Budget Tracker Worksheet

Budgeting your finances can be a daunting task, but with the help of a budget tracker worksheet, managing your money becomes a whole lot easier. Whether you're a college student trying to stay on top of your expenses or a newlywed couple hoping to save for the future, this customizable tool is tailored to cater to your specific financial needs. By utilizing a budget tracker worksheet, you can track your expenses, set financial goals, and ultimately take control of your financial journey.

Table of Images 👆

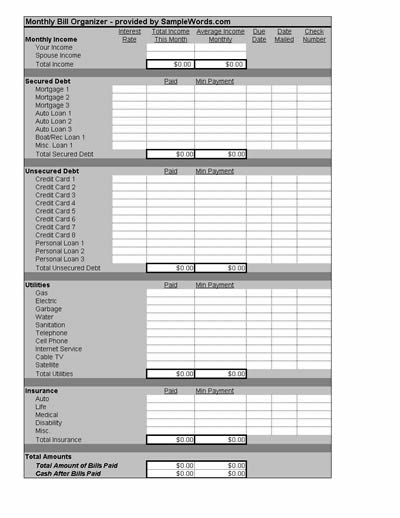

- Monthly Bill Organizer Template

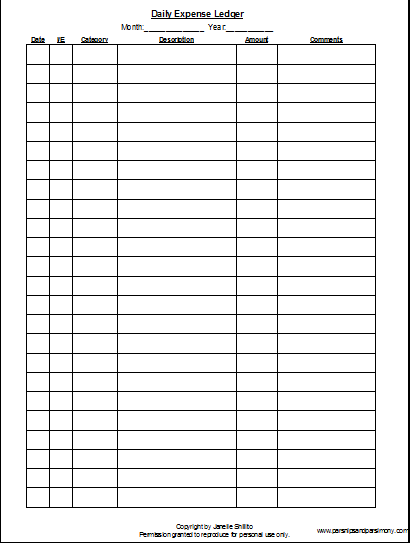

- Free Printable Daily Expense Ledger

- Free Printable Weekly Budget Template

- Fundraising Budget Worksheet Template

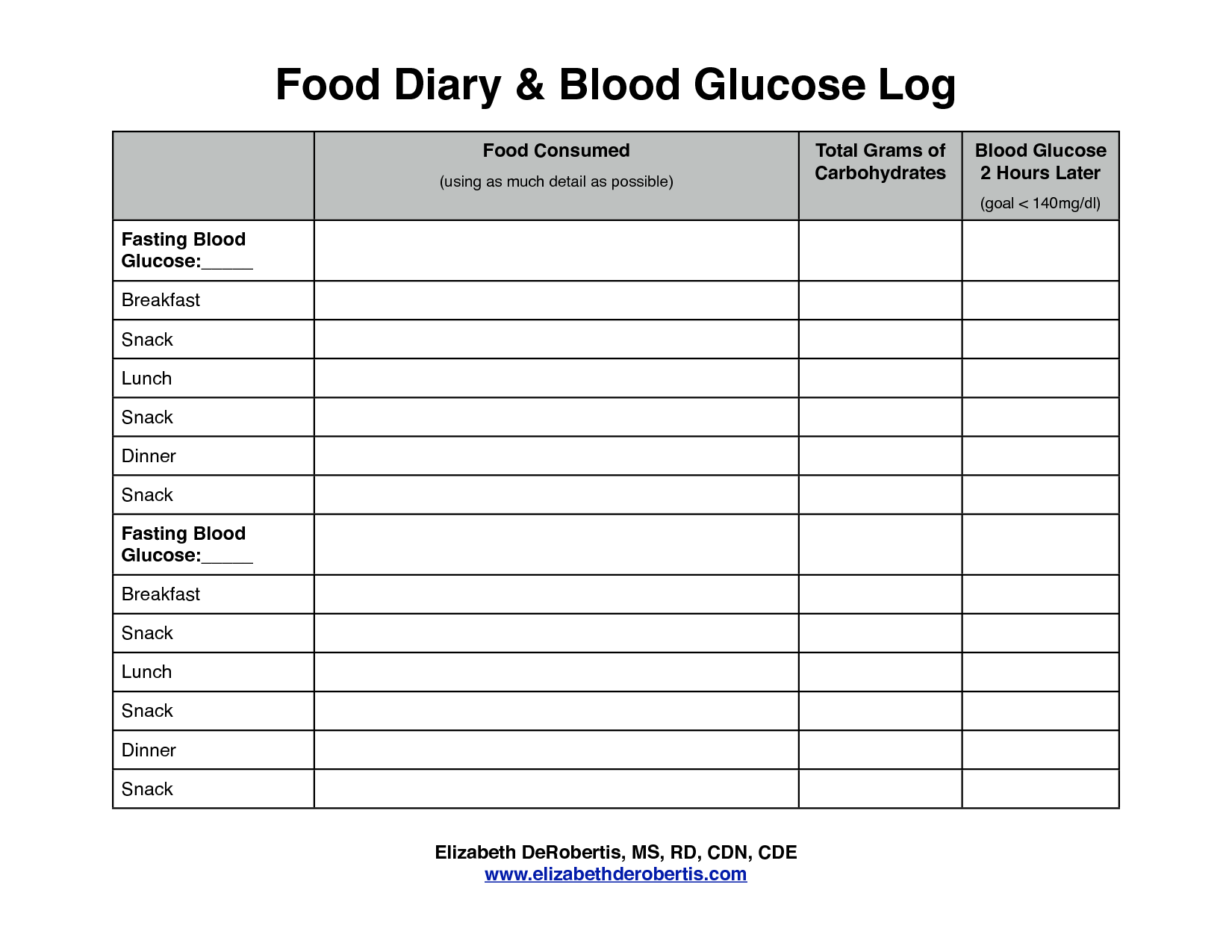

- Printable Diabetic Food and Blood Sugar Log

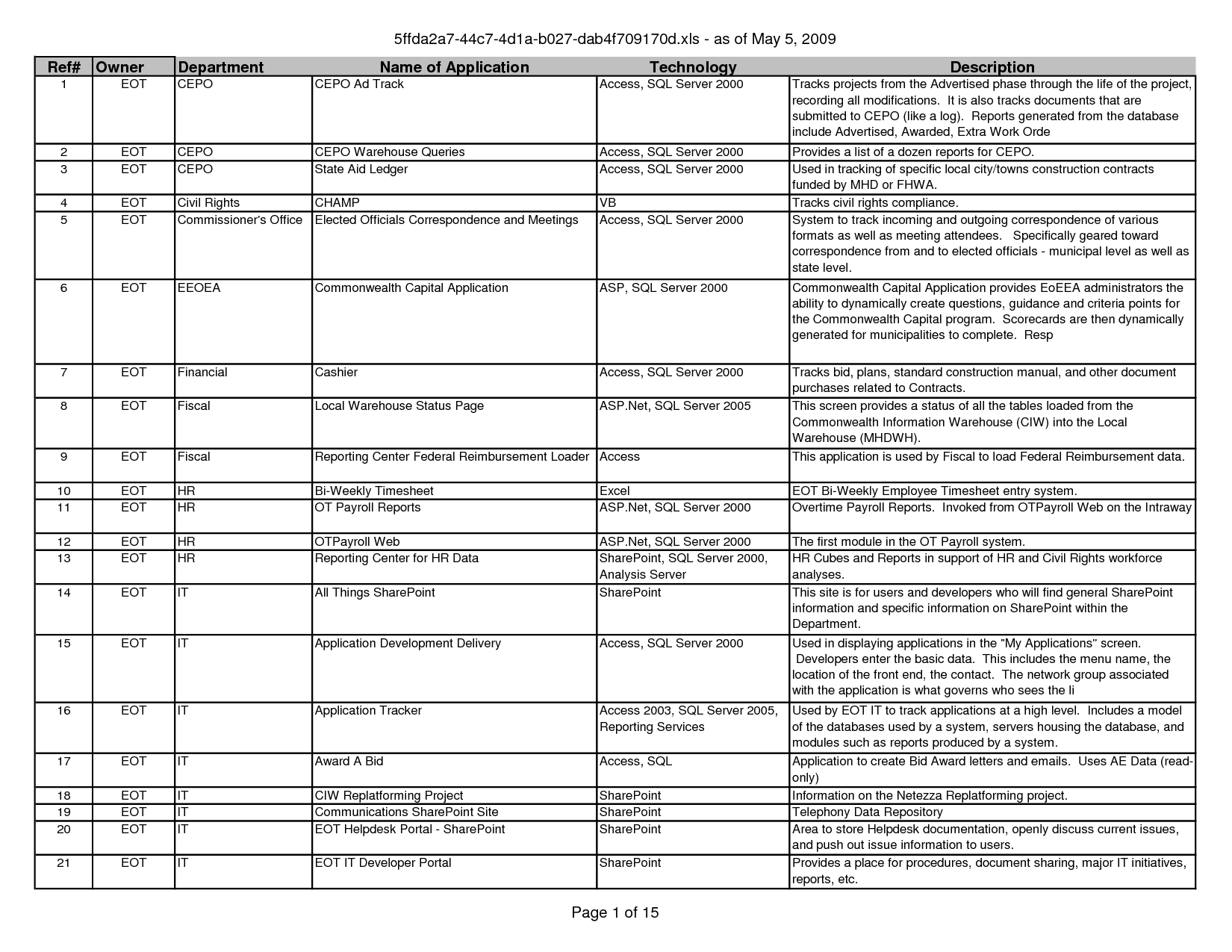

- Meeting Action Log Template

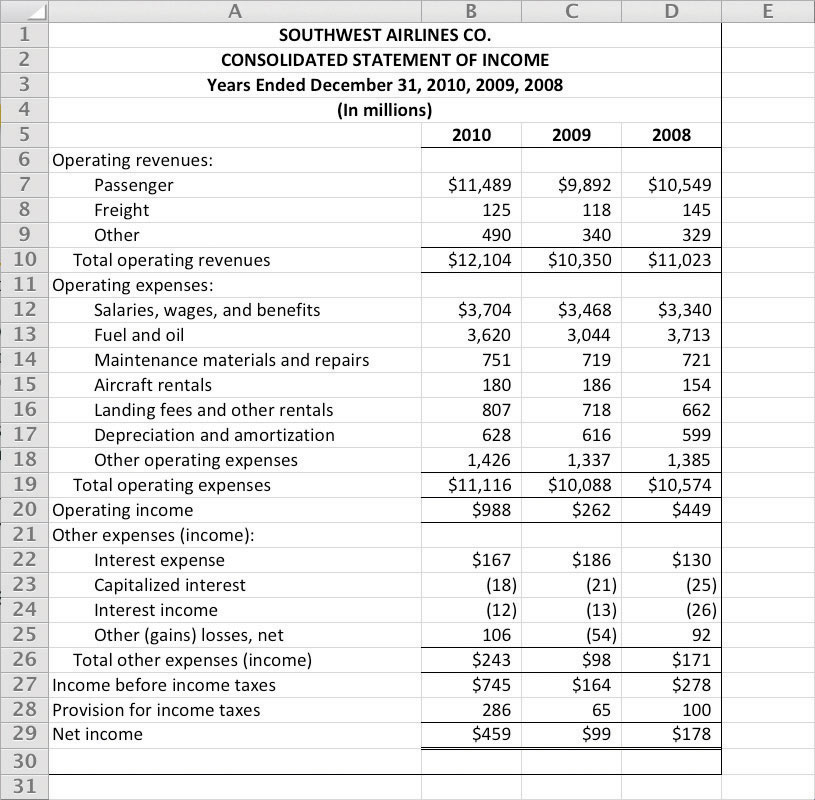

- Excel Spreadsheet Income Statement

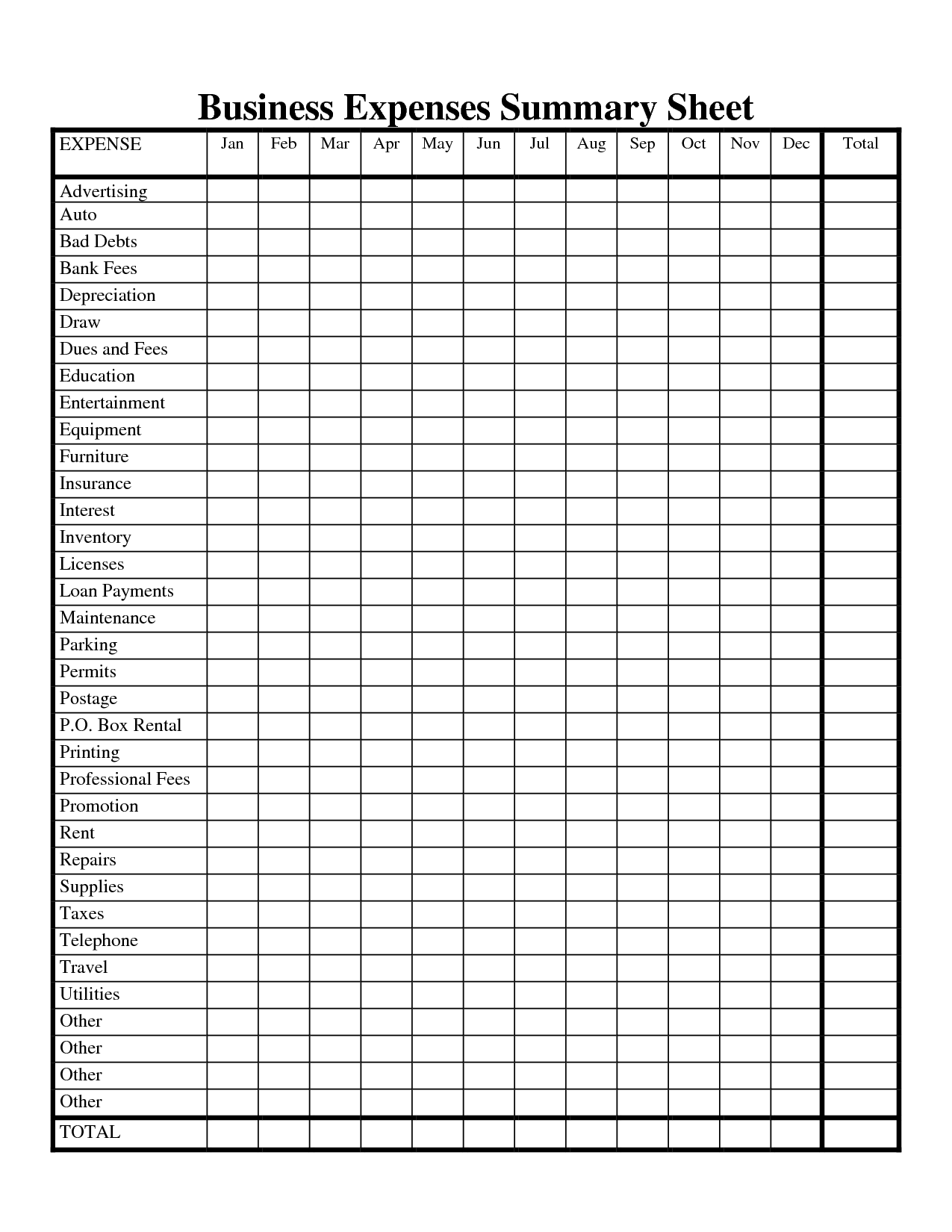

- Business Expense Sheet Template

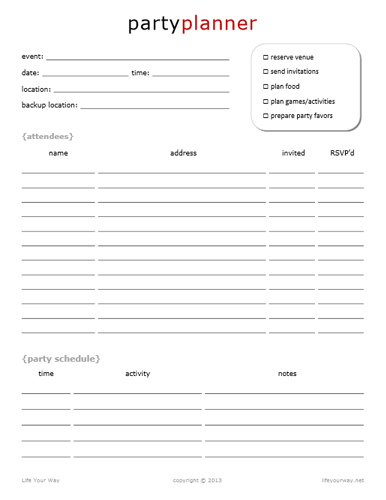

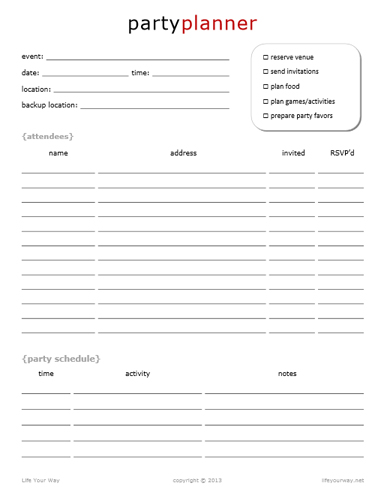

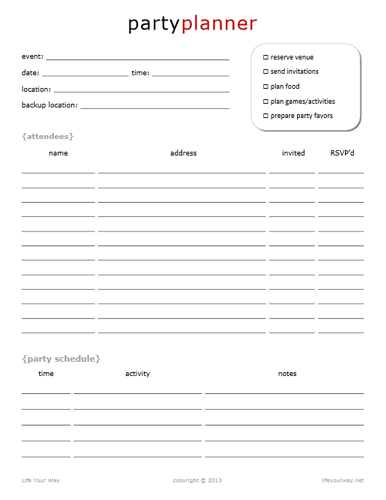

- Birthday Party Planner Printable

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a Budget Tracker Worksheet?

A Budget Tracker Worksheet is a tool used to track and plan one's finances by listing income, expenses, savings, and other financial goals in a systematic manner. It helps individuals or households manage their money effectively, monitor their spending habits, set financial priorities, and work towards achieving financial stability and goals.

How does a Budget Tracker Worksheet help in managing finances?

A Budget Tracker Worksheet helps in managing finances by providing a structured framework to track income, expenses, and savings goals. It allows individuals to monitor their spending habits, identify areas where they can cut costs, and prioritize financial goals. By regularly updating and analyzing the information on the worksheet, individuals can make informed decisions to ensure they stay within their budget, save effectively, and work towards achieving financial stability.

What are the key components of a Budget Tracker Worksheet?

A budget tracker worksheet typically includes key components such as income sources, expense categories, planned budget amounts, actual spending, variance calculations, and a section to track savings or debt repayment progress. It allows individuals to monitor and manage their finances effectively by comparing their planned budget to actual income and expenses, identifying areas where adjustments may be needed, and tracking progress towards financial goals.

How often should a Budget Tracker Worksheet be updated?

A Budget Tracker Worksheet should ideally be updated on a weekly basis to ensure accuracy and effectiveness in monitoring your finances. This frequency allows for timely adjustments, tracking of expenses, and staying in control of your financial goals. However, some people prefer to update it bi-weekly or monthly, depending on their personal preferences and financial situation.

What types of expenses should be included in a Budget Tracker Worksheet?

A Budget Tracker Worksheet should include all regular monthly expenses such as rent or mortgage, utilities, groceries, transportation, insurance, and debt payments. It should also include variable expenses like entertainment, dining out, shopping, and miscellaneous expenses to ensure a comprehensive overview of your spending habits. Additionally, savings and investments should be accounted for in order to track your financial goals and progress.

How does a Budget Tracker Worksheet help in setting financial goals?

A Budget Tracker Worksheet helps in setting financial goals by providing a clear overview of income, expenses, and savings. By tracking spending habits and identifying areas where money can be saved or allocated more efficiently, individuals can create a realistic budget that aligns with their financial goals. The worksheet allows for setting specific targets for saving, debt repayment, or investment, and monitoring progress towards these goals over time, enabling better financial planning and decision-making.

Can a Budget Tracker Worksheet be customized to fit individual needs?

Yes, a Budget Tracker Worksheet can be customized to fit individual needs by adding or removing categories, adjusting budget amounts, and inputting specific expenses unique to the individualís financial situation. This customization allows for a personalized and tailored approach to tracking and managing finances effectively.

What are common mistakes to avoid when using a Budget Tracker Worksheet?

Common mistakes to avoid when using a Budget Tracker Worksheet include not updating the information regularly, failing to categorize expenses accurately, not including all sources of income, underestimating expenses, not setting realistic financial goals, and not adjusting the budget as needed. It's important to diligently track and review your finances, ensure all expenses are accounted for, accurately track income and expenses, and consistently evaluate and adjust your budget to align with your financial goals.

How does a Budget Tracker Worksheet aid in tracking and reducing unnecessary expenses?

A Budget Tracker Worksheet aids in tracking and reducing unnecessary expenses by providing a clear overview of income, expenses, and spending patterns. By regularly entering expenses and comparing them to the budgeted amounts, individuals can identify areas where they are overspending and make adjustments to reduce unnecessary expenses. The visual representation of financial data on the worksheet helps individuals to stay on track, prioritize essential expenditures, and cut back on non-essential ones, ultimately leading to better financial management and savings.

Are there any tools or resources available to help create and use a Budget Tracker Worksheet effectively?

Yes, there are various tools and resources available to help create and use a Budget Tracker Worksheet effectively. Some popular ones include budgeting apps like Mint, YNAB (You Need a Budget), and EveryDollar, as well as spreadsheet software like Microsoft Excel or Google Sheets. These tools offer customizable budget templates, automated tracking features, visualizations, and goal setting capabilities to help you manage your finances more efficiently. Additionally, there are many online resources and tutorials that provide guidance on budgeting best practices and tips for using budget trackers effectively.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments