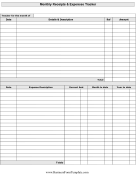

Business Income Coverage Worksheet

The Business Income Coverage Worksheet is a useful tool for small business owners to assess their financial situation. This comprehensive document allows individuals to evaluate their business income and expenses, helping them make informed decisions about insurance coverage. By diligently filling out this worksheet, entrepreneurs can gain a clear understanding of their financial standing and ensure they have adequate protection for their entity.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is the purpose of the Business Income Coverage Worksheet?

The purpose of the Business Income Coverage Worksheet is to help businesses calculate and determine the appropriate amount of coverage needed to protect their income in the event of a business interruption or loss. This worksheet takes into account various factors such as the company's financial statements, operating expenses, and anticipated revenues to provide an estimate of the potential income loss during a period of disruption. By using this worksheet, businesses can ensure they have the right level of coverage to safeguard their financial stability in times of crisis.

What types of expenses are typically included in the calculation of business income?

Expenses included in the calculation of business income typically encompass costs incurred in the regular course of operating a business, such as rent, utilities, salaries, supplies, insurance, advertising, taxes, and depreciation of assets. These expenses are subtracted from the total revenue to determine the net income or profit of the business. Additionally, interest expenses, amortization, and other operating costs directly related to generating revenue may also be considered in the calculation of business income.

How is net income calculated for business income coverage?

To calculate net income for business income coverage, start with the business's total revenues and deduct all expenses incurred during the same period, including operating expenses, non-operating expenses, and any taxes paid. The resulting figure is the net income, which represents the profit generated by the business after all deductions have been accounted for. This net income figure is essential for determining the amount of coverage needed to protect the business's income in the event of a disruption or loss.

What are the different methods used to determine the amount of business income coverage needed?

There are several methods to determine the amount of business income coverage needed, including the coinsurance method, the actual loss sustained method, the gross earnings form, the gross profits form, and the maximum period of indemnity. Each method considers factors such as historical financial data, projected income, expenses, and potential risks to determine the appropriate level of coverage needed to protect a business's income in the event of a disruption. It's essential for businesses to carefully assess their unique situation and consult with insurance professionals to select the method that best suits their needs.

What information is typically included in the worksheet when determining business income coverage?

When determining business income coverage, the worksheet typically includes details such as the business's historical financial data, projected revenue and expenses, business interruption risks, potential extra expenses to continue operations, and financial impact analysis due to various perils such as fire, natural disasters, or other disruptions. This information helps insurers calculate the appropriate coverage amount for the business to ensure it can recover from any interruptions or loss of income.

How does the worksheet take into account potential changes in revenue and expenses?

The worksheet takes into account potential changes in revenue and expenses by allowing for dynamic input fields where users can adjust values to simulate different scenarios. By modifying these values, users can see how it impacts the overall financial picture, enabling them to make informed decisions based on different revenue and expense projections. This flexibility helps in forecasting potential changes and making strategic adjustments to the budget accordingly.

What factors should be considered when estimating the time period for business income coverage?

When estimating the time period for business income coverage, factors to consider include the potential duration of a business interruption, such as repair or restoration time for physical damage, supplier delays, or other factors impacting operations; the industry in which the business operates, as some may have longer recovery times than others; historical data on past interruptions or losses; the time it takes to reach pre-loss levels of revenue and profitability; and any external factors such as government regulations or market conditions that could affect the timeline for resuming normal operations.

How does the worksheet account for additional expenses incurred after a business interruption?

The worksheet accounts for additional expenses incurred after a business interruption by allowing the business to record these expenses separately from its regular operating expenses. These additional expenses may include costs related to repairs, temporary relocation, overtime wages, and any other expenses directly caused by the interruption. By tracking these expenses separately, the business can assess the full impact of the interruption on its financial resources and make informed decisions on how to allocate its funds effectively.

How does the worksheet address extra expenses necessary to minimize the loss of business income?

The worksheet addresses extra expenses necessary to minimize the loss of business income by providing a platform for identifying potential additional costs that may arise in order to maintain business operations during a period of income loss. By accounting for these extra expenses, businesses can better prepare and strategize for unexpected costs that may be incurred in order to minimize the impact on their income stream and overall financial stability.

How does the business income coverage worksheet assist with setting adequate insurance limits for a business?

The business income coverage worksheet helps in determining the appropriate insurance limits for a business by calculating the potential income loss that may occur due to a covered peril, such as a fire or natural disaster. By identifying and estimating various factors such as the business's revenue, expenses, and potential loss of income during a period of interruption, the worksheet helps in setting adequate insurance limits that can safeguard the business against financial loss in the event of a disruption.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments