Financial Inventory Worksheet

A financial inventory worksheet is a valuable tool for anyone seeking to gain control over their personal finances. With this simple yet powerful tool, you can easily track and organize your income, expenses, assets, and liabilities all in one place. Whether you are a student looking to manage your budget, a young professional trying to save for a down payment on a house, or a retiree looking to keep track of your investments and expenses, a financial inventory worksheet can be an essential resource.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a financial inventory worksheet?

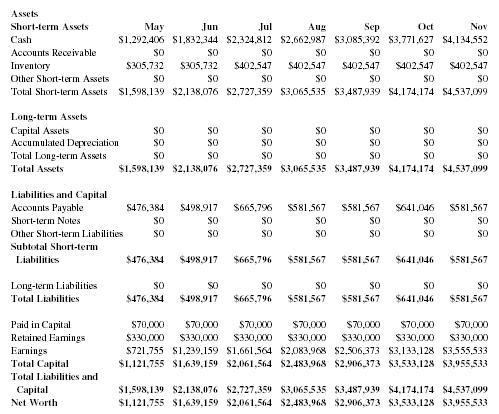

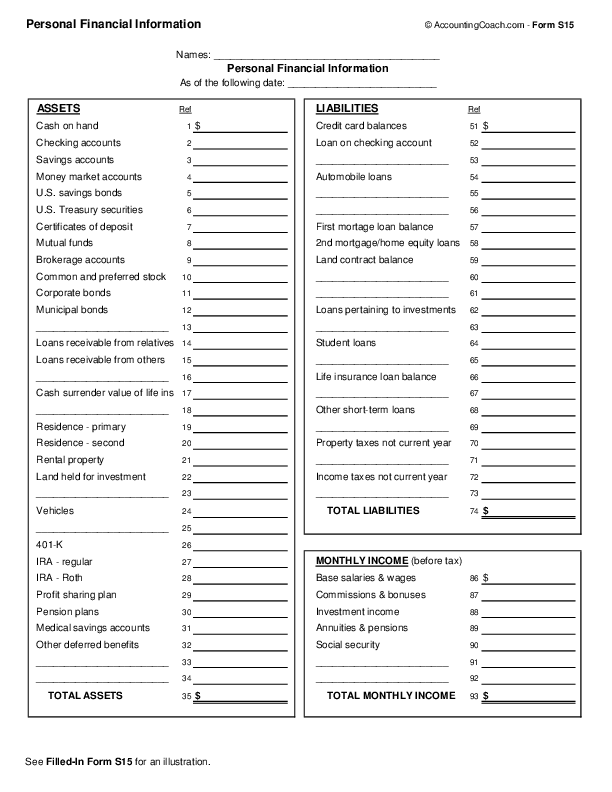

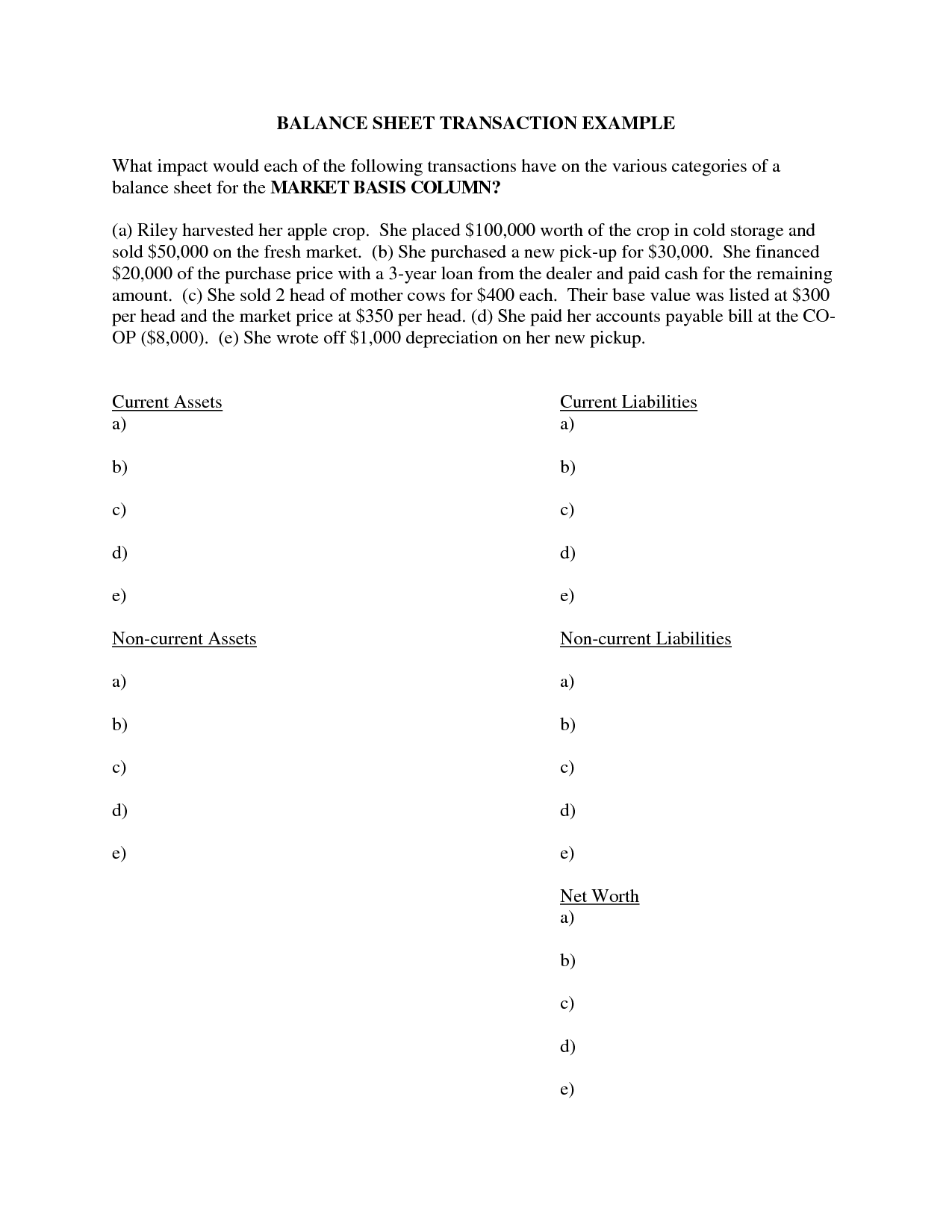

A financial inventory worksheet is a tool used to organize and track all of one's financial assets and liabilities in a systematic way. It typically includes a list of all bank accounts, investments, debts, real estate properties, retirement accounts, insurance policies, and other financial belongings. By compiling all this information in one place, individuals can assess their overall financial health, identify areas for improvement, and make informed decisions about budgeting, investing, and planning for the future.

How is a financial inventory worksheet used in personal finance management?

A financial inventory worksheet is used in personal finance management to organize and track all of one's financial information in one place. This can include assets, liabilities, income, expenses, debts, investments, and savings. By maintaining a comprehensive overview of one's financial situation, individuals can better understand their financial health, set goals, create budgets, prioritize spending, and make informed decisions about saving and investing for the future. This tool helps individuals assess their current financial status, identify areas for improvement, and ultimately work towards achieving financial stability and security.

What key information should be included in a financial inventory worksheet?

A financial inventory worksheet should include key information such as all assets (cash, savings, investments, real estate, vehicles), liabilities (loans, mortgages, credit card debt), income sources (salary, dividends, rental income), expenses (housing, utilities, transportation, food), insurance policies, retirement accounts, and any other financial accounts. It's important to list all financial details to get a clear picture of your overall financial health and make informed decisions about budgeting and planning for the future.

How often should a financial inventory worksheet be updated?

A financial inventory worksheet should ideally be updated at least once a month to reflect any changes in income, expenses, assets, and debts. This regular updating ensures that your financial picture is always current and enables you to make more informed decisions about your money management and budgeting.

What are the benefits of using a financial inventory worksheet?

A financial inventory worksheet can provide benefits such as helping individuals track their assets and liabilities, organize their financial information, identify areas for improvement in their financial situation, and create a comprehensive overview of their financial health. By listing all financial accounts and assets in one place, individuals can better understand their financial standing, set financial goals, and make informed decisions about budgeting, saving, and investing for the future.

What types of financial assets and liabilities should be included in a financial inventory worksheet?

A financial inventory worksheet should include all assets and liabilities that impact an individual's or organization's financial position. This may include, but is not limited to, cash and cash equivalents, accounts receivable, investments, property, equipment, loans, accounts payable, and other debts. It is important to include both liquid and illiquid assets as well as short-term and long-term liabilities to provide a comprehensive overview of an entity's financial health.

How can a financial inventory worksheet help with budgeting and financial planning?

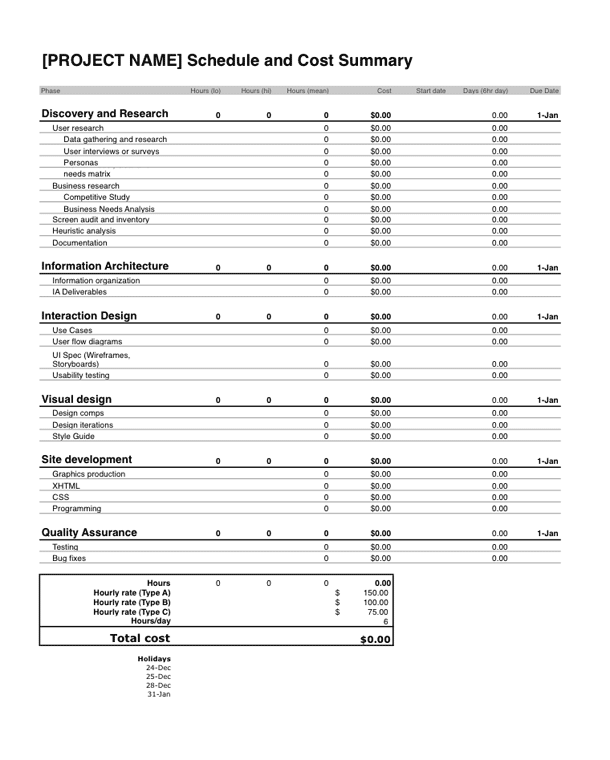

A financial inventory worksheet can help with budgeting and financial planning by providing a detailed overview of all assets, liabilities, income, and expenses. This tool allows individuals to have a clear understanding of their financial situation, making it easier to identify areas for improvement and set realistic financial goals. By regularly updating and referencing the worksheet, individuals can track their progress, make informed decisions, and create a more effective budget to better plan for their future financial needs.

Are there any limitations or drawbacks to using a financial inventory worksheet?

Yes, there are limitations and drawbacks to using a financial inventory worksheet. Some of the limitations include the possibility of overlooking certain assets or liabilities, inaccuracies due to estimation of values, and the need for regular updating to reflect changes in financial status. Additionally, the worksheet may not capture intangible assets or complex financial instruments accurately, leading to an incomplete picture of an individual's financial situation. It is important to supplement the use of a financial inventory worksheet with professional advice and regular review to ensure comprehensive and accurate financial planning.

What are some common mistakes to avoid when creating or using a financial inventory worksheet?

Some common mistakes to avoid when creating or using a financial inventory worksheet include not updating it regularly to reflect changes in assets or liabilities, omitting any important financial information that could impact your overall financial health, not being specific enough when listing items, overlooking certain categories such as digital assets or subscriptions, and failing to secure and maintain the confidentiality of the worksheet to protect sensitive financial information. It's important to periodically review and adjust your financial inventory worksheet to ensure it remains accurate and helpful in managing your finances effectively.

How can a financial inventory worksheet be customized to meet individual or family financial goals and needs?

A financial inventory worksheet can be customized to meet individual or family financial goals and needs by adding specific categories or sections related to those goals, such as savings for a vacation, emergency funds, or retirement planning. Additionally, the worksheet can include personalized budgeting tools, savings targets, and timelines for reaching financial milestones. By tailoring the worksheet to align with specific goals and needs, individuals and families can track progress, stay organized, and make informed financial decisions to help achieve their desired outcomes.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments