Create a Budget Worksheet

Are you in search of an efficient tool to help you manage your finances effectively? Look no further! A budget worksheet is a simple yet powerful resource that can provide you with a clear overview of your income, expenses, and savings. Whether you are a student, a young professional, or a small business owner, creating a budget worksheet can be the key to gaining control over your financial situation. With its user-friendly interface and organized structure, this tool is designed to make budgeting a breeze.

Table of Images 👆

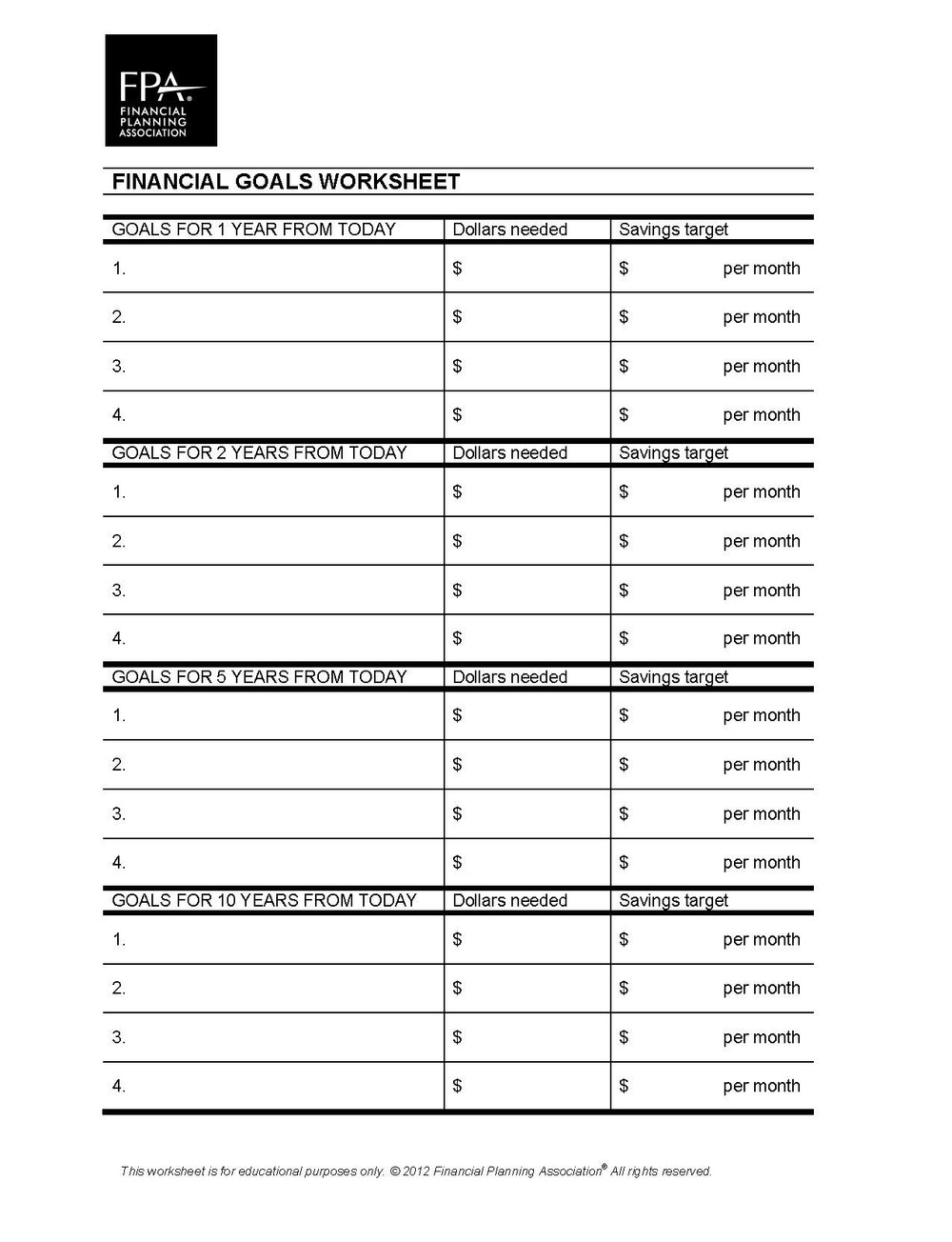

- Financial Planning Goals Worksheet

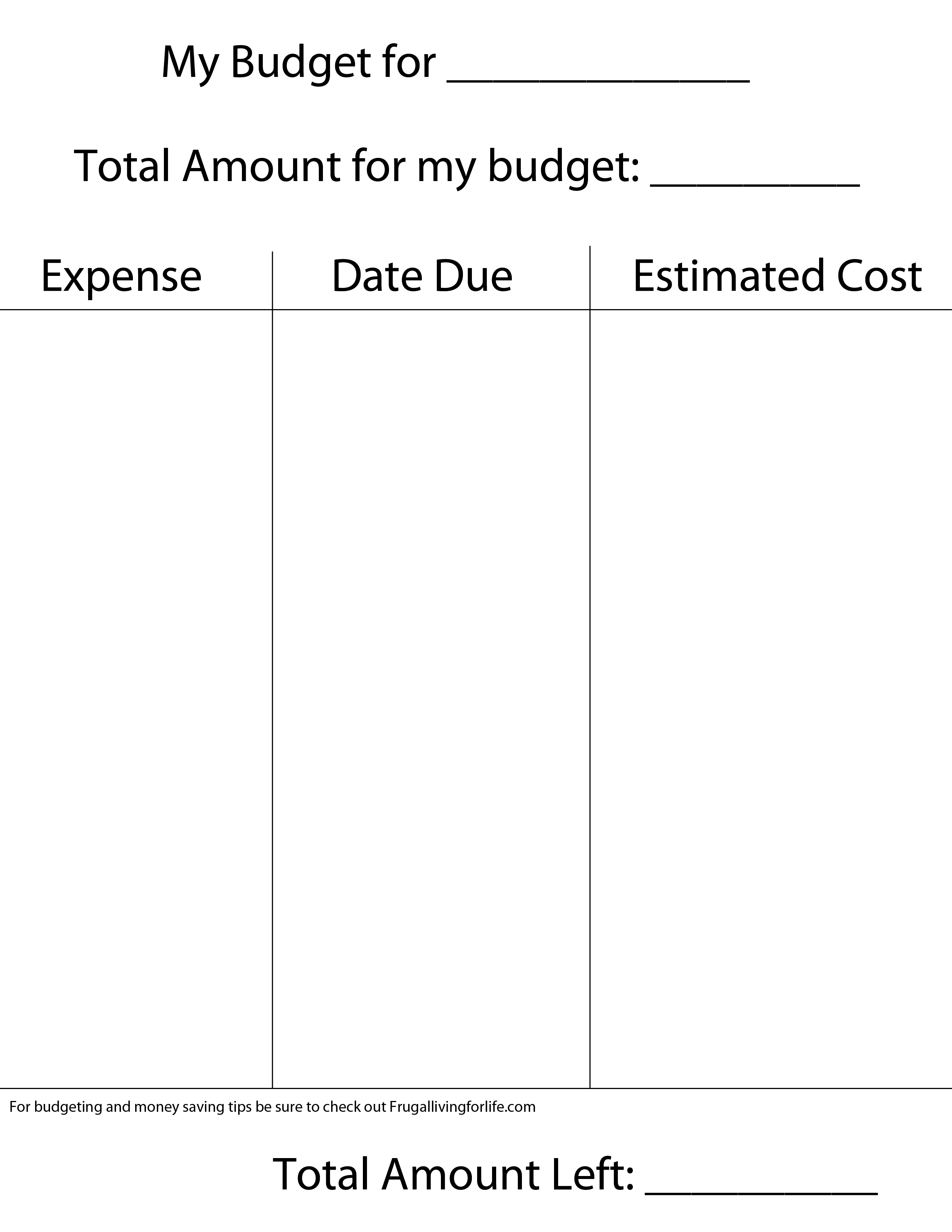

- Bill Budget Worksheet Template

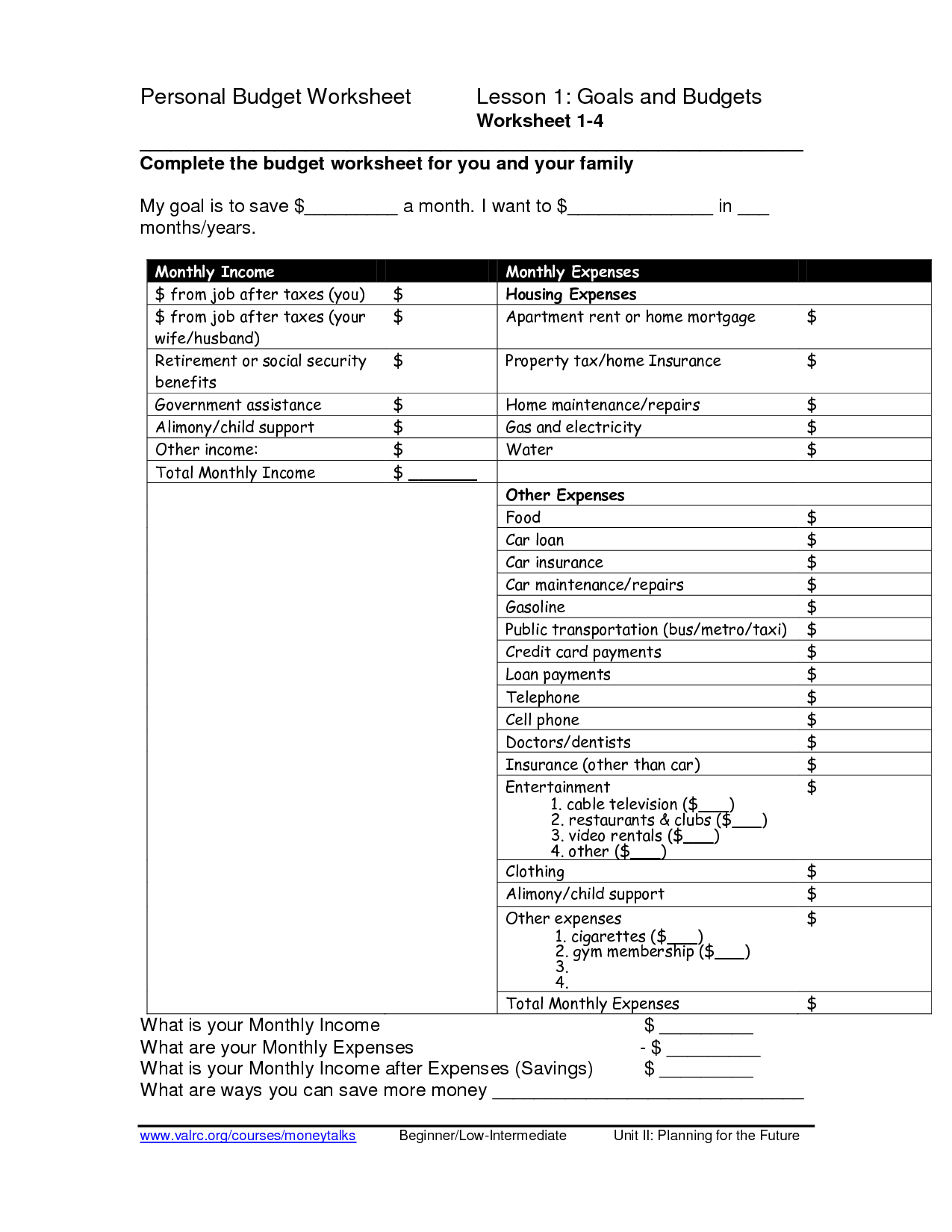

- Personal Monthly Budget Worksheet

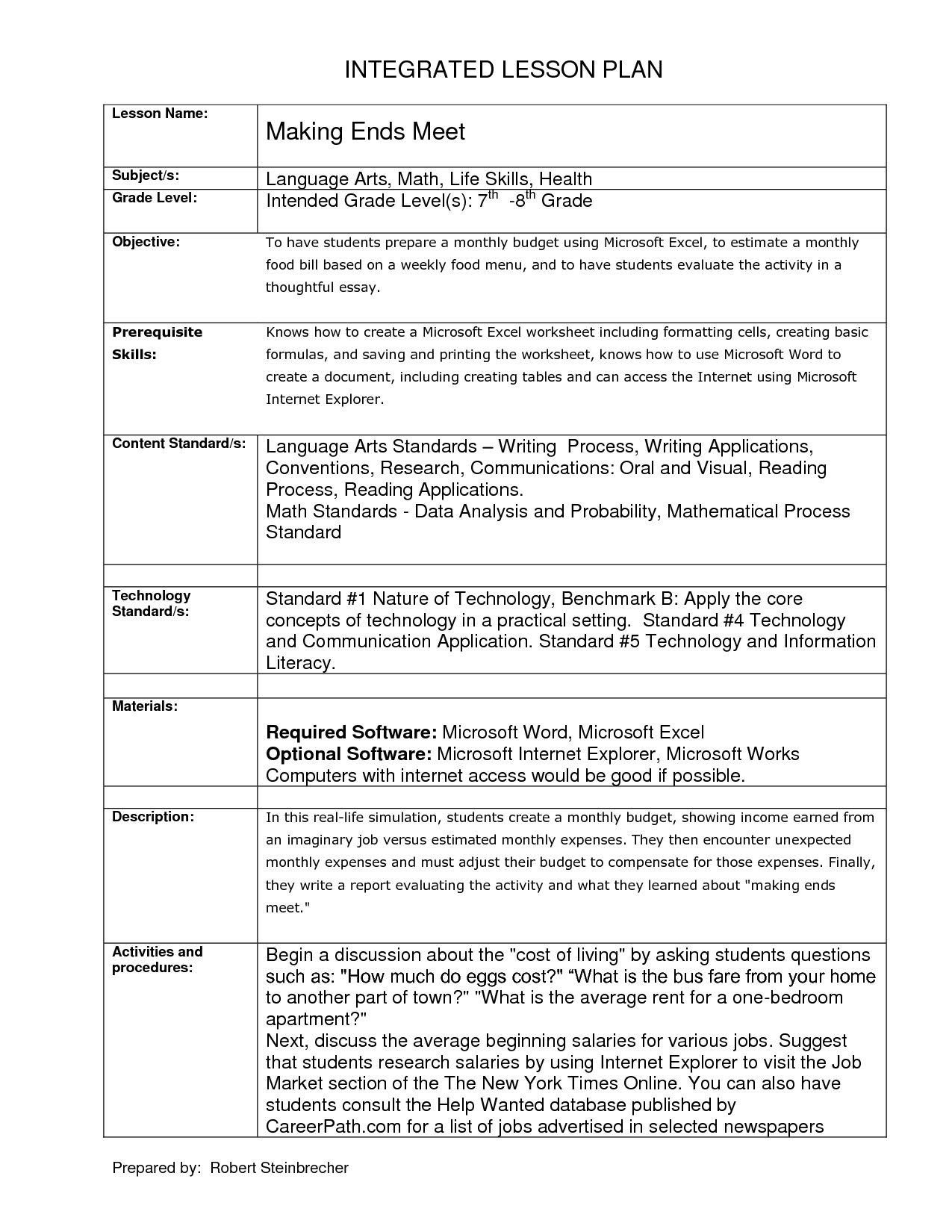

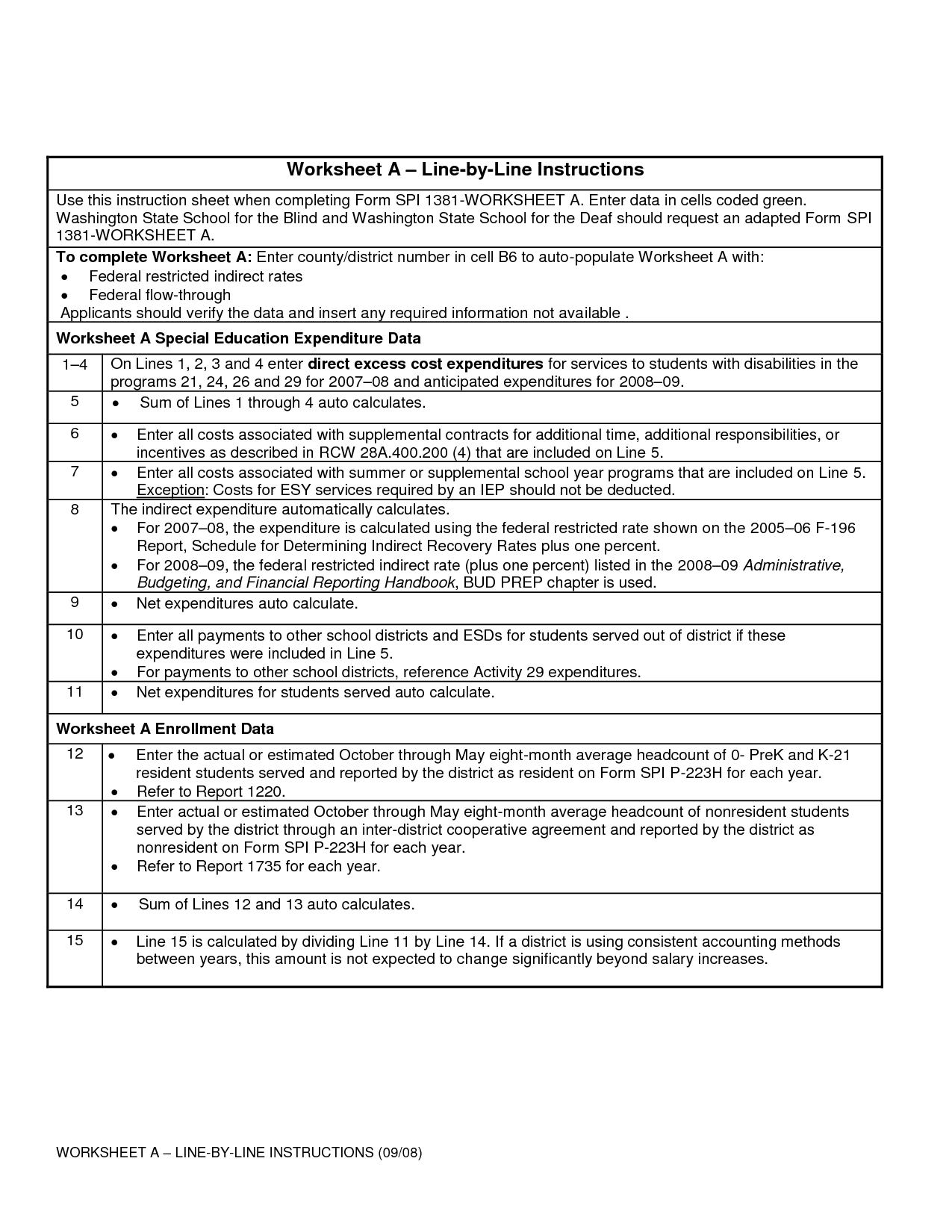

- Budget Worksheet Lesson Plan

- Smart Goal Worksheet Template

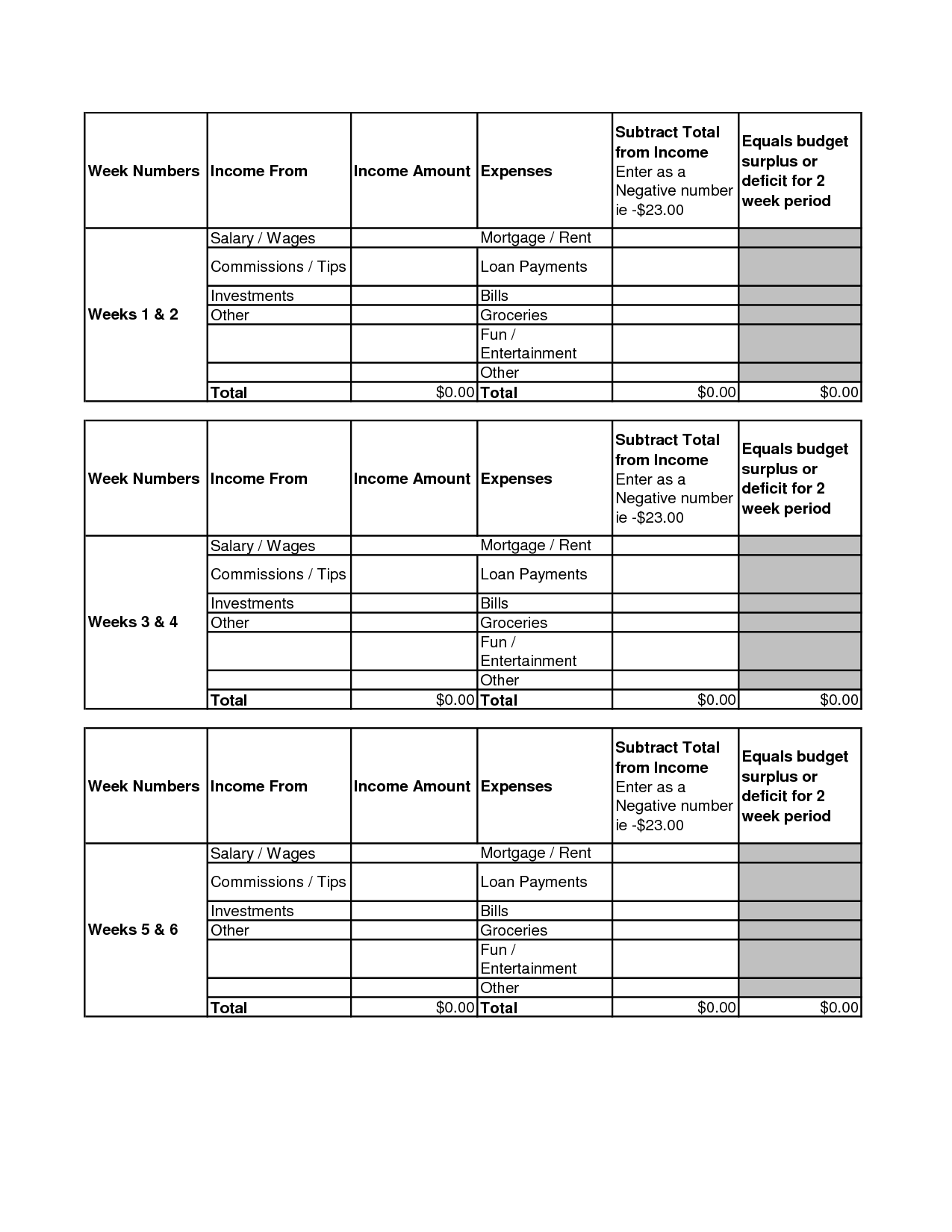

- Weekly Budget Worksheet Template

- Form 1040EZ Worksheet Line F

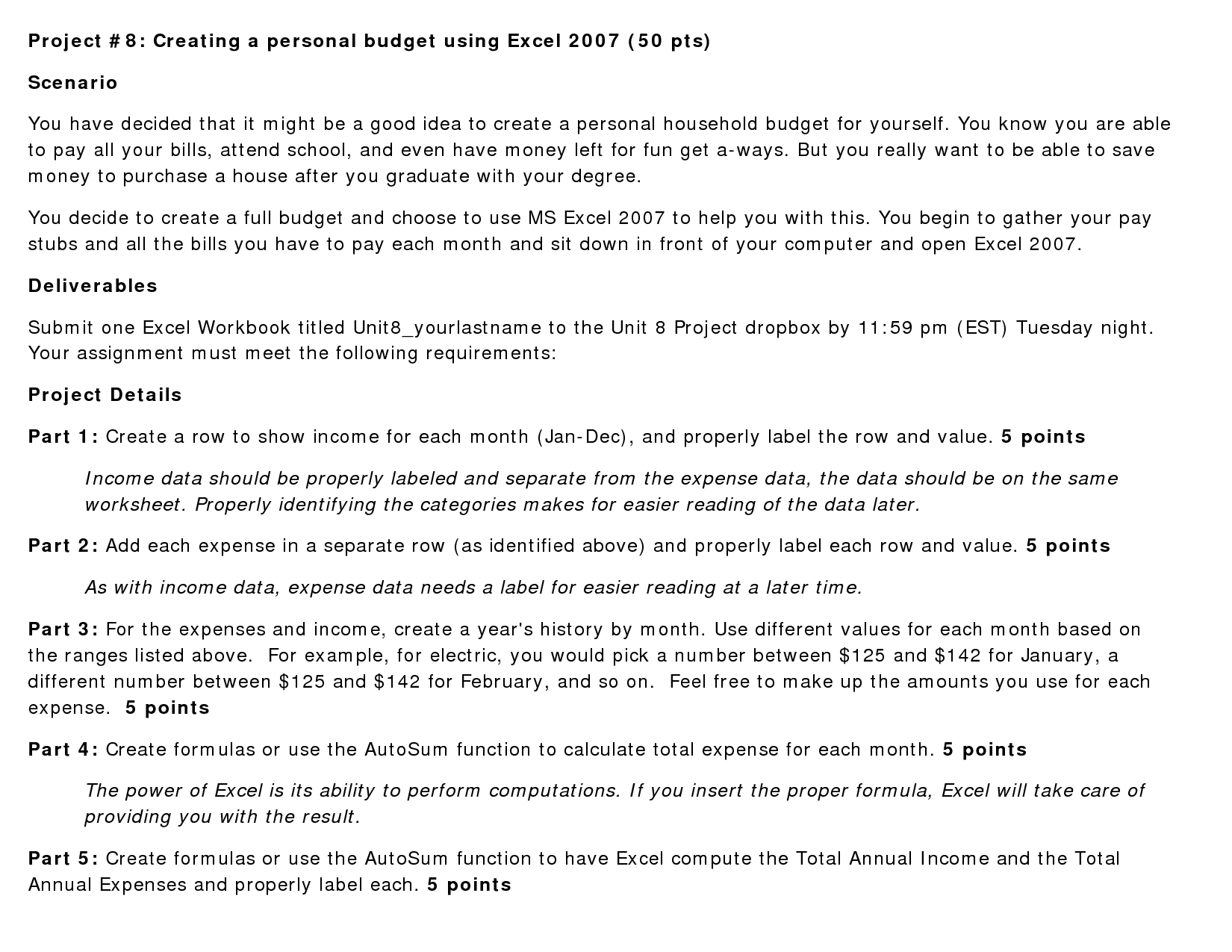

- Personal Budget Template Excel

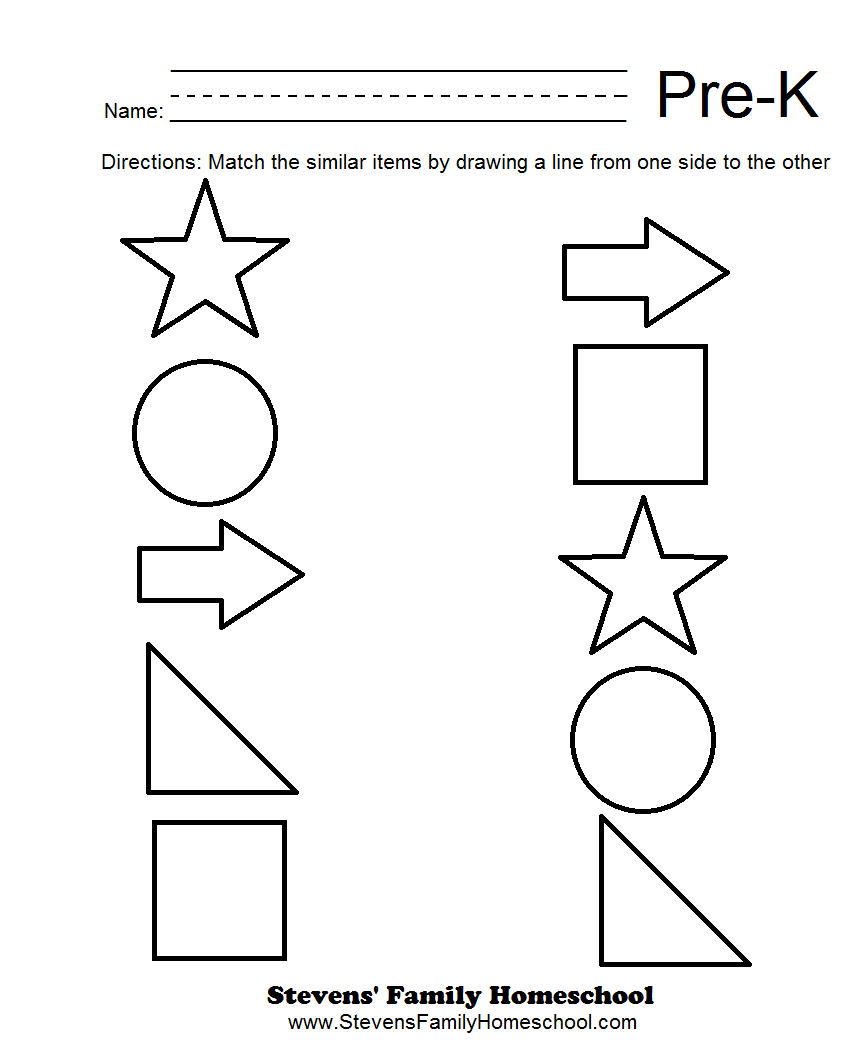

- Pre-K Matching Worksheets

- American Revolution Map Worksheet

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a budget worksheet?

A budget worksheet is a tool used to track and manage income and expenses. It typically includes sections for listing sources of income, itemizing expenses, and calculating totals to help individuals or businesses understand their financial situation and make informed decisions about spending and saving.

What are the key components of a budget worksheet?

A budget worksheet typically includes a list of income sources, expenses, and savings goals. It also often includes categories for fixed expenses like rent or mortgage payments, variable expenses like groceries or entertainment, and any one-time or unforeseen expenses. Additionally, a budget worksheet may feature sections for tracking debt payments, investments, and overall financial goals. It serves as a tool for organizing, monitoring, and adjusting one's finances to achieve financial stability and reach specific targets.

How can a budget worksheet help individuals or families manage their finances?

A budget worksheet can help individuals or families manage their finances by providing a clear and organized structure to track income, expenses, and saving goals. It allows for better visibility into spending habits, helps prioritize financial needs and wants, and enables individuals to make informed decisions on how to allocate their money effectively. By regularly updating and reviewing the budget worksheet, individuals can identify areas for potential cost-cutting, plan for future expenses, reduce financial stress, and work towards achieving their financial goals.

How do you create a budget worksheet?

To create a budget worksheet, start by listing all sources of income and fixed expenses. Then, categorize variable expenses such as groceries, utilities, entertainment, etc. Assign a monthly budget to each category and track actual spending. Include a section for savings and investments. Make sure to review and adjust the budget regularly to stay on track with your financial goals. Use software like Excel or Google Sheets for a digital format, or simply create a table on paper or in a notebook.

What categories should be included in a budget worksheet?

A budget worksheet should include categories for income, expenses, savings, debt payments, and financial goals. This will help individuals or households track their financial inflows and outflows, prioritize their spending, allocate funds towards saving and investing, manage and reduce debt, and work towards achieving their financial objectives. Additional categories may include emergency funds, insurance premiums, and miscellaneous expenses to ensure a comprehensive budgeting plan.

How often should a budget worksheet be updated?

A budget worksheet should ideally be updated at least once a month to ensure that it accurately reflects your current financial situation and spending patterns. However, it may be beneficial to update it more frequently if you experience significant changes in your income or expenses. Regularly updating your budget worksheet can help you stay on track with your financial goals and make adjustments as needed.

Should a budget worksheet include both fixed and variable expenses?

Yes, a budget worksheet should include both fixed and variable expenses. Fixed expenses are costs that remain constant each month, such as rent or loan payments, while variable expenses fluctuate based on usage or consumption, like groceries or entertainment. By including both types of expenses in your budget worksheet, you can accurately track your spending, plan for future expenses, and make informed financial decisions.

What role does income play in a budget worksheet?

Income plays a crucial role in a budget worksheet as it serves as the foundation for determining how much money is available to allocate towards expenses, savings, and investments. Knowing the exact amount of income helps individuals or households create a realistic budget that aligns with their financial capabilities. Income also allows for better planning and decision-making regarding prioritizing expenses, setting financial goals, and monitoring cash flow to ensure financial stability and achieve long-term financial objectives.

What are some common mistakes to avoid when using a budget worksheet?

Some common mistakes to avoid when using a budget worksheet include not keeping it updated regularly, underestimating expenses, omitting irregular expenses or emergency funds, not tracking all sources of income, and setting unrealistic goals. It is important to review and adjust your budget regularly to ensure it accurately reflects your financial situation and goals.

Can a budget worksheet help with long-term financial planning?

Yes, a budget worksheet can help with long-term financial planning by providing a clear overview of income, expenses, savings, and financial goals. By consistently tracking and managing your finances through a budget worksheet, you can make more informed decisions about saving for retirement, investing, paying off debt, and achieving your long-term financial objectives.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments