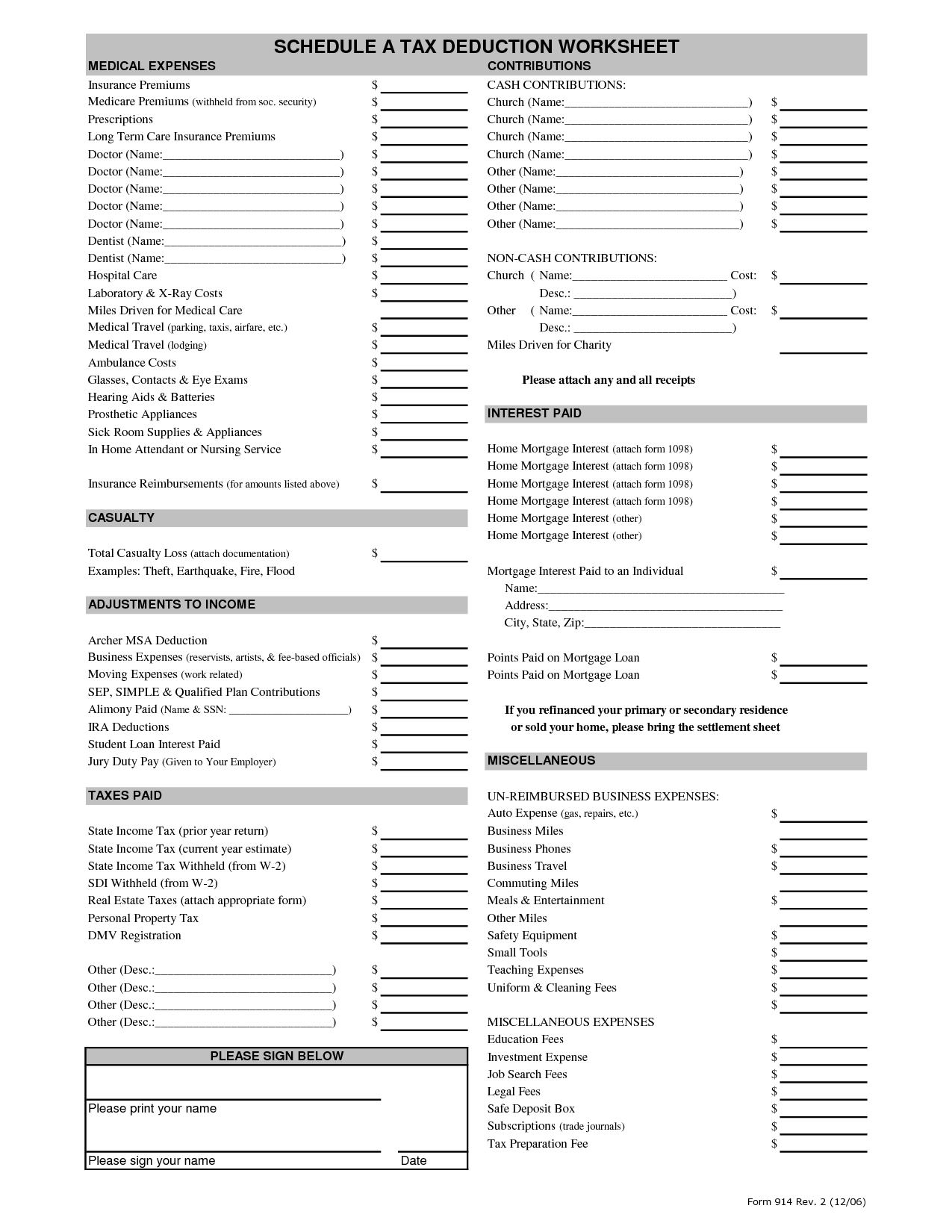

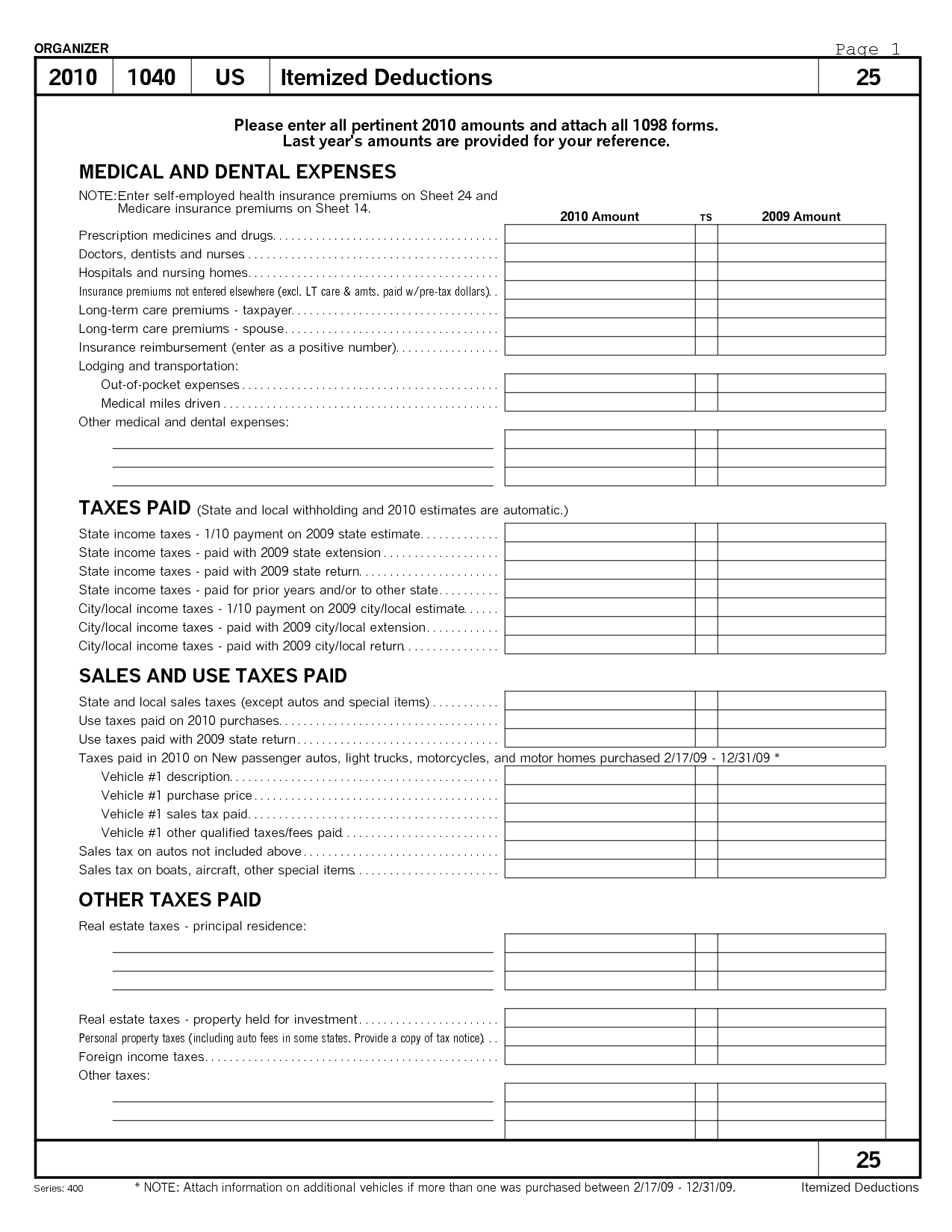

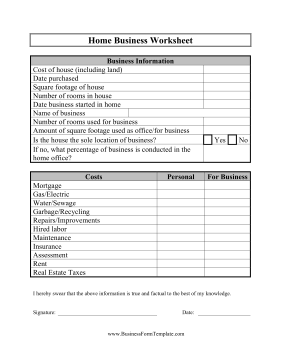

Home Business Tax Deductions Worksheet

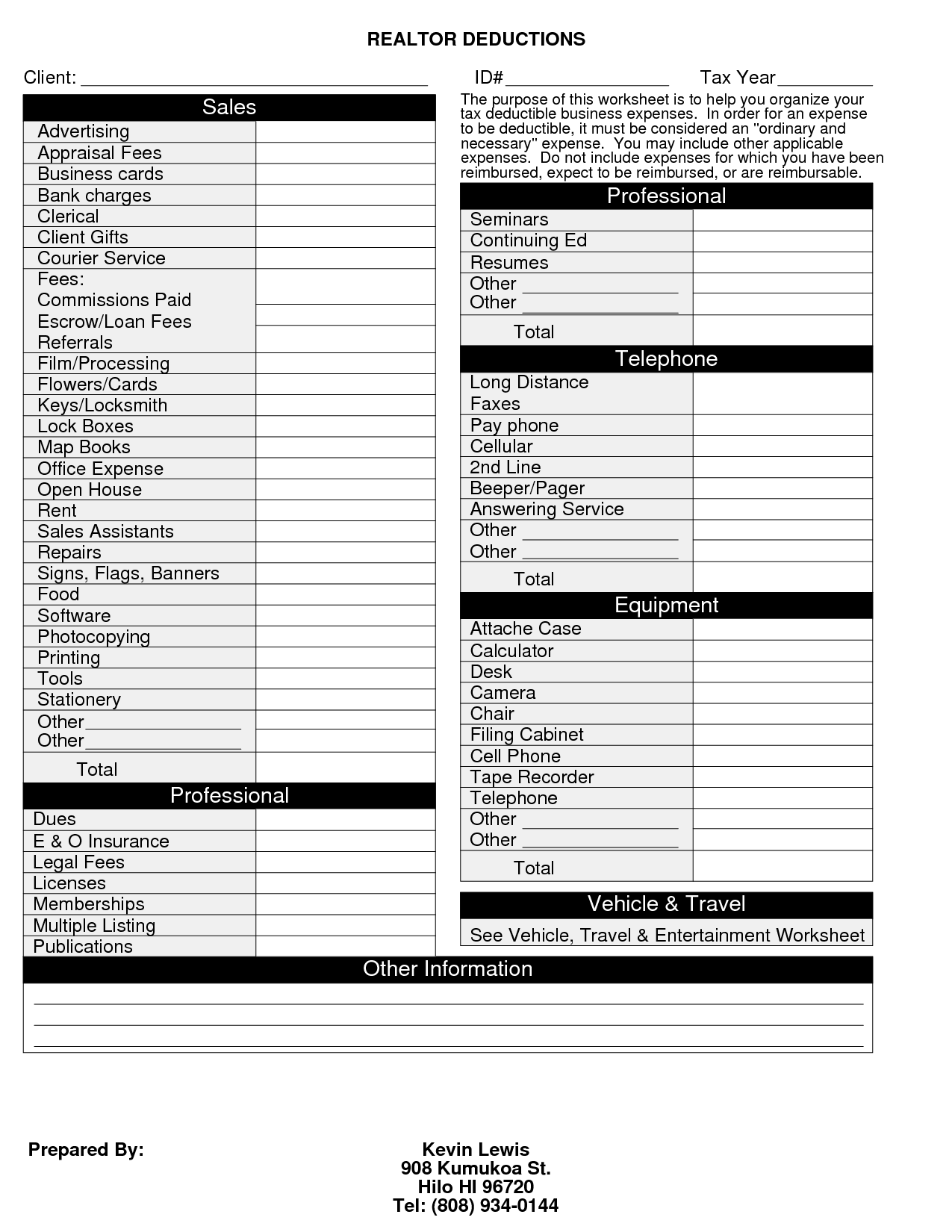

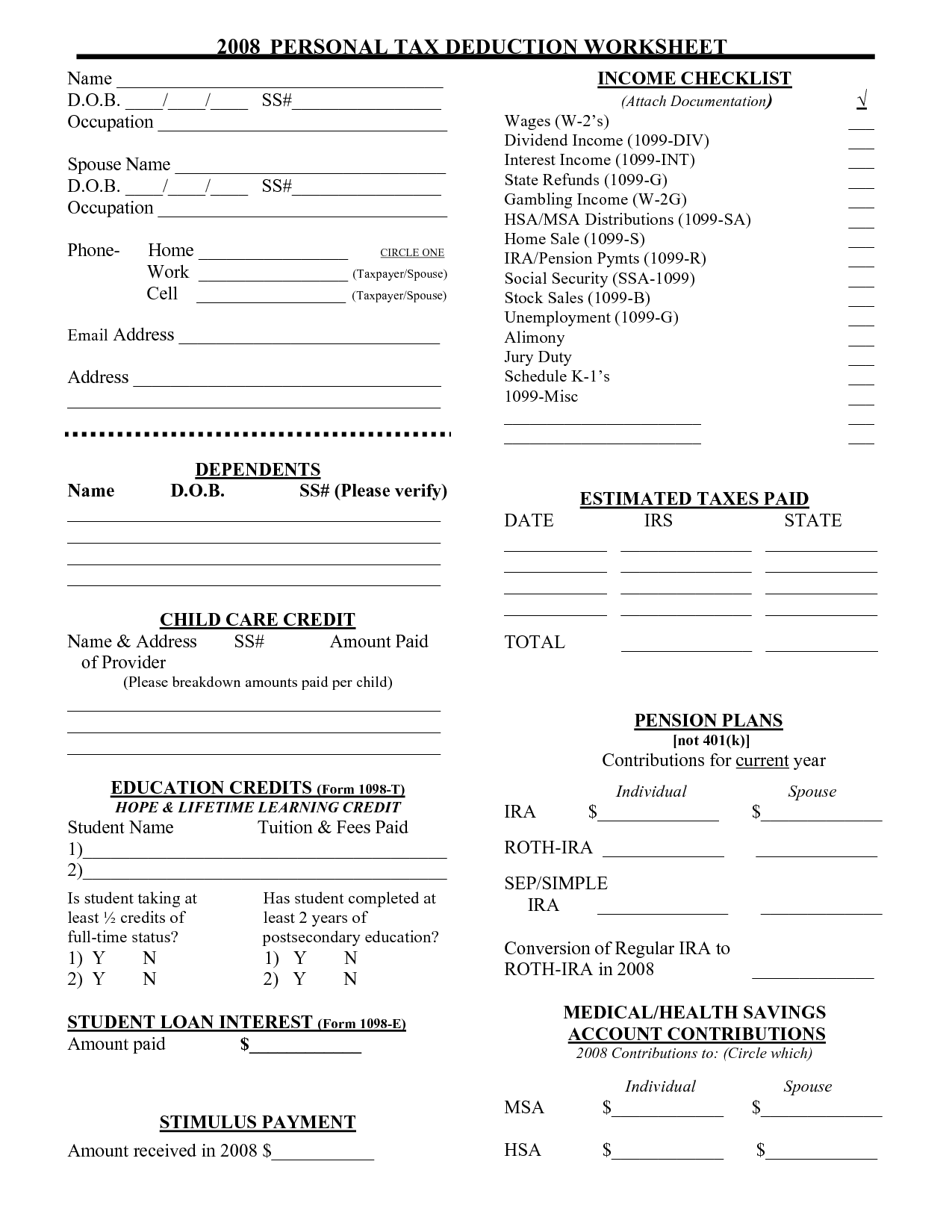

The Home Business Tax Deductions Worksheet is a useful tool for individuals or small business owners who operate their businesses from home and want to ensure they are maximizing their tax deductions. This worksheet provides a comprehensive list of expenses that are commonly associated with running a business from home, allowing users to easily track and calculate their deductible costs.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is the purpose of the Home Business Tax Deductions Worksheet?

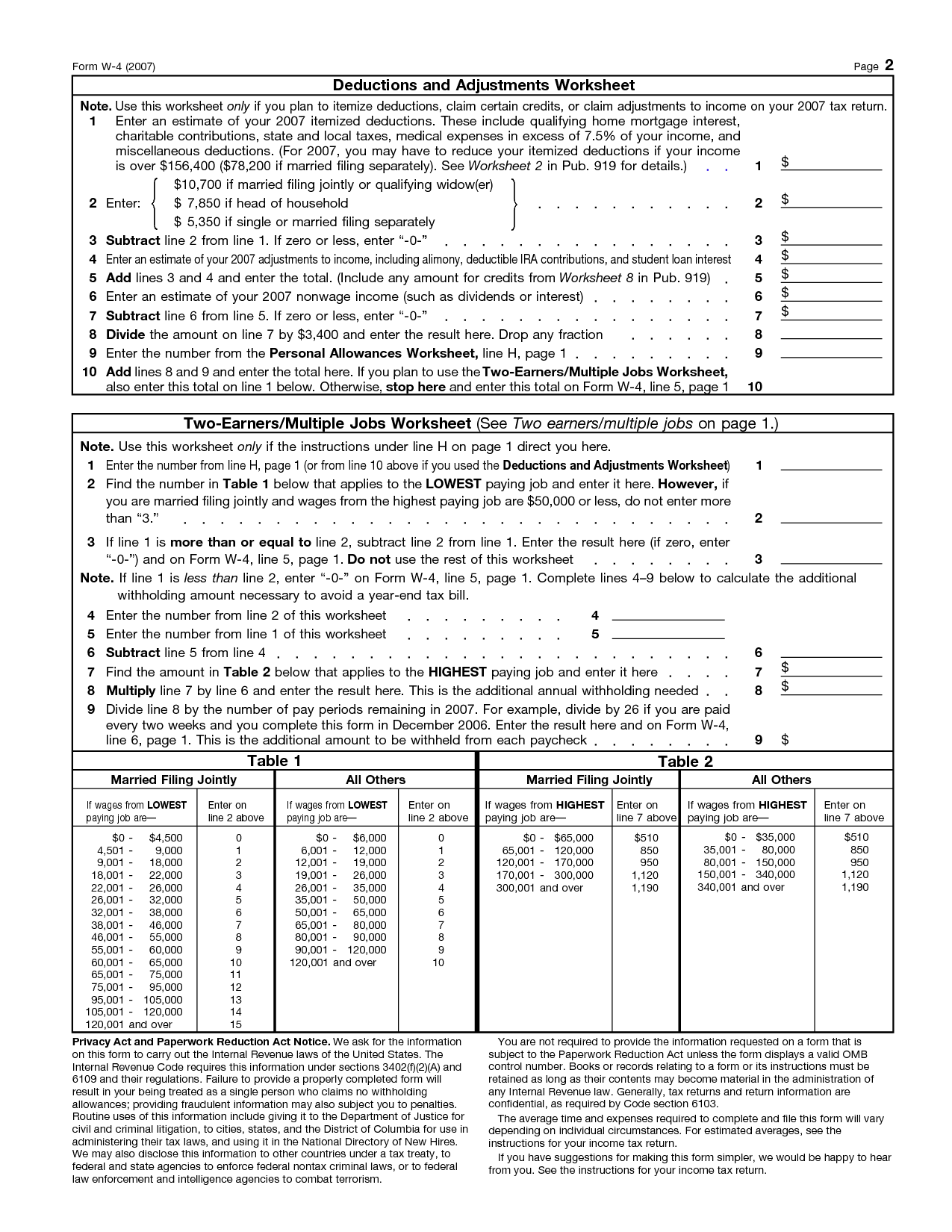

The purpose of the Home Business Tax Deductions Worksheet is to help self-employed individuals or small business owners track and calculate the expenses related to operating a business from their home. By using this worksheet, individuals can identify and document deductible expenses such as home office costs, utilities, phone bills, internet expenses, and other relevant expenditures that can be claimed as tax deductions to reduce their taxable income.

What expenses can be deducted using the Home Business Tax Deductions Worksheet?

The Home Business Tax Deductions Worksheet allows you to deduct certain expenses related to running a business from home, such as a portion of your mortgage or rent, utilities, internet and phone bills, home office supplies, and certain home improvements like repairs to the home office space. It is important to carefully track and document these expenses to ensure they qualify for the deduction.

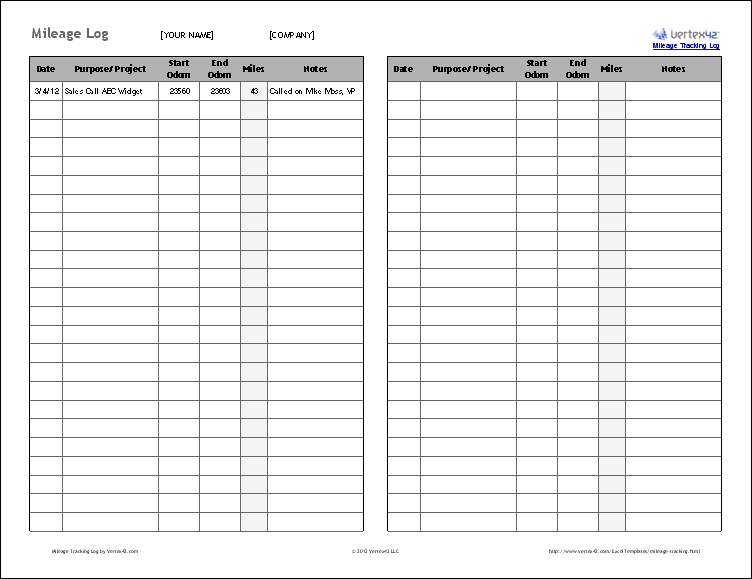

How does the worksheet help track and organize business expenses?

A worksheet helps track and organize business expenses by providing a structured format to record all expenses in an organized manner. It allows for categorization of expenses such as utilities, rent, supplies, etc., making it easier to analyze and monitor where money is being spent. Additionally, a worksheet helps calculate totals, track trends over time, and compare actual expenses to budgeted amounts, providing valuable insights for financial management and decision-making within the business.

Does the worksheet differentiate between personal and business expenses?

Yes, the worksheet differentiates between personal and business expenses by categorizing them separately to help individuals or businesses easily track and distinguish their spending in each category.

Can the Home Business Tax Deductions Worksheet be used for multiple businesses?

No, the Home Business Tax Deductions Worksheet is typically designed to be used for a single business operated from a home, rather than for multiple businesses. It is important to keep accurate records and separate documentation for each business to ensure accurate and compliant tax filings.

Is the worksheet applicable for both full-time and part-time home businesses?

Yes, the worksheet can be applicable for both full-time and part-time home businesses as it helps in organizing and tracking business expenses, income, and other important financial data regardless of the business's size or operating hours. It is a useful tool for all types of home-based businesses to manage their finances effectively.

Does the worksheet consider the size or type of home business?

Yes, the worksheet does take into consideration the size or type of home business as it factors in various expenses and revenues that may vary depending on the nature and scale of the business being operated from home. By including these specifics, the worksheet provides a more tailored and accurate representation of the financial aspects of the home business.

Can the worksheet be used to calculate estimated tax savings?

No, the worksheets are typically used to organize and calculate data, such as income, expenses, and deductions, but they do not directly calculate estimated tax savings. Estimated tax savings would depend on various factors and calculations based on the specific tax laws and regulations applicable to an individual or business. It would be advisable to consult a tax professional for accurate estimations of tax savings based on your unique circumstances.

Are there any specific instructions or guidelines for filling out the worksheet?

Yes, make sure to read and follow any instructions provided on the worksheet itself. Pay attention to any specific format requirements, such as writing in pen or pencil, using a certain size of font, or providing answers in a specific order. If there are no specific instructions, ensure that you clearly and neatly fill out all sections of the worksheet to the best of your ability.

Can the Home Business Tax Deductions Worksheet be submitted along with tax returns as supporting documentation?

The Home Business Tax Deductions Worksheet cannot be submitted along with tax returns as supporting documentation. However, it is an important tool for organizing and calculating deductible expenses related to a home business, which can then be used to complete the appropriate tax forms and schedules for claiming deductions on the tax return. It is recommended to keep the worksheet for your records in case of an audit by the IRS.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments