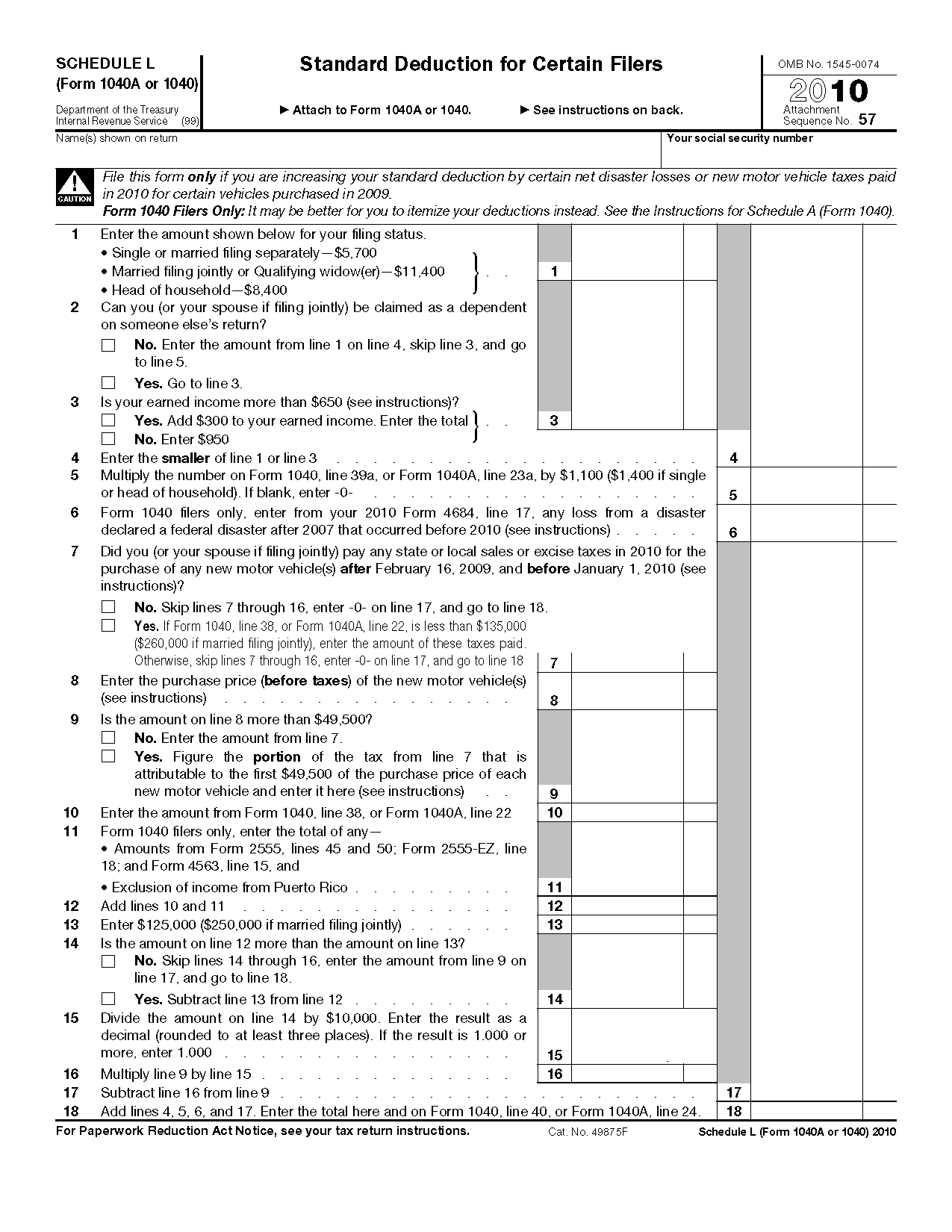

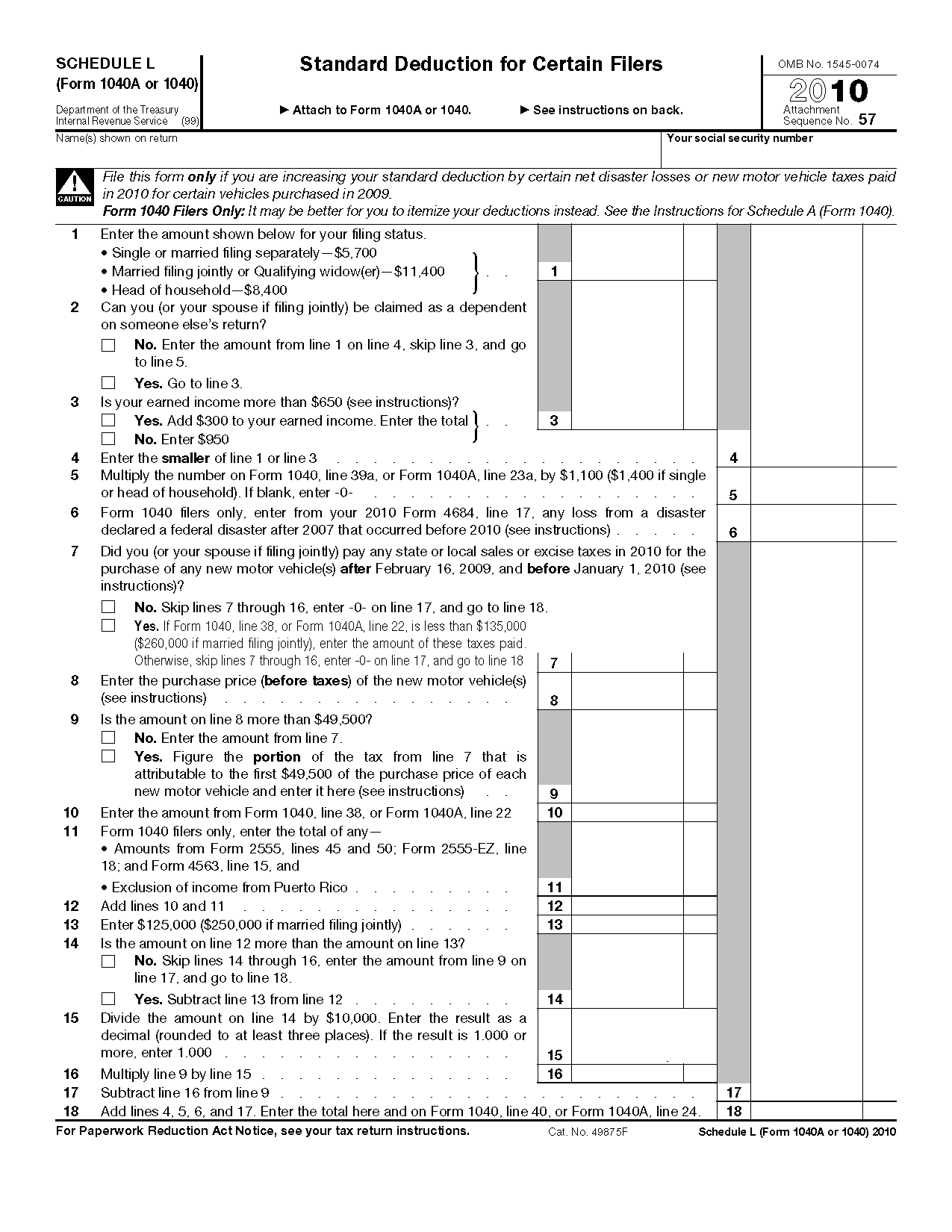

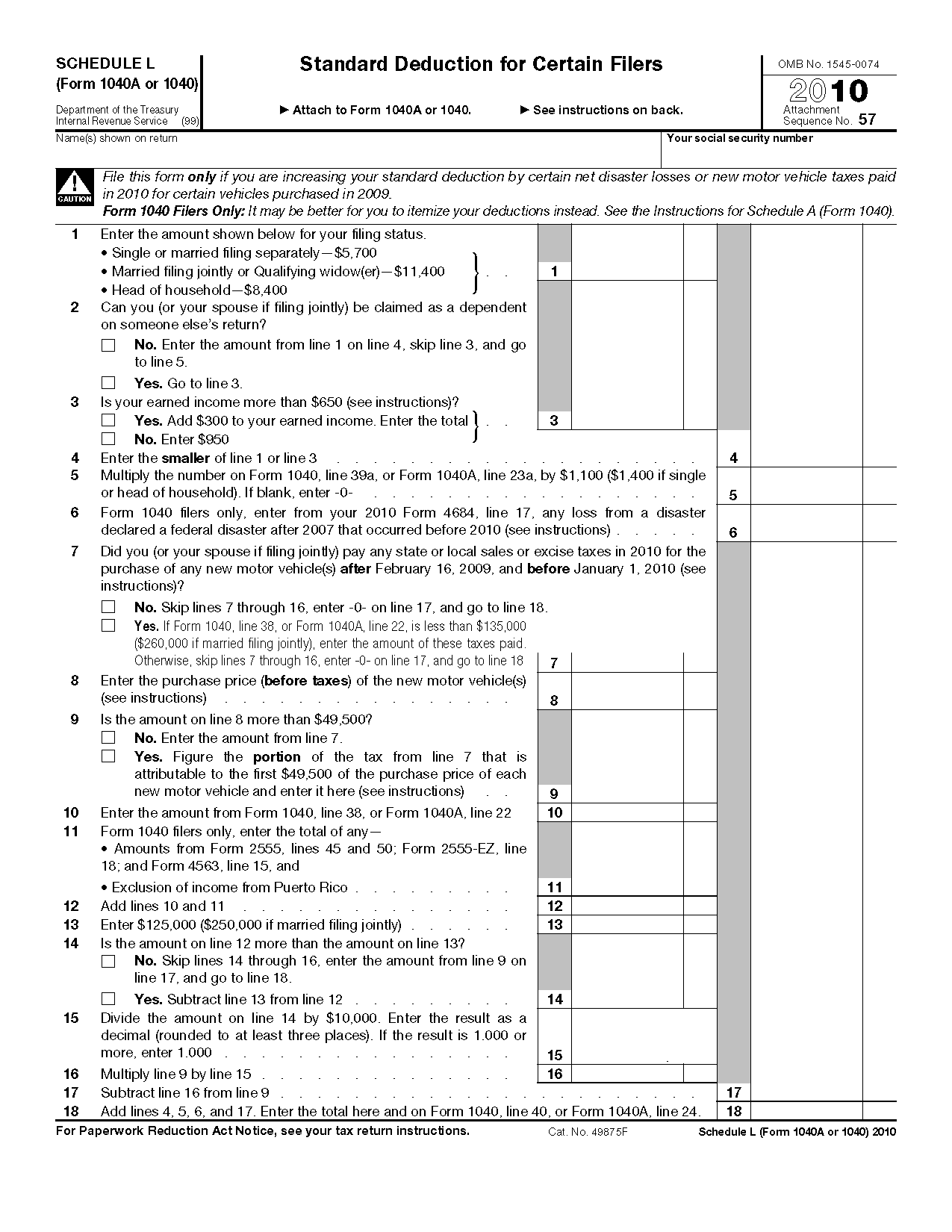

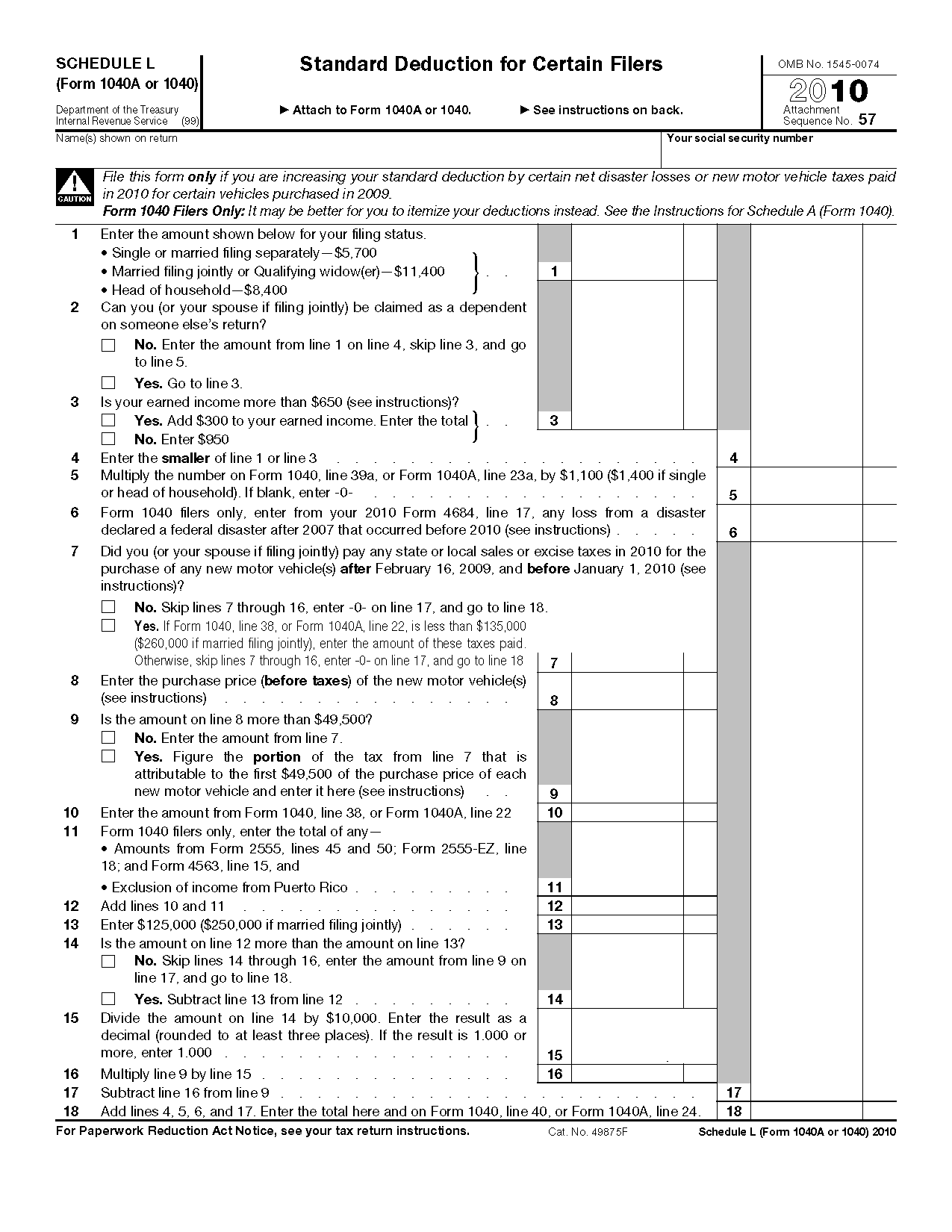

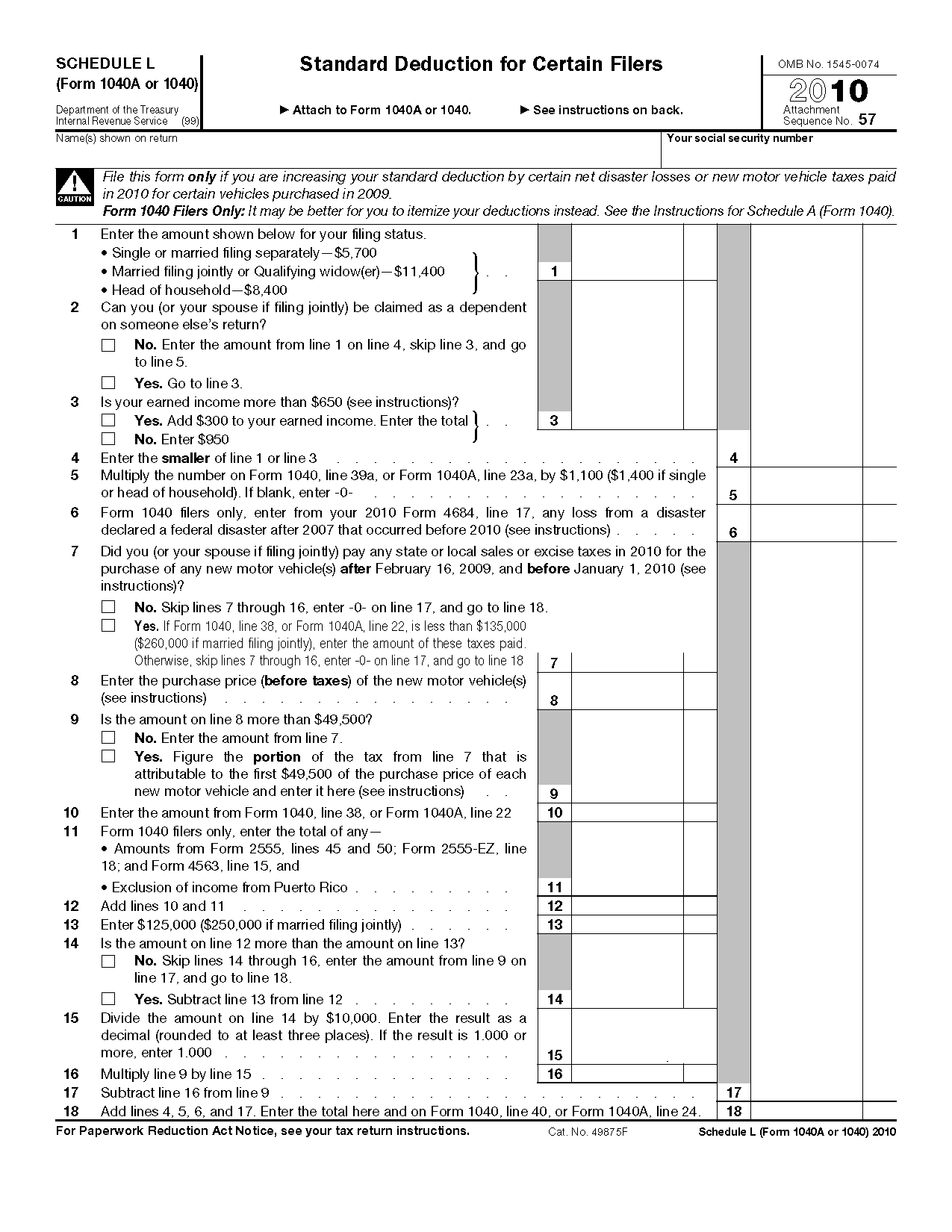

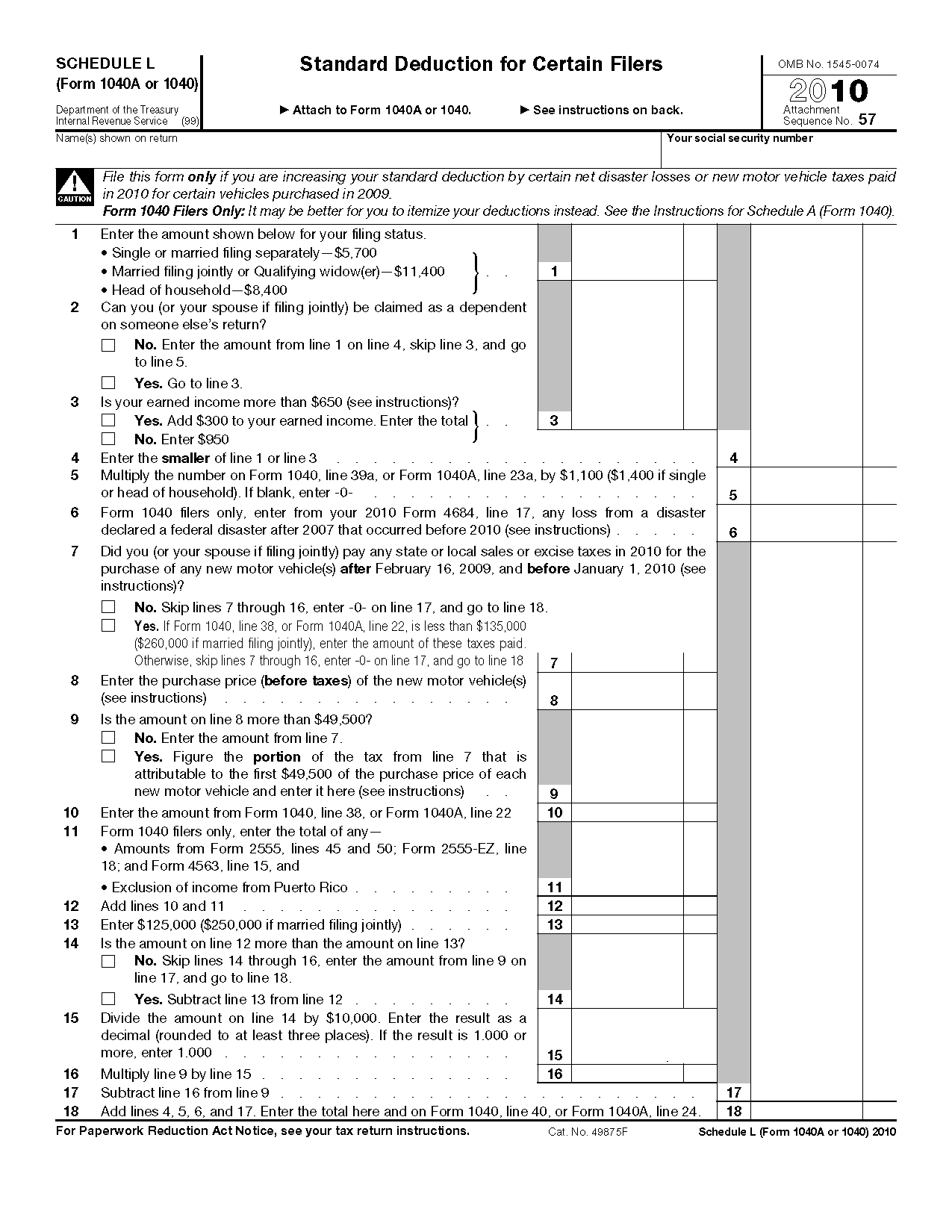

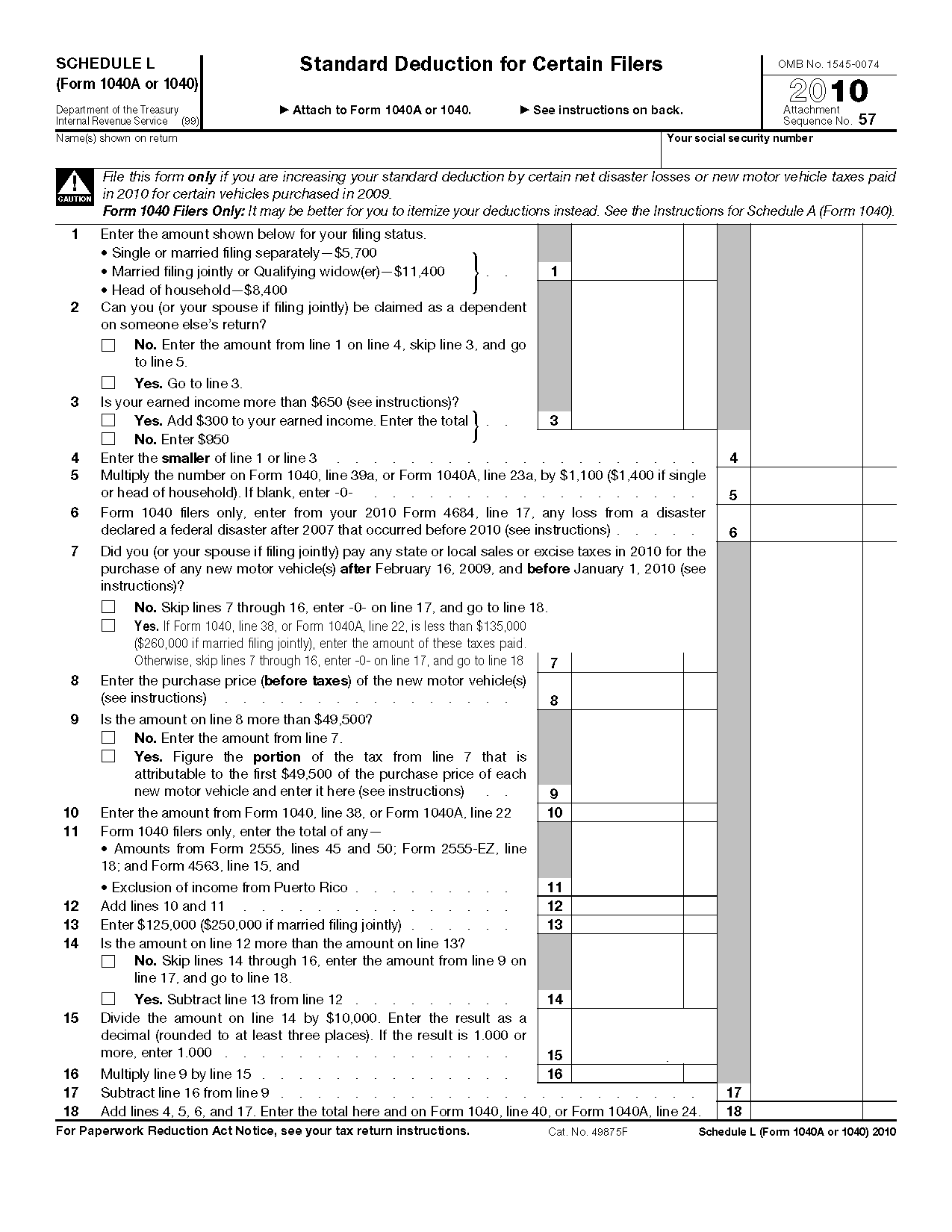

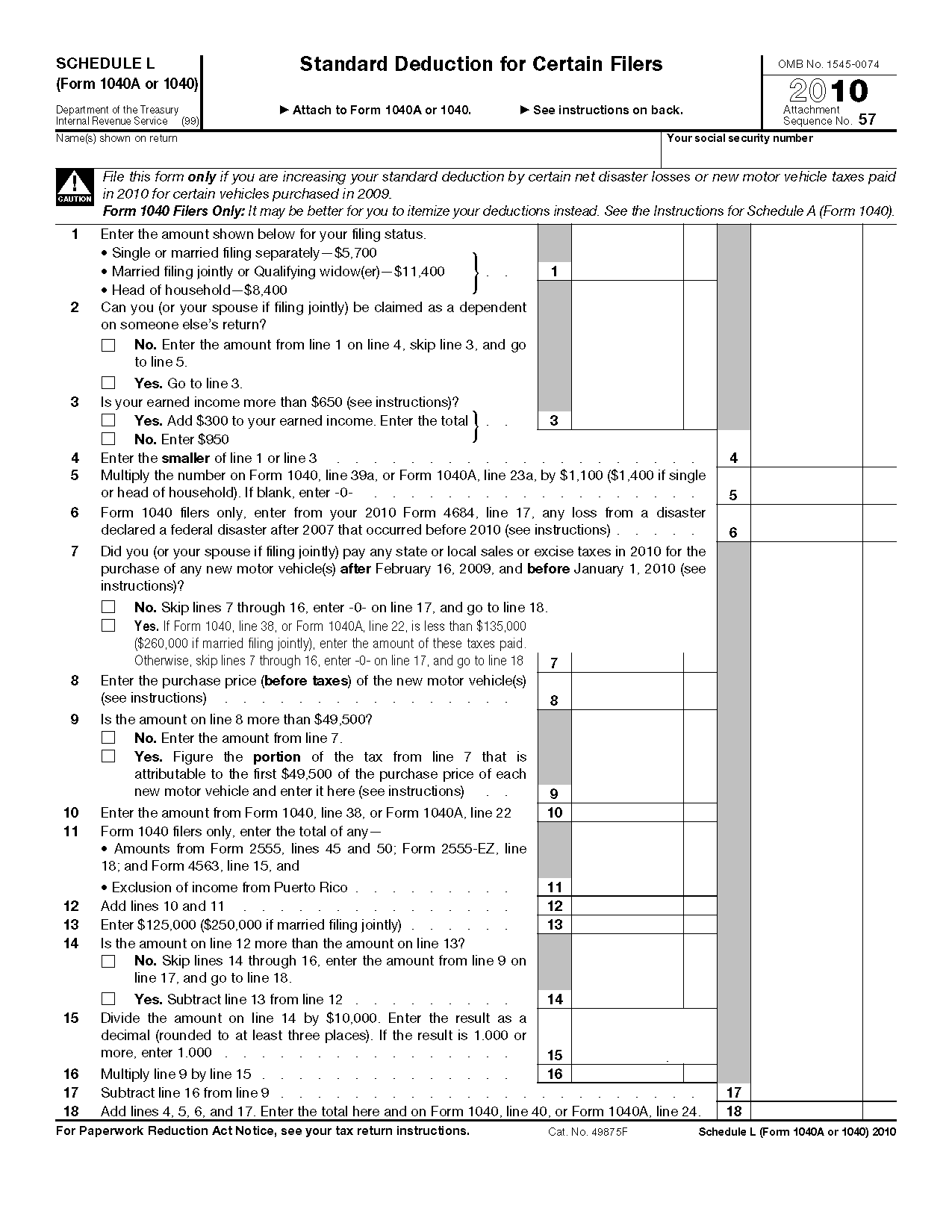

Federal Itemized Deductions Worksheet

The Federal Itemized Deductions Worksheet is a valuable tool for individuals looking to maximize their tax savings. This worksheet provides a comprehensive breakdown of all the eligible expenses that can be claimed as itemized deductions on your federal tax return. By carefully filling out this worksheet, you can ensure that you don't miss out on any potential tax deductions and save yourself money in the process.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is the purpose of the Federal Itemized Deductions Worksheet?

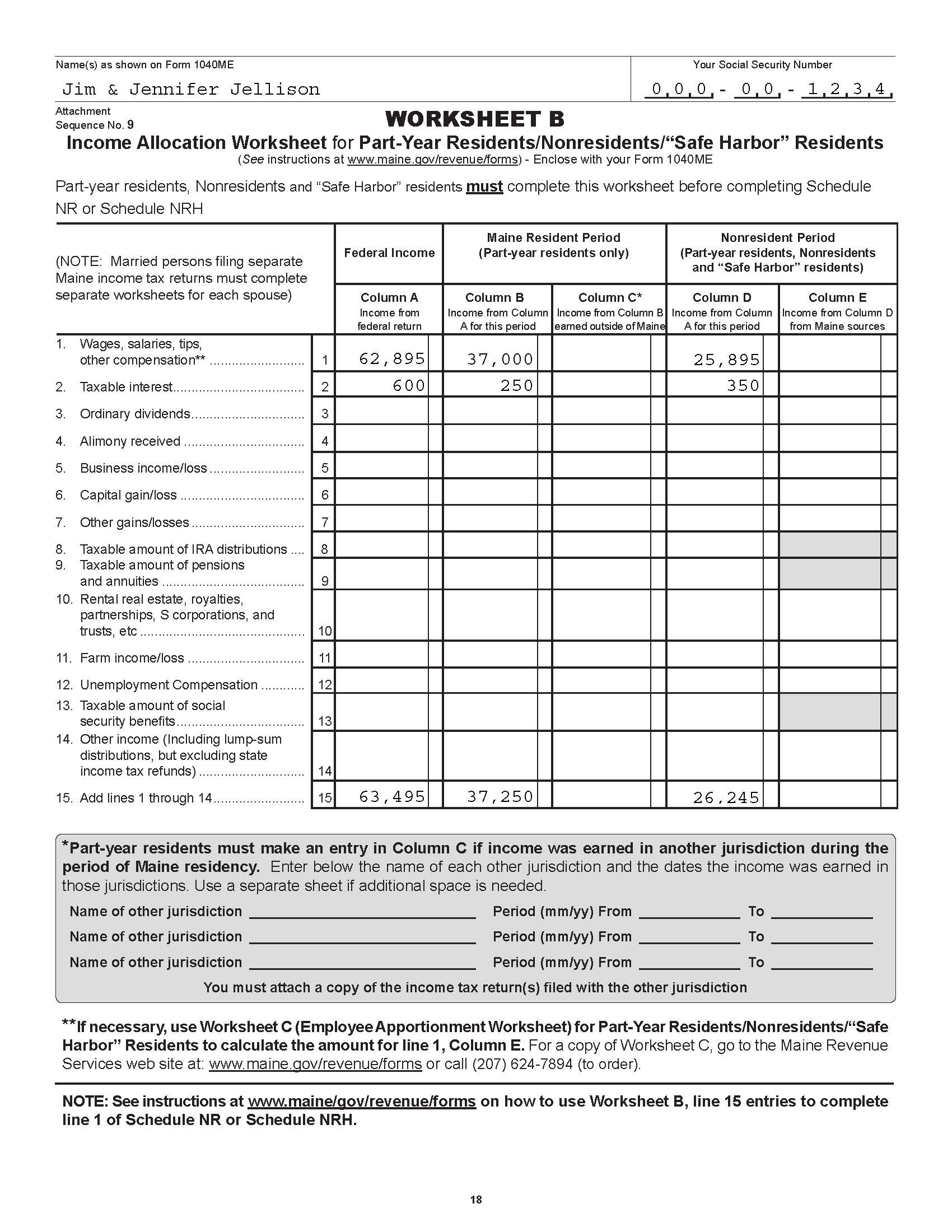

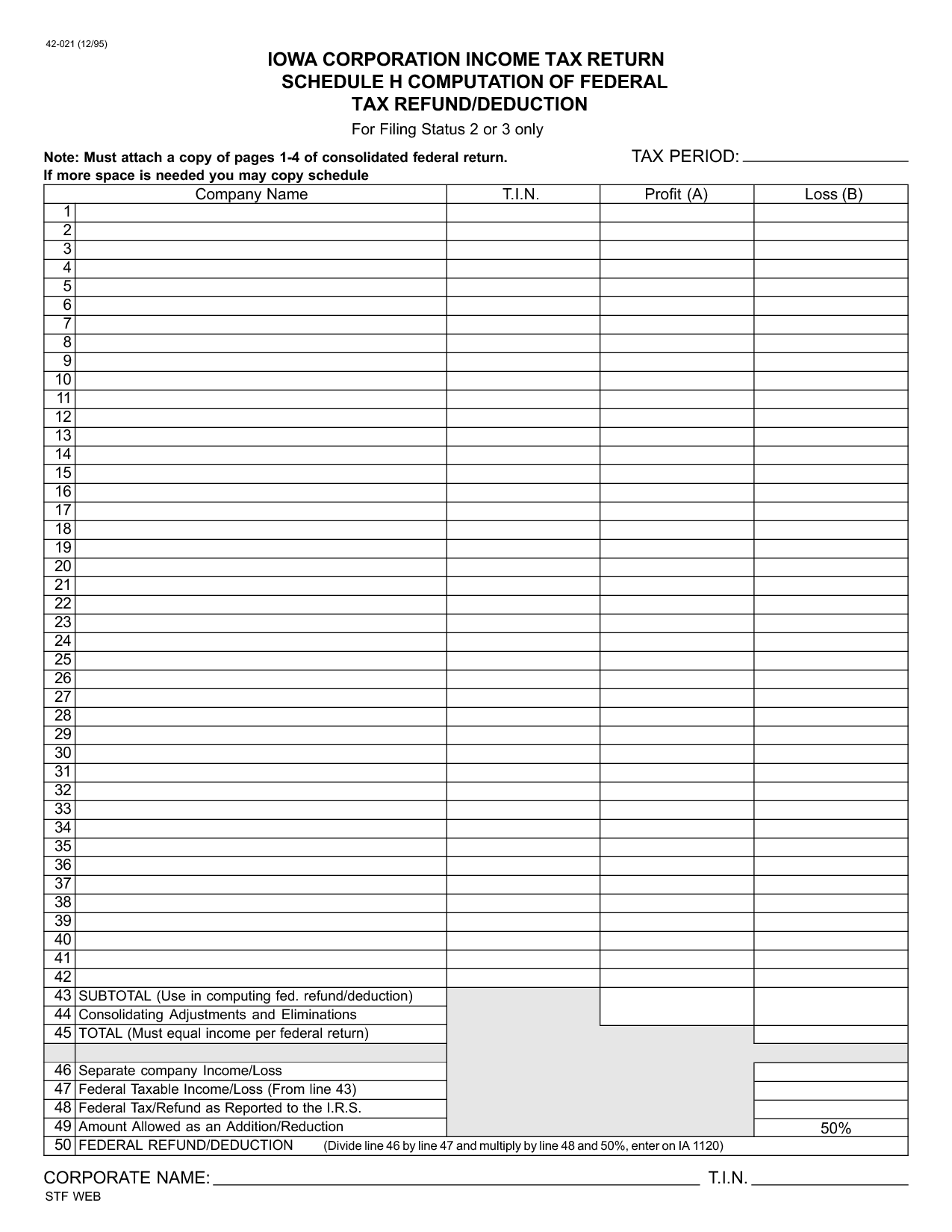

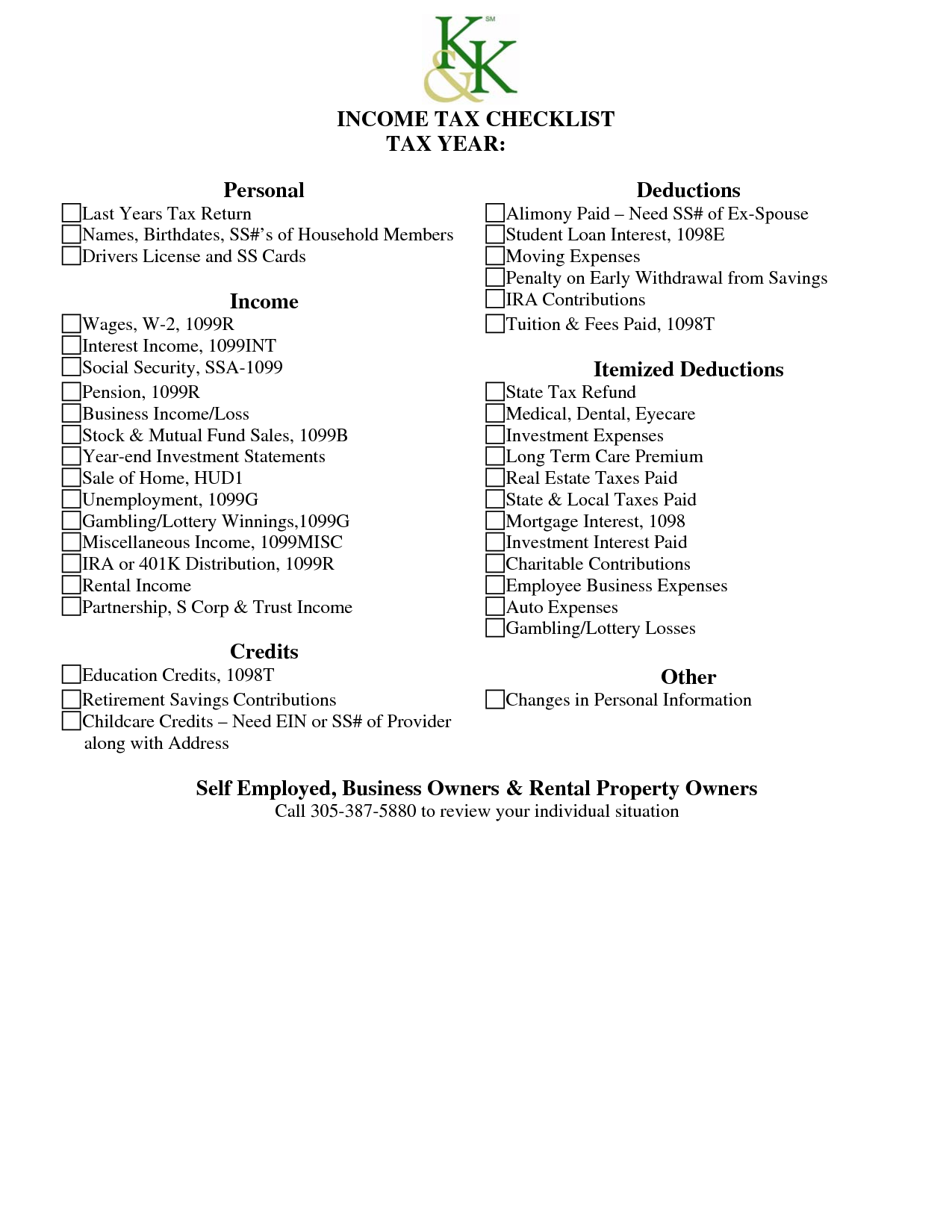

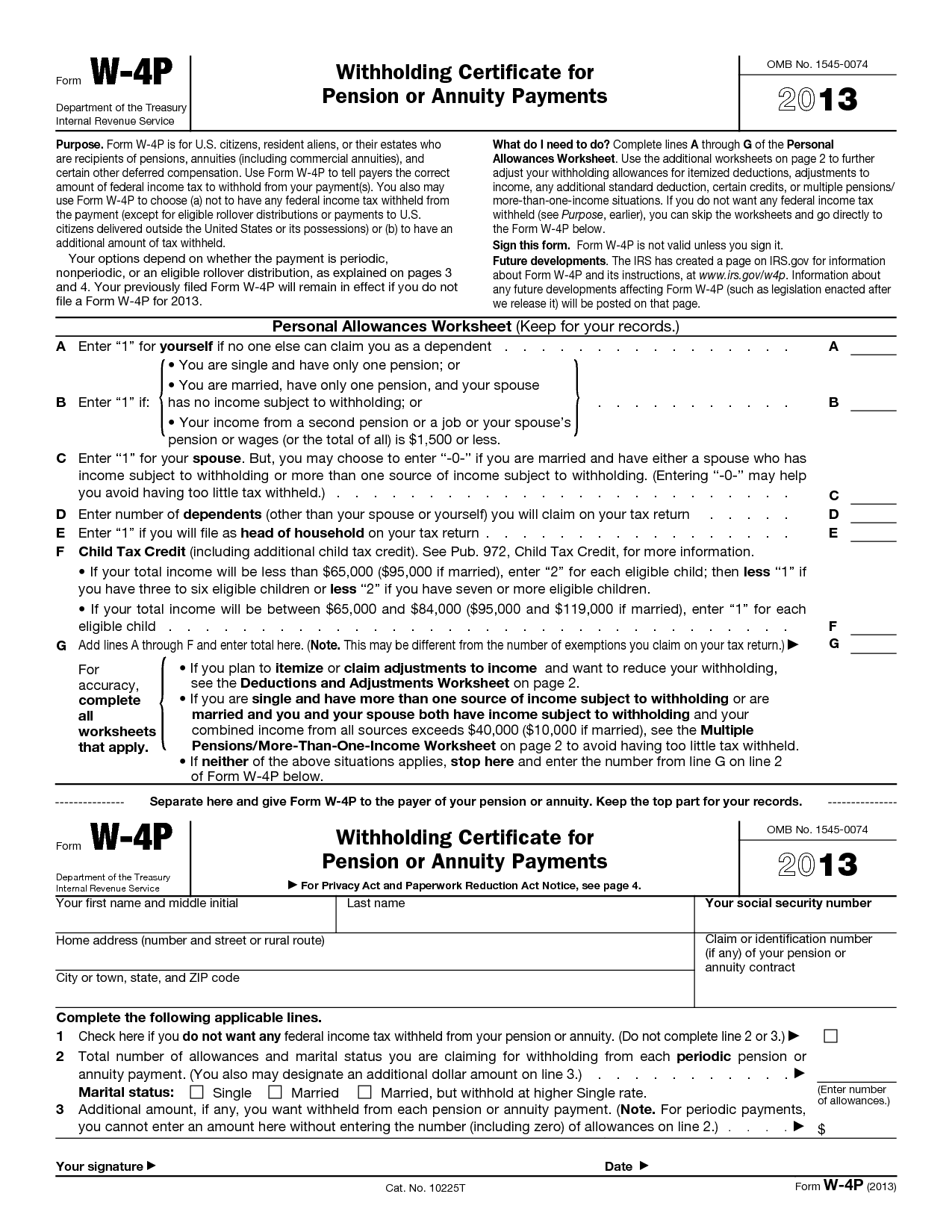

The purpose of the Federal Itemized Deductions Worksheet is to assist taxpayers in calculating their total itemized deductions and determining if they are eligible to itemize deductions on their federal tax return. This worksheet helps taxpayers to maximize their deductions by taking into account various qualifying expenses such as medical expenses, state and local taxes, mortgage interest, charitable contributions, and other eligible deductions.

How does the worksheet help individuals determine their deductible expenses?

Worksheets are helpful tools that guide individuals in calculating their deductible expenses by organizing and categorizing relevant information. They typically list out different types of expenses that qualify for deductions, such as medical expenses or business expenses, and provide a structured format for individuals to input their actual amounts. By filling out the worksheet with accurate numbers and following any instructions provided, individuals can easily determine their deductible expenses and accurately report them on their tax returns for potential tax savings.

What types of expenses can be included in the itemized deductions worksheet?

Expenses that can be included in the itemized deductions worksheet typically include state and local taxes, mortgage interest, property taxes, medical expenses that exceed a certain percentage of your income, charitable contributions, and certain miscellaneous deductions such as unreimbursed business expenses or investment expenses. Other expenses, such as personal expenses or expenses that have been reimbursed, cannot be included in the itemized deductions worksheet.

Does the worksheet provide guidance on limits or restrictions for each deduction category?

Yes, the worksheet typically provides guidance on limits or restrictions for each deduction category, allowing individuals to understand the maximum amount they can claim for each deduction and ensuring compliance with tax laws and regulations.

Is the worksheet applicable to all taxpayers or are there specific qualifications?

Worksheets used for tax purposes can vary based on the specific tax situation, so it's important to check the guidelines provided by the tax authority or consult with a tax professional to determine if the worksheet is applicable to your particular circumstances. Taxpayers may need to meet certain qualifications or criteria to use a specific worksheet, so it's advisable to ensure eligibility before proceeding with its use.

Can the worksheet be used to claim deductions for self-employed individuals?

Yes, the worksheet can be used to help self-employed individuals claim deductions on their tax returns by organizing and calculating their business expenses and other deductible expenses. This can help them accurately report their income and reduce their taxable income, potentially lowering their overall tax liability.

Is there a specific format or structure to follow when filling out the worksheet?

Yes, typically worksheets have specific sections or columns that need to be completed according to the instructions provided. Make sure to read the directions carefully and fill out each section or column as instructed. If there are any specific formatting guidelines, such as using certain units of measurement or providing answers in a specific format, make sure to adhere to those as well. Following the specified structure will help ensure that you provide the correct information and complete the worksheet accurately.

Are there any specific line items or sections to include for certain types of deductions?

Yes, when claiming deductions on your tax return, certain types of expenses may require specific line items or sections to be filled out. For example, medical expenses typically have a separate section with specific guidelines for what can be included. Similarly, itemized deductions such as charitable contributions or business expenses may have designated areas on tax forms where you can detail these expenses. It is important to carefully review the instructions provided with your tax forms to ensure you are correctly reporting all relevant deductions in the appropriate sections.

Does the worksheet provide detailed instructions on how to calculate the amount for each deduction?

The detailed instructions on how to calculate the amount for each deduction are typically outlined in the worksheet to assist individuals in accurately determining the deductions from the total amount.

What is the importance of accurately completing the Federal Itemized Deductions Worksheet?

Accurately completing the Federal Itemized Deductions Worksheet is crucial because it allows taxpayers to maximize their deductions and potentially lower their taxable income. By detailing specific expenses such as mortgage interest, medical expenses, and charitable contributions, taxpayers can claim more deductions, thereby reducing the amount of income subject to taxation. This can lead to substantial savings on tax liabilities and may even result in a larger tax refund.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments