Business Financial Planning Worksheet

If you're a small business owner or aspiring entrepreneur, having a solid financial plan is crucial for the success of your venture. One tool that can help you stay organized and on track is a business financial planning worksheet. This simple yet effective resource allows you to track your income and expenses, project future cash flows, and make informed decisions about your business's financial health. By utilizing a well-designed financial planning worksheet, you can gain better control over your finances and set yourself up for long-term success.

Table of Images 👆

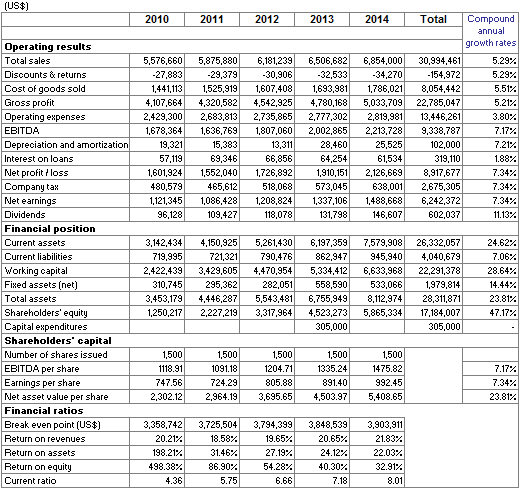

- Business Financial Plan Sample

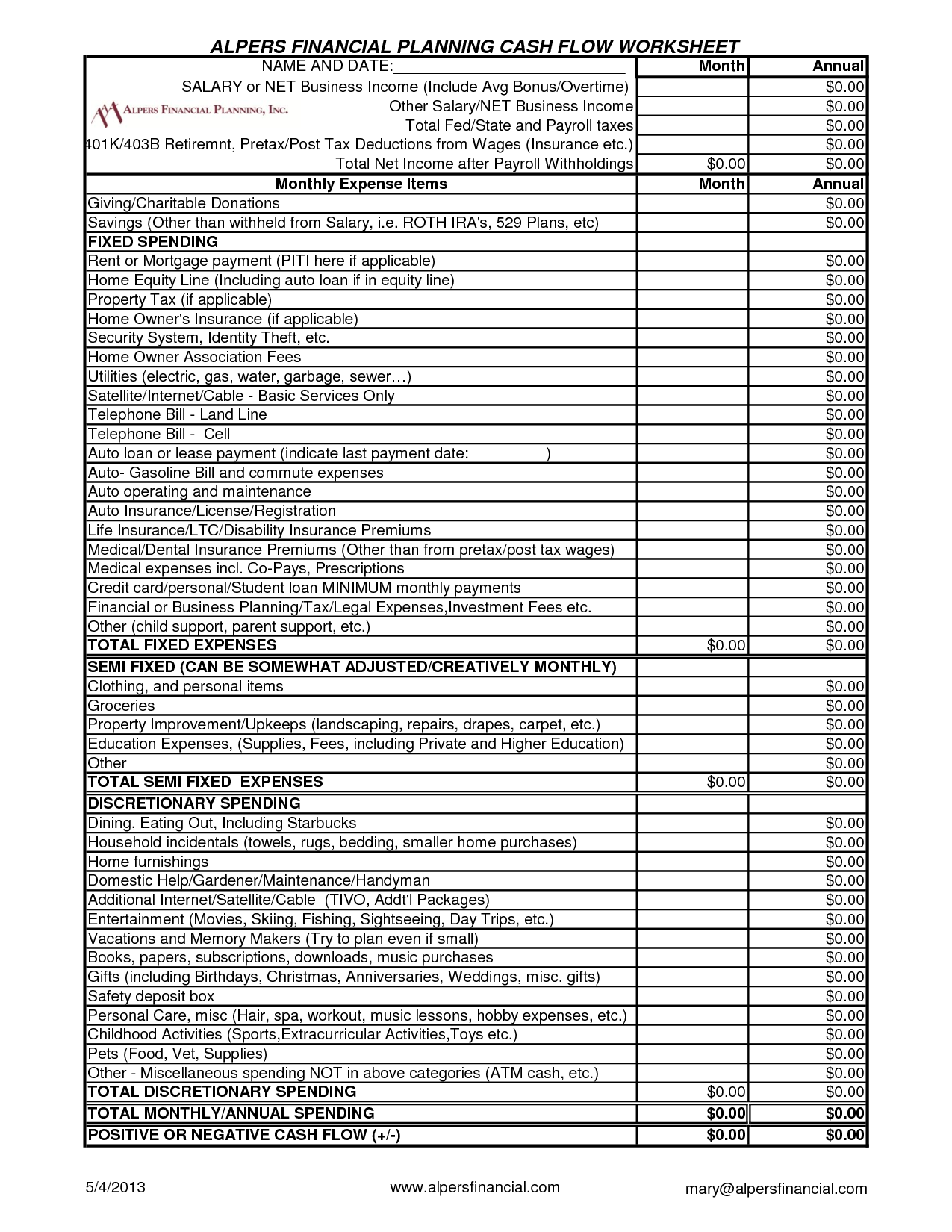

- Cash Flow Planning Worksheets

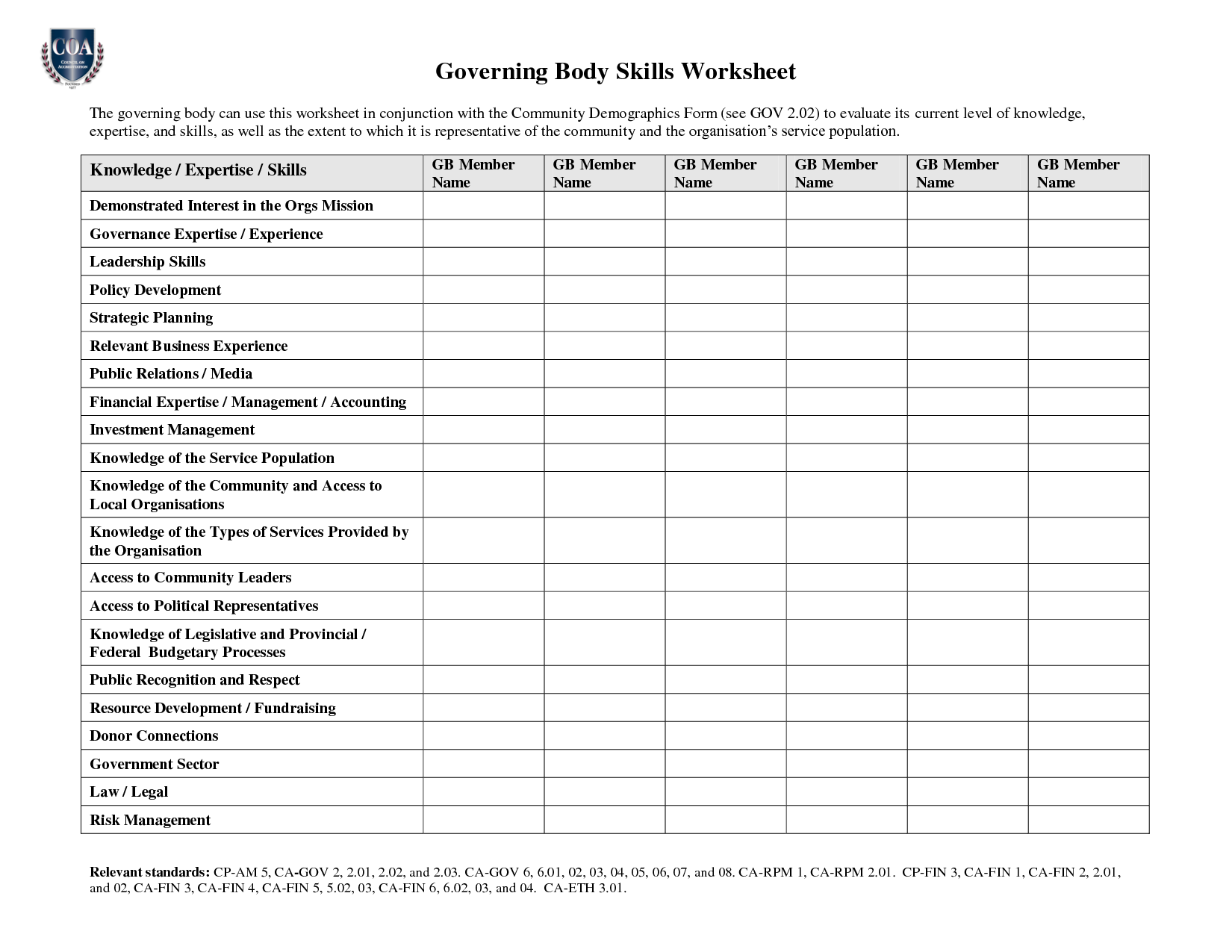

- Community Service Worksheet

- Employee Goal Worksheet

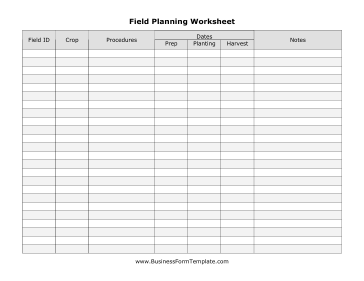

- Free Business Plan Template Worksheet

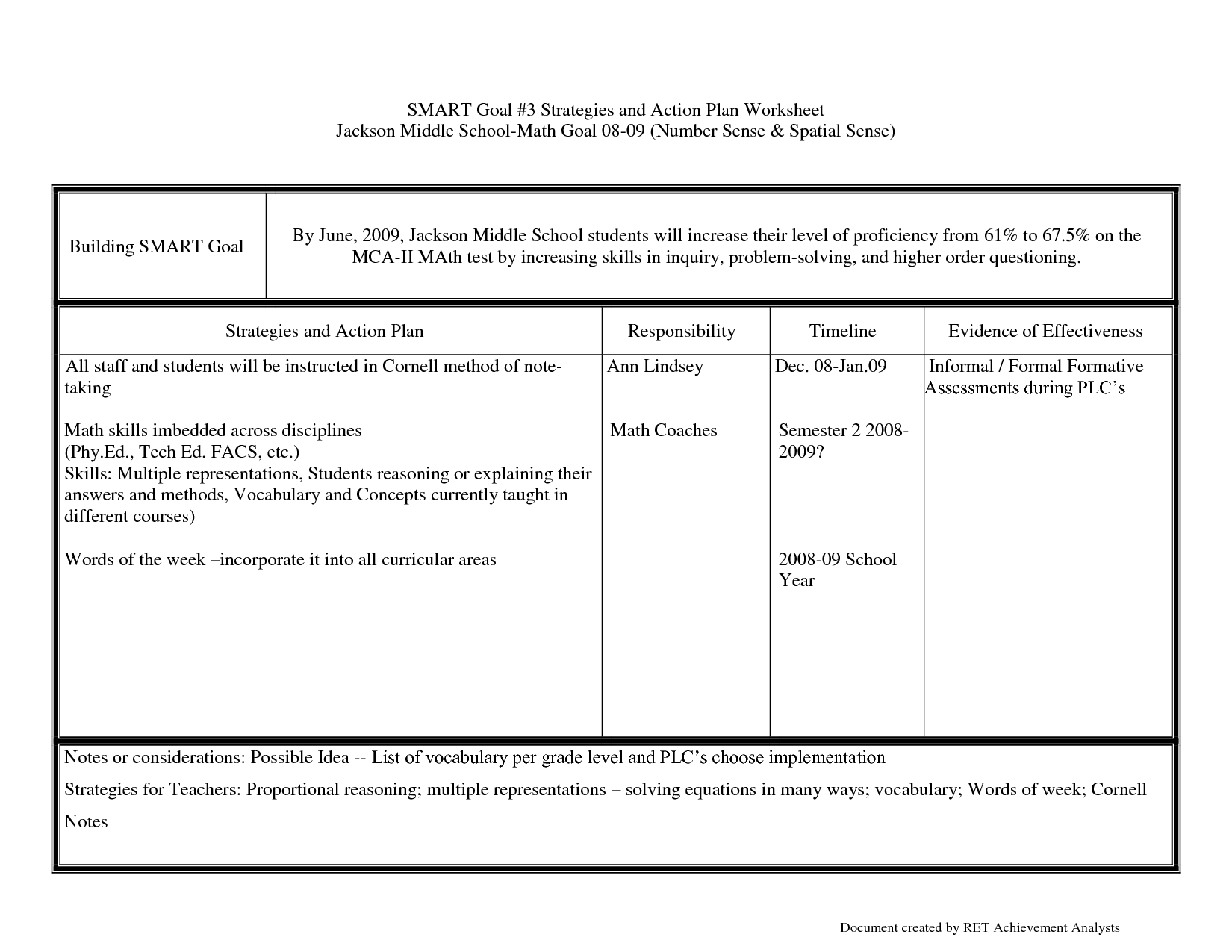

- Smart Goals Worksheet

- Sample Balance Sheet for Service Company

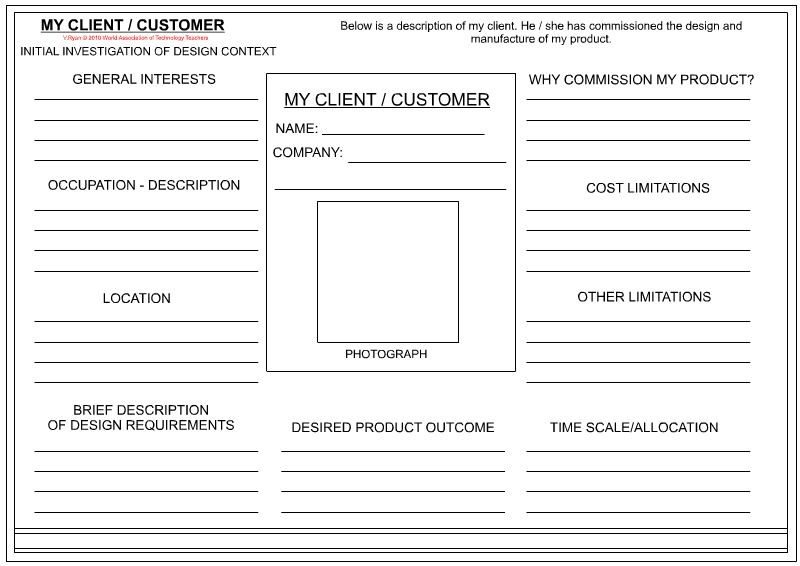

- Customer Profile Sheet Template

- Microsoft Office Excel Worksheet

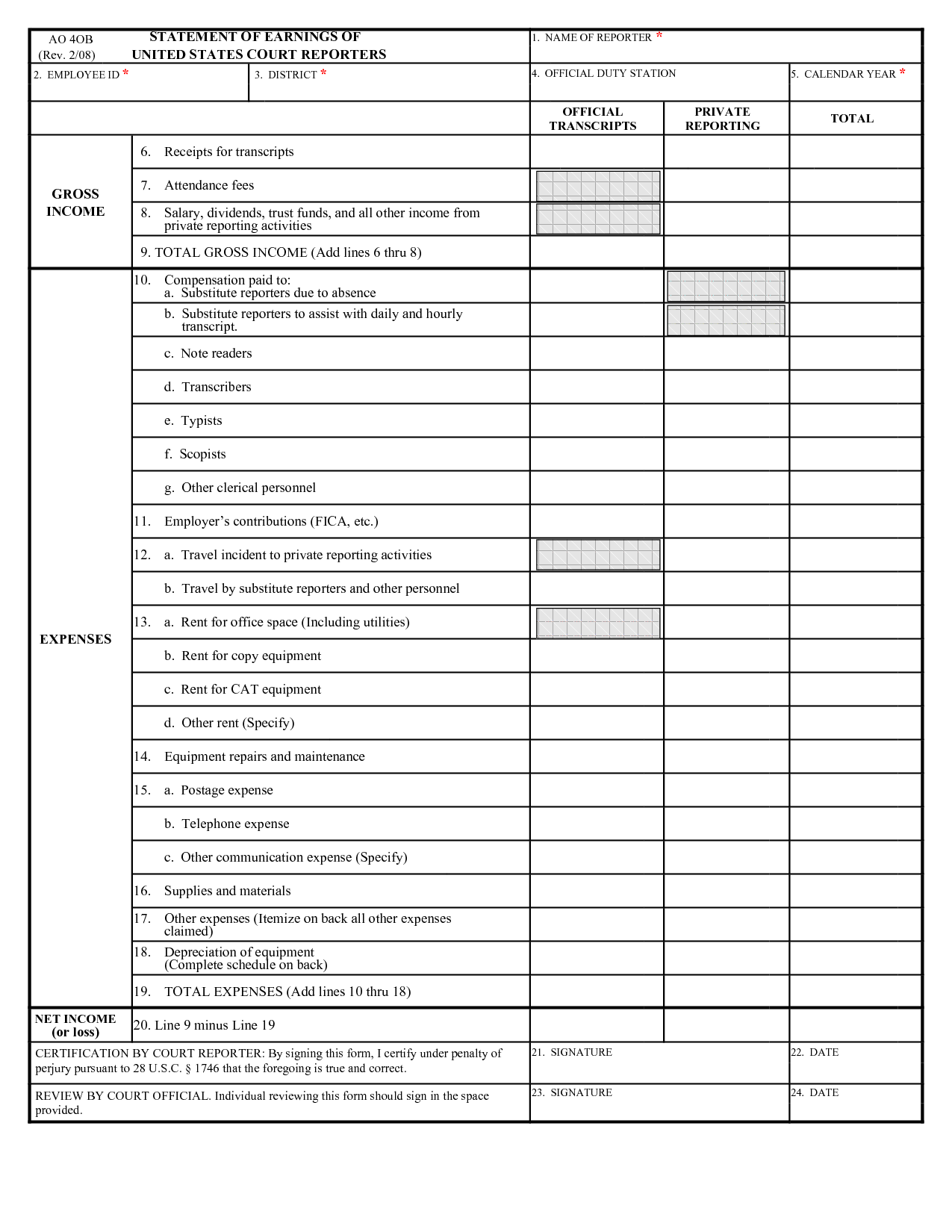

- Blank Income Statement Form

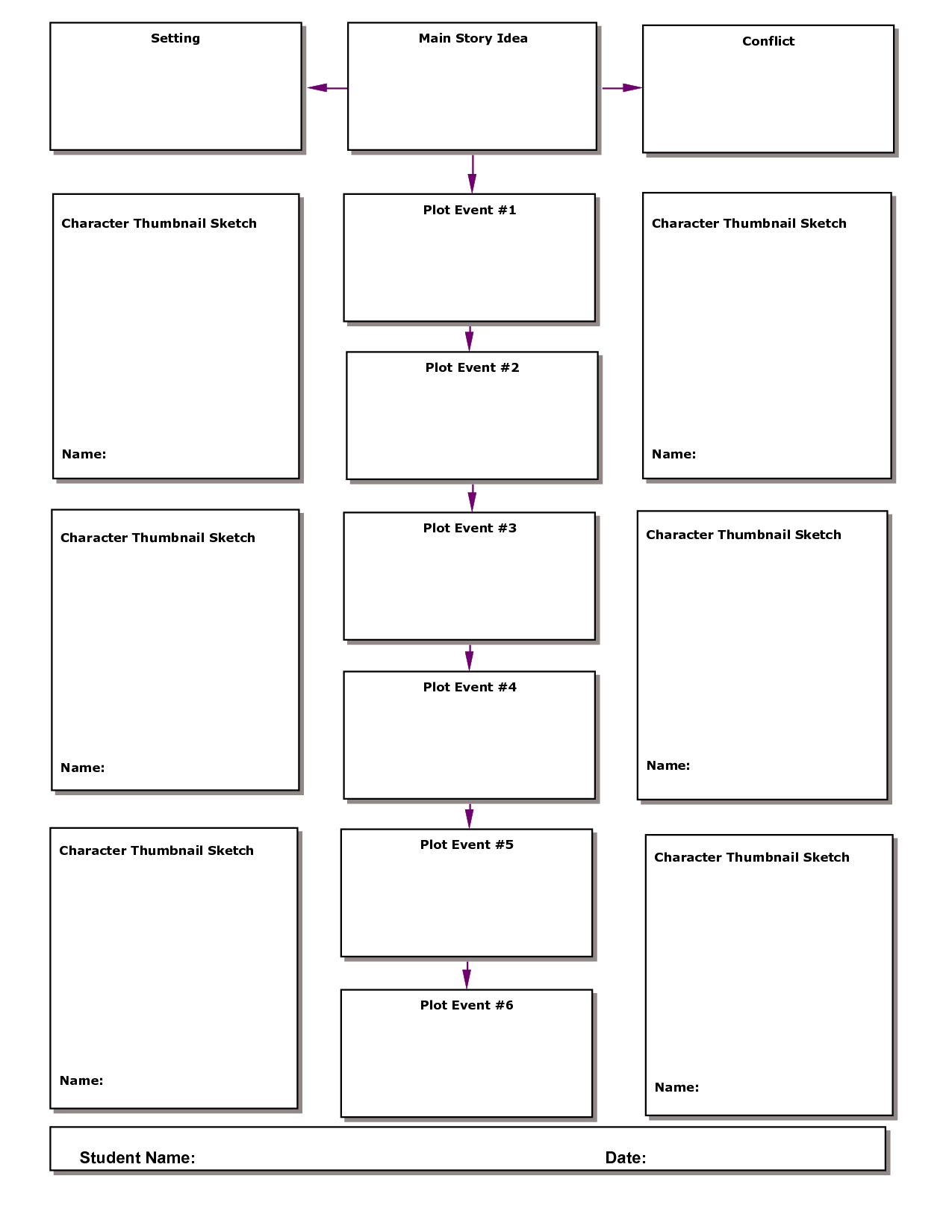

- Plot Character and Setting Worksheets

- Sumatran tiger

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a business financial planning worksheet?

A business financial planning worksheet is a tool used to organize and calculate all financial aspects of a business, including revenues, expenses, and projections. It helps business owners or managers to set financial goals, create budgets, track performance, and make informed decisions to ensure the financial health and success of the business. This worksheet typically includes sections for income sources, expenses, cash flow projections, balance sheets, and other relevant financial information.

Why is a business financial planning worksheet important for businesses?

A business financial planning worksheet is important for businesses because it helps to organize and track financial information, create budgets, forecast financial needs, and analyze performance. By using a financial planning worksheet, businesses can make informed decisions, set financial goals, monitor progress, and ensure financial stability and growth. It serves as a valuable tool for managing finances efficiently, identifying potential issues early on, and guiding strategic decision-making to achieve long-term success.

What are the key components of a business financial planning worksheet?

A business financial planning worksheet typically includes key components such as revenue projections, expense forecasts, cash flow analysis, profit margins, balance sheets, and income statements. It also involves assessing and updating important financial ratios, setting financial goals, and creating an overall budget to guide the company's financial decision-making. Additionally, it may include considerations for investments, risk management, and contingency planning to ensure the business remains financially stable and profitable in the long term.

How can a business financial planning worksheet help with budgeting?

A business financial planning worksheet can help with budgeting by providing a structured framework for organizing and tracking financial information, such as revenues, expenses, and cash flow projections. It allows businesses to identify areas where they can reduce costs, allocate resources effectively, and set realistic financial goals. By using a financial planning worksheet, businesses can monitor their financial health, make informed decisions, and adapt their budgeting strategies in response to changing circumstances.

What are the key steps to creating a business financial planning worksheet?

To create a business financial planning worksheet, start by outlining your financial goals and objectives. Next, list all sources of revenue and categorize expenses to determine your cash flow. Include projections for sales, costs, and profits. Consider factors like market trends and customer behavior. Create a detailed budget that covers operational expenses, capital investments, and contingencies. Review and update your worksheet regularly to track progress and adjust strategies accordingly. Be sure to consult with financial professionals for guidance and expertise.

How can a business financial planning worksheet assist with forecasting future financial performance?

A business financial planning worksheet can assist with forecasting future financial performance by providing a structured framework for organizing and analyzing financial data, such as revenues, expenses, and cash flow projections. By inputting historical financial data and making assumptions about future performance, the worksheet can help identify trends, potential risks, and opportunities for growth. This organized approach allows businesses to create realistic financial projections, set goals, and make informed decisions to optimize their financial performance in the future.

How does a business financial planning worksheet help with identifying potential financial risks?

A business financial planning worksheet helps in identifying potential financial risks by providing a comprehensive overview of the company's financial situation, including revenue streams, expenses, and cash flow projections. By analyzing these financial data points, businesses can pinpoint areas of weakness or vulnerability, such as insufficient cash reserves, overreliance on a single customer or supplier, or high levels of debt. This allows them to proactively address these risks through strategic planning and risk management measures, ensuring the business is better prepared to mitigate financial challenges and uncertainties in the future.

How can a business financial planning worksheet help with making strategic business decisions?

A business financial planning worksheet can help with making strategic business decisions by providing a clear overview of the company's financial situation, including revenues, expenses, profits, and cash flow projections. By analyzing this information, business owners and managers can identify trends, opportunities, and potential risks, enabling them to make informed decisions about resource allocation, investment priorities, cost management strategies, and growth initiatives. The worksheet serves as a valuable tool for assessing the financial implications of different scenarios, evaluating the impact of decisions on the bottom line, and developing a comprehensive financial strategy that aligns with the overall business goals and objectives.

What are some common challenges when creating a business financial planning worksheet?

Some common challenges when creating a business financial planning worksheet include accurately forecasting revenue and expenses, anticipating unforeseen costs or shifts in the market, balancing short-term and long-term financial goals, ensuring the worksheet is comprehensive and accounts for all aspects of the business, as well as maintaining the flexibility to adjust the plan as needed based on changing circumstances or opportunities.

How often should a business review and update their financial planning worksheet?

A business should review and update their financial planning worksheet on a regular basis, such as monthly or quarterly, to ensure that they are accurately tracking their financial performance and making informed decisions based on current data. This frequent review allows the business to identify any trends, adjust their strategies, and stay on track towards achieving their financial goals.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments