Business Tax Organizer Worksheet

If you're a business owner or self-employed individual looking for a convenient and efficient way to organize your tax information, a Business Tax Organizer Worksheet can be the perfect solution. With this tool, you can keep track of all the necessary financial details and ensure that you have everything in order when tax season arrives. Whether you're a sole proprietor or run a small business, this worksheet will help you stay on top of your tax obligations and minimize the stress of filing your returns.

Table of Images 👆

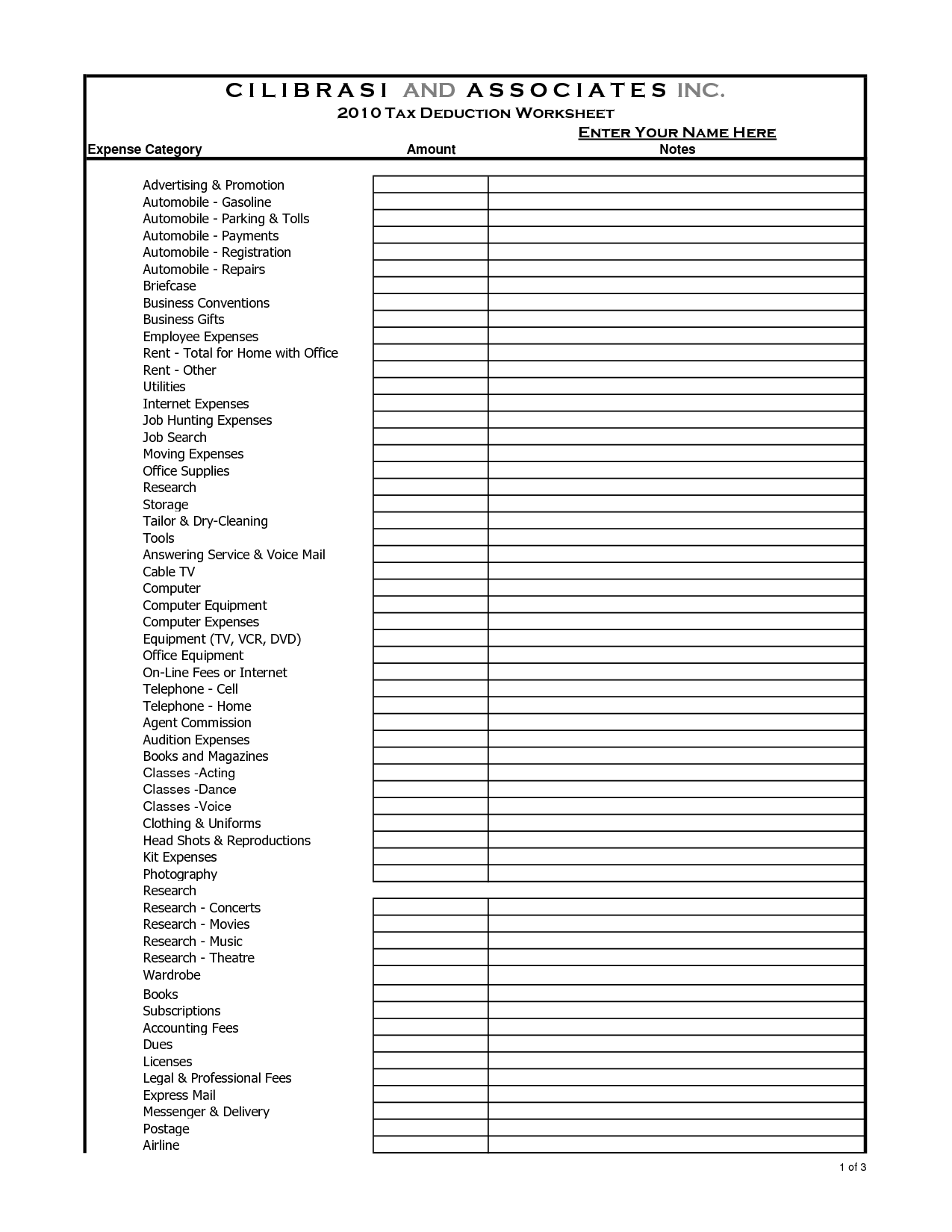

- Tax Deduction Worksheet

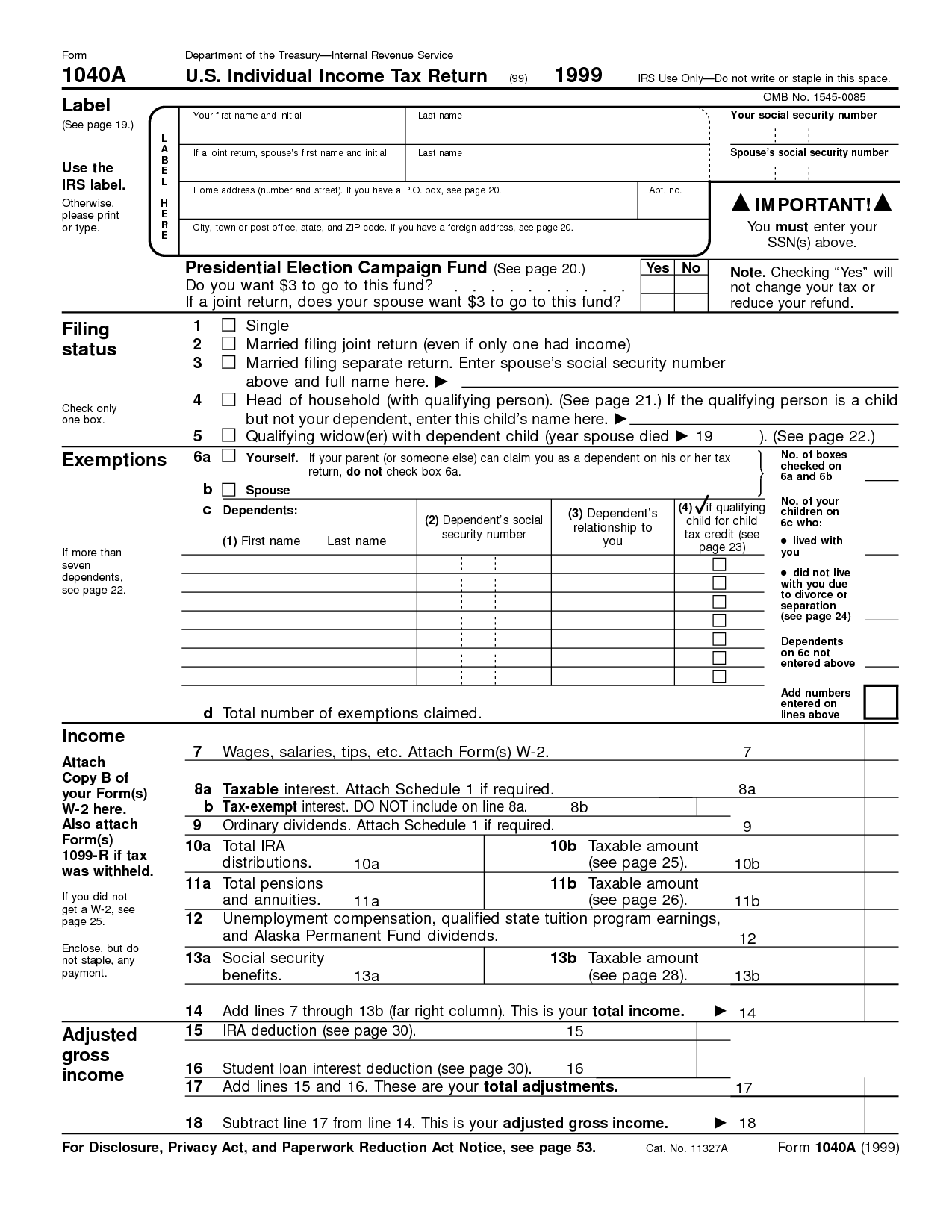

- IRS Itemized Deduction Worksheet Form 2015

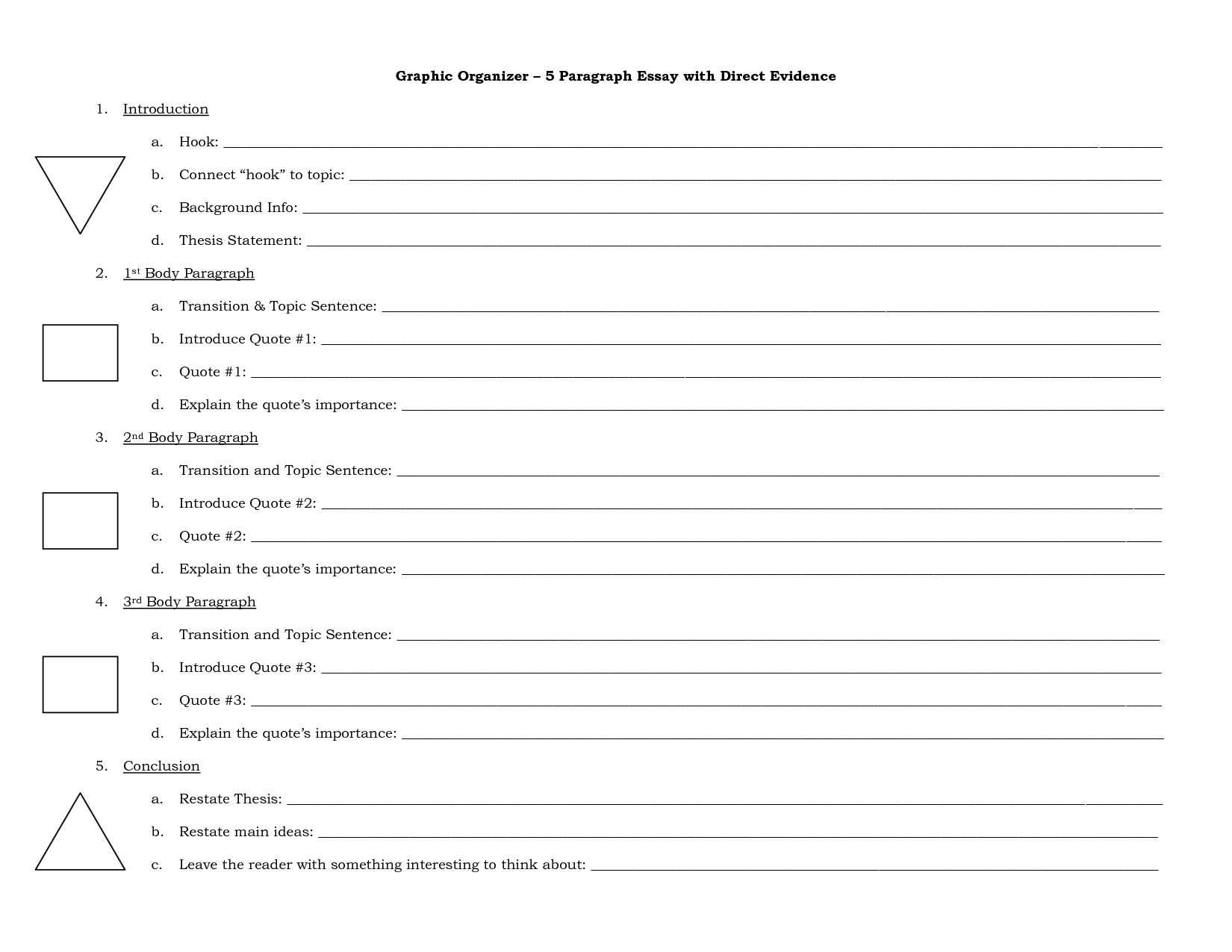

- 5 Paragraph Essay Graphic Organizer

- Biome Organizer Chart Worksheet

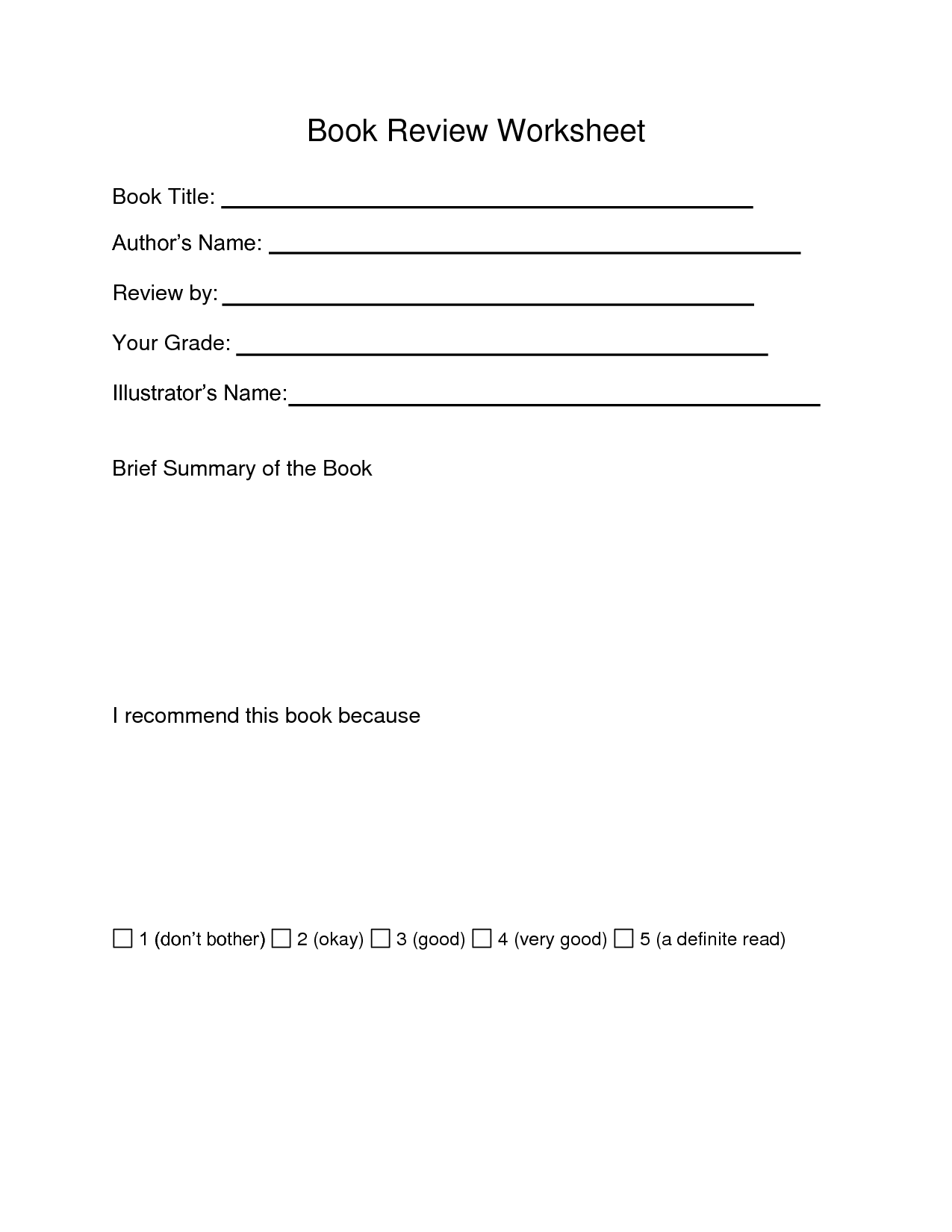

- Sample Book Review Worksheet

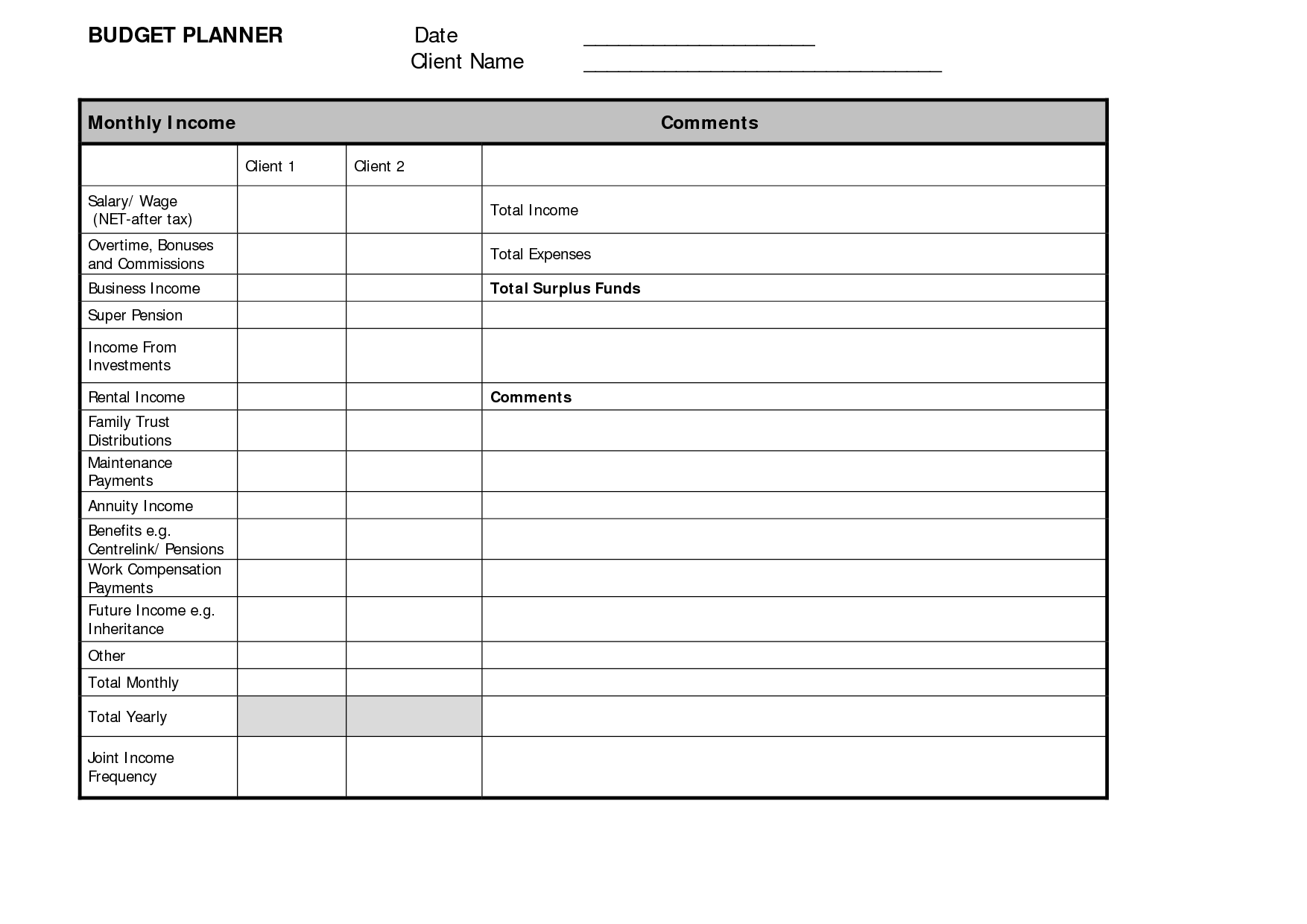

- Free Monthly Budget Planner Template

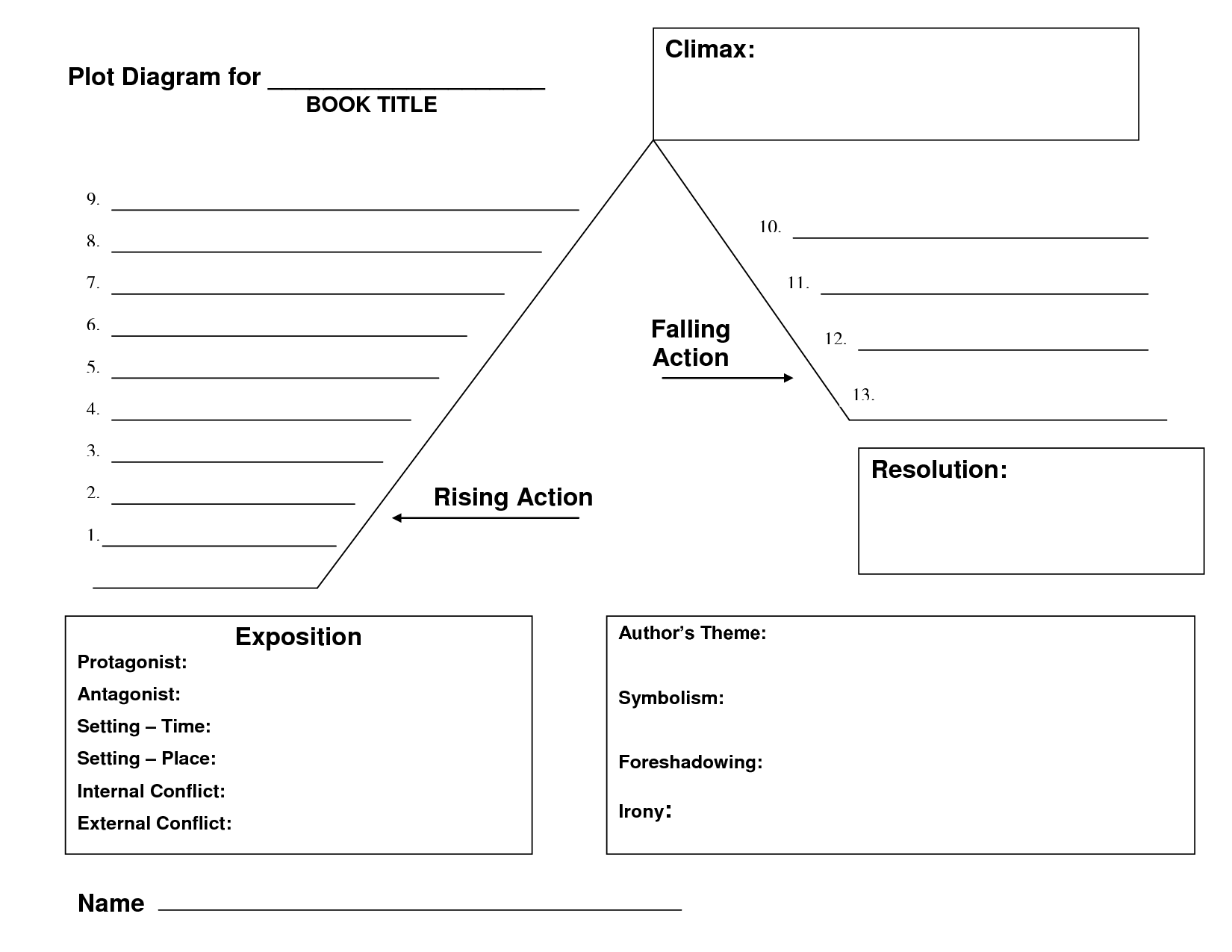

- Plot Diagram Template

- Story Plot Map Graphic Organizer

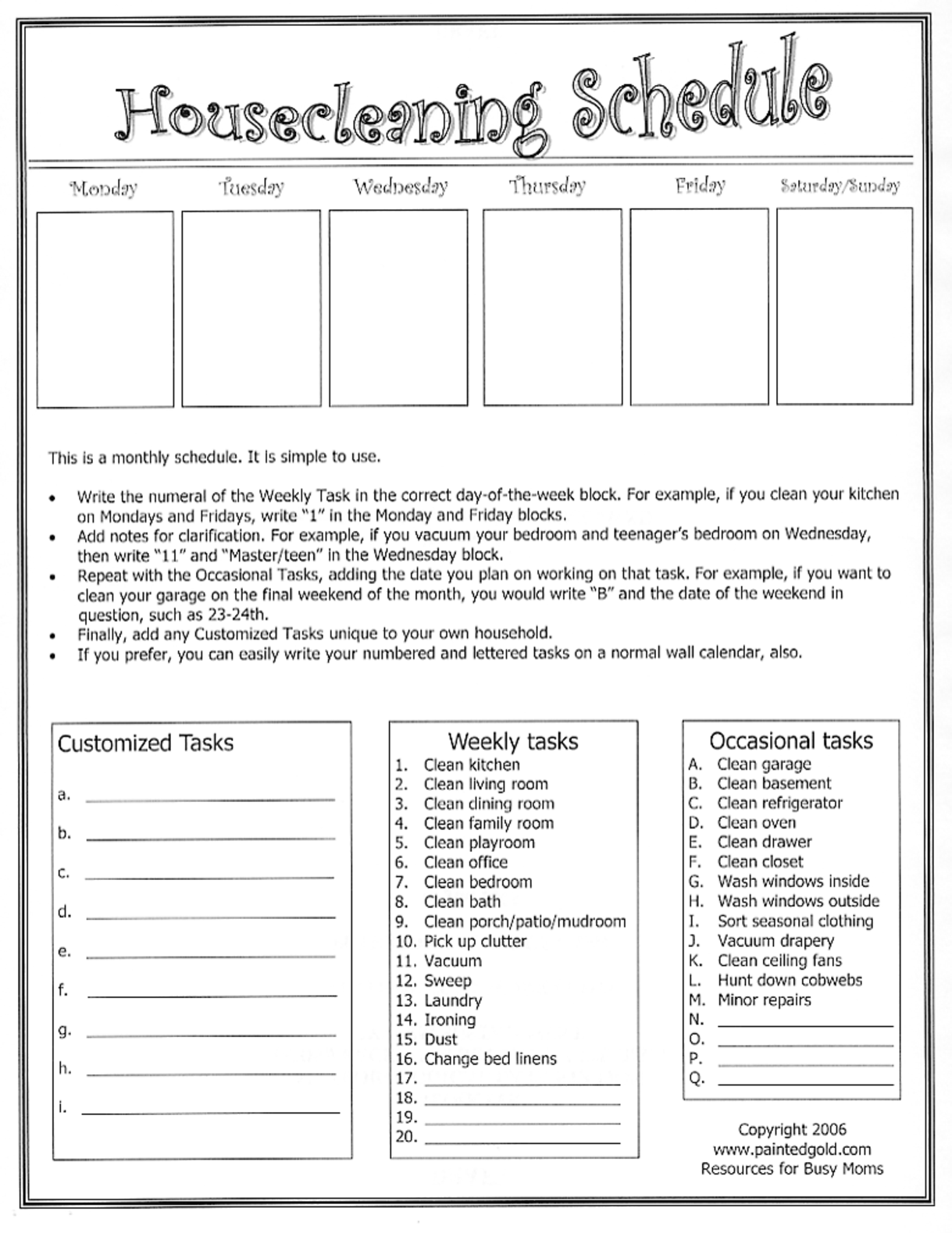

- Free Printable Household Chore Charts

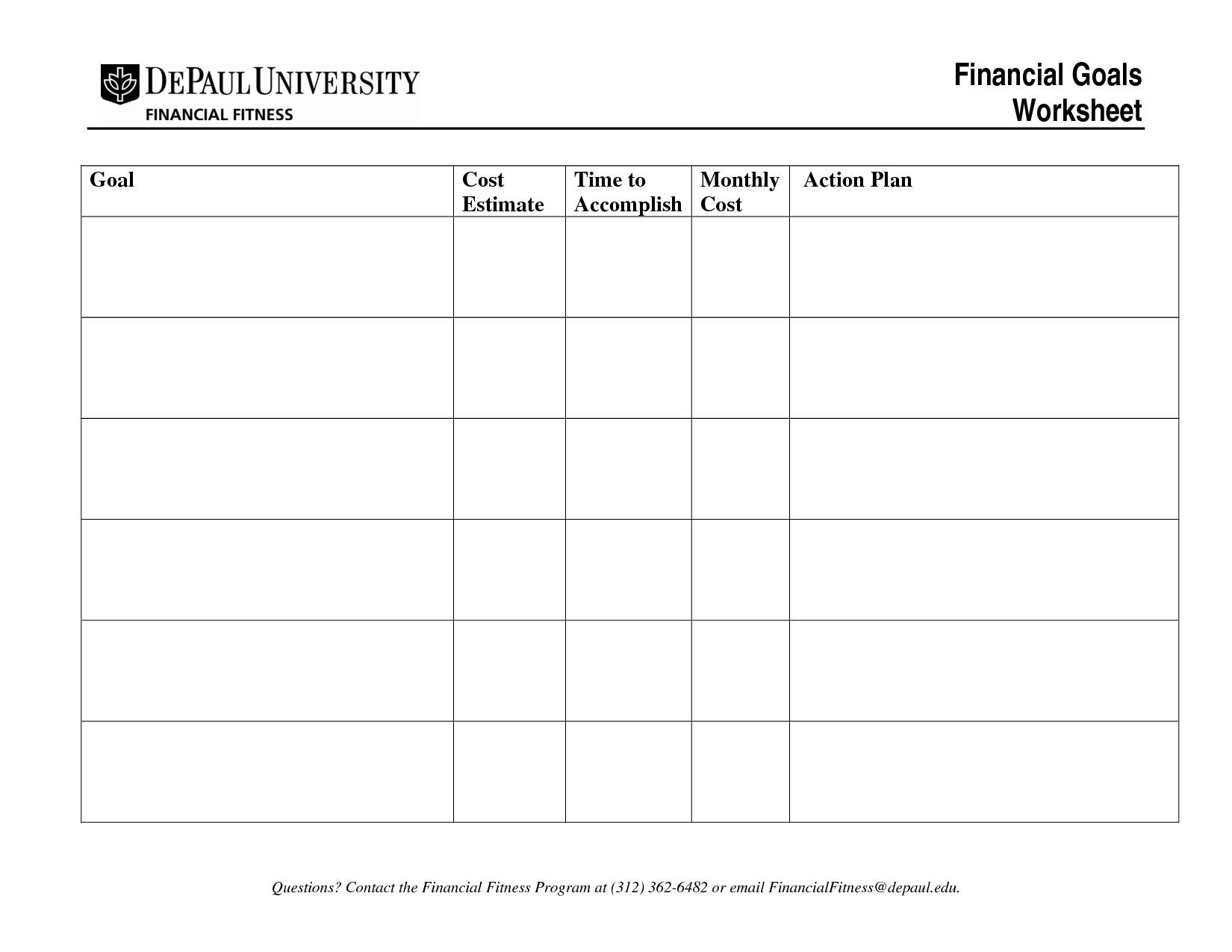

- Goals and Action Plan Template

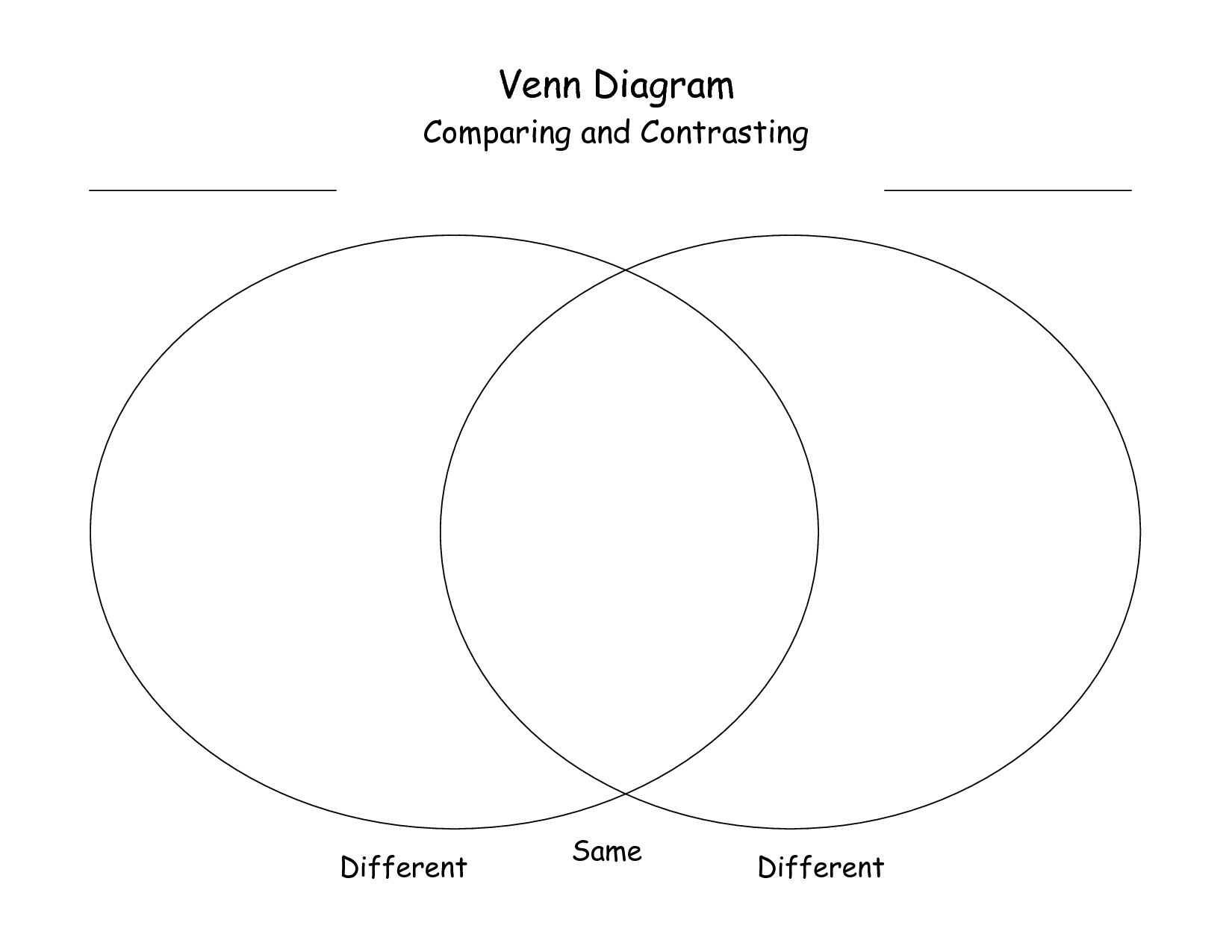

- Blank Venn Diagram Template

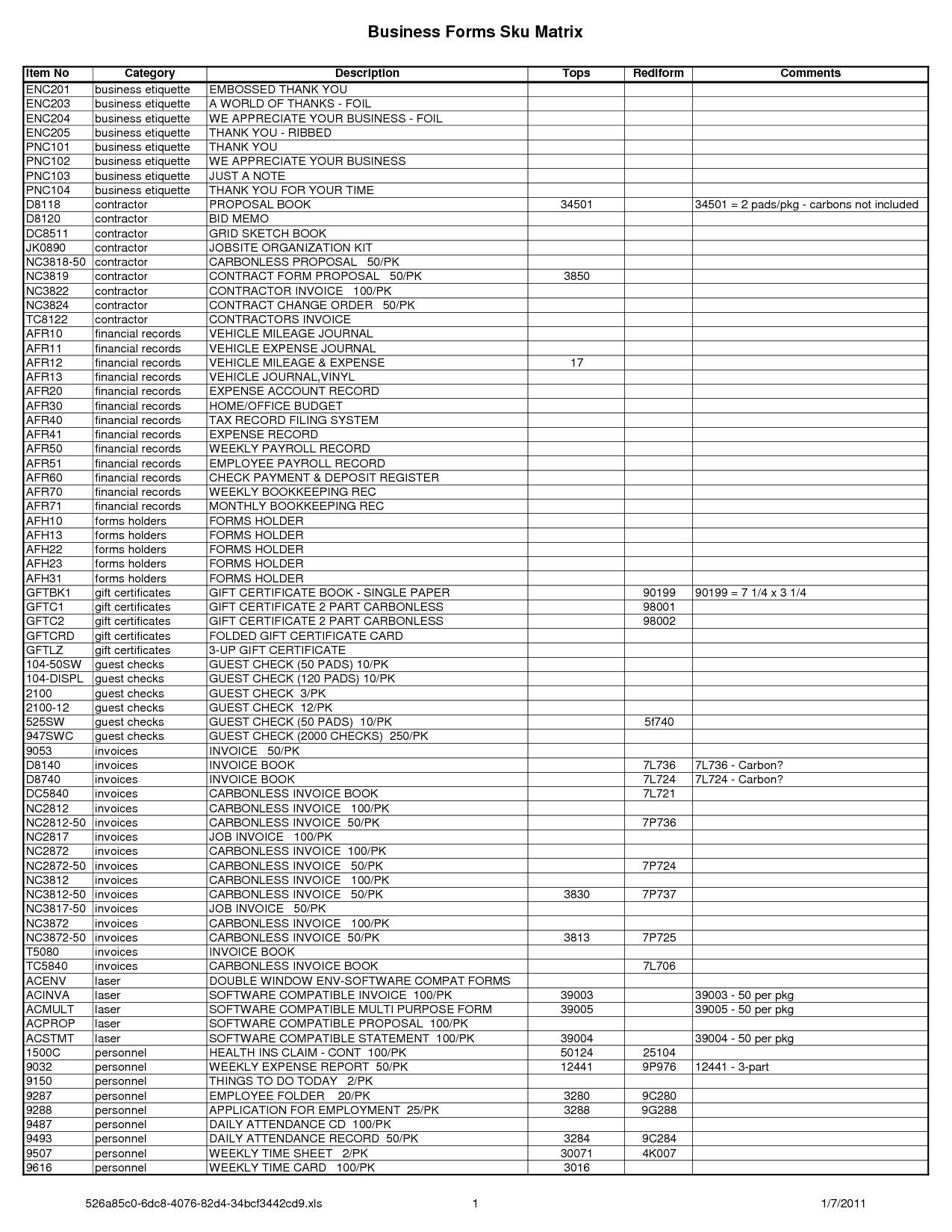

- Receipt Book Template Excel

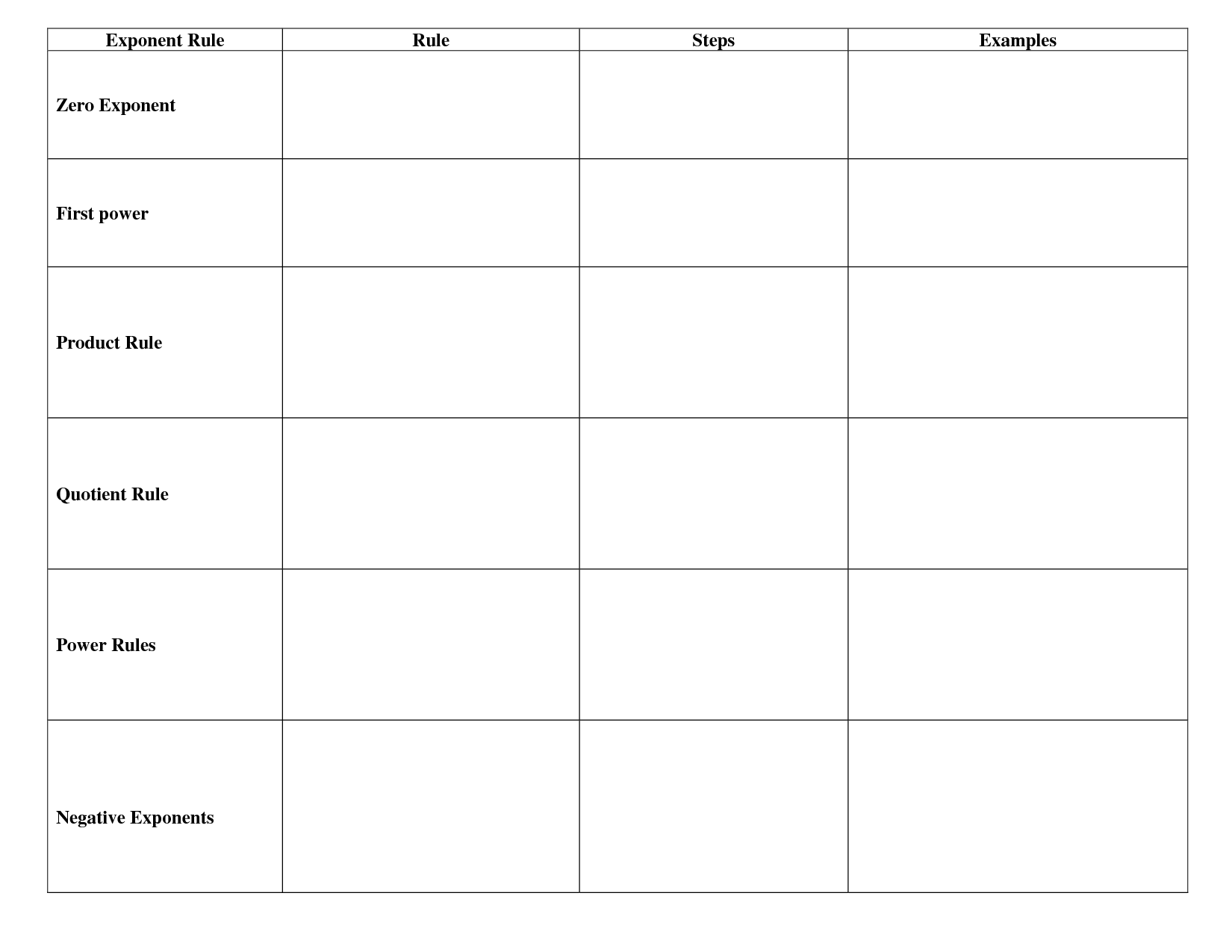

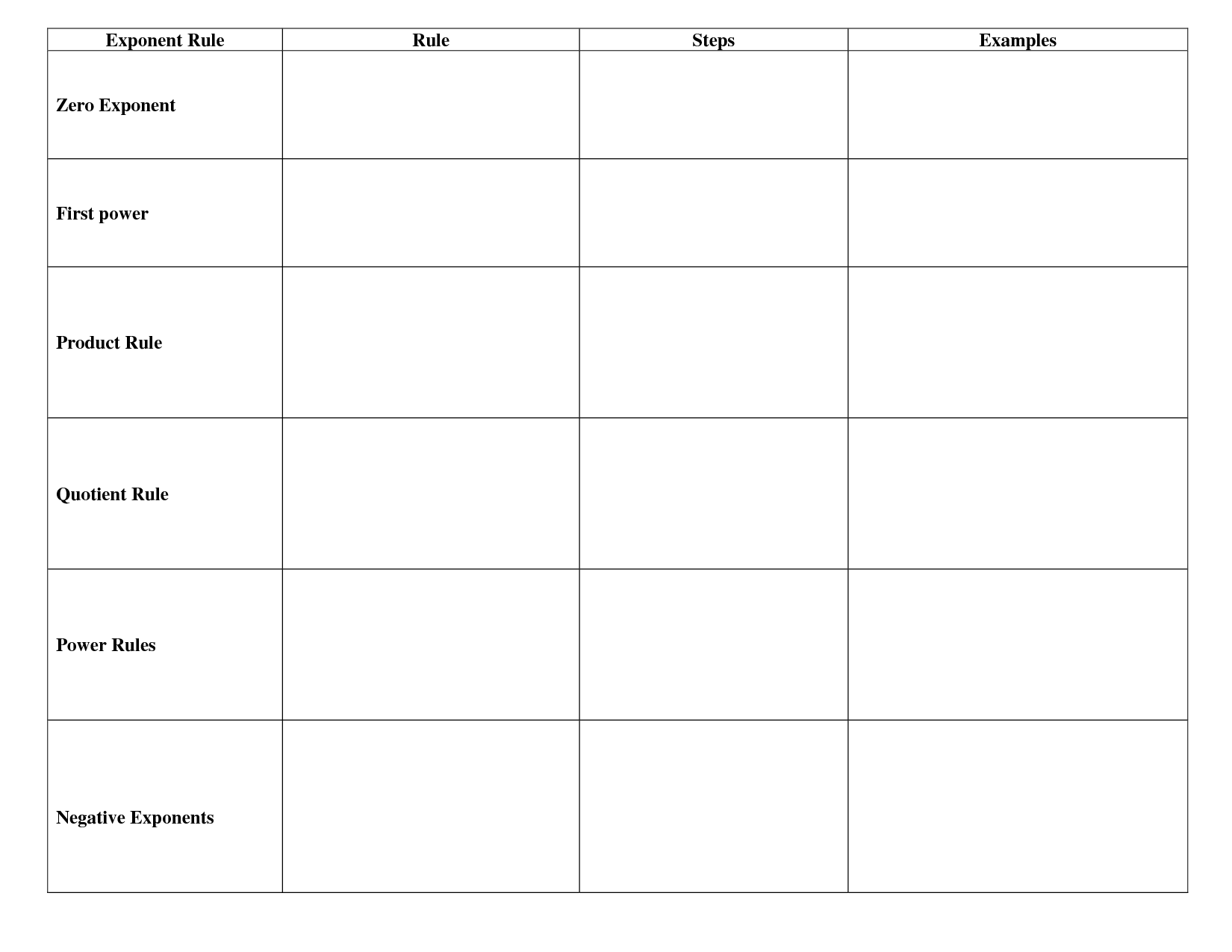

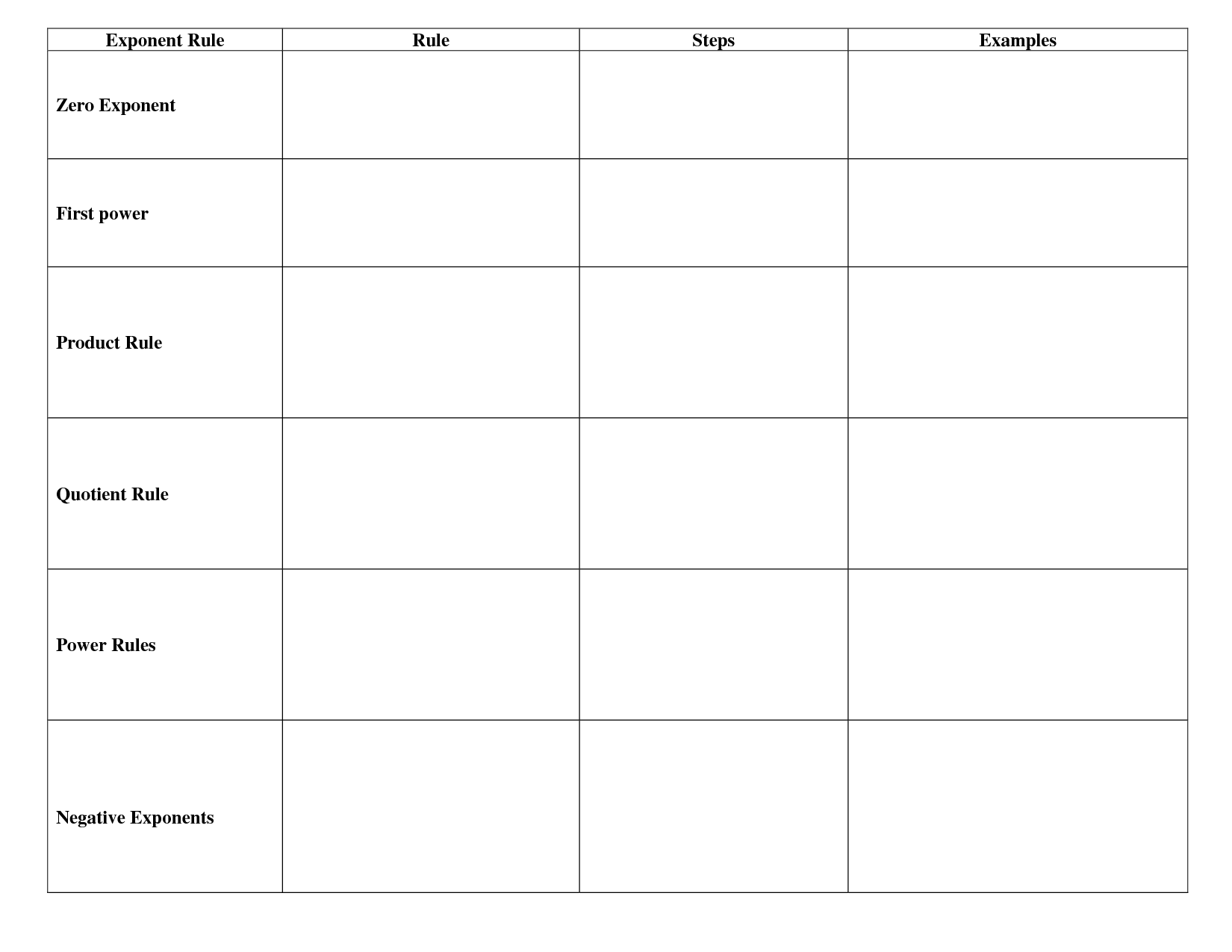

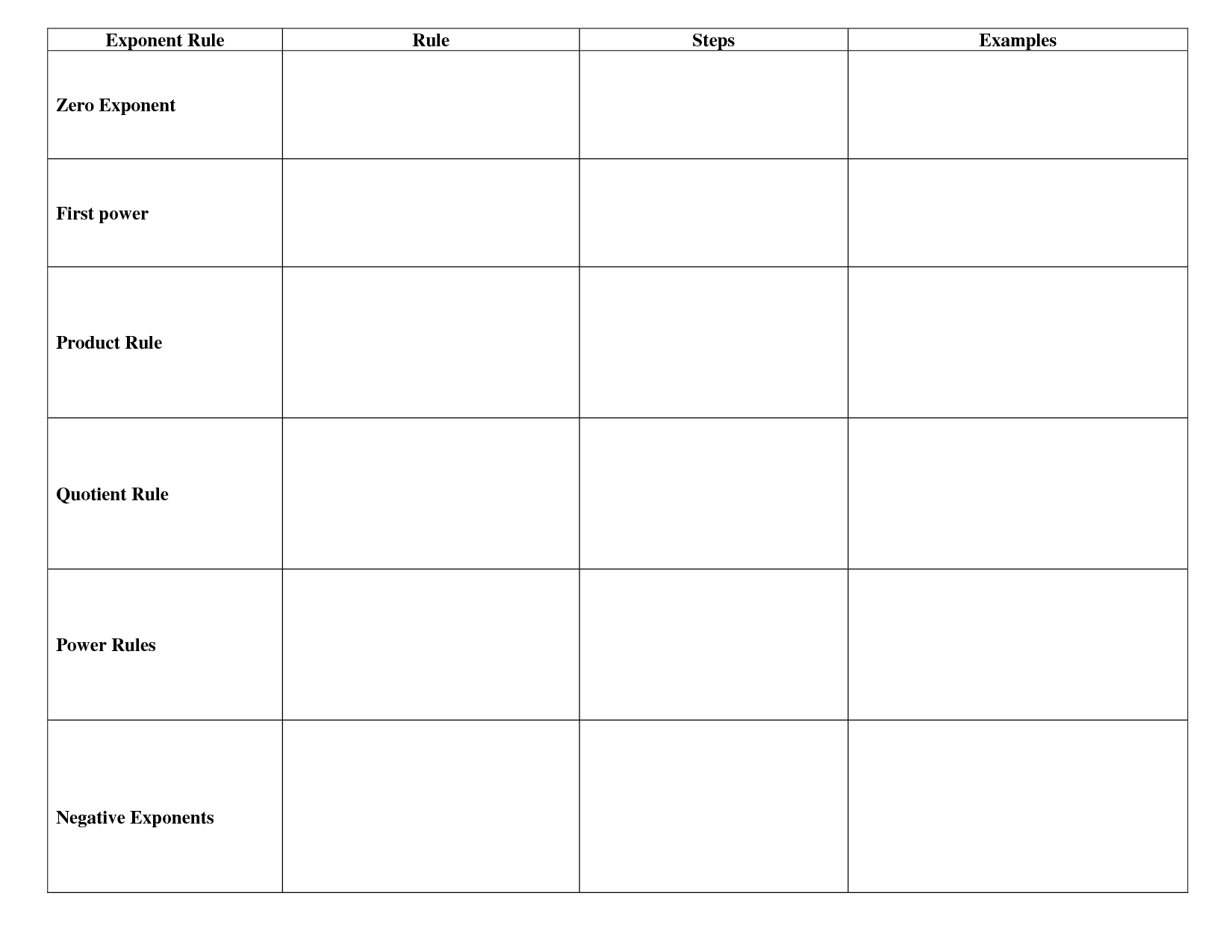

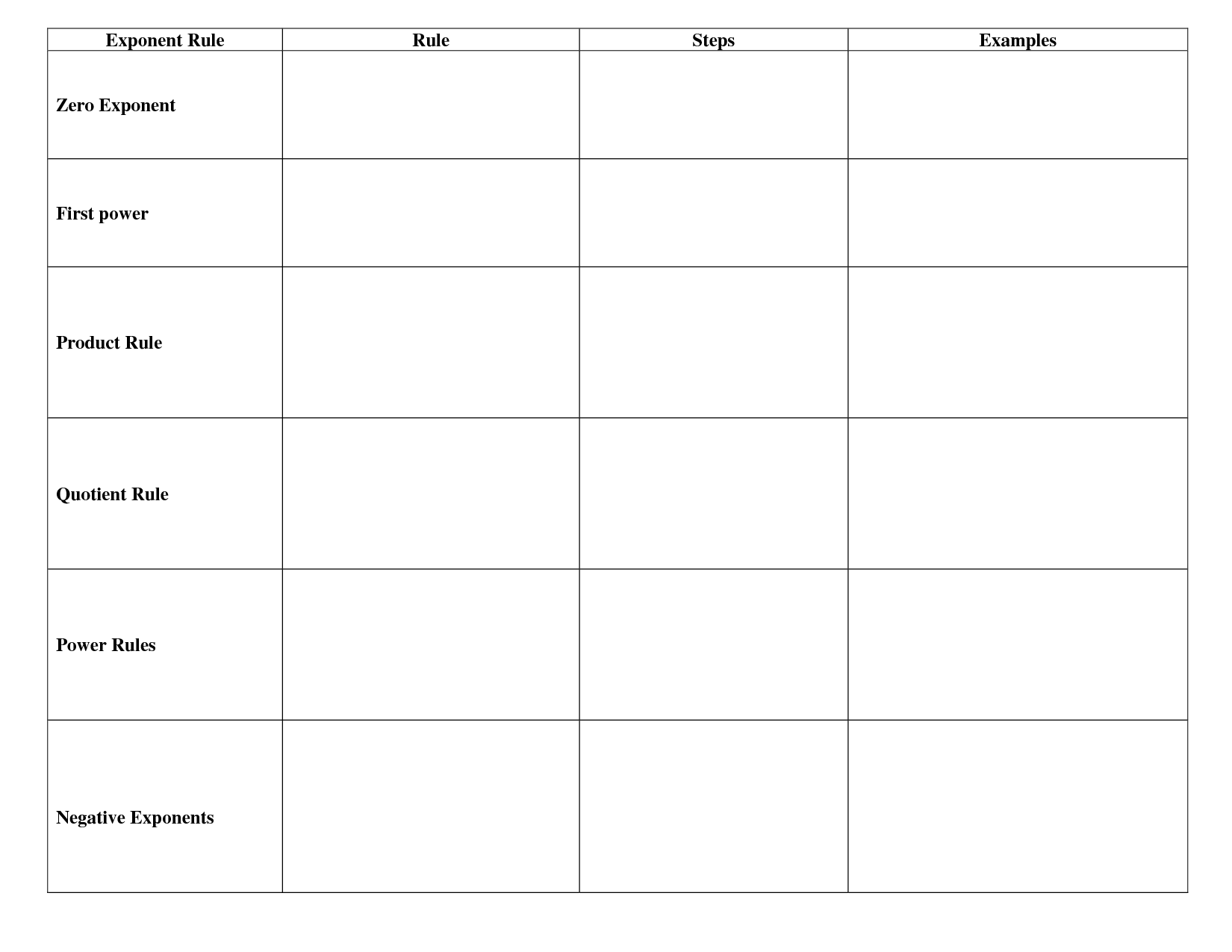

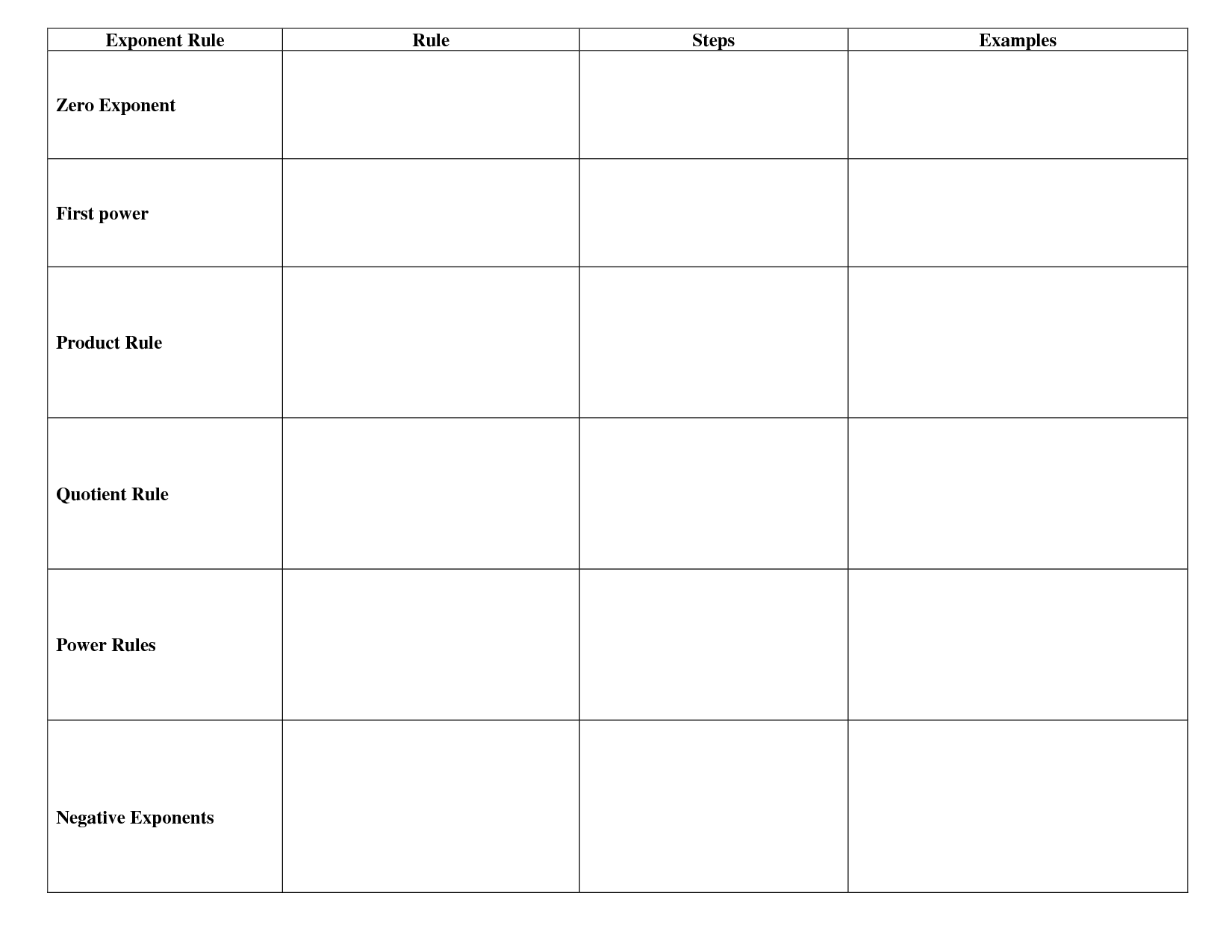

- Exponent Rules Chart Printable

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is the purpose of a Business Tax Organizer Worksheet?

A Business Tax Organizer Worksheet is used to help business owners gather and organize the necessary financial information and documentation needed to file their taxes accurately and efficiently. It provides a structured format for documenting income, expenses, deductions, and other relevant financial details required for tax preparation. By using a Business Tax Organizer Worksheet, business owners can ensure they are properly reporting their financial information and maximizing their tax deductions, ultimately helping to streamline the tax filing process and potentially reduce the risk of errors or audits.

Who typically uses a Business Tax Organizer Worksheet?

Businesses typically use a Business Tax Organizer Worksheet to help gather and organize important financial information needed for preparing and filing their business taxes. This worksheet can simplify the process by categorizing income, expenses, deductions, and other tax-related data in one place, making it easier for businesses to ensure they have all the necessary information ready for tax preparation.

What types of information are typically included in a Business Tax Organizer Worksheet?

A Business Tax Organizer Worksheet typically includes information such as the company's name, address, employer identification number (EIN), contact information, income and expenses statements, asset and liability details, payroll information, previous year's tax returns, record of any tax payments made, and details of any tax deductions or credits applicable to the business. It helps business owners organize and prepare the necessary information needed for filing their tax returns accurately and on time.

How can a Business Tax Organizer Worksheet help with tax preparation?

A Business Tax Organizer Worksheet can help with tax preparation by providing a structured guide for organizing essential financial information such as income, expenses, deductions, and credits. It helps business owners gather all necessary documents and data in one place, ensuring nothing is overlooked. The worksheet can also serve as a reference tool to track and record important details throughout the year, making the tax filing process smoother and more efficient.

Are there any specific sections or categories in a Business Tax Organizer Worksheet?

Yes, a Business Tax Organizer Worksheet typically includes sections such as income, expenses, deductions, assets, liabilities, and other relevant tax information. These categories help organize and collect the necessary data for filing business taxes accurately and efficiently.

How can a Business Tax Organizer Worksheet help in ensuring accurate and complete tax reporting?

A Business Tax Organizer Worksheet can help in ensuring accurate and complete tax reporting by providing a structured template for organizing all necessary financial information, such as income, expenses, deductions, and credits. By using this worksheet, businesses can systematically gather and document all relevant tax details in one place, which can help prevent oversights or errors in reporting. This organized approach also makes it easier for tax preparers to review and verify the information, reducing the risk of inaccuracies and potentially costly audits. It ultimately streamlines the tax preparation process and facilitates compliance with tax laws, leading to more accurate and complete tax reporting.

Are there any specific instructions for filling out a Business Tax Organizer Worksheet?

It's important to carefully review the instructions provided with the Business Tax Organizer Worksheet before filling it out. Typically, you will be asked to gather relevant financial documents such as income statements, balance sheets, and expense records. Make sure to accurately report all income sources, deductions, and credits to ensure compliance with tax regulations. Additionally, double-check your entries for accuracy and completeness before submitting the worksheet to avoid any potential errors or issues with your tax return.

Can a Business Tax Organizer Worksheet be customized or tailored to fit specific business needs?

Yes, a Business Tax Organizer Worksheet can be customized or tailored to fit specific business needs. By working with a tax professional or using customizable templates, the worksheet can be adjusted to include relevant information, categories, and calculations that align with the unique requirements of a specific business. This customization can help ensure that all necessary information is captured accurately and that the tax preparation process is streamlined and efficient.

What are the benefits of using a Business Tax Organizer Worksheet for tax professionals?

A Business Tax Organizer Worksheet can greatly benefit tax professionals by helping them efficiently gather and organize relevant financial information from their clients. This tool ensures that no important details are overlooked during the tax preparation process, saving time and reducing the risk of errors. With a structured layout, the worksheet streamlines the collection of data, making it easier for tax professionals to analyze financial records and accurately complete tax returns. Additionally, using a Business Tax Organizer Worksheet can enhance client communication and collaboration, leading to a more effective and productive working relationship.

How can businesses ensure that they have properly utilized a Business Tax Organizer Worksheet for tax filing purposes?

Businesses can ensure they have properly utilized a Business Tax Organizer Worksheet for tax filing by diligently filling out all relevant sections with accurate and updated financial information, organizing and attaching necessary documents, reviewing the information for completeness and accuracy, seeking out professional guidance if needed, and submitting the completed worksheet to their tax preparer well ahead of the filing deadline to allow for any necessary adjustments or clarifications. Regularly updating the worksheet throughout the year with financial transactions also helps in ensuring all relevant information is captured for tax purposes.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments