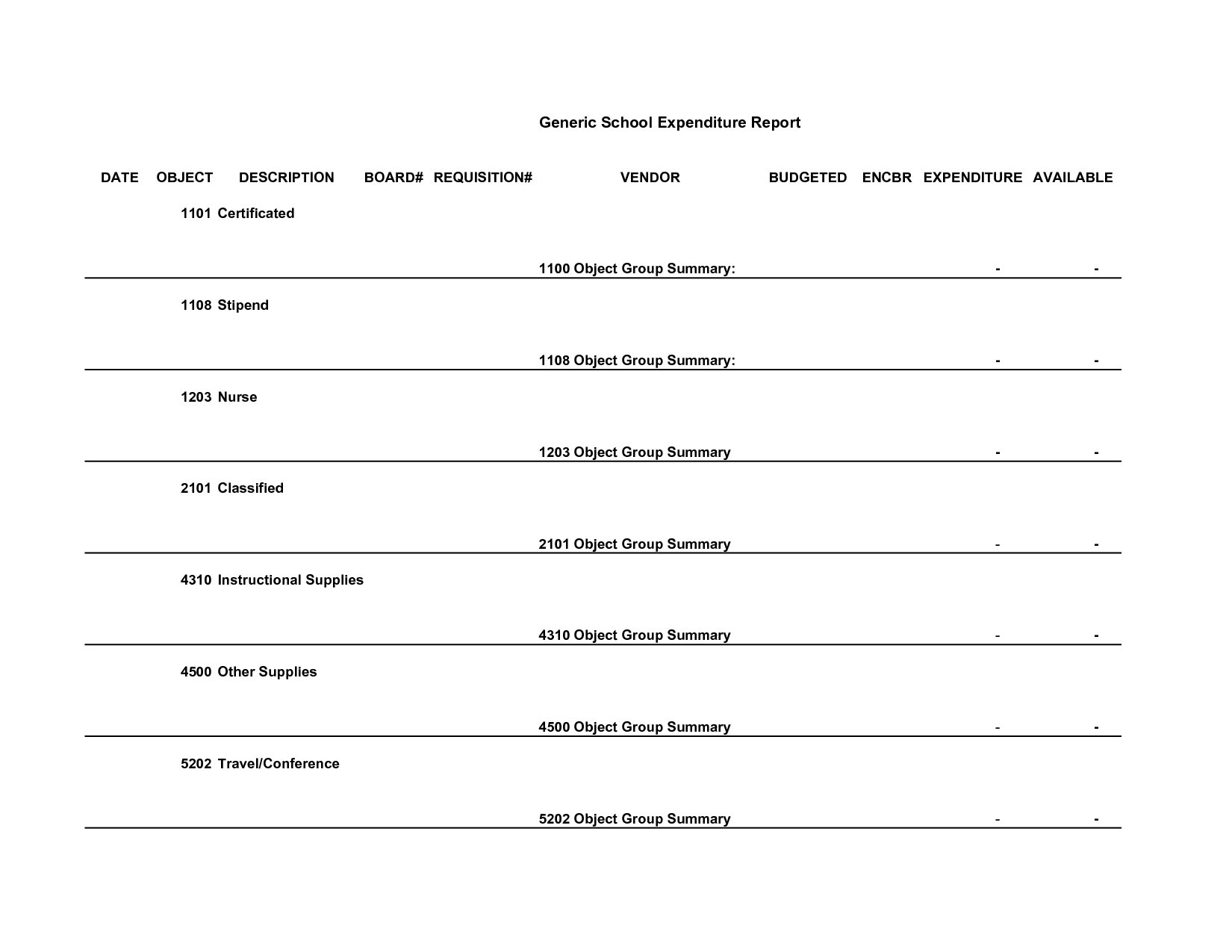

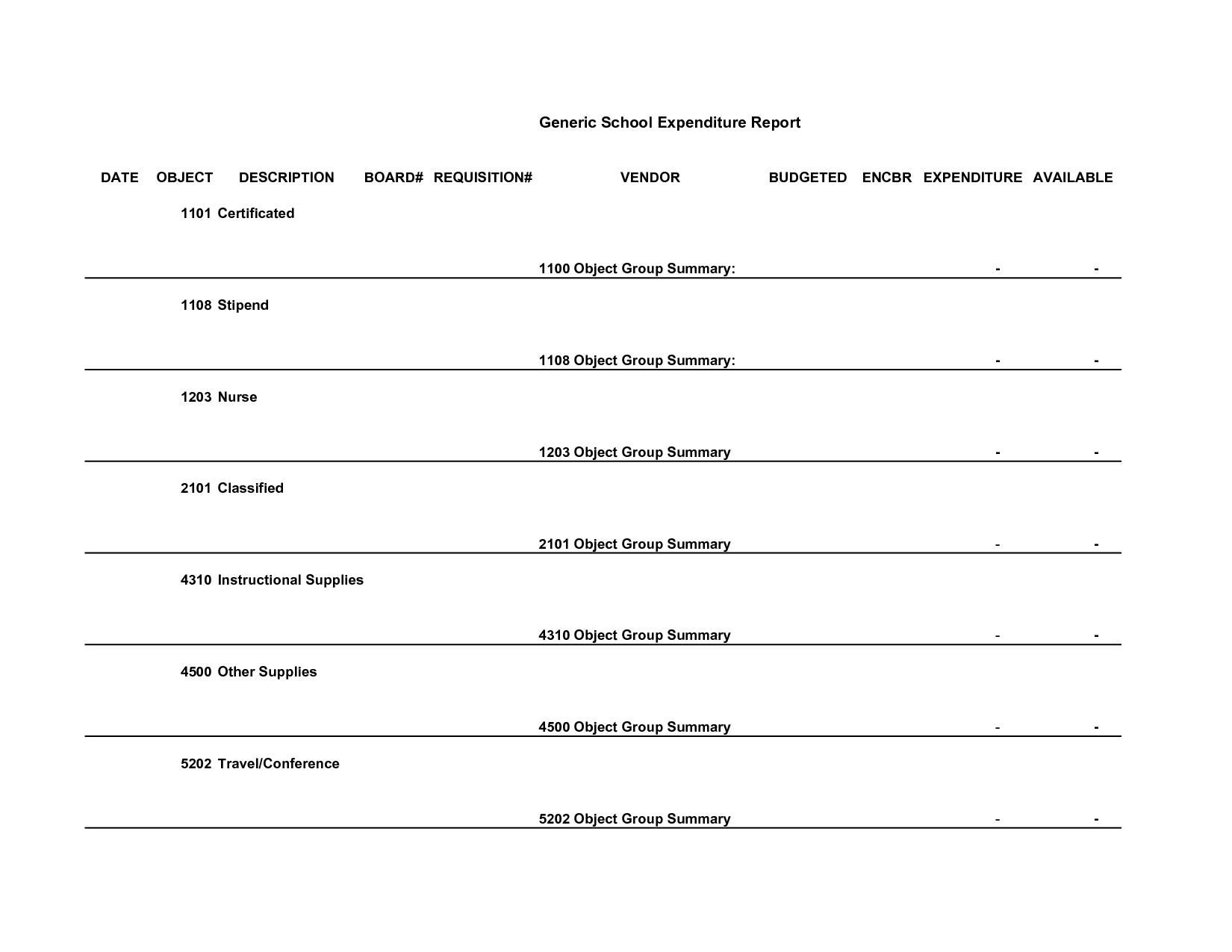

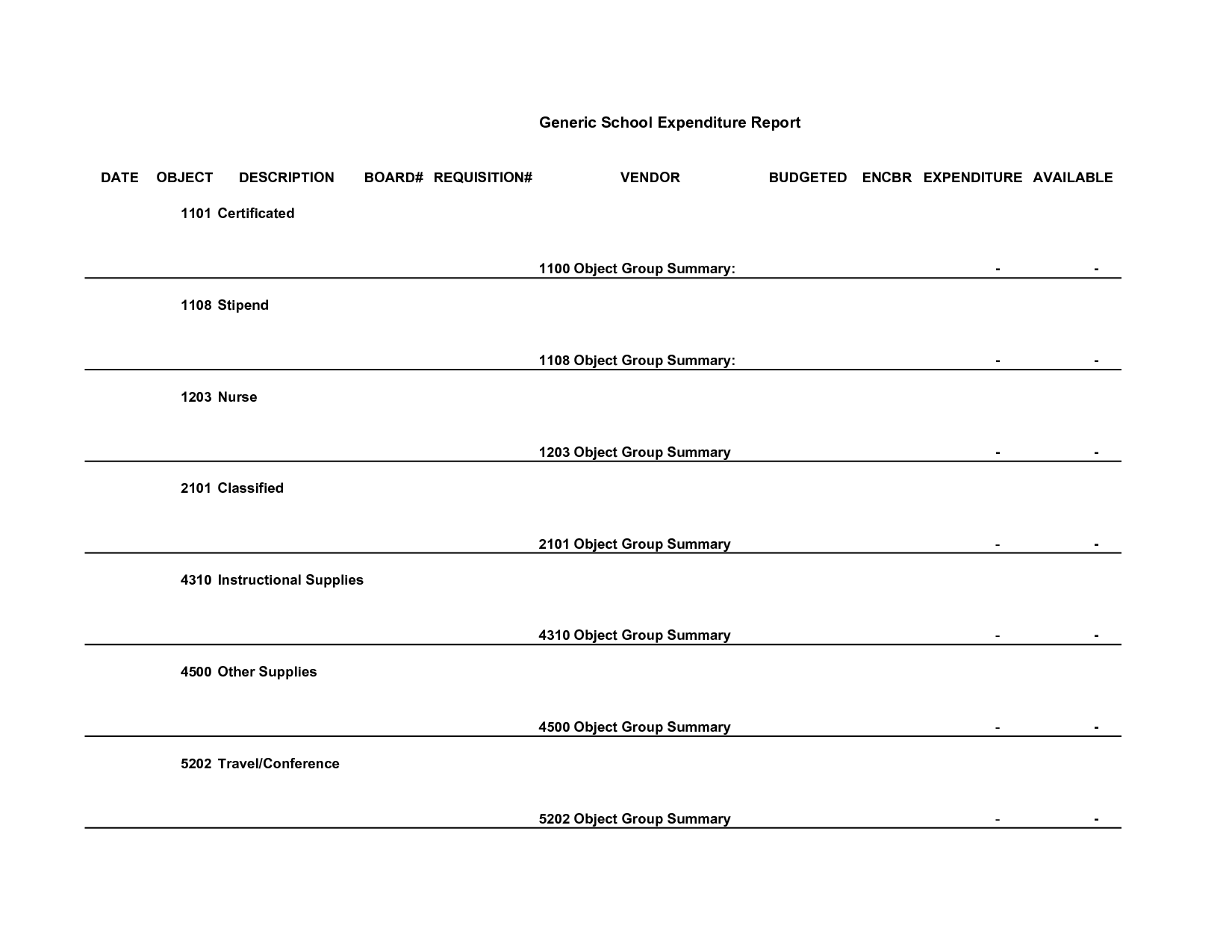

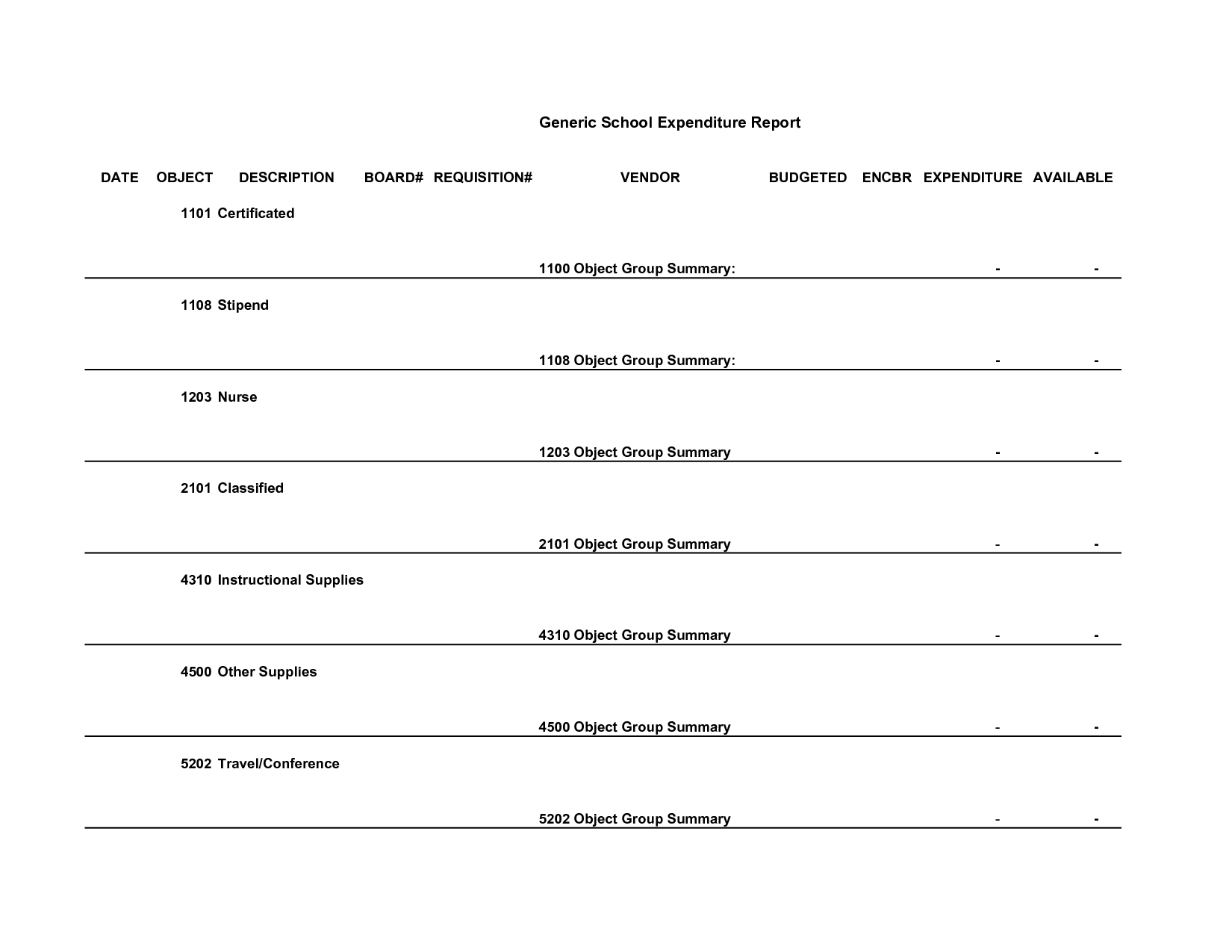

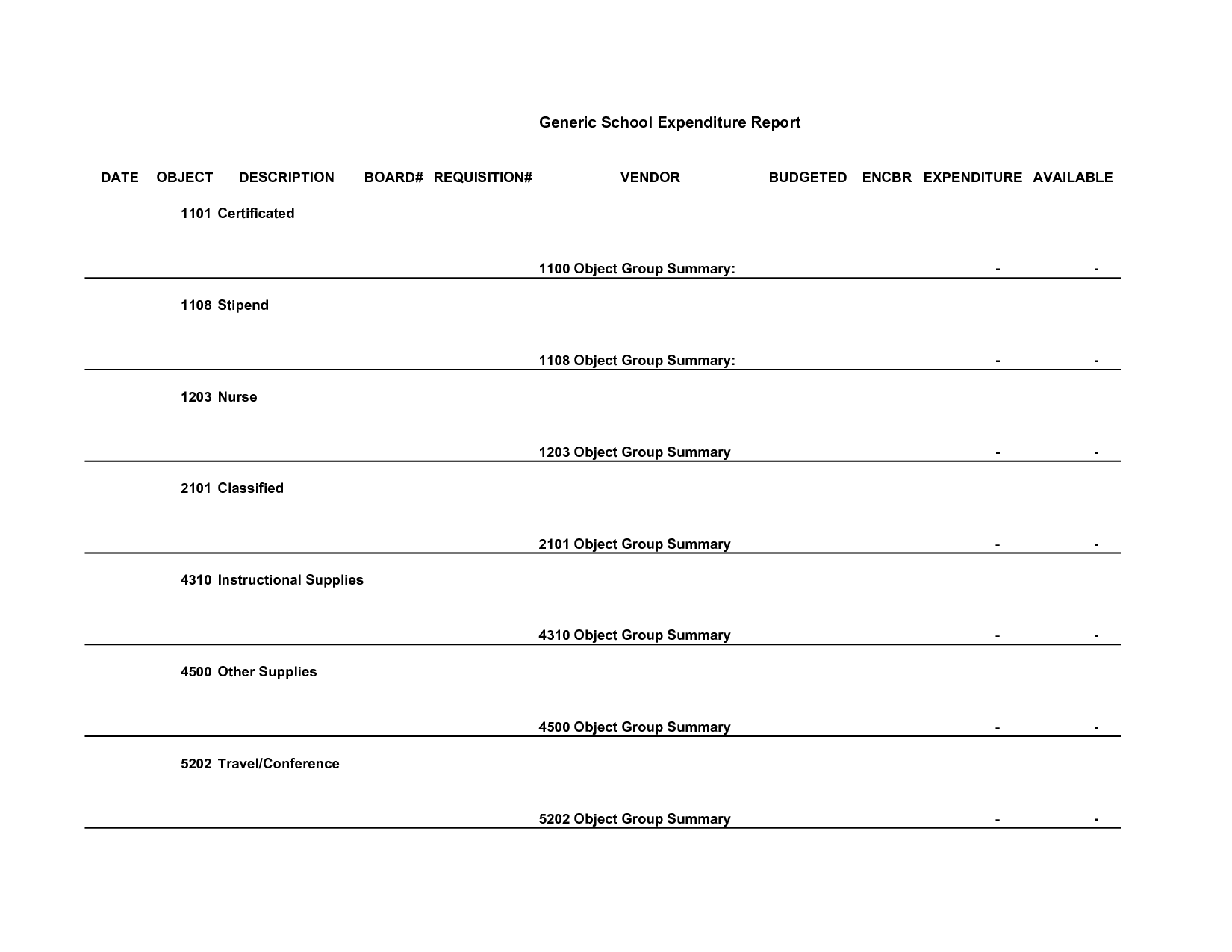

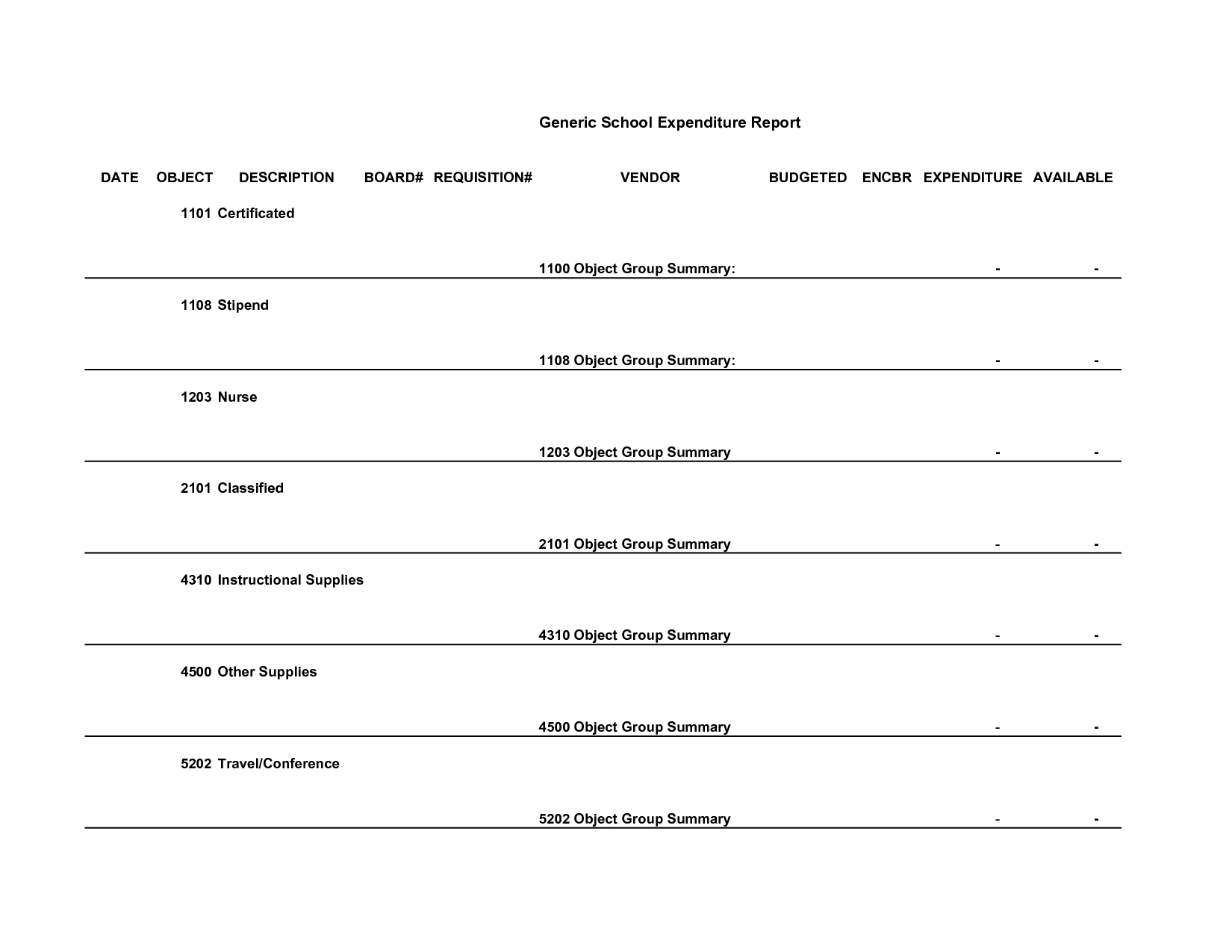

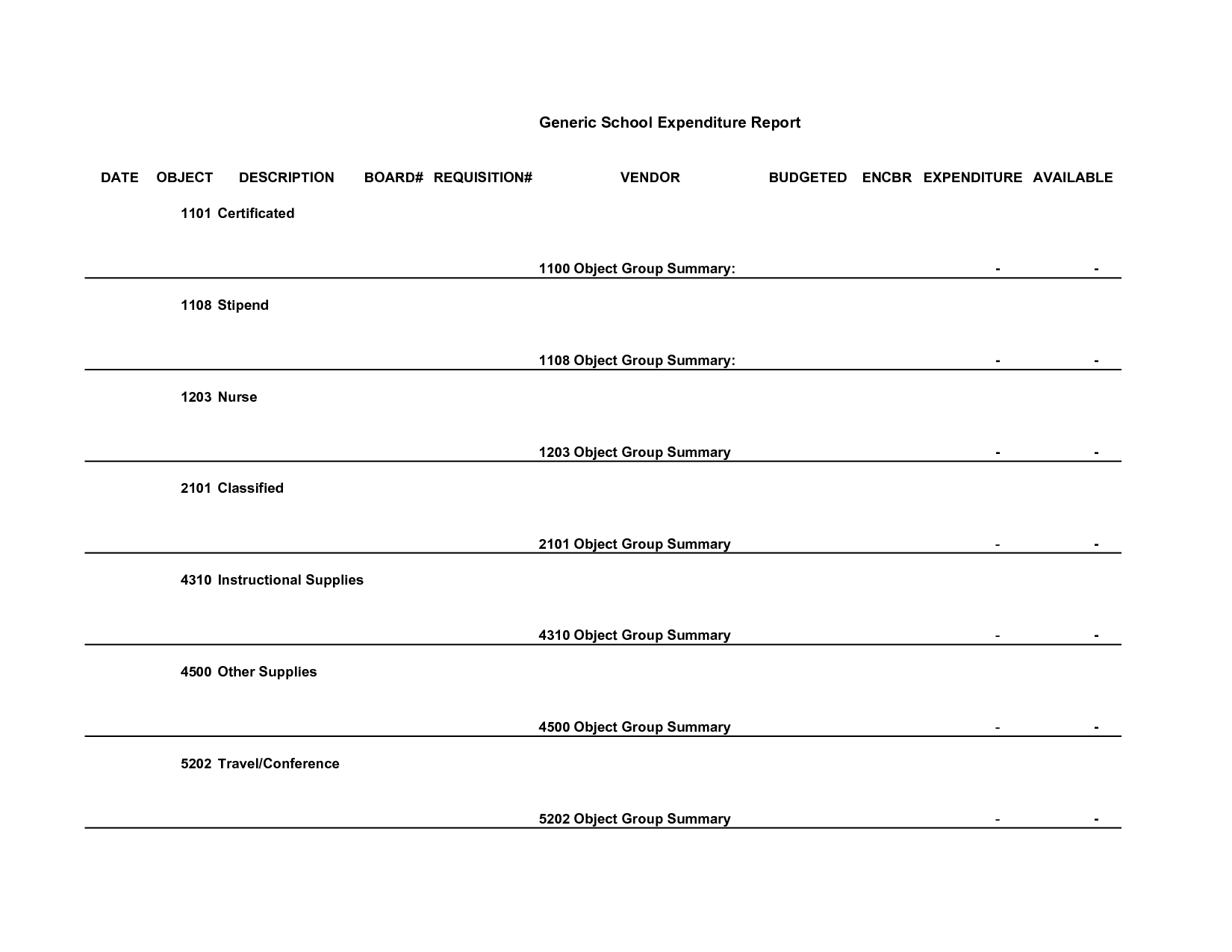

Capital Budgeting Worksheet

If you're an individual or small business owner seeking a simple and efficient way to monitor your finances, a Capital Budgeting Worksheet can be a valuable tool to consider. This organizational document allows you to track and evaluate your investments, expenses, and potential sources of income. By using a Capital Budgeting Worksheet, you can make informed decisions about where to allocate your financial resources and effectively plan for the future.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a capital budgeting worksheet?

A capital budgeting worksheet is a tool used by businesses to evaluate potential investment opportunities and make informed decisions about allocating financial resources to long-term projects or assets. It typically includes calculations for analyzing cash flows, estimating costs, determining return on investment, assessing risk, and evaluating the overall feasibility of a capital expenditure. This worksheet helps businesses prioritize and select projects that align with their strategic goals and financial objectives.

How is a capital budgeting worksheet used in financial decision-making?

A capital budgeting worksheet is used in financial decision-making to evaluate potential investment opportunities and allocate resources efficiently. It helps in assessing the cash flows, risks, and returns associated with different projects, enabling managers to prioritize investments that align with the company's strategic objectives and generate the highest return on investment. By providing a structured framework for analyzing and comparing investment options, a capital budgeting worksheet helps decision-makers make informed choices that optimize the company's long-term financial performance and growth prospects.

What types of information are typically included in a capital budgeting worksheet?

A capital budgeting worksheet typically includes information such as the initial investment amount, projected cash flows over the investment's useful life, estimated salvage value at the end of the project, calculation of net present value or internal rate of return, cost of capital or discount rate used for analysis, and any relevant assumptions or considerations that impact the decision-making process.

Why is it important to accurately estimate cash flows in a capital budgeting worksheet?

Accurately estimating cash flows in a capital budgeting worksheet is crucial because it helps in making informed decisions regarding investment opportunities. Reliable cash flow projections allow businesses to assess the profitability and risk associated with a potential project or investment, determine the feasibility of the investment, calculate important financial metrics like net present value and internal rate of return, and allocate resources effectively. By having precise cash flow estimates, organizations can avoid misallocating capital, reduce financial risks, and maximize returns on investment in the long run.

How does a capital budgeting worksheet help to assess the profitability of an investment project?

A capital budgeting worksheet helps to assess the profitability of an investment project by compiling all relevant financial information, such as expected cash inflows, outflows, and the initial investment cost. By calculating key metrics like net present value (NPV), internal rate of return (IRR), and payback period, stakeholders can analyze the potential returns and risks associated with the project. This structured approach allows decision-makers to make informed choices based on financial data, ensuring that the investment aligns with the organization's strategic goals and has the potential to generate positive returns over its lifespan.

What is the purpose of discounting cash flows in a capital budgeting worksheet?

The purpose of discounting cash flows in a capital budgeting worksheet is to account for the time value of money. By discounting future cash flows back to their present value, it allows decision makers to compare the profitability of different investment opportunities by considering the impact of timing on cash flows. This process helps in making informed decisions about which projects are worth pursuing, as it ensures that all future cash flows are evaluated on a consistent basis and adjusted for their risk and opportunity cost.

How do you calculate net present value (NPV) using a capital budgeting worksheet?

To calculate the net present value (NPV) using a capital budgeting worksheet, you need to follow these steps: 1. List all cash inflows and outflows associated with the investment project over its entire life. 2. Determine the discount rate (usually the cost of capital) that reflects the project's risk. 3. Apply the discount rate to each cash flow to convert them to their present value. 4. Sum up all the present values of cash inflows and outflows to calculate the net present value. A positive NPV indicates the project is expected to generate profits above the cost of capital, making it a viable investment.

How does the internal rate of return (IRR) factor into a capital budgeting worksheet?

The internal rate of return (IRR) is a key metric in capital budgeting as it represents the rate at which the net present value (NPV) of an investment becomes zero. In a capital budgeting worksheet, the IRR is used to evaluate the feasibility of an investment project by comparing it to the company's cost of capital. If the IRR is greater than the cost of capital, the project is deemed acceptable and potentially profitable. If the IRR is less than the cost of capital, the project may not be worthwhile. Overall, the IRR helps decision-makers assess the potential returns and risks associated with different investment opportunities.

How can sensitivity analysis be conducted using a capital budgeting worksheet?

Sensitivity analysis can be conducted using a capital budgeting worksheet by making changes to key variables such as sales volume, costs, and discount rates to see how they impact the project's net present value (NPV) or internal rate of return (IRR). By varying these inputs within a certain range, analysts can assess how sensitive the project is to changes in these factors, helping to identify which variables have the most significant impact on the project's financial performance and potential risks. This analysis provides useful insights for decision-makers in evaluating the robustness and feasibility of the capital budgeting project under different scenarios.

What are some limitations of using a capital budgeting worksheet in decision-making?

Some limitations of using a capital budgeting worksheet in decision-making include the reliance on assumptions and estimations that may not accurately reflect future outcomes, the potential for overlooking non-financial factors that are important in decision-making, the time and resources required to create and maintain the worksheet, and the risk of biases influencing the decision-making process despite the use of quantitative techniques. Additionally, unexpected changes in the economic or business environment may render the assumptions and projections used in the worksheet obsolete, leading to suboptimal decisions.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments