Economic Models Worksheet

Are you a student or professional in the field of economics seeking a practical tool to reinforce your understanding of economic models and their application? If so, you've come to the right place. This blog post will introduce you to the concept of economic models and showcase the benefits of using worksheets as a valuable resource for enhancing your comprehension and analysis of key economic principles and theories.

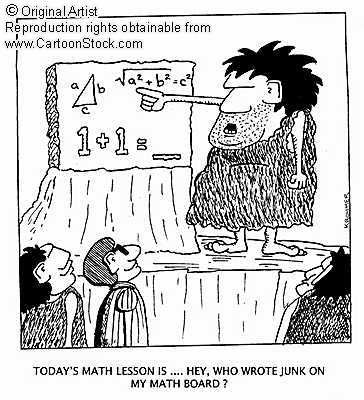

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What are economic models?

Economic models are simplified frameworks used by economists to analyze and make predictions about economic situations. These models are constructed based on assumptions about how individuals, businesses, and governments make decisions and interact in the economy. By using economic models, economists can better understand complex economic relationships, test hypotheses, and provide insights into how various factors may impact outcomes such as prices, production levels, and market behavior.

How are economic models used in the field of economics?

Economic models are used in the field of economics to analyze and understand the behavior of economic agents, such as individuals, firms, and governments, as well as the interactions among them. These models provide a simplified representation of real-world economic phenomena, allowing economists to make predictions, test hypotheses, and formulate policies to address economic issues and challenges. By using economic models, researchers and policymakers can gain insights into complex economic systems and make informed decisions to promote economic growth, stability, and welfare.

What are the key components of an economic model?

The key components of an economic model include assumptions, variables, equations or relationships between variables, and predictions or outcomes. Assumptions are the underlying concepts or theories that the model is based on, while variables represent the inputs or factors that influence the model. Equations or relationships are the mathematical expressions that describe how the variables interact with each other, and predictions or outcomes are the results of the model analysis. By considering these components, economists can evaluate how different economic factors may impact each other and make informed decisions.

What is the purpose of building and using economic models?

The purpose of building and using economic models is to simplify the real-world economy, understand economic relationships and behaviors, make predictions, and inform decision-making. By using economic models, policymakers, businesses, and individuals can analyze the potential impacts of different policies, events, or conditions on the economy, assess the trade-offs involved in various choices, and ultimately make more informed and effective decisions.

What are the different types of economic models?

Some of the different types of economic models include classical models, Keynesian models, monetarist models, neoclassical models, and structuralist models. Classical models focus on the idea of market equilibrium and the role of supply and demand in determining prices and quantities exchanged. Keynesian models are based on the theories of John Maynard Keynes and emphasize the role of government intervention in stabilizing the economy through fiscal and monetary policy. Monetarist models focus on the importance of money supply in influencing economic outcomes. Neoclassical models integrate elements of both classical and Keynesian theories, emphasizing rational decision-making and market efficiency. Structuralist models focus on the impact of institutional structures and social factors on economic outcomes.

How are economic models tested and validated?

Economic models are tested and validated through empirical analysis, which involves comparing the predictions of the model with real-world data. Researchers collect relevant data, such as historical economic trends or current market information, and use statistical techniques to analyze it in relation to the model's predictions. If the model consistently aligns with the data and accurately explains the economic phenomenon being studied, it is considered validated. Additionally, sensitivity analysis and robustness tests are conducted to assess the model's accuracy and reliability under different scenarios or assumptions. Overall, the validation process helps economists assess the usefulness and predictive power of economic models in understanding and forecasting economic outcomes.

How do economic models help in predicting economic outcomes?

Economic models use mathematical equations and data to simulate real-world economic situations and help predict possible outcomes by analyzing the interactions of different economic variables. These models consider factors such as consumer behavior, government policies, market trends, and external influences to generate predictions about the potential economic consequences of different scenarios. By using these models, policymakers, businesses, and individuals can better understand the potential implications of their decisions and make more informed choices to help shape future economic outcomes.

What are the limitations of economic models?

The limitations of economic models include simplification of complex real-world situations, assumptions that may not always hold true, inability to capture all relevant factors, and variability in predicting human behavior. Additionally, economic models may not account for unforeseen events such as natural disasters or political changes, and their accuracy can depend on the quality of data used in the analysis. Overall, while economic models are valuable tools for analyzing and understanding economic phenomena, they should be used with caution and alongside other forms of analysis to account for their inherent limitations and uncertainties.

How do economists choose between different economic models?

Economists choose between different economic models based on various factors such as the specific research question being addressed, the assumptions of the model, the data available for testing the model, and the level of complexity required to answer the question. They often use a combination of theoretical analysis, empirical evidence, and statistical methods to evaluate and compare the predictive power and practical relevance of different models in explaining real-world economic phenomena. Ultimately, the most suitable economic model is chosen based on its ability to accurately capture and explain the dynamics of the economic system being studied.

How do economic models contribute to policy-making processes?

Economic models contribute to policy-making processes by providing a structured framework for analyzing complex economic phenomena and predicting the potential outcomes of different policy interventions. These models help policymakers evaluate the likely impacts of policy decisions on various aspects of the economy, such as growth, inflation, employment, and income distribution. By using economic models, policymakers can make more informed and evidence-based decisions that aim to achieve desired policy goals and outcomes. Additionally, economic models can also help policymakers understand the trade-offs and unintended consequences of different policy options, allowing them to consider alternative strategies and approaches to address economic challenges effectively.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments