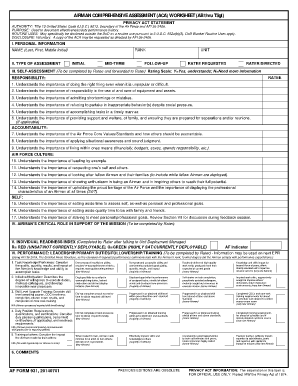

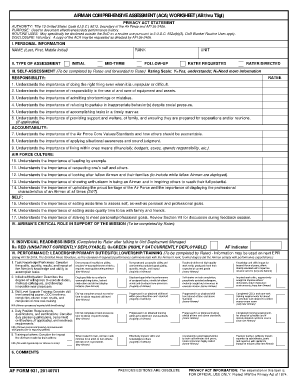

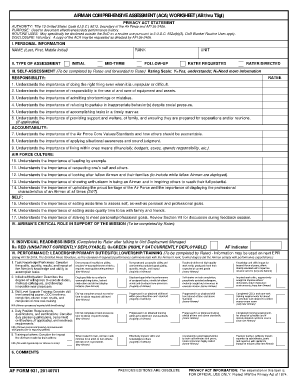

Federal Tax Deposit Worksheet

Are you a small business owner or self-employed individual seeking a reliable tool to help track your federal tax deposits? Look no further than the Federal Tax Deposit Worksheet. Designed specifically for this purpose, this worksheet serves as an organized entity and subject for managing your tax obligations to the IRS.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

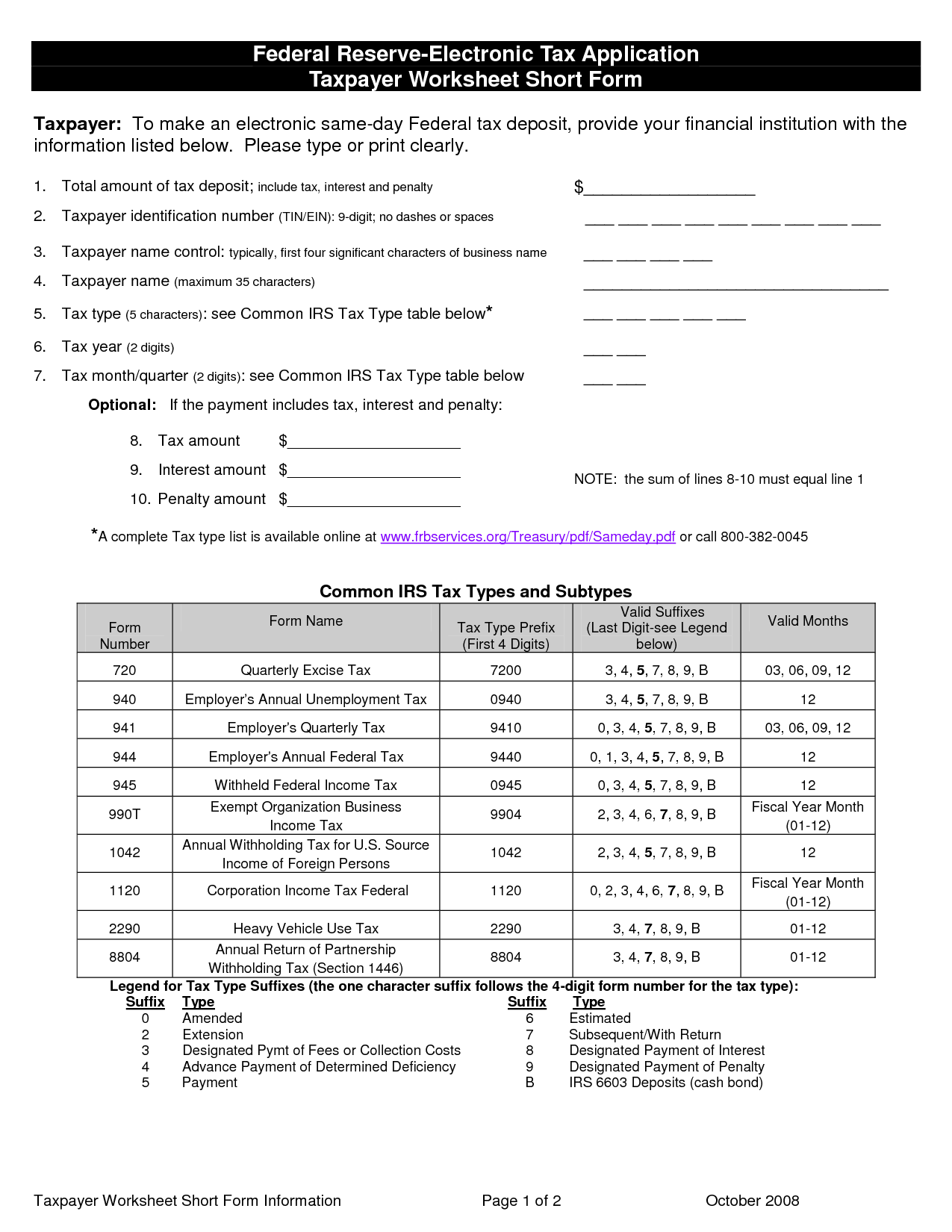

What is a Federal Tax Deposit Worksheet?

A Federal Tax Deposit Worksheet is a form used by businesses to help calculate the amount of federal taxes they owe and need to deposit with the Internal Revenue Service (IRS). This form helps businesses track their tax liabilities, such as income tax, Social Security tax, and Medicare tax, and ensures they make timely and accurate tax deposits to meet their federal tax obligations.

When is the Federal Tax Deposit Worksheet used?

The Federal Tax Deposit Worksheet is used by employers to calculate the amount of federal tax that must be deposited from employee wages to the Internal Revenue Service (IRS). It helps businesses determine the correct amount of federal tax liability based on various factors such as employee wages, tax rates, and deposit schedules.

What information is required on the Federal Tax Deposit Worksheet?

The Federal Tax Deposit Worksheet requires information such as the employer's name, address, EIN (Employer Identification Number), tax period, total tax liability, total deposit amount, and the dates of the pay period. Additionally, it will also include details regarding any adjustments, penalties, or interest amounts applicable to the tax deposit.

How often should the Federal Tax Deposit Worksheet be completed?

The Federal Tax Deposit Worksheet should be completed each time a federal tax deposit is made. This typically occurs when a business pays its federal payroll taxes, like the Federal Insurance Contributions Act (FICA) taxes, Federal Unemployment Tax Act (FUTA) tax, and federal income tax withholdings, to the Internal Revenue Service (IRS).

Who is responsible for completing the Federal Tax Deposit Worksheet?

Employers are responsible for completing the Federal Tax Deposit Worksheet, which is used to calculate the amount of federal taxes that need to be deposited to the IRS. This worksheet helps ensure that companies properly withhold and remit payroll taxes on behalf of their employees.

Where can I obtain a Federal Tax Deposit Worksheet?

You can obtain a Federal Tax Deposit Worksheet by visiting the official website of the Internal Revenue Service (IRS) at IRS.gov. On the website, navigate to the Forms and Publications section and search for Form 941, which is used to report quarterly federal tax deposits. The worksheet is included as part of this form and can be accessed for free on the IRS website.

What are the consequences of not submitting a Federal Tax Deposit Worksheet?

The consequences of not submitting a Federal Tax Deposit Worksheet include potential financial penalties, interest charges, and a disruption in compliance with tax regulations. Failure to submit the worksheet can result in inaccuracies in tax payments, which may lead to underpayment or late payment of taxes owed to the federal government. This can lead to penalties and interest charges being assessed on the amount owed. Additionally, non-compliance with tax regulations could result in audits or further legal action by the Internal Revenue Service (IRS).

Can the Federal Tax Deposit Worksheet be submitted electronically?

Yes, the Federal Tax Deposit Worksheet can be submitted electronically through the Electronic Federal Tax Payment System (EFTPS) or through a trusted third-party tax software provider. It is crucial to ensure that all required information is accurately entered for seamless processing of your tax deposit.

Are there any penalties for inaccuracies on the Federal Tax Deposit Worksheet?

Yes, there can be penalties for inaccuracies on the Federal Tax Deposit Worksheet. If the amounts reported are incorrect or if deposits are made late, the IRS may impose penalties and interest on the underpayment. It's important to double-check all information before submitting the worksheet to ensure accuracy and timely payment.

How long should I keep copies of the Federal Tax Deposit Worksheet for record-keeping purposes?

You should keep copies of the Federal Tax Deposit Worksheet for a minimum of 4 years as part of your record-keeping for tax purposes. This is in line with the recommended timeframe for retaining tax-related documents by the Internal Revenue Service (IRS) in case of an audit or any questions regarding your tax filings.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments