some common sources of income to consider when filling out a Household Budget Planning Worksheet?

Some common sources of income to consider when filling out a Household Budget Planning Worksheet include salaries/wages, bonuses, commissions, rental income, dividends/interest, child support/alimony, government benefits (such as Social Security or unemployment benefits), and income from side jobs or freelance work. It's important to account for all sources of income to accurately assess your financial situation and properly allocate funds for expenses and savings.

What expenses should be included in a Household Budget Planning Worksheet?

Expenses that should be included in a Household Budget Planning Worksheet are: rent/mortgage, utilities (such as electricity, water, gas, internet), groceries, transportation (car payments, insurance, gas, public transportation), healthcare (insurance premiums, medications), childcare or school expenses, entertainment (dining out, movies, subscriptions), savings (emergency fund, retirement contributions), debt payments (credit cards, loans), and any other recurring monthly expenses specific to the household. It's important to also account for irregular or annual expenses by setting aside a portion of the budget for those future payments.

How often should a Household Budget Planning Worksheet be reviewed and updated?

A Household Budget Planning Worksheet should be reviewed and updated on a monthly basis to ensure it reflects any changes in income, expenses, or financial goals. Regularly reviewing and updating the budget allows for better financial management and helps in making informed decisions about spending and saving.

What are some tips for effectively using a Household Budget Planning Worksheet?

To effectively use a Household Budget Planning Worksheet, start by listing all sources of income, followed by categorizing and tracking expenses accurately each month. Set realistic financial goals and prioritize spending based on necessities versus wants. Regularly review and adjust the budget to align with changing financial circumstances. Additionally, use tools like spreadsheets or budgeting apps to help streamline the process and maintain a comprehensive overview of your finances. Finally, stay committed and disciplined in following your budget to achieve your financial objectives.

How can a Household Budget Planning Worksheet help in identifying areas for potential cost savings?

A Household Budget Planning Worksheet can help in identifying areas for potential cost savings by documenting all sources of income and expenses in one place, allowing individuals to see a clear breakdown of where their money is being spent. By analyzing the data, individuals can pinpoint areas where they are overspending or where there may be opportunities to cut costs, such as reducing unnecessary expenses or finding alternative, more cost-effective solutions. This tool can also provide insights into spending patterns and help prioritize financial goals, ultimately leading to smarter financial decisions and a more efficient use of resources.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments