Debt Worksheet Excel

Debt is a financial burden that can cause stress and anxiety for many individuals. If you are someone who wants to gain control over your finances and start paying off your debt, using a debt worksheet in Excel can be a helpful tool. With a debt worksheet, you can easily track and manage your outstanding balances, interest rates, and monthly payments. It provides a clear overview of your financial obligations, allowing you to make informed decisions and create a practical plan to become debt-free.

Table of Images 👆

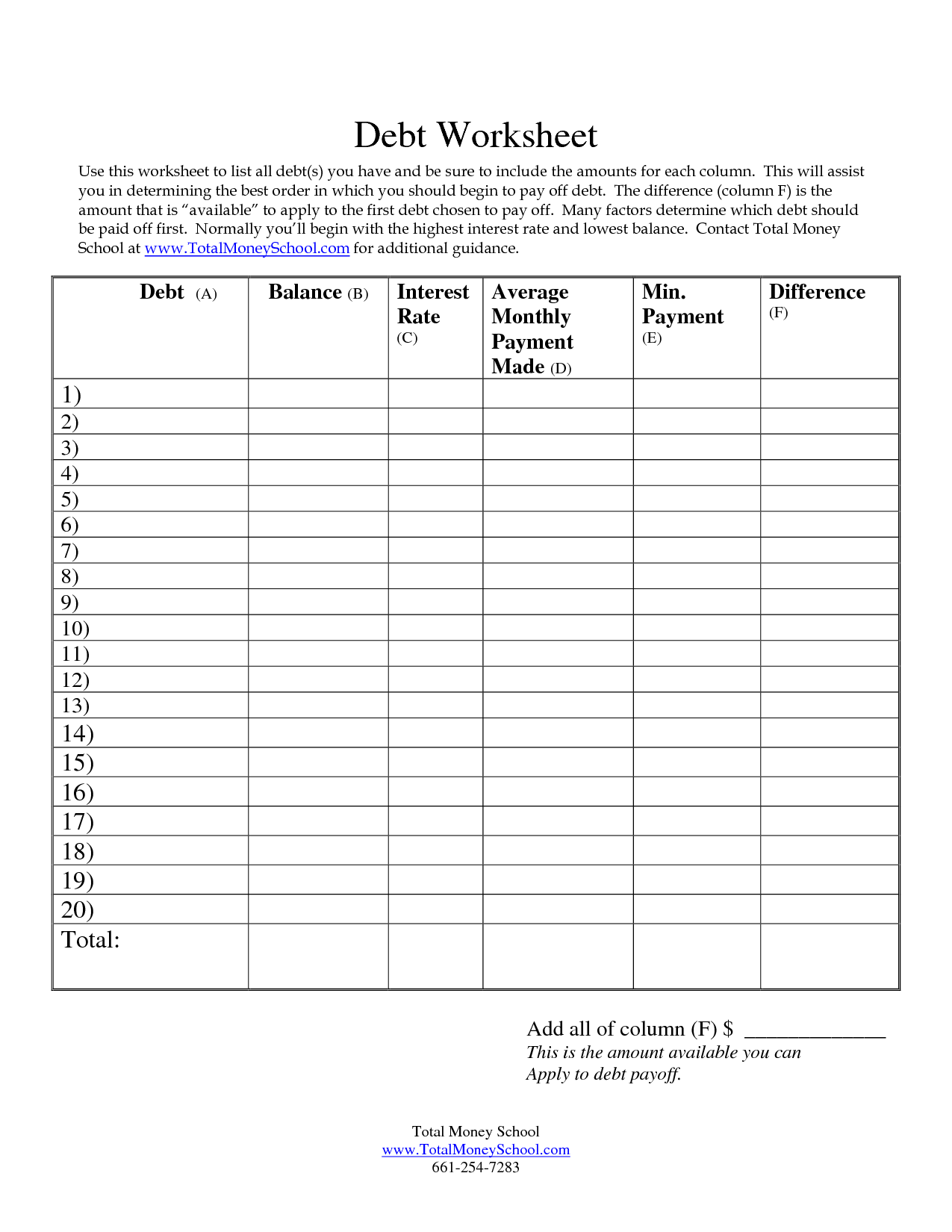

- Debt Free Printable Bill Payment Sheet

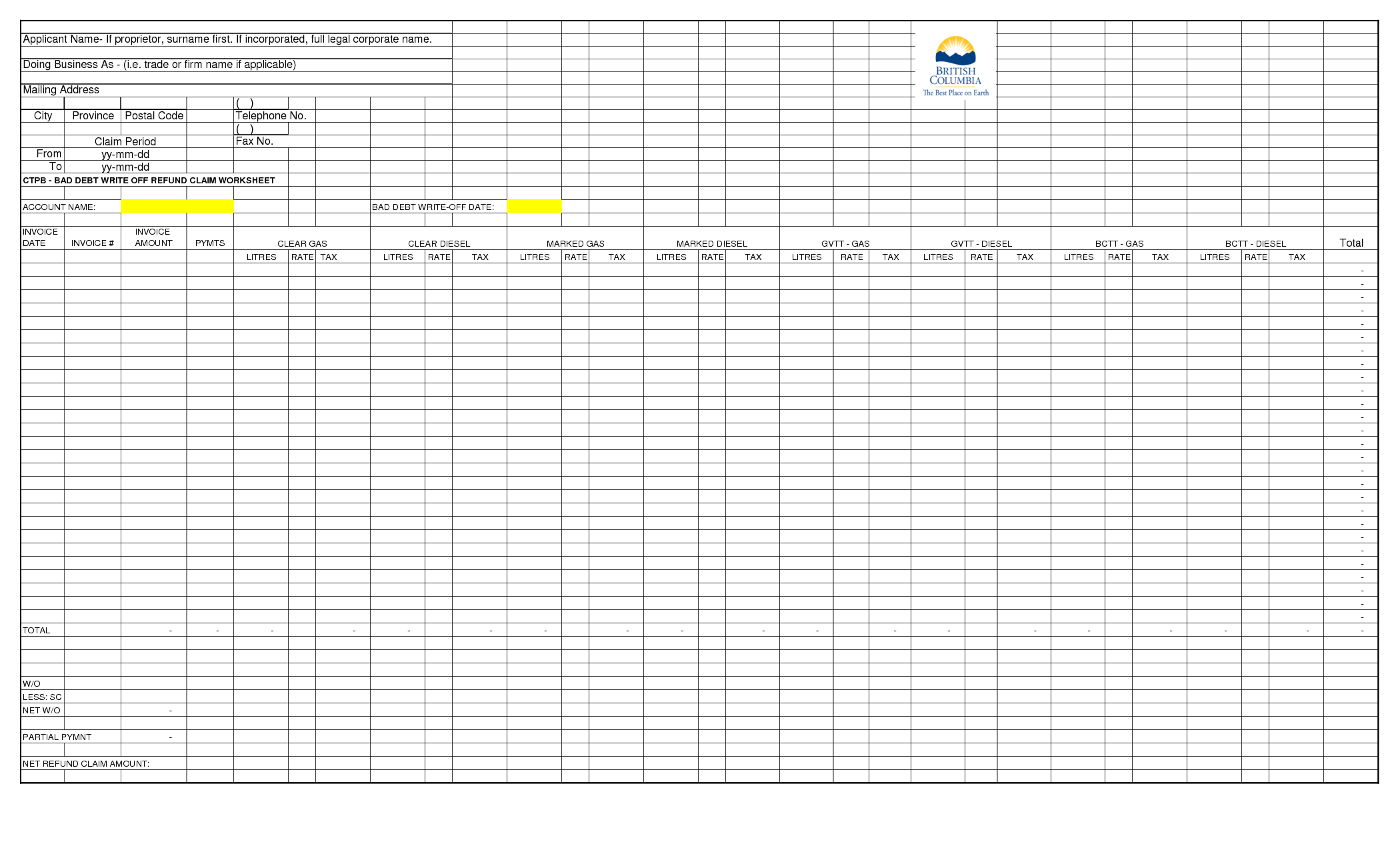

- Excel Debt Spreadsheet Template

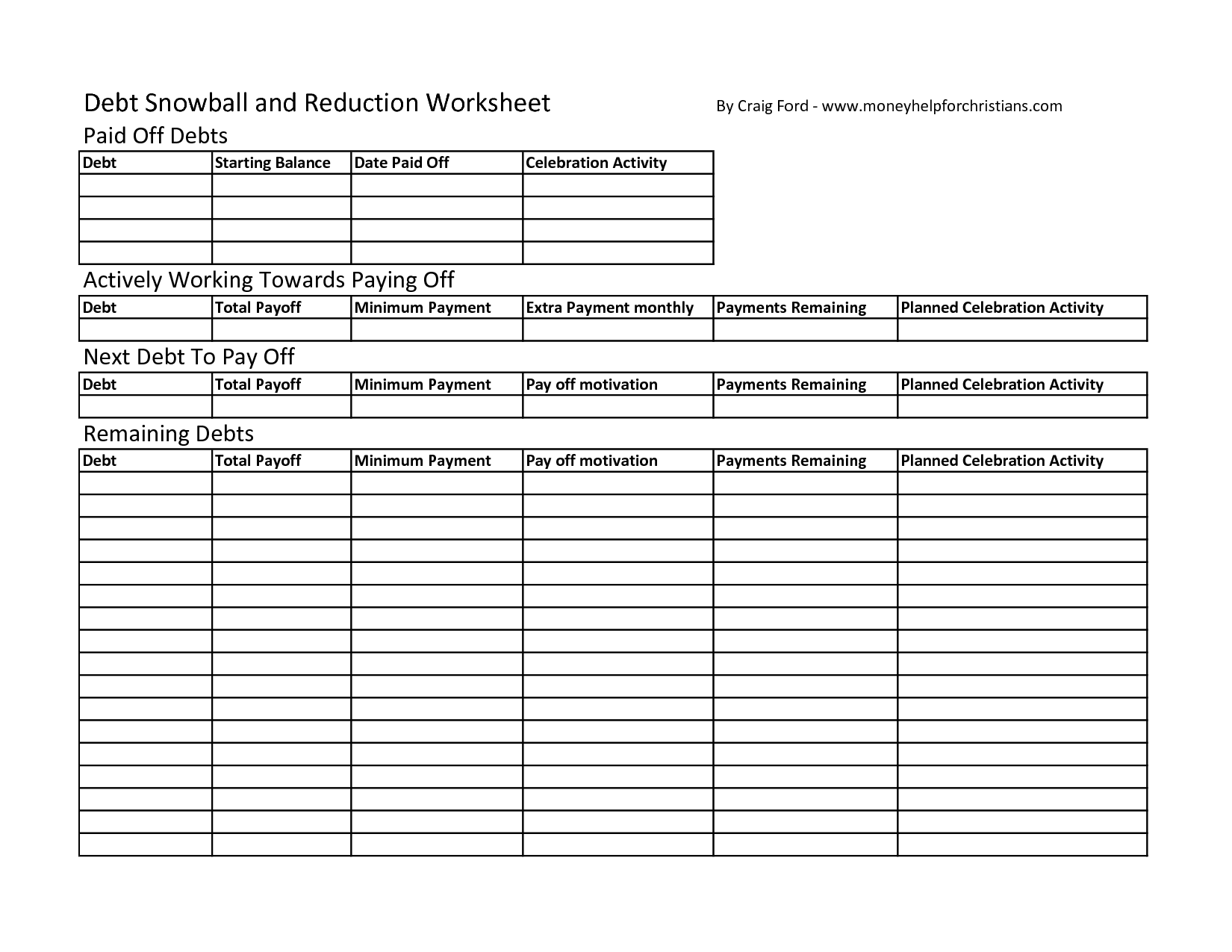

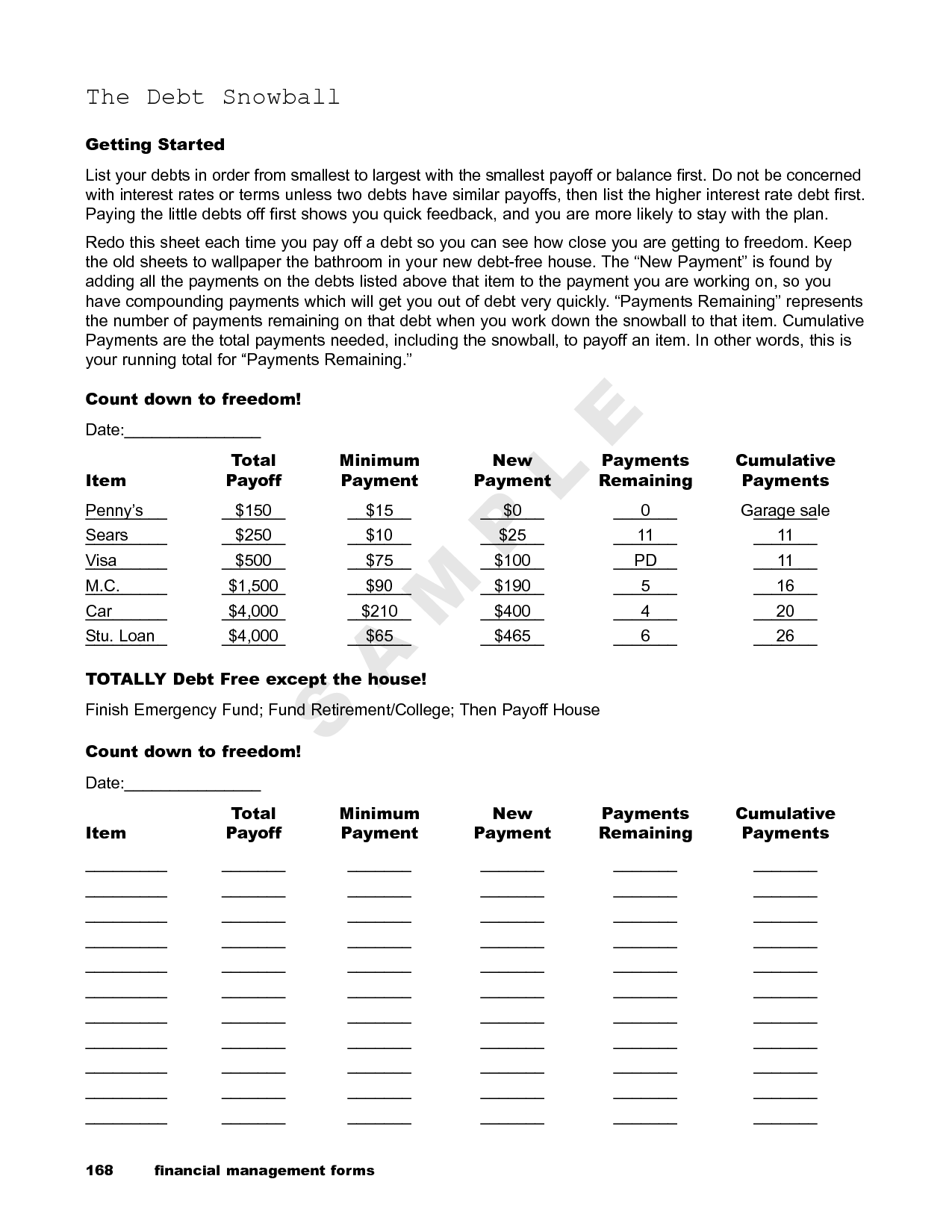

- Snowball Debt Worksheet Template

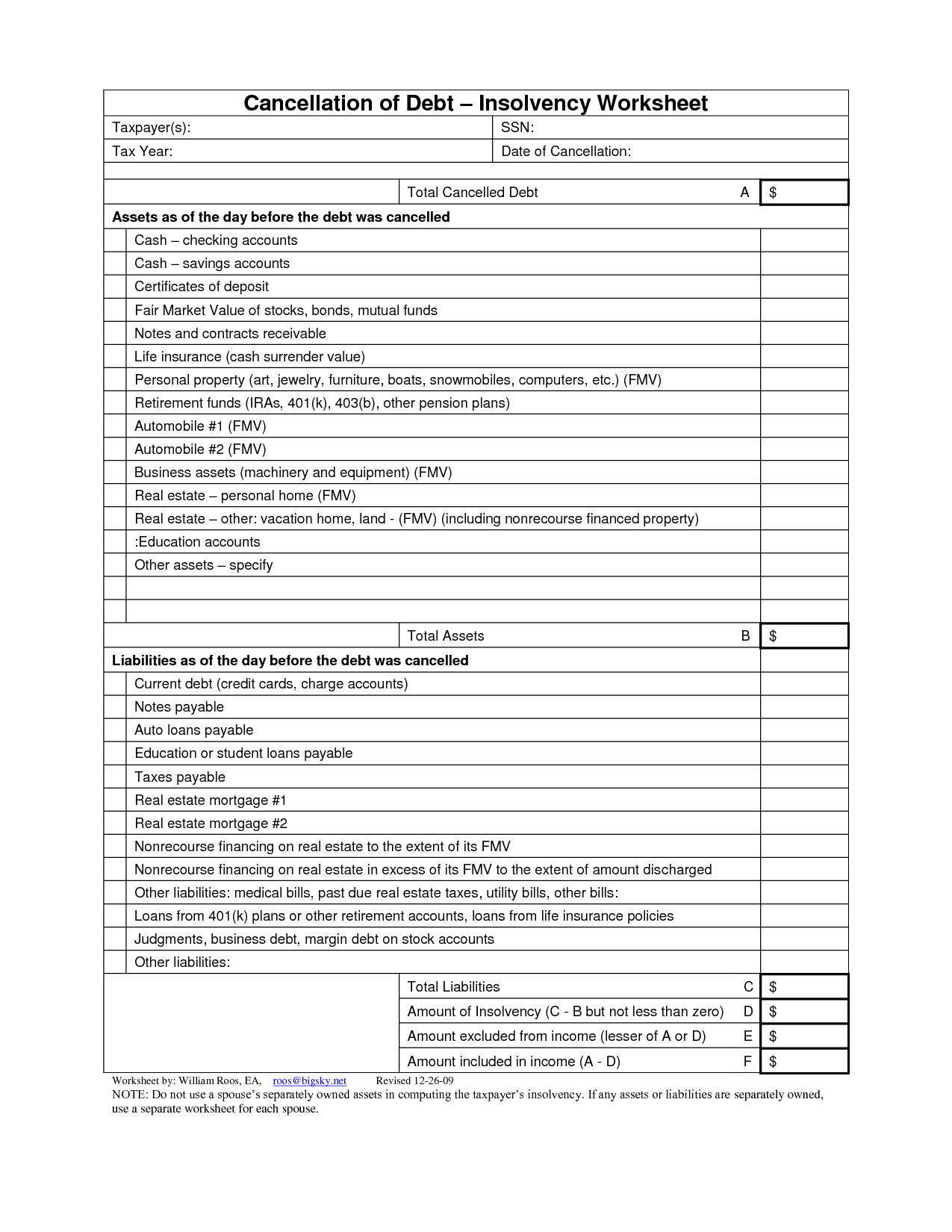

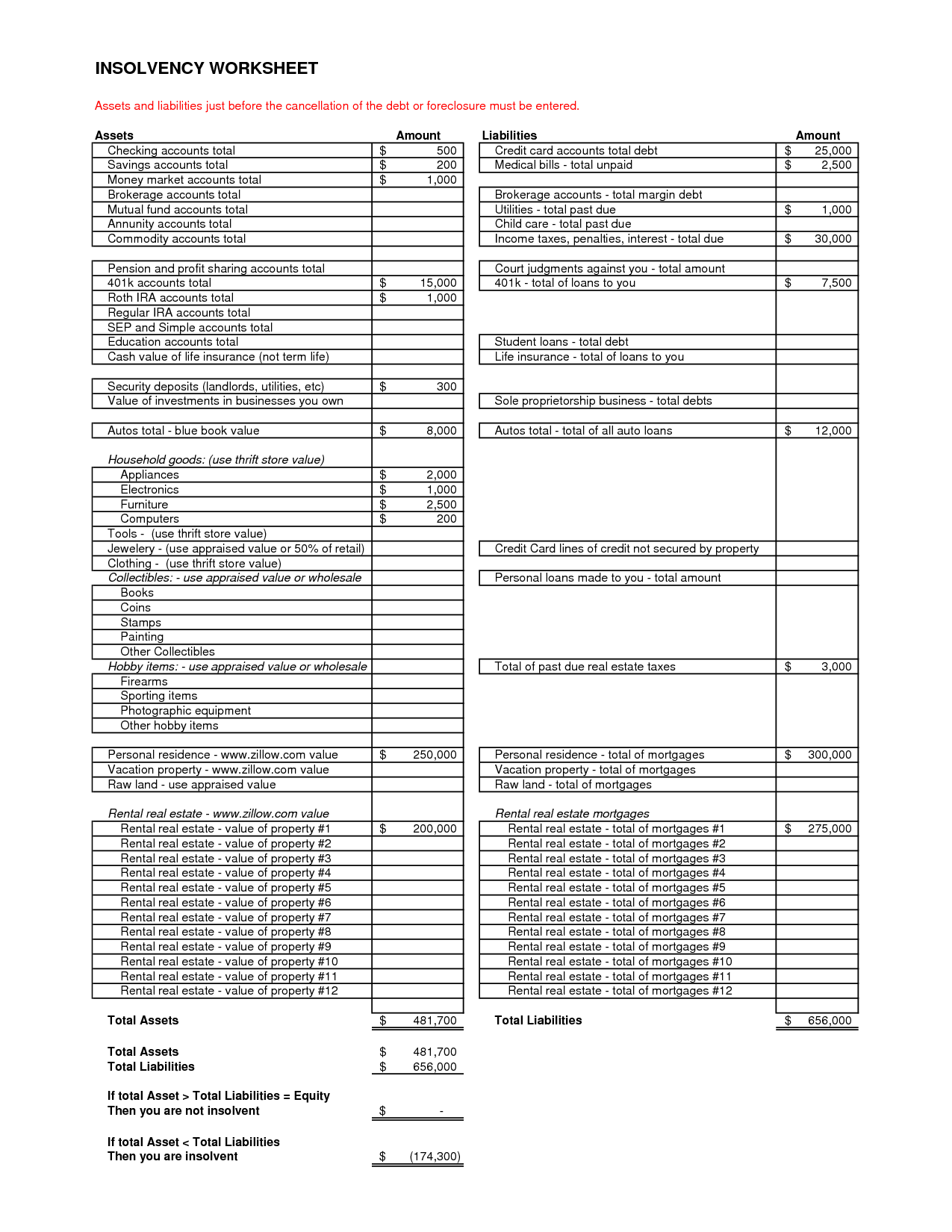

- Cancellation of Debt Insolvency Worksheet

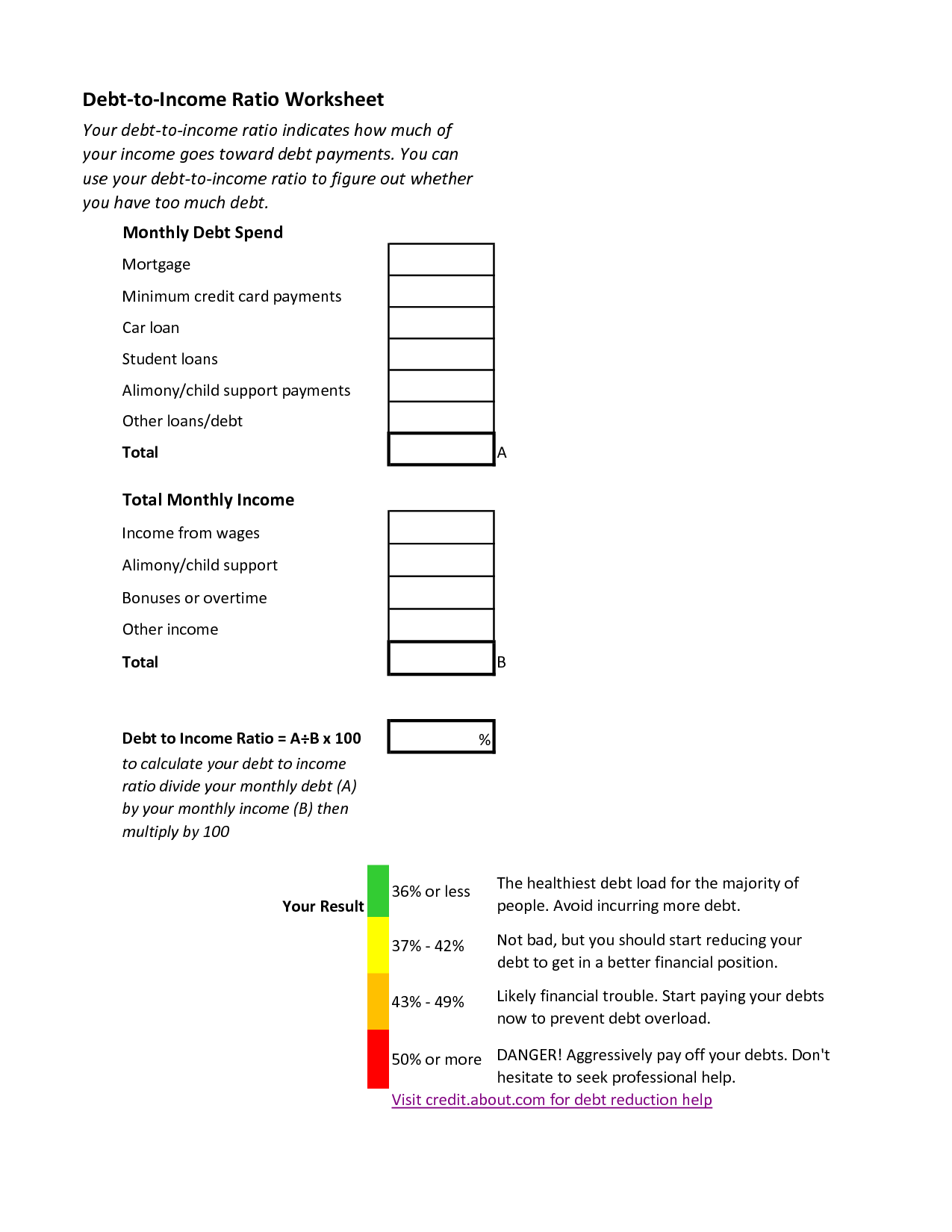

- Debt Income Ratio Worksheet

- Free Printable Meal Sign Up Sheet

- Excel Assets and Liabilities Worksheet

- Dave Ramsey Debt Snowball Form

- Pay Off Debt Worksheet

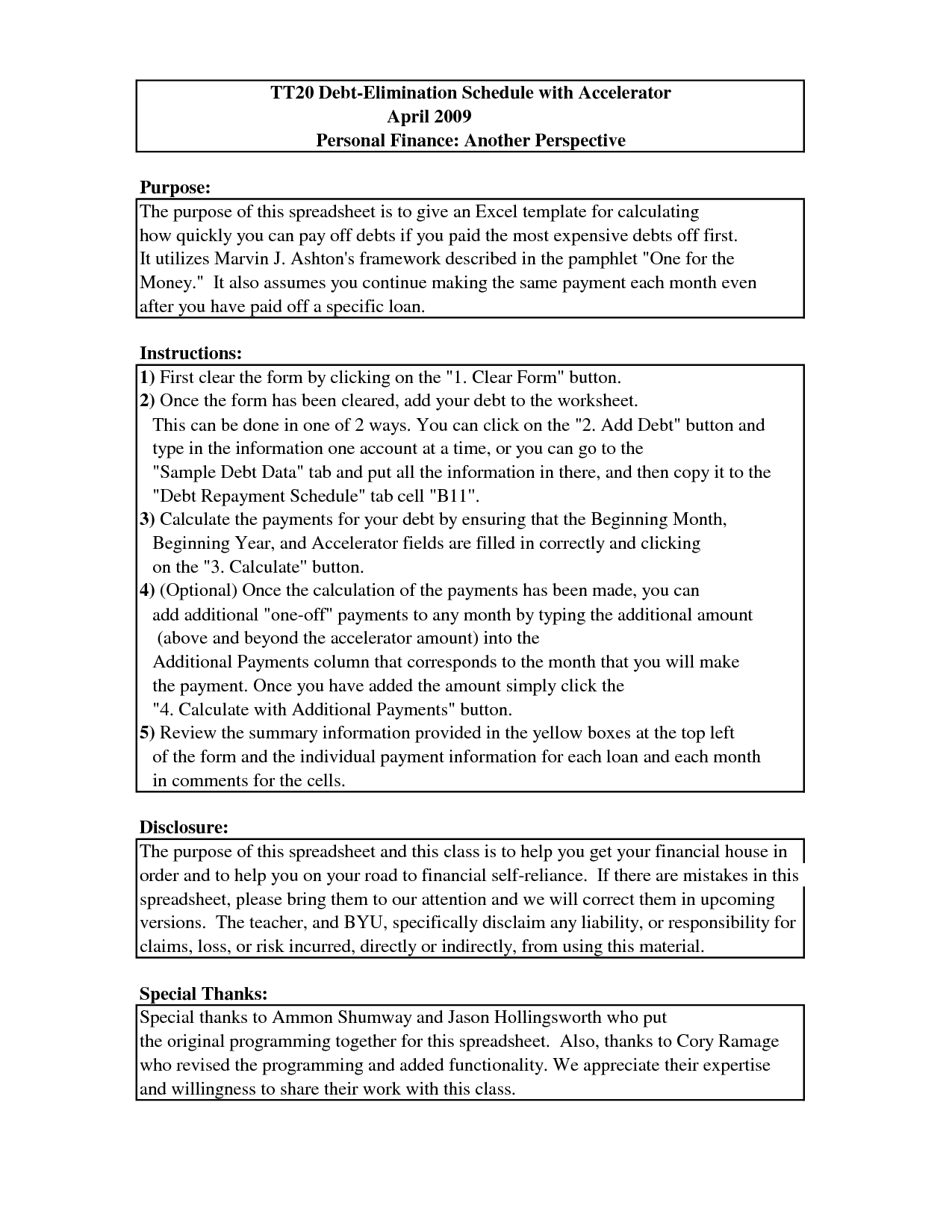

- Sample Debt Elimination Worksheet

- Debt Snowball Worksheet Printable

- Family and Consumer Science Worksheets

- Dave Ramsey Budget Worksheet Printable

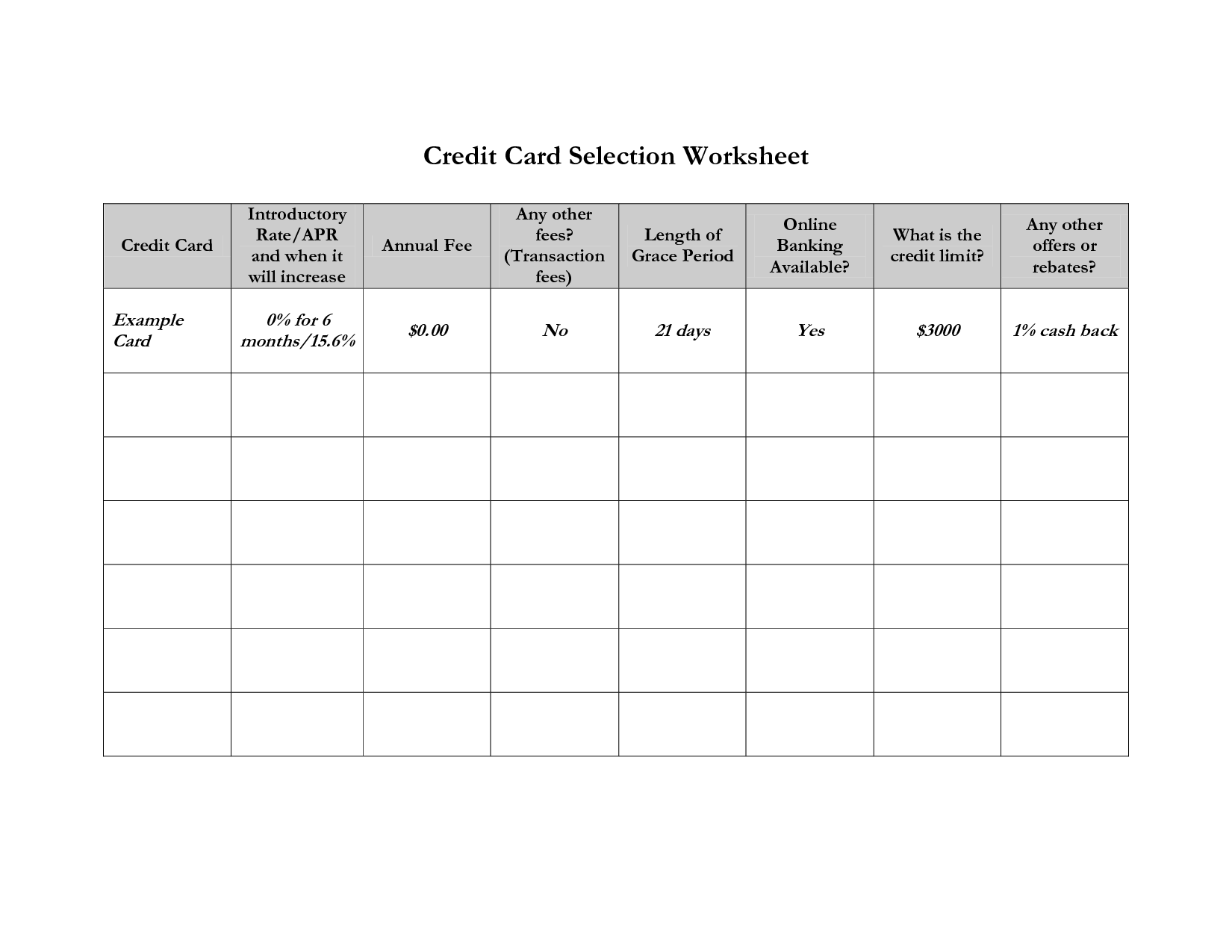

- Printable Credit Card Worksheet

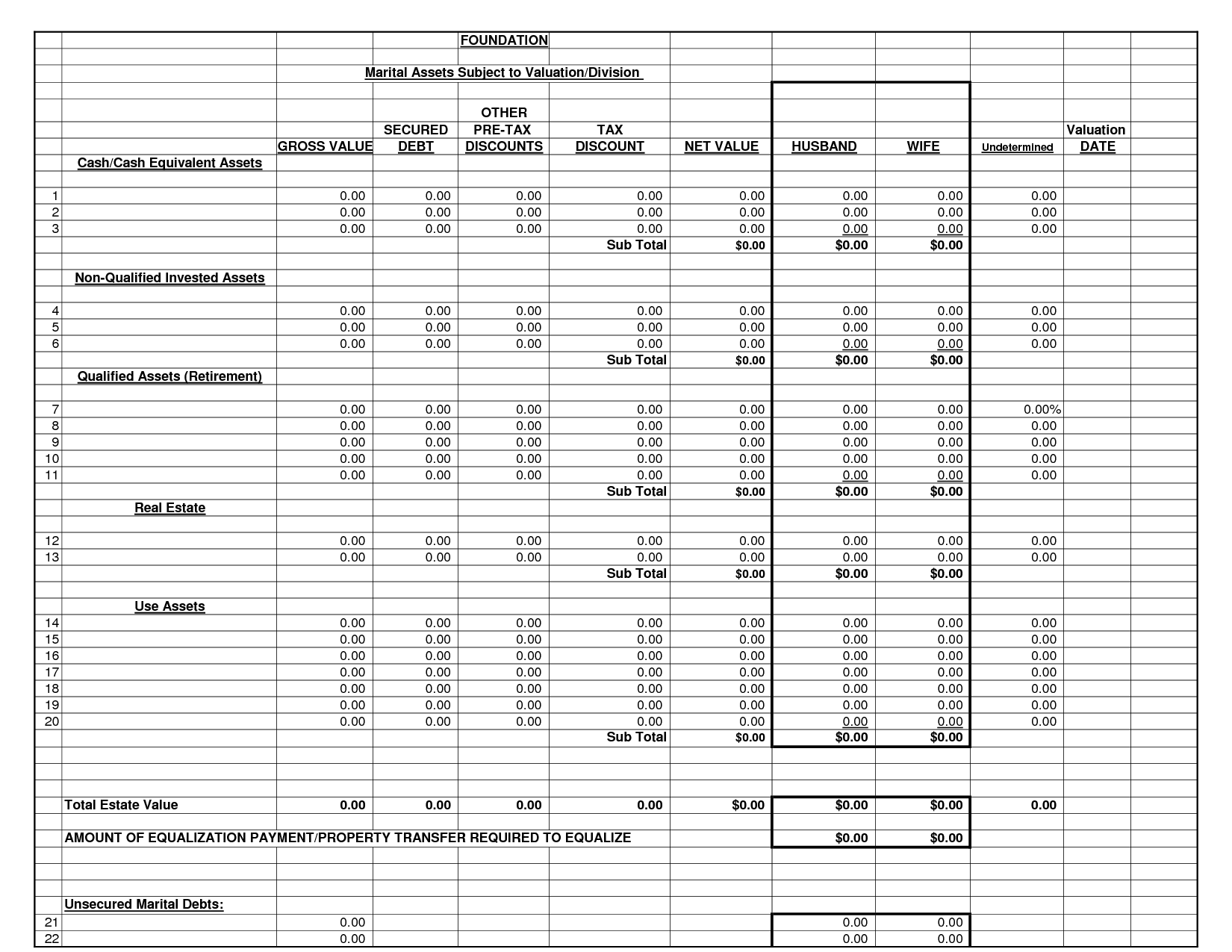

- Asset Spreadsheet Template Excel

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is Debt Worksheet Excel?

A debt worksheet Excel is a spreadsheet that helps individuals or businesses organize and track their debts more efficiently. This tool allows users to enter details such as the creditor name, outstanding balance, interest rate, monthly payments, and due dates in a structured format. By using a debt worksheet Excel, individuals can better understand their debt obligations, create a repayment plan, and monitor their progress towards becoming debt-free.

How can Debt Worksheet Excel help in managing personal finances?

The Debt Worksheet Excel can help in managing personal finances by providing a clear overview of debts, including amounts owed, interest rates, payment due dates, and minimum payments. By organizing this information in one place, individuals can better track and manage their debt repayment strategy, prioritize debts to pay off first, and visualize their progress towards becoming debt-free. Additionally, using Excel formulas can facilitate automatic calculations, helping to create a budget and better understand one's financial situation.

What information should be included in a Debt Worksheet Excel?

A Debt Worksheet Excel should include detailed information about each debt held, including the creditor's name, types of debt (e.g., credit card, student loan, mortgage), outstanding balance, interest rate, minimum monthly payment, due date, and any additional notes or terms related to the debt. It is also helpful to include total debt owed, total monthly payments, and a debt payoff plan to track progress towards debt reduction.

How can Debt Worksheet Excel be used to track and prioritize debts?

To use a Debt Worksheet Excel to track and prioritize debts, you can start by listing all of your debts including the creditor, outstanding balance, interest rate, minimum payment, and due date. Then, you can use formulas to calculate total debt, minimum monthly payments, and amount paid towards each debt. Prioritize debts by organizing them based on factors such as interest rates or balances. Additionally, you can use conditional formatting to highlight high-interest debts or overdue payments. Regularly updating the worksheet with payments made will help you track progress and prioritize which debts to focus on paying off first.

Can Debt Worksheet Excel calculate interest and debt payments?

Yes, a Debt Worksheet in Excel can be set up to calculate interest and debt payments. You can use formulas and functions like PMT (payment), IPMT (interest payment), and PPMT (principal payment) to help track and calculate the payments on your debts. By inputting the necessary information such as the principal amount, interest rate, and loan term, you can create a useful tool to manage your debts efficiently.

Is it possible to create graphs and charts to visualize debt trends in Debt Worksheet Excel?

Yes, it is possible to create graphs and charts to visualize debt trends in Debt Worksheet Excel. You can use the data from the Debt Worksheet to create various types of charts such as line charts, bar charts, pie charts, and more to visually represent the trend of your debts over time. This can help you better understand your debt situation and make informed decisions on managing and paying off your debts.

Can Debt Worksheet Excel be used to set and monitor debt repayment goals?

Yes, Debt Worksheet Excel can be used to set and monitor debt repayment goals by organizing and tracking your debts, creating a repayment plan, and monitoring your progress over time. It is a useful tool for managing and ultimately eliminating debt by providing a clear overview of your financial situation and helping you stay focused on your repayment goals.

How can Debt Worksheet Excel help in creating a budget and allocating funds towards debt payments?

Debt Worksheet Excel can help in creating a budget by providing a clear overview of income and expenses, allowing users to identify opportunities for reducing spending and increasing savings towards debt payments. By detailing all debts, interest rates, and minimum payments, the worksheet enables users to prioritize and allocate funds effectively towards debt repayment, ultimately aiding in creating a structured plan to pay off debts in a systematic and organized manner.

Is Debt Worksheet Excel customizable to suit individual financial needs and goals?

Yes, Debt Worksheet Excel is customizable to suit individual financial needs and goals. Users can input their own data, customize formulas, and add or remove categories to tailor the worksheet to their specific financial situation. By personalizing the spreadsheet, users can track their debts, set financial goals, and create a plan to pay off debt in a way that aligns with their unique financial objectives.

What are the advantages of using Debt Worksheet Excel over other methods of tracking and managing debts?

Using Debt Worksheet Excel offers advantages such as customizable templates to track different types of debts, the ability to easily calculate interest rates and payment schedules, visual representation of debt progress through charts, and the convenience of having all debt information in one centralized location for easy access and organization. Additionally, Excel allows for easy sharing and collaboration with others, making it a versatile and efficient tool for managing debts.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments