Business Plan Financial Plan Worksheet

The Business Plan Financial Plan Worksheet is a useful tool designed specifically for entrepreneurs and small business owners who are looking to align their financial goals with their overall business strategy. This comprehensive worksheet allows you to track all the necessary financial information, enabling you to effectively plan and manage your business finances.

Table of Images 👆

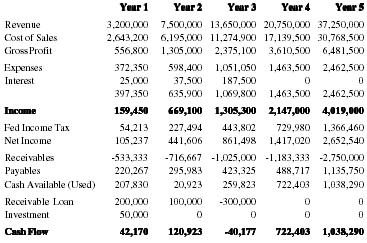

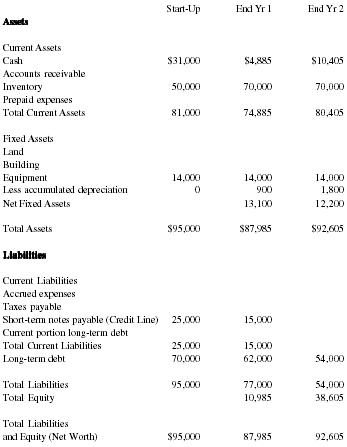

- 3 Year Business Projection Plan

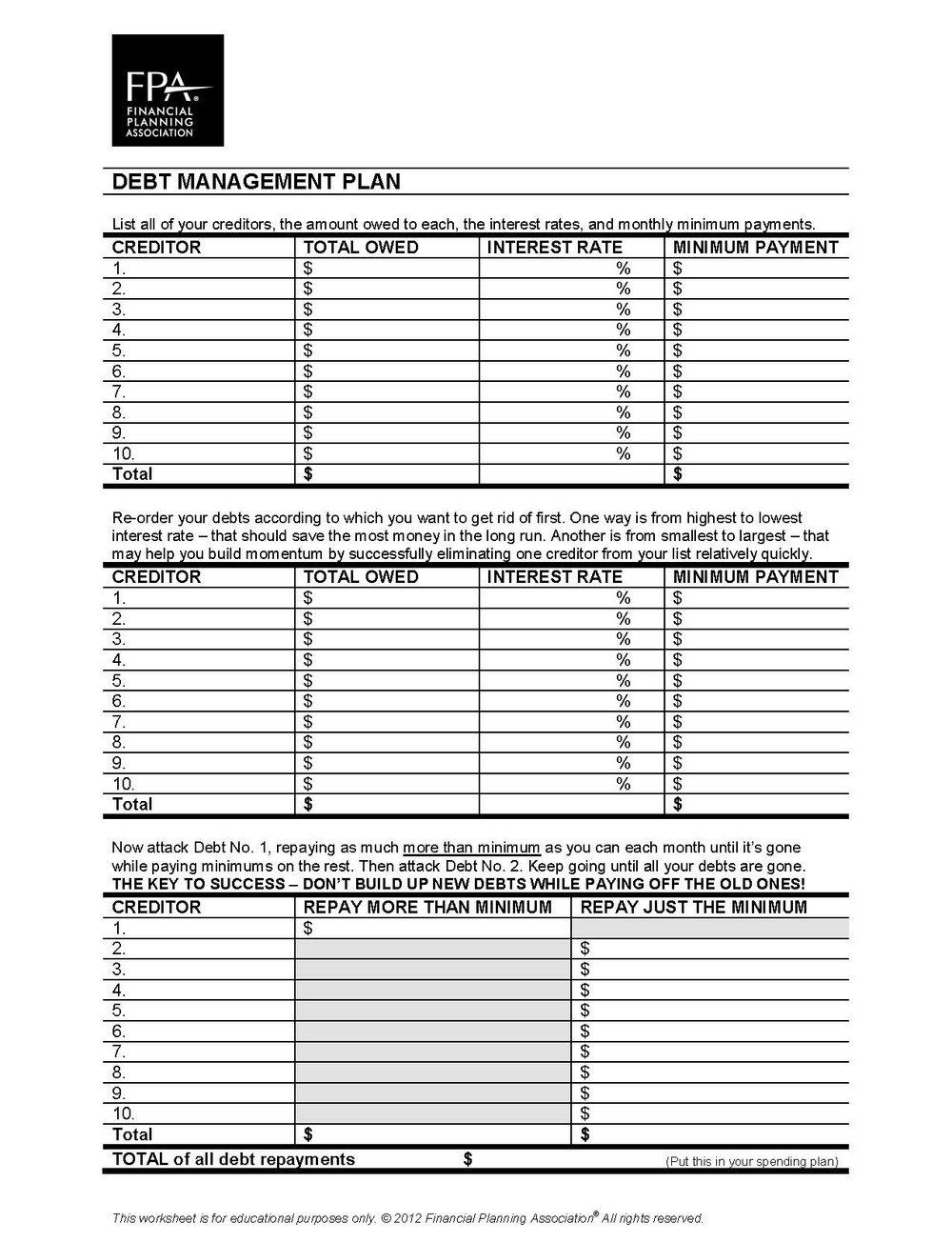

- Spending Plan Worksheet

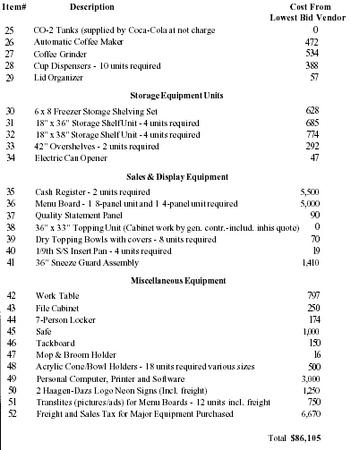

- Pizza Business Plan Template Free

- Ice Cream Truck Business Plan Sample

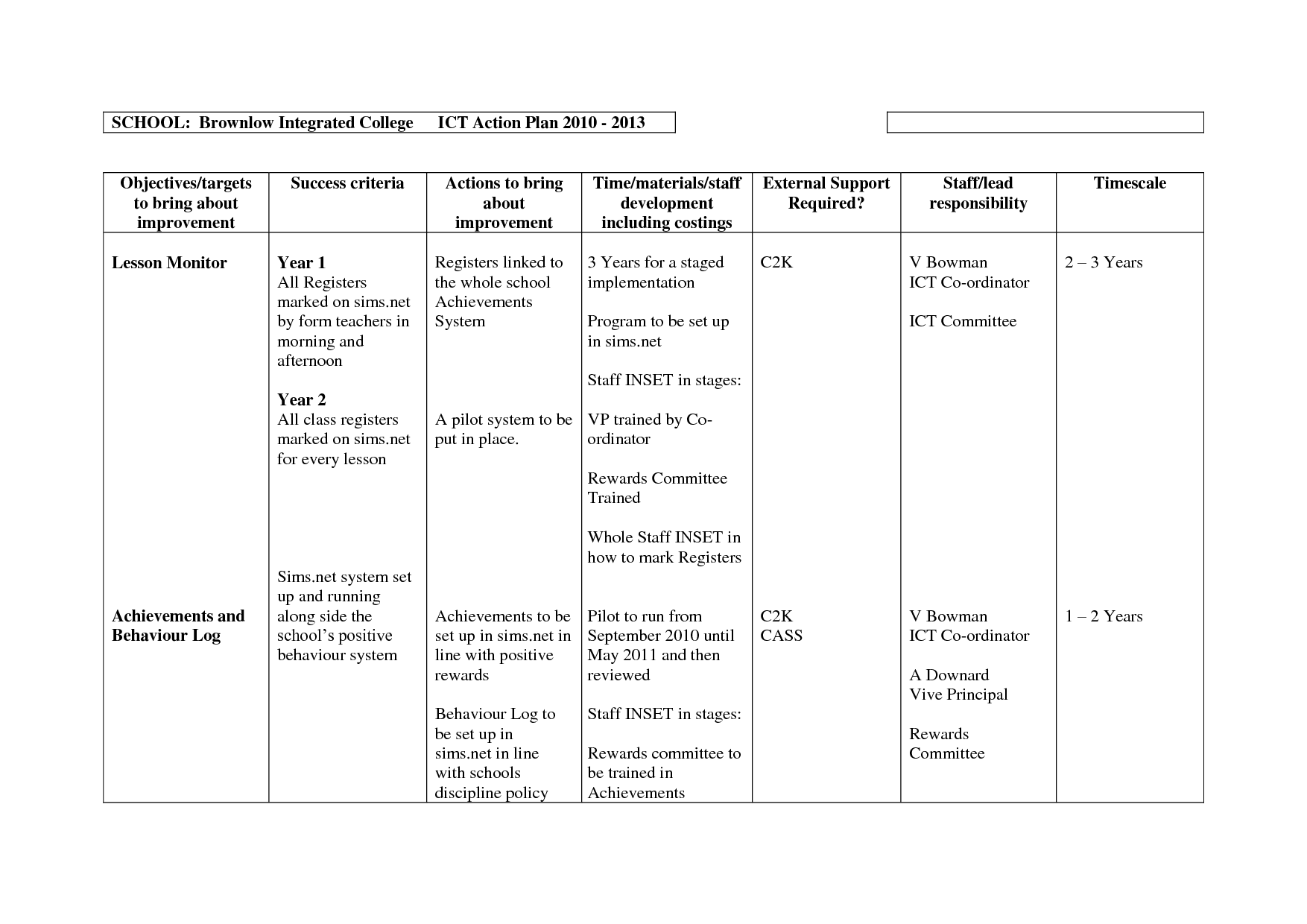

- Engagement Action Plan Template

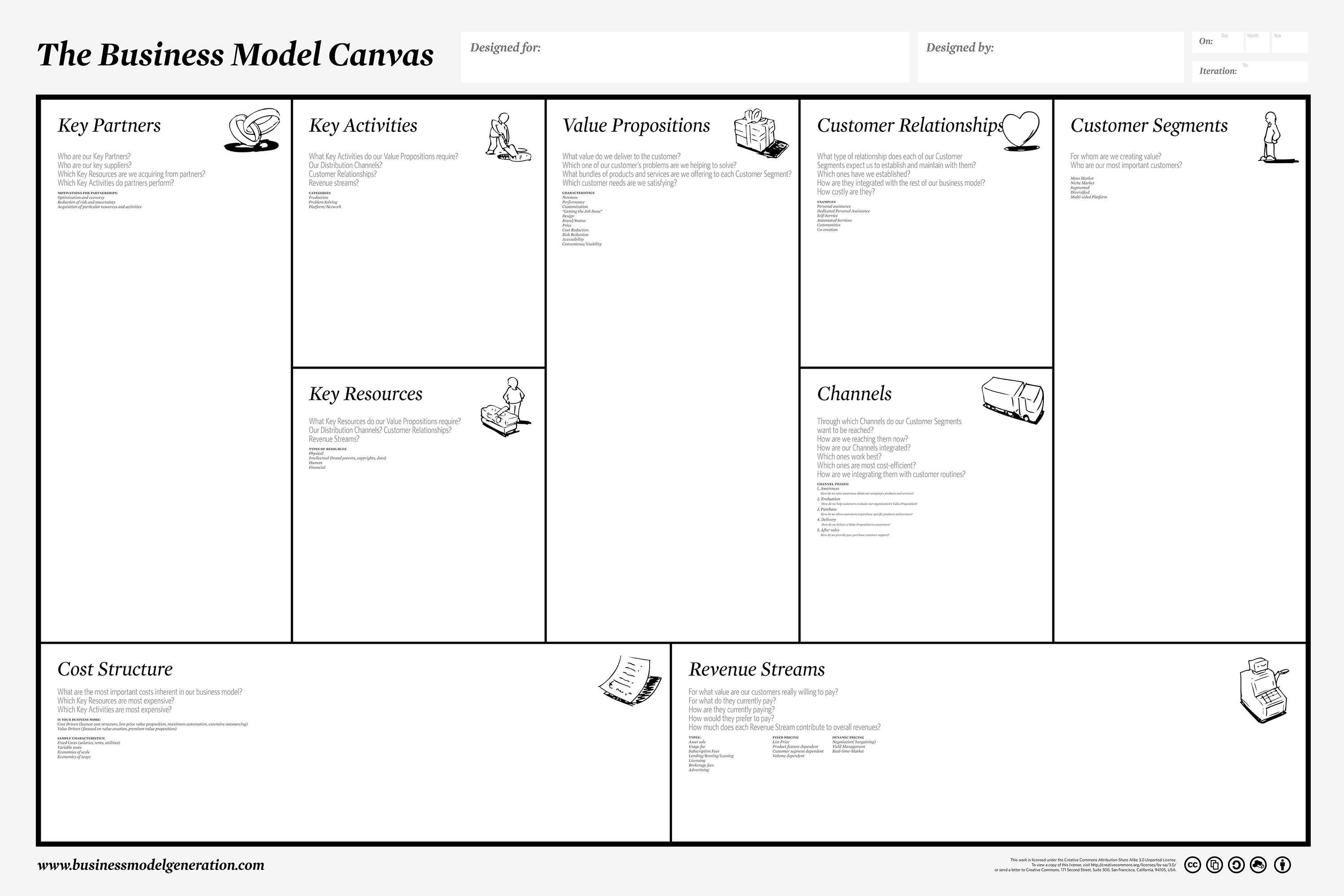

- Business Model Canvas Template

- Goal Setting Worksheet Template

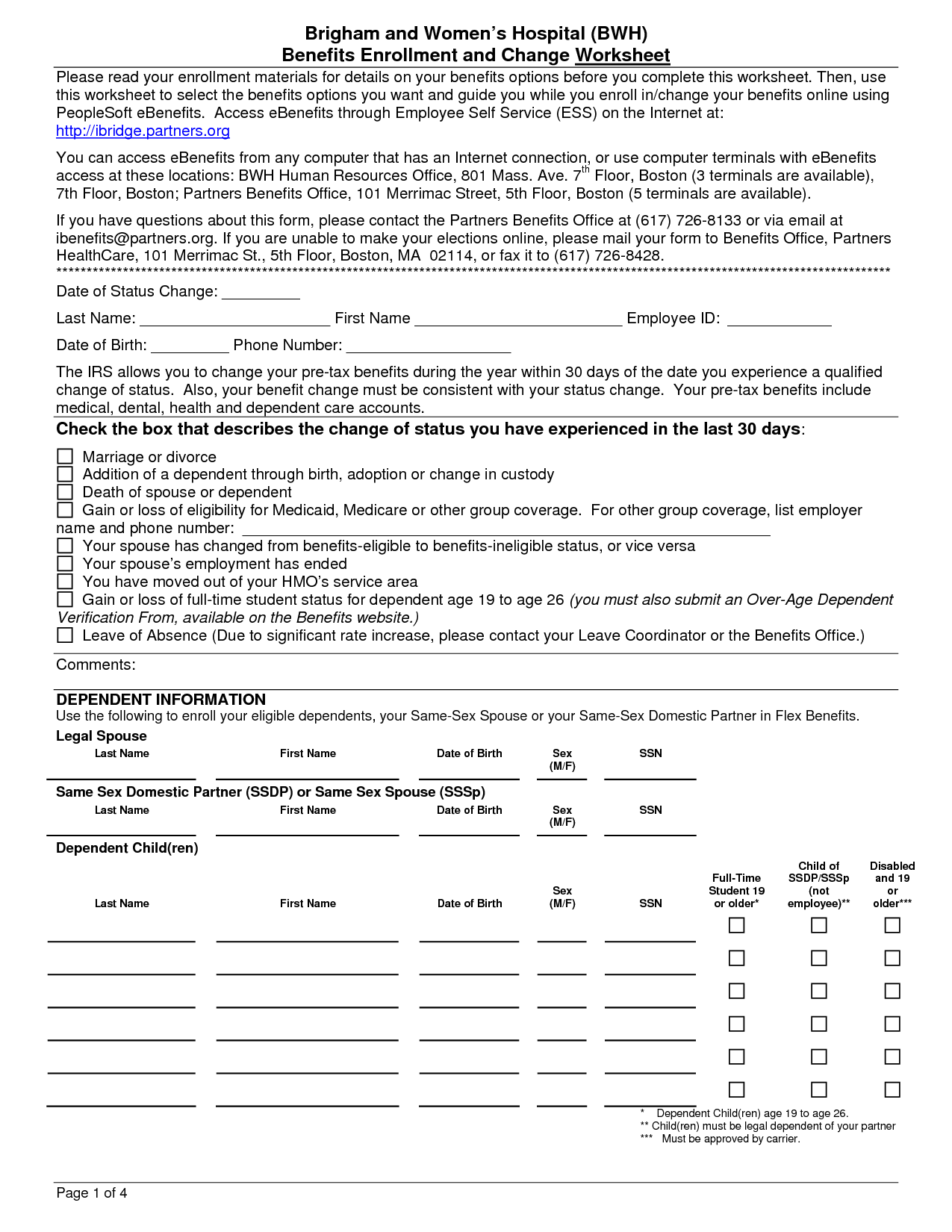

- Benefits of Change Worksheet

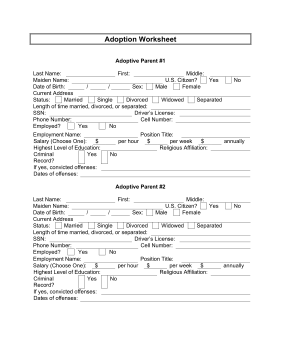

- Printable Child Adoption Papers

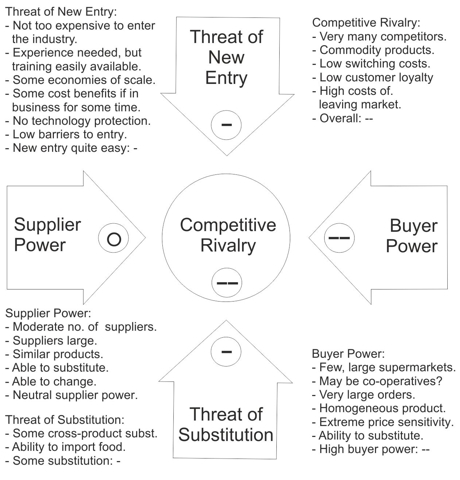

- Porters Five Forces Analysis

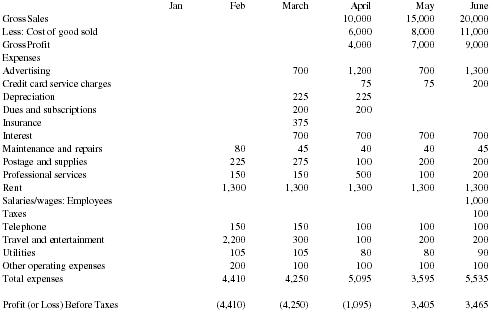

- Projected Income Statement Template

- Business Expenses Definition

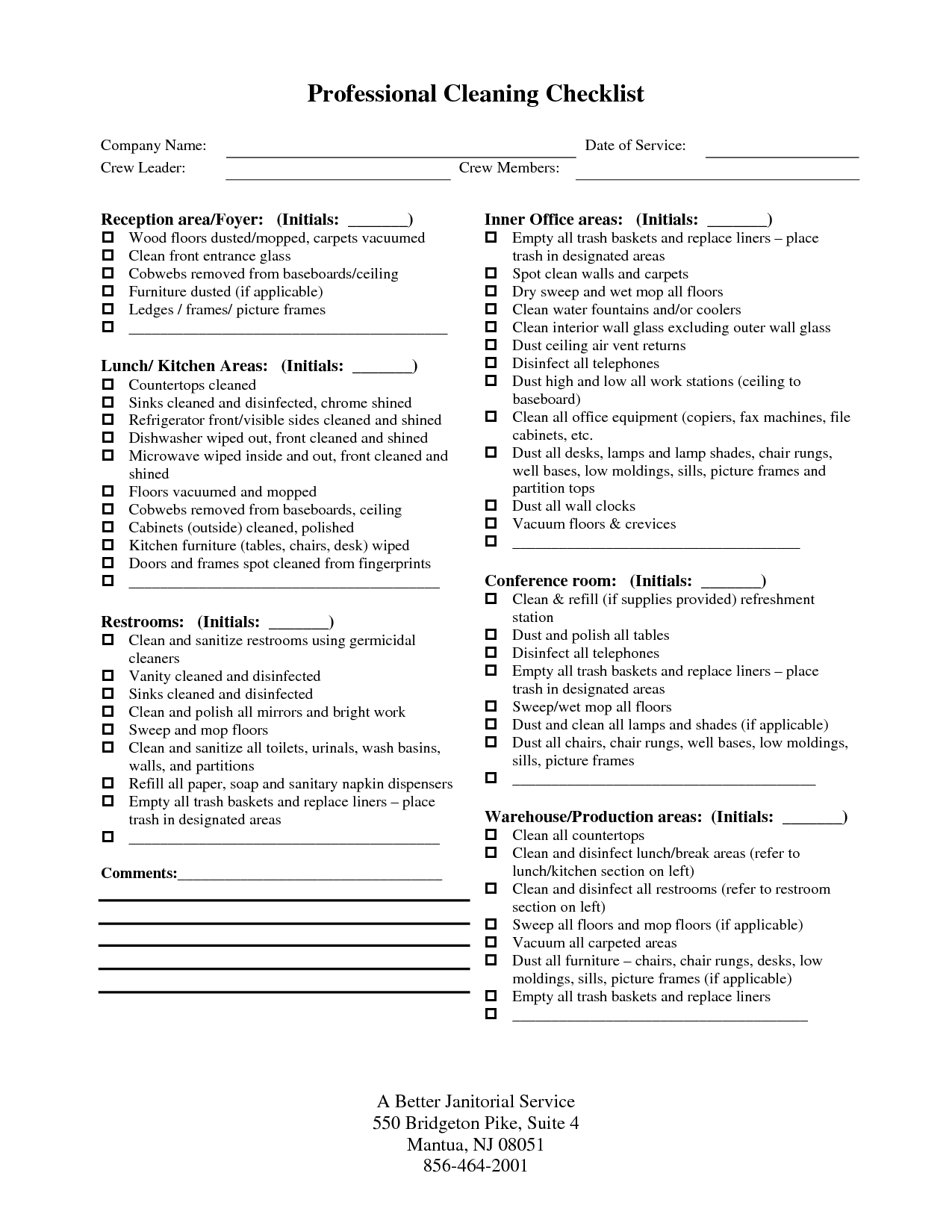

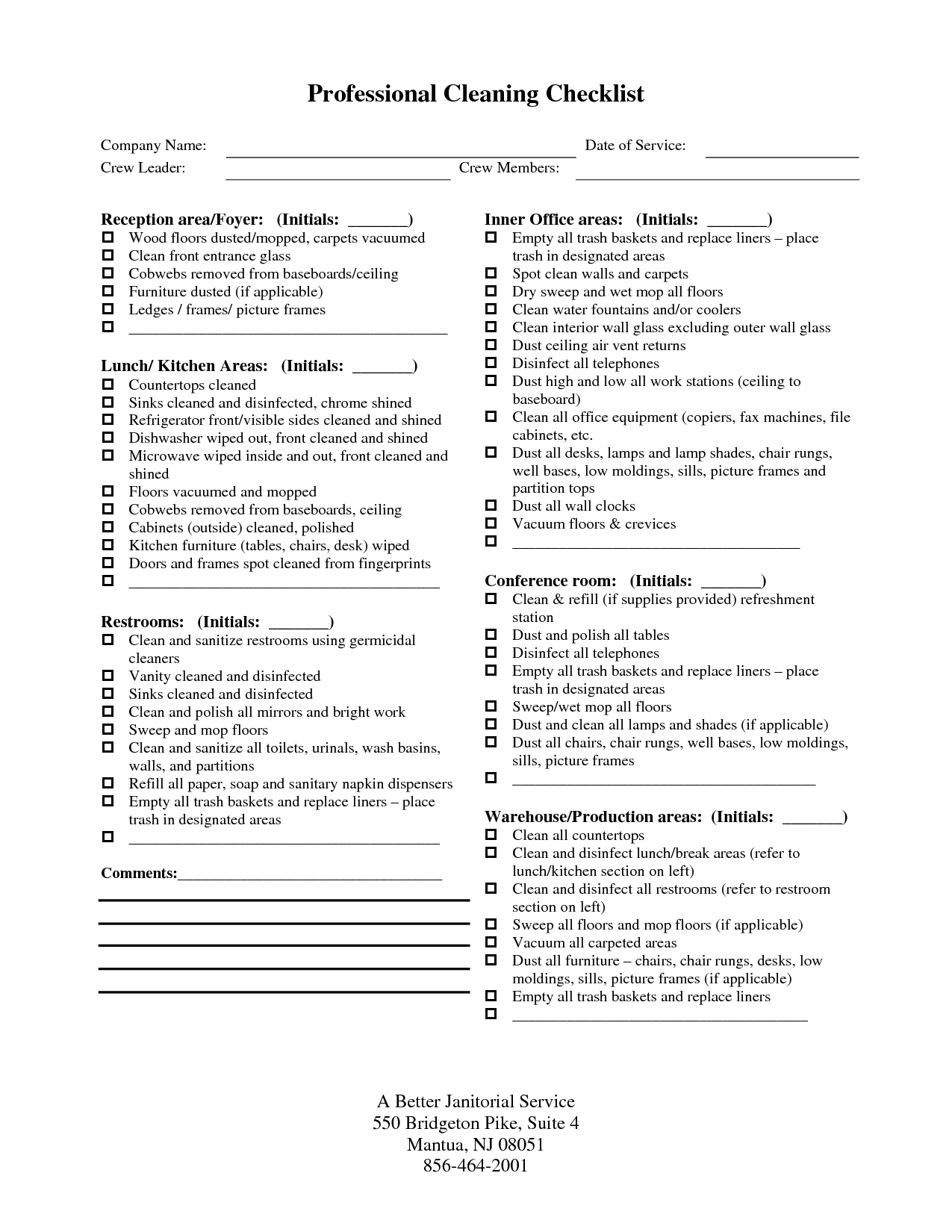

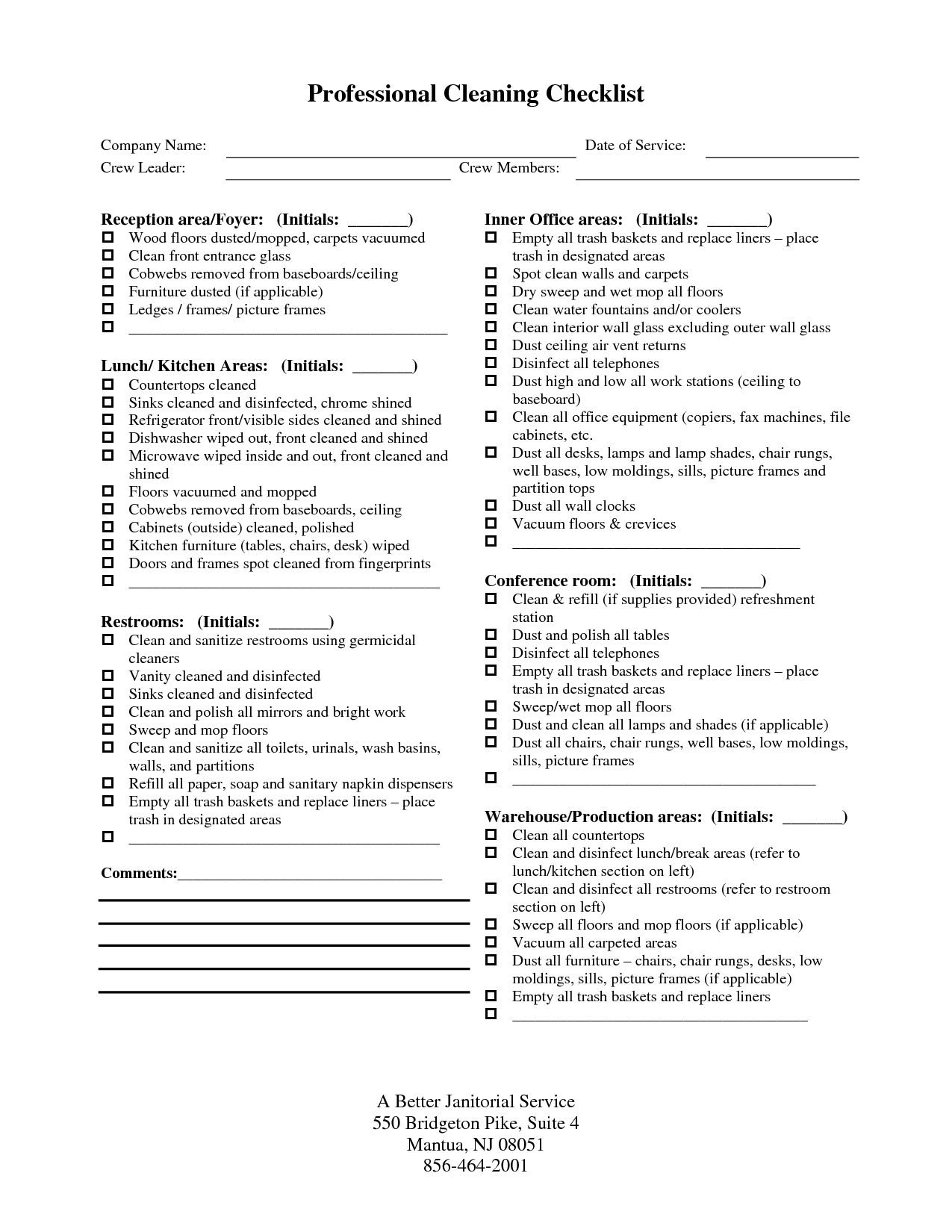

- Professional House Cleaning Checklist Printable

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is the purpose of the Financial Plan Worksheet in a business plan?

The Financial Plan Worksheet serves the purpose of outlining the financial projections and key financial information for a business, including revenue forecasts, expenses, cash flow projections, and break-even analysis. It helps in estimating the financial feasibility and sustainability of the business, identifying potential funding needs, and providing a roadmap for financial decision-making and strategic planning. Additionally, it is a crucial tool for investors and stakeholders to assess the financial health and future prospects of the business.

What are the key components included in the Financial Plan Worksheet?

The key components included in a financial plan worksheet typically consist of income sources, expenses, savings goals, debts, assets, and a budget breakdown. This document helps individuals or businesses to track and manage their finances effectively by outlining their financial obligations, income streams, and long-term financial objectives. It provides a comprehensive overview of one's financial health and guides decision-making processes for better money management and wealth accumulation.

How is revenue projected and calculated in the Financial Plan Worksheet?

Revenue is projected and calculated in the Financial Plan Worksheet by estimating the number of units sold or services rendered multiplied by the price per unit or service. This calculation gives the total projected revenue for each period. Additionally, revenue projections may take into consideration factors such as market demand, competition, seasonal trends, and anticipated growth to determine a realistic and achievable revenue forecast for the business.

What expenses should be taken into consideration while preparing the Financial Plan Worksheet?

When preparing the Financial Plan Worksheet, you should consider all expenses such as fixed and variable costs, operating expenses, taxes, loan payments, interest payments, insurance premiums, utilities, salaries and wages, marketing expenses, equipment costs, lease payments, and any other costs directly related to running and growing the business. It is essential to account for both ongoing operational expenses as well as one-time expenses to accurately estimate and plan for the financial needs of the business.

How are operating costs determined in the Financial Plan Worksheet?

Operating costs are typically determined in the Financial Plan Worksheet by listing out all the expenses incurred in running the business on a regular basis. These costs can include items such as rent, utilities, salaries, supplies, insurance, marketing, and other overhead expenses. By identifying and estimating the amount for each cost, the total operating expenses can be calculated to provide a clear picture of the financial obligations and cash flow requirements of the business.

How is the cash flow projected and analyzed in the Financial Plan Worksheet?

Cash flow is projected and analyzed in the Financial Plan Worksheet by forecasting the inflows and outflows of cash over a specific period of time, typically monthly or annually. Inflows of cash include revenue from sales, loans, investments, and other sources, while outflows consist of expenses such as salaries, utilities, rent, and loan repayments. By comparing these inflows and outflows, businesses can determine their net cash flow, which helps in understanding their financial health, liquidity, and ability to cover expenses and invest in growth opportunities. This analysis is crucial in making strategic financial decisions and ensuring the long-term sustainability of the business.

What financial ratios and metrics are typically assessed in the Financial Plan Worksheet?

In a Financial Plan Worksheet, common financial ratios and metrics that are typically assessed include profitability ratios (such as net profit margin and return on investment), liquidity ratios (such as current ratio and quick ratio), leverage ratios (such as debt-to-equity ratio), efficiency ratios (such as asset turnover ratio), and growth metrics (such as revenue growth rate and customer acquisition cost). These ratios and metrics help in evaluating the financial health, performance, and sustainability of a business, providing insights for decision-making and strategic planning.

How is the break-even analysis conducted within the Financial Plan Worksheet?

Break-even analysis is conducted within the Financial Plan Worksheet by calculating the point at which total revenues equal total costs, resulting in zero profit or loss. This is achieved by identifying fixed costs, variable costs, and selling price per unit. Then, the break-even point is determined by dividing the total fixed costs by the difference between the selling price per unit and the variable cost per unit. This analysis helps businesses understand the level of sales needed to cover costs and start generating profit.

What role does the Financial Plan Worksheet play in assessing the feasibility and profitability of a business venture?

The Financial Plan Worksheet plays a crucial role in assessing the feasibility and profitability of a business venture by outlining all the financial aspects of the business, including startup costs, operational expenses, revenue forecasts, and cash flow projections. By organizing this information in a structured manner, entrepreneurs can identify potential risks, estimate the amount of funding needed, determine when the business is expected to break even and start generating profits, and assess the overall financial health of the venture. This tool helps entrepreneurs make informed decisions and develop strategies to ensure the long-term success of their business.

How does the Financial Plan Worksheet assist in securing funding or attracting investors?

The Financial Plan Worksheet assists in securing funding or attracting investors by providing a clear and detailed overview of the financial health and projections of the business. It showcases the potential profitability, revenue streams, expenses, and financial needs of the venture, enabling investors to assess the viability and potential return on investment. Additionally, it demonstrates that the business has a strategic and well-thought-out plan for managing its finances, which can instill confidence in potential investors or lenders.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments