Cash Flow Projection Worksheet Template

Cash flow projection worksheets are an essential tool for managing your finances and planning for the future. Whether you're a small business owner, a freelancer, or even an individual looking to get a better handle on your personal finances, these worksheets provide a comprehensive overview of your income and expenses. With organized columns and formulas built in, you can easily track your cash inflows and outflows, giving you a clear picture of your financial health.

Table of Images 👆

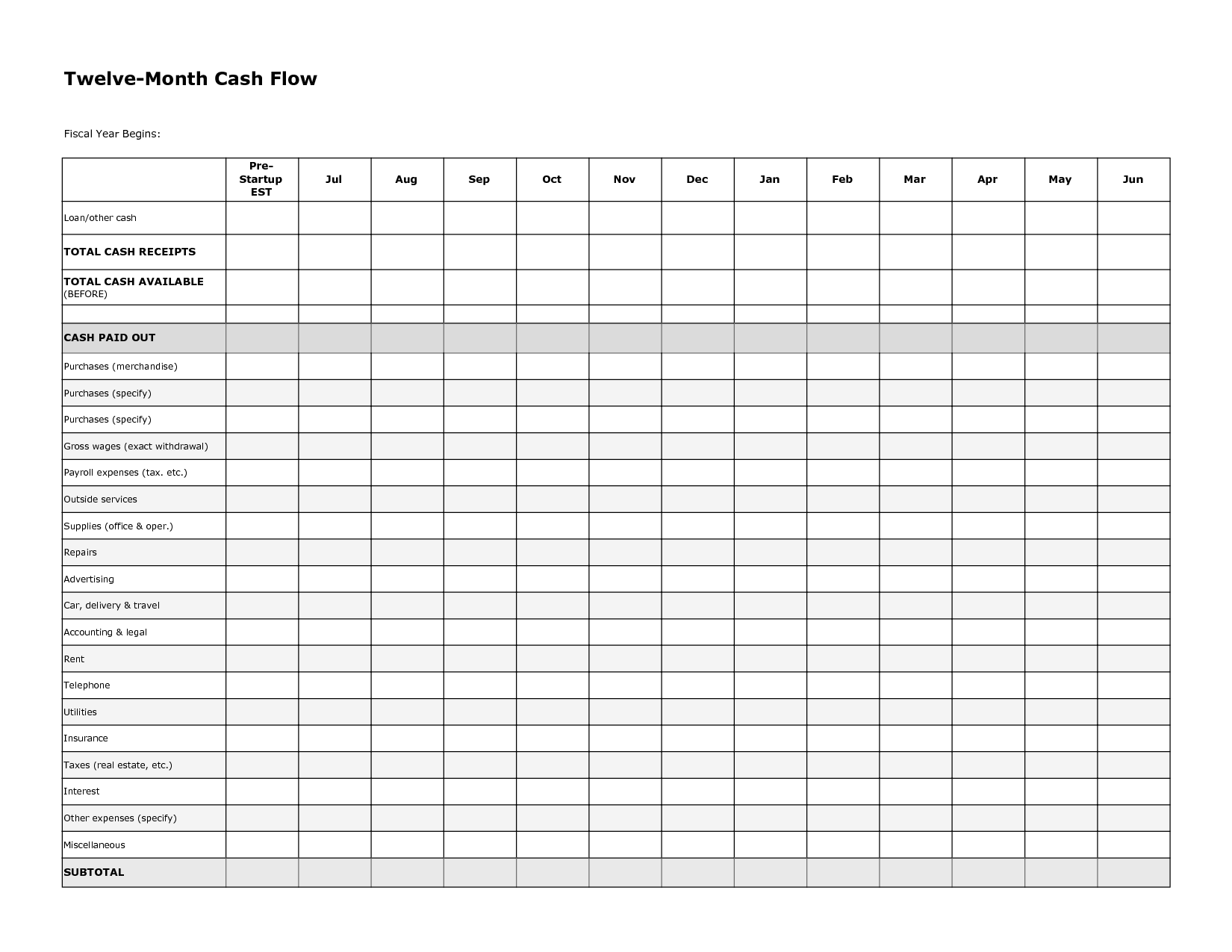

- Free Cash Flow Projection Template

- 12 Month Cash Flow Worksheet

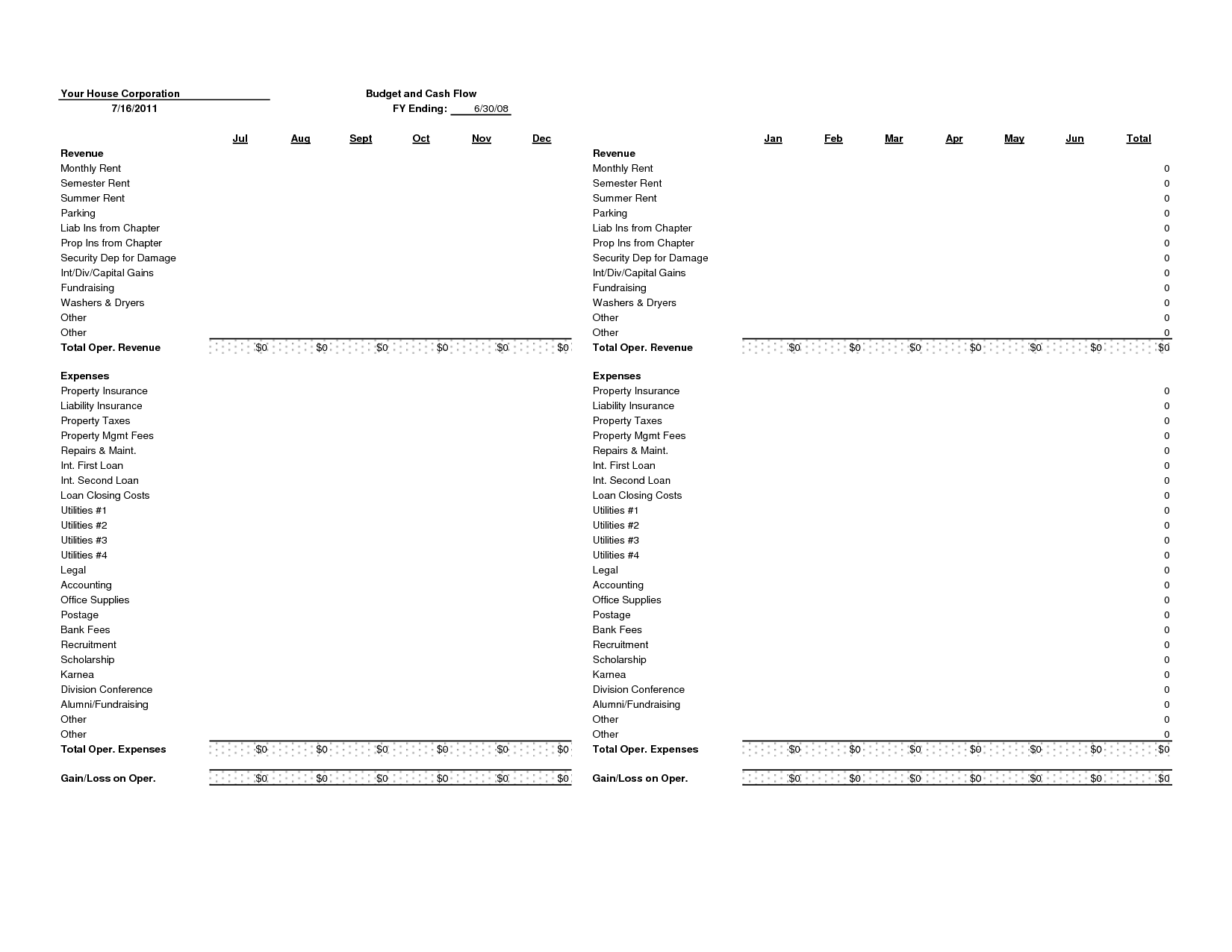

- Personal Cash Flow Budget Worksheet

- Cash Flow Budget Worksheet Template

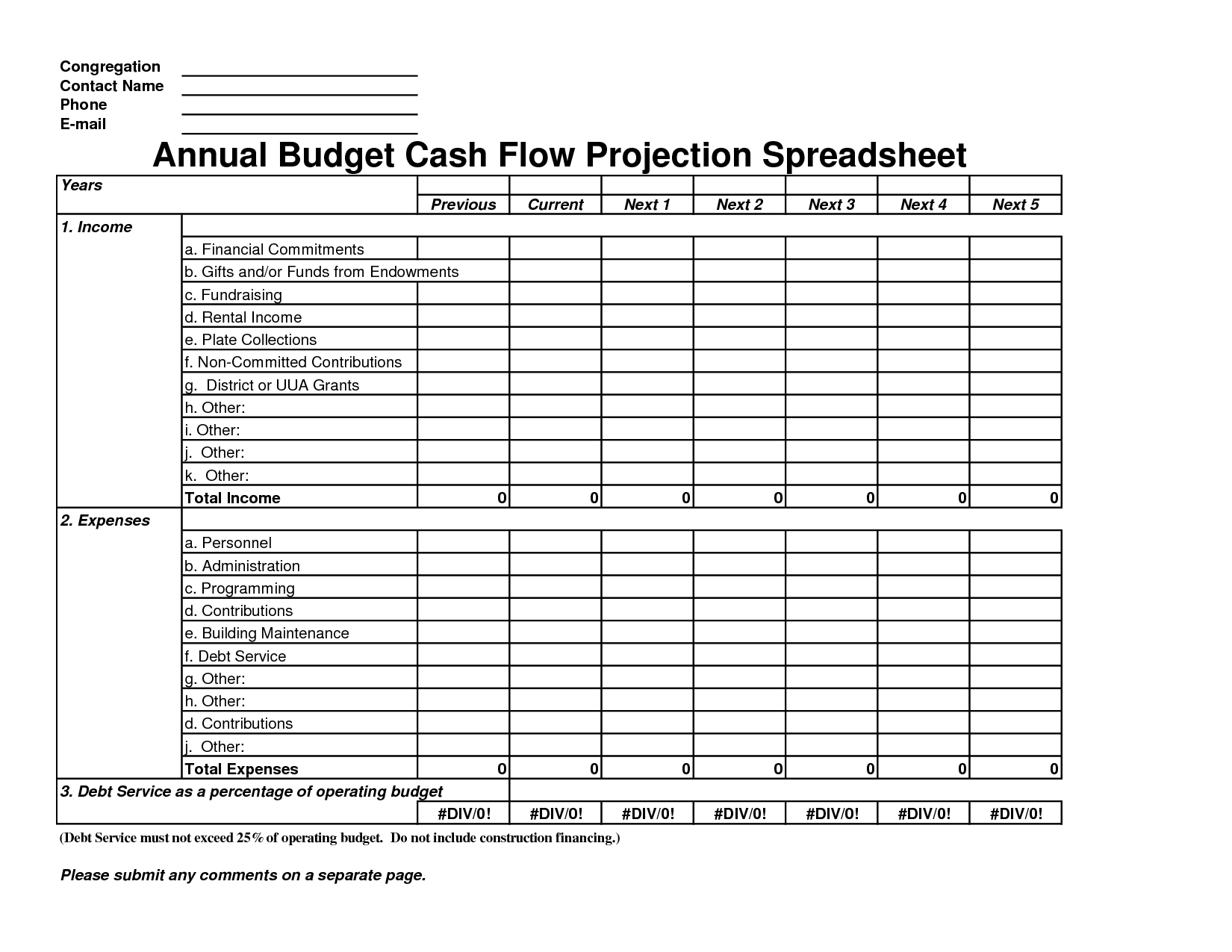

- Cash Flow Projection Template Excel

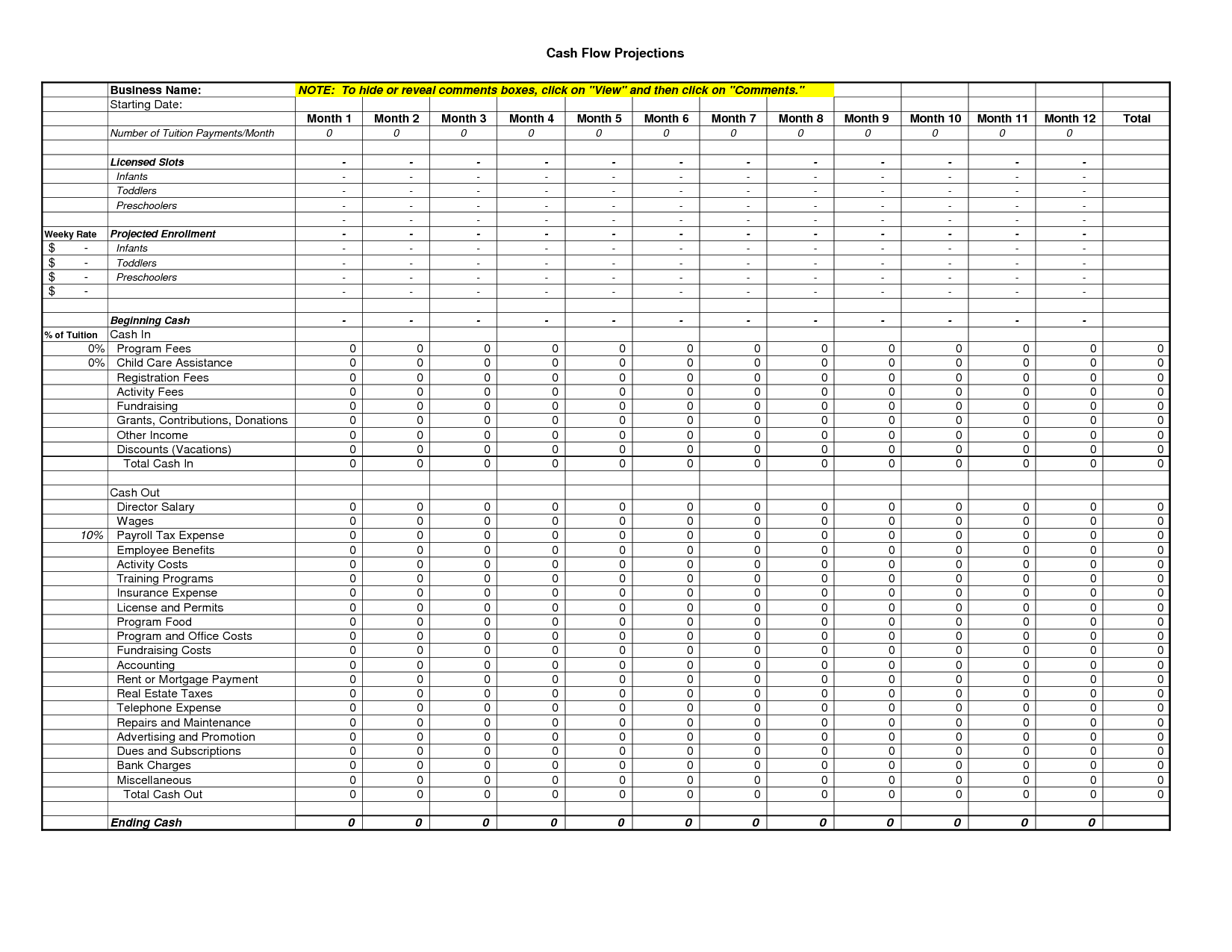

- Cash Flow Projection Worksheet

- Cash Flow Statement

- Blank Service Contract Template

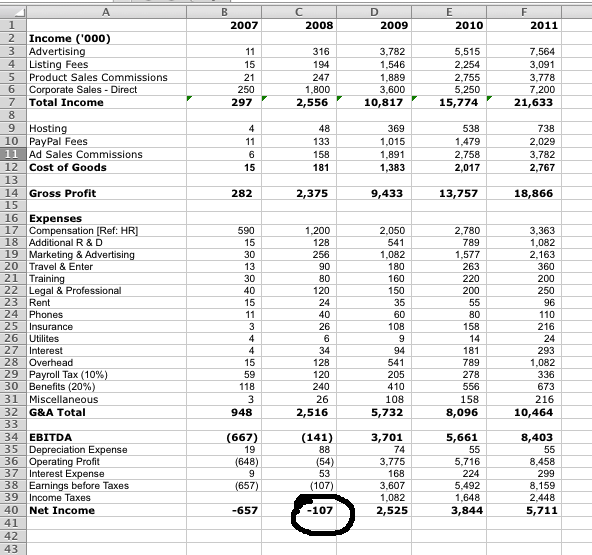

- Example of a 5 Year Business Plan Spreadsheet

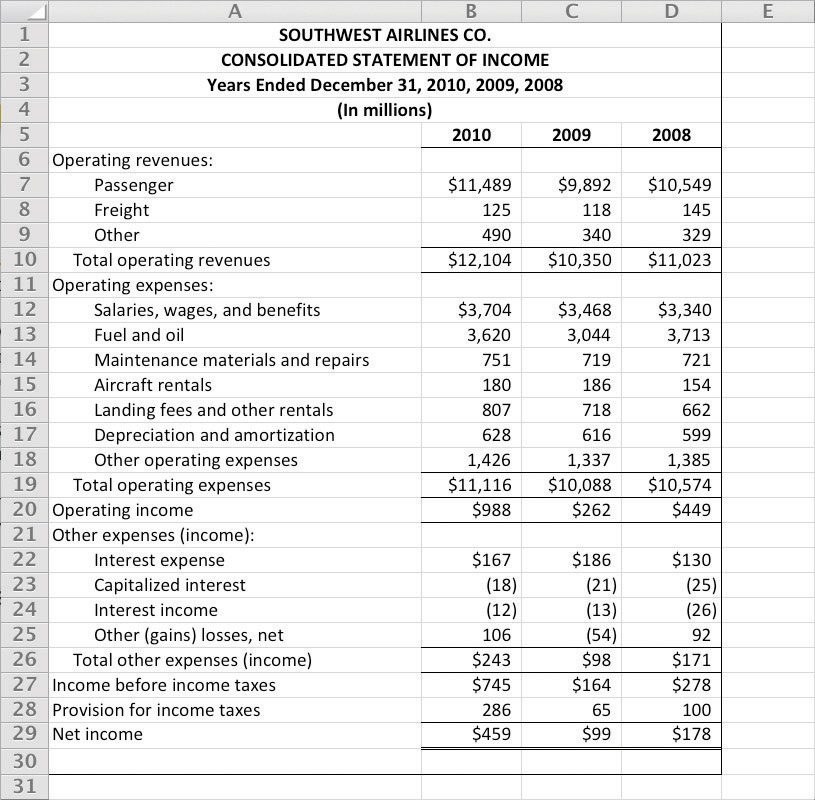

- Excel Spreadsheet Income Statement

- Car Wash Detailing Prices

- Accounting Equation Example

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

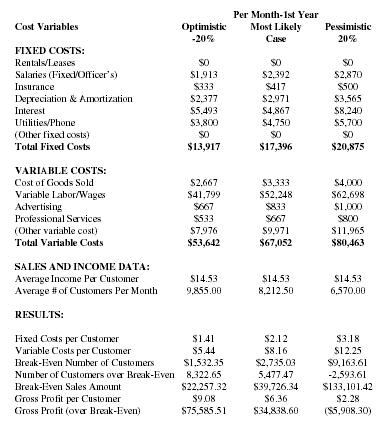

What is a cash flow projection worksheet template?

A cash flow projection worksheet template is a financial tool that helps businesses forecast and track their cash inflows and outflows over a specific period of time. This template typically includes sections for listing all sources of cash inflows (such as sales revenue, investment income) and cash outflows (such as operating expenses, loan repayments), enabling businesses to anticipate future cash shortages or surpluses and make informed decisions about their financial health and liquidity.

Why is a cash flow projection important for a business?

A cash flow projection is important for a business because it helps in forecasting and managing the inflow and outflow of cash, enabling the business to anticipate potential cash shortages or surpluses. By understanding future cash needs, a business can make informed decisions regarding investments, expenses, and financing, ensuring its sustainability and growth. Additionally, it provides valuable insights for strategic planning, budgeting, and identifying areas for improvement to optimize cash flow management.

How does a cash flow projection worksheet help in managing cash flow?

A cash flow projection worksheet helps in managing cash flow by providing a clear picture of expected inflows and outflows of cash over a defined period. By forecasting future cash flows, businesses can anticipate potential cash shortages or surpluses, allowing for proactive decision-making to address any financial gaps or take advantage of opportunities. It helps in monitoring and adjusting financial strategies, identifying trends, and ultimately improving cash flow management by ensuring that there is enough liquidity to cover operational expenses and strategic investments.

What are the key components of a cash flow projection worksheet template?

The key components of a cash flow projection worksheet template typically include sections for cash inflows, such as sales revenues, loans, or investments; cash outflows, like operating expenses, loan repayments, and capital expenditures; a section for beginning cash balance and ending cash balance; accounts receivable and accounts payable schedules; and a cash flow statement reconciling cash at the beginning and end of the period. Additionally, some templates may include sections for projected income statements and balance sheets to provide a holistic view of the financial health of the business.

How often should a business update its cash flow projection worksheet?

It is generally recommended for businesses to update their cash flow projection worksheet at least once a month to ensure that they have an accurate and current understanding of their financial position. However, in times of uncertainty or significant changes in the business environment, more frequent updates may be necessary to make informed decisions and adjustments as needed.

What types of expenses and revenues should be included in a cash flow projection?

In a cash flow projection, both operating and non-operating expenses should be included such as rent, utilities, salaries, inventory costs, interest expenses, and taxes. Revenues should consist of sales income, investment income, and any other income sources. It is essential to consider all cash inflows and outflows, including both recurring and one-time expenses, to accurately forecast the company's cash position over a specific period.

How can a cash flow projection worksheet help in identifying potential cash shortages?

A cash flow projection worksheet can help in identifying potential cash shortages by providing a detailed overview of expected inflows and outflows of cash over a specific period. By forecasting future cash movements, businesses can anticipate when they may not have enough cash on hand to cover upcoming expenses. This allows them to proactively plan for such shortages by seeking additional financing, adjusting payment schedules, or cutting costs to ensure they can meet their financial obligations on time.

What are the benefits of using a cash flow projection worksheet template?

Using a cash flow projection worksheet template can provide several benefits, such as helping a business to forecast its future financial position accurately, allowing for better financial planning and decision-making. It can also assist in identifying potential cash shortages or surpluses in advance, enabling proactive measures to be taken to manage these situations effectively. Additionally, using a template can save time and effort in creating a cash flow projection from scratch, as it provides a structured framework and formulas that streamline the process.

How can a cash flow projection worksheet aid in making informed financial decisions?

A cash flow projection worksheet can aid in making informed financial decisions by providing a clear picture of a company's future cash inflows and outflows. By forecasting cash flow, businesses can anticipate periods of surplus or deficit, enabling strategic planning for expenditures, investments, and financing decisions. This tool helps in identifying potential cash shortages well in advance, allowing for adjustments in operations or financial strategies to ensure the company remains solvent and can meet its financial obligations. Additionally, the ability to analyze different scenarios and outcomes can help in making proactive decisions to optimize cash flow and overall financial performance.

What are some common challenges faced when creating and using a cash flow projection worksheet template?

Some common challenges faced when creating and using a cash flow projection worksheet template include accurately forecasting future cash flows, adjusting for unforeseen expenses or income fluctuations, ensuring all expenses and revenue sources are accounted for, maintaining up-to-date and accurate data, and adapting the template to changing business conditions or financial goals. Additionally, issues like human error, incomplete data, and difficulty in integrating data from various sources can also pose challenges in creating and utilizing cash flow projection worksheets effectively.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments