Budget Easy Worksheet to Use

Managing your personal finances can be a tricky task, but with the right tools, you can stay on top of your budget without any stress. If you're in search of a user-friendly worksheet to help you track your income and expenses, you're in the right place. This blog post will introduce you to a budget worksheet that is perfect for individuals looking for a practical and straightforward way to organize their financial information.

Table of Images 👆

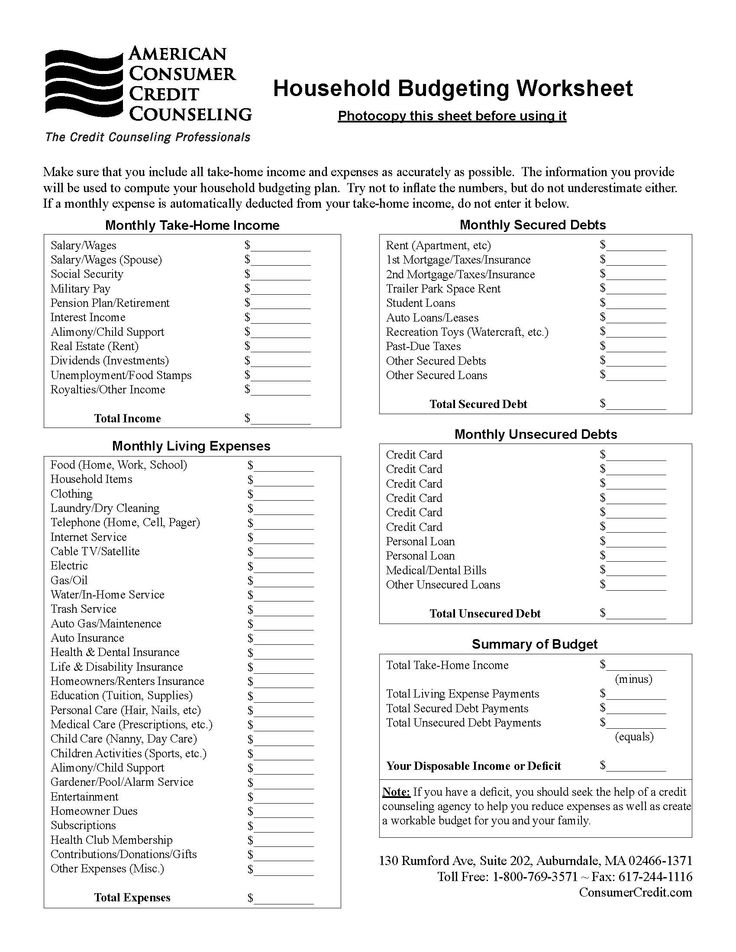

- Monthly Household Budget Worksheet

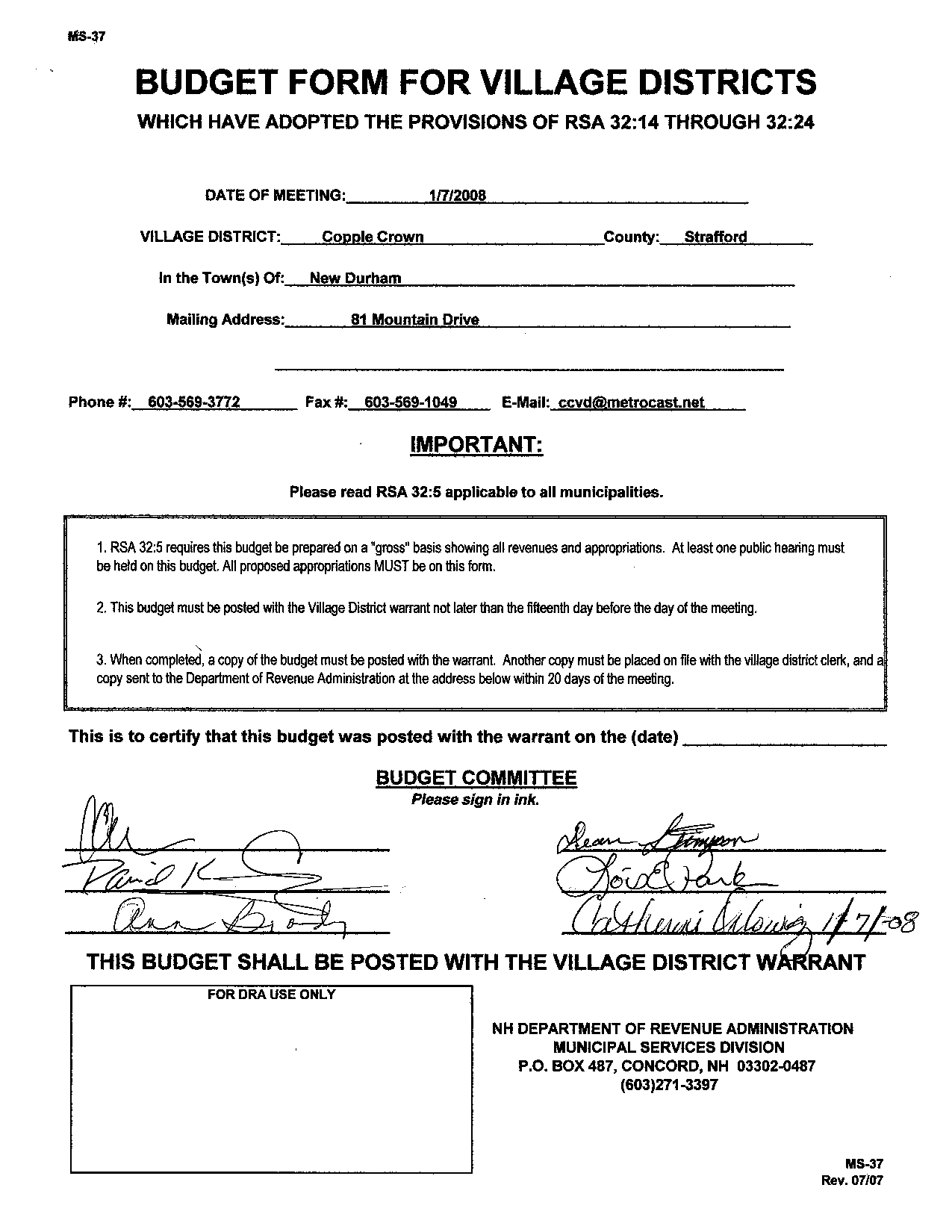

- Office Budget Worksheet

- Sample Grant Budget Worksheet

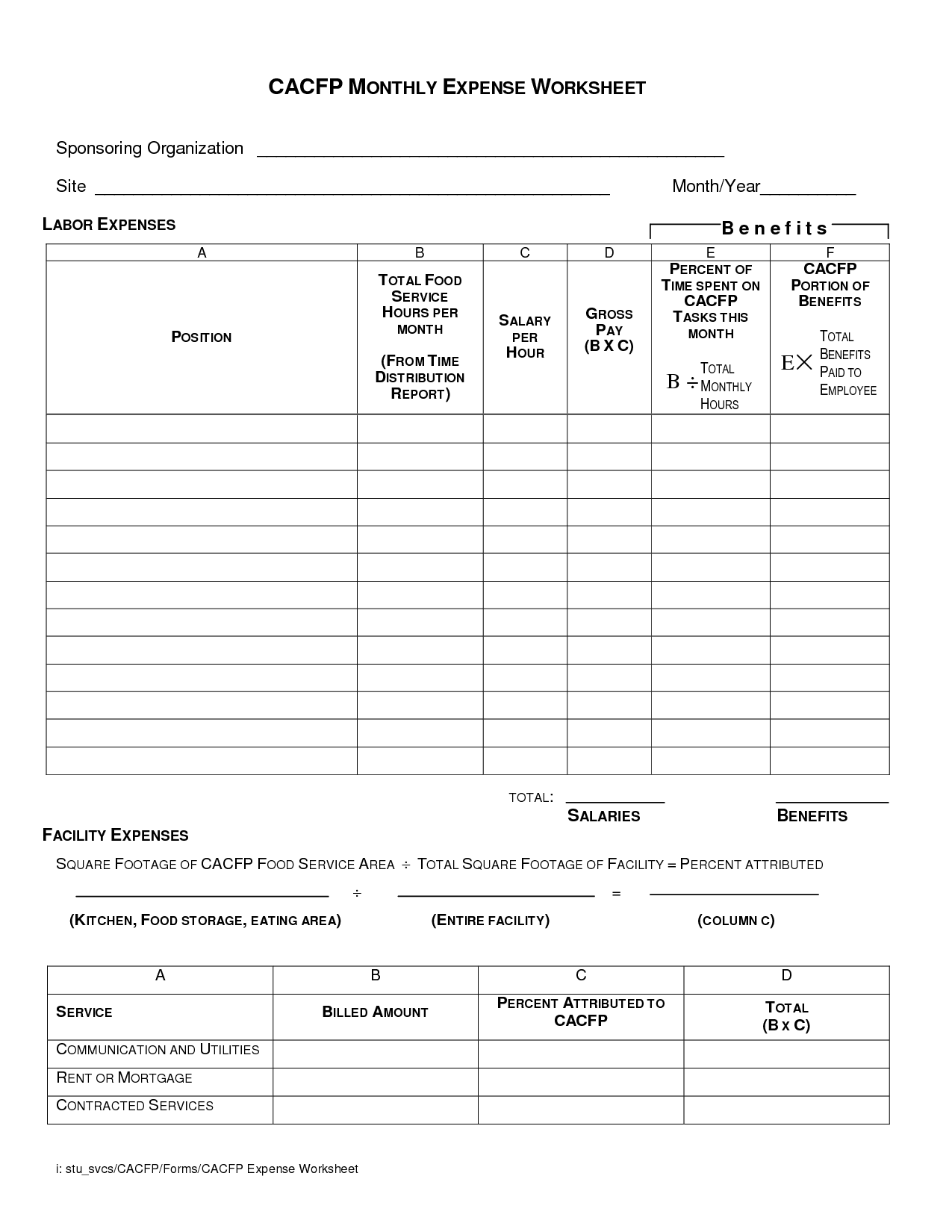

- Monthly Business Expense Worksheet

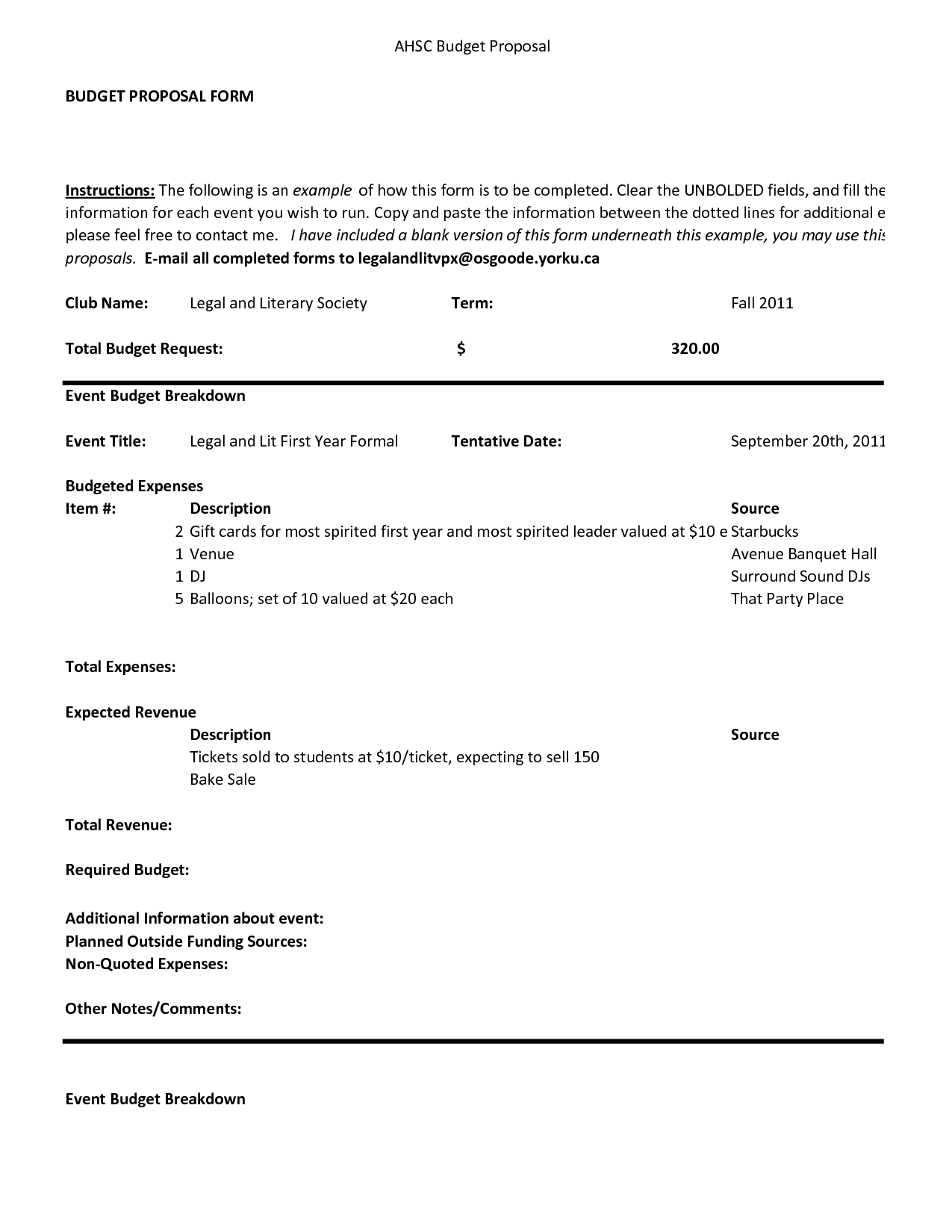

- Sample Budget Proposal Template

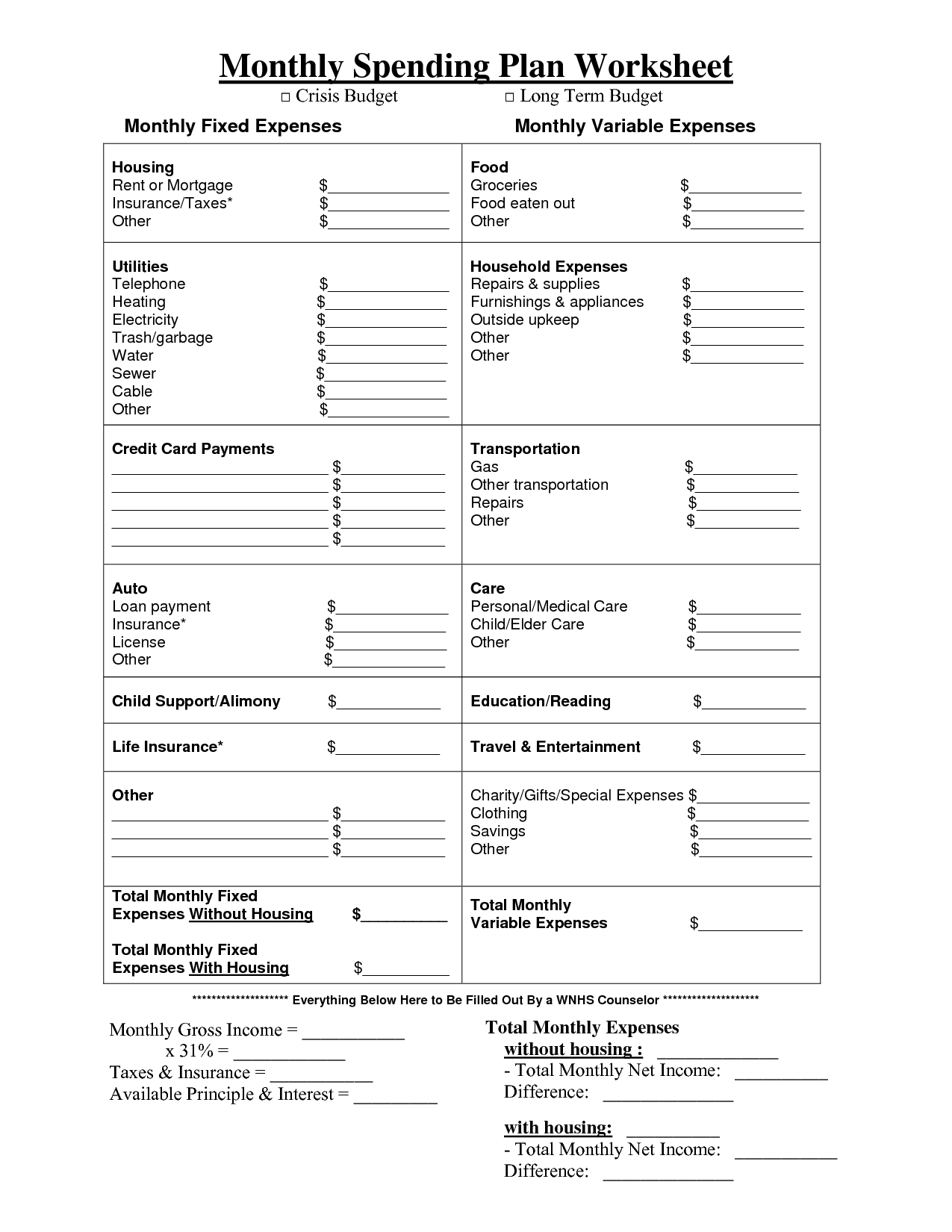

- Spending Plan Worksheet PDF

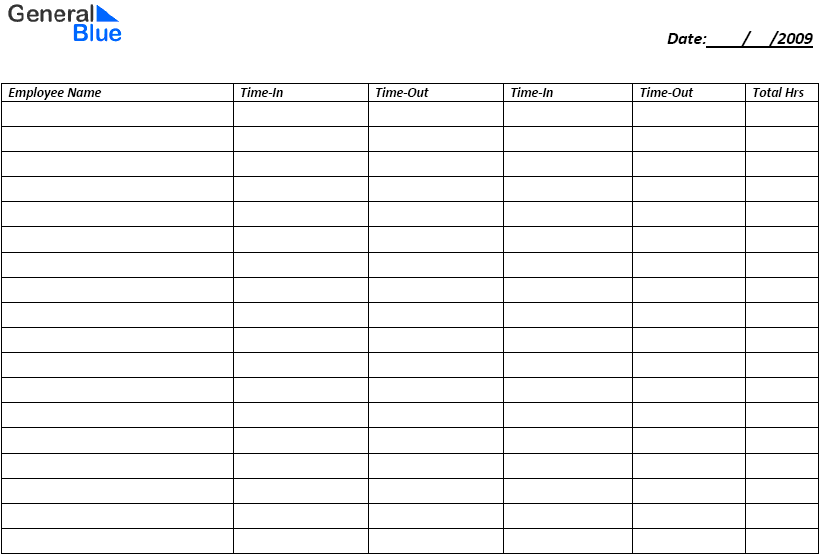

- Printable Blank Time Sheet Template

- Letter G Coloring Worksheet

- Free Printable Budget Worksheets

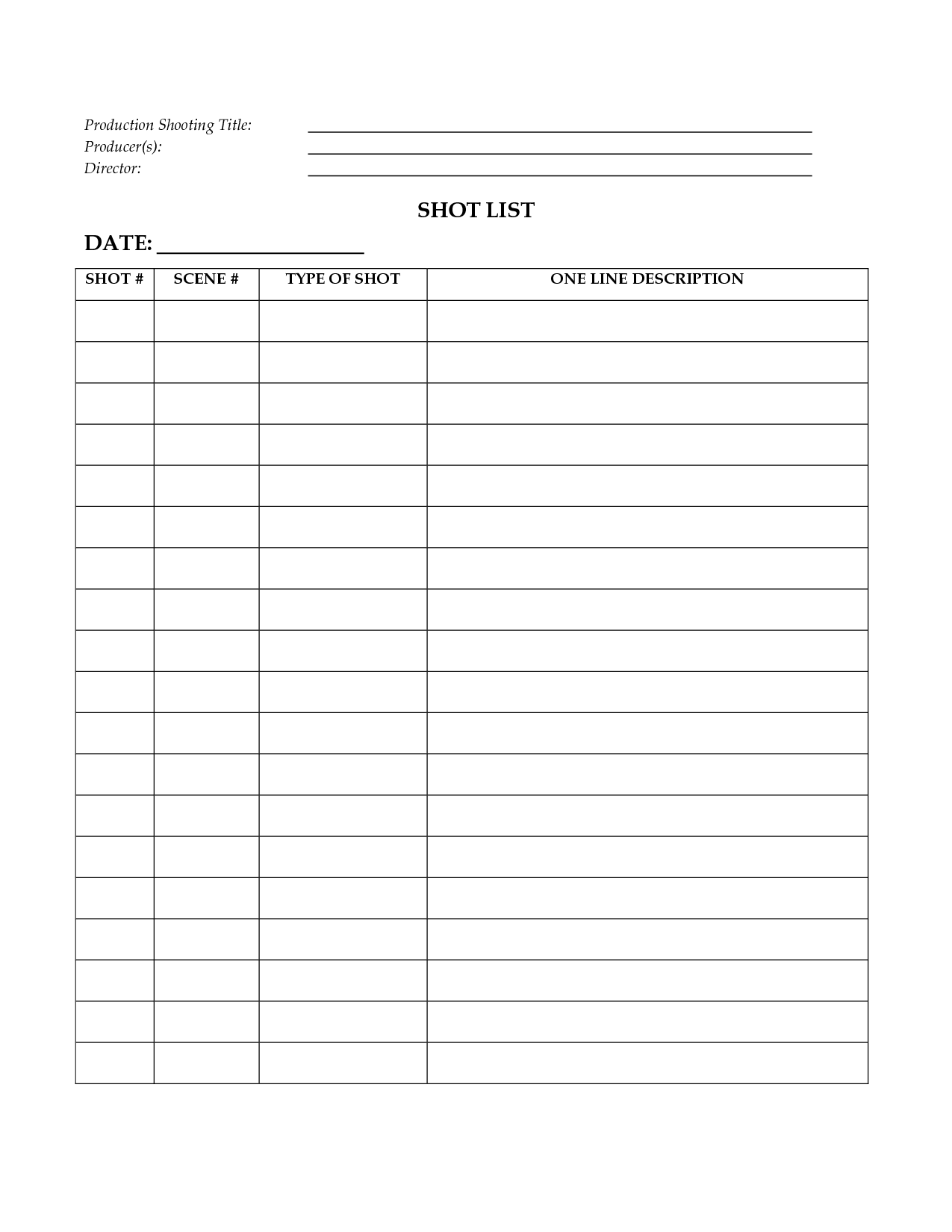

- Film Shot List Template Word

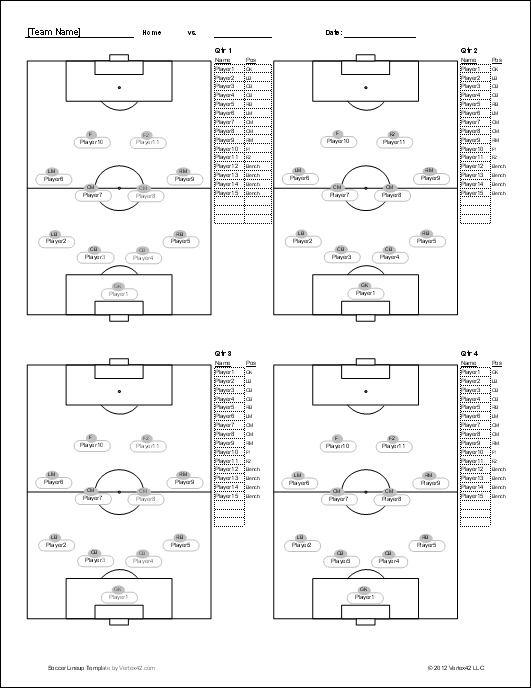

- Printable Mens Slow Pitch or Girls Softball

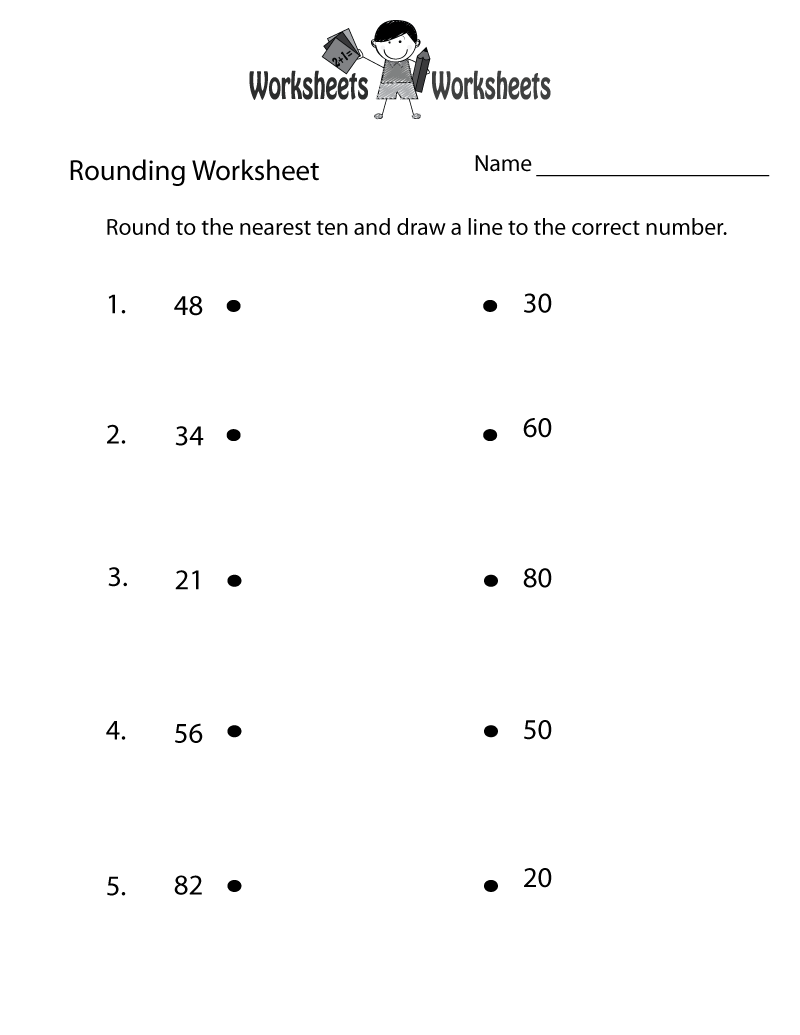

- Rounding Numbers Worksheets

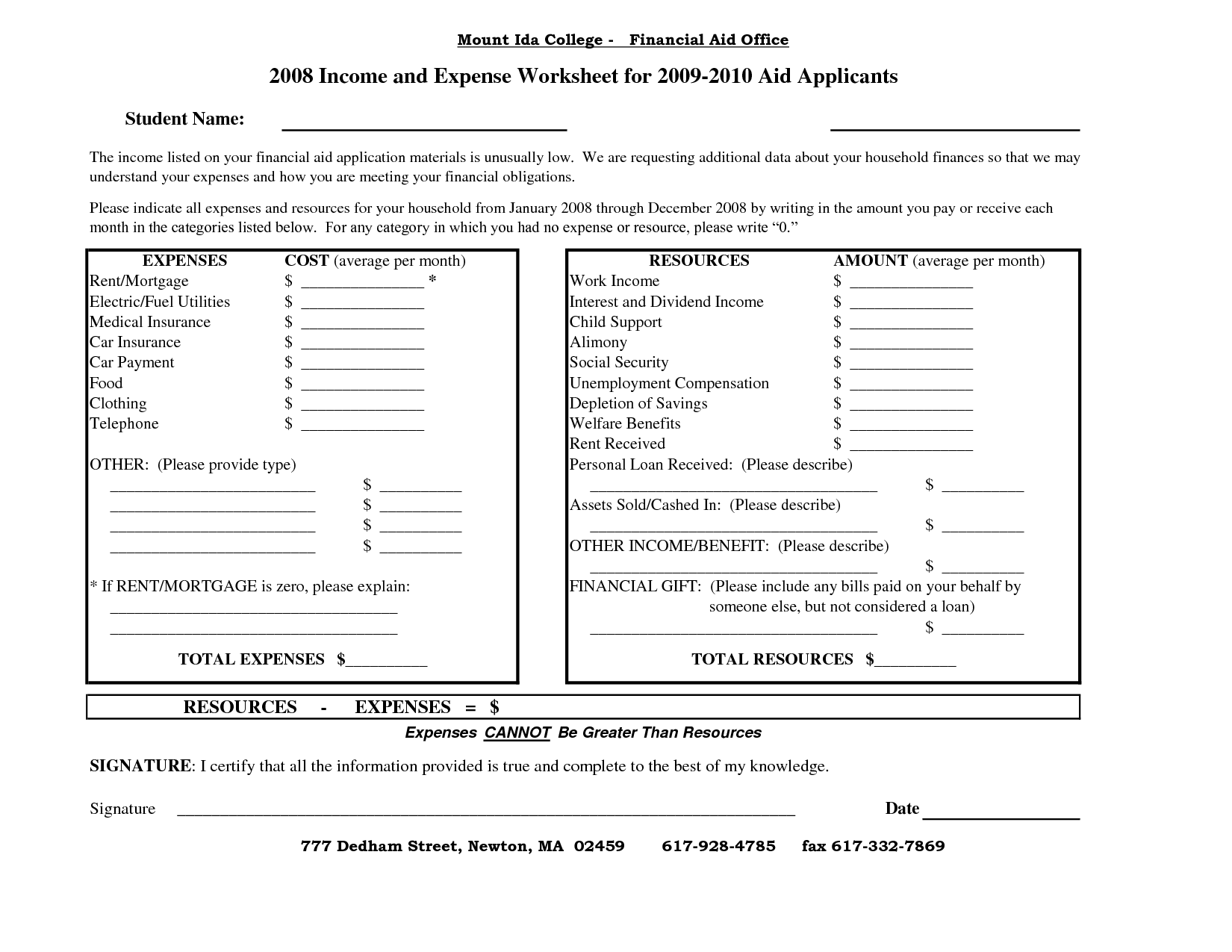

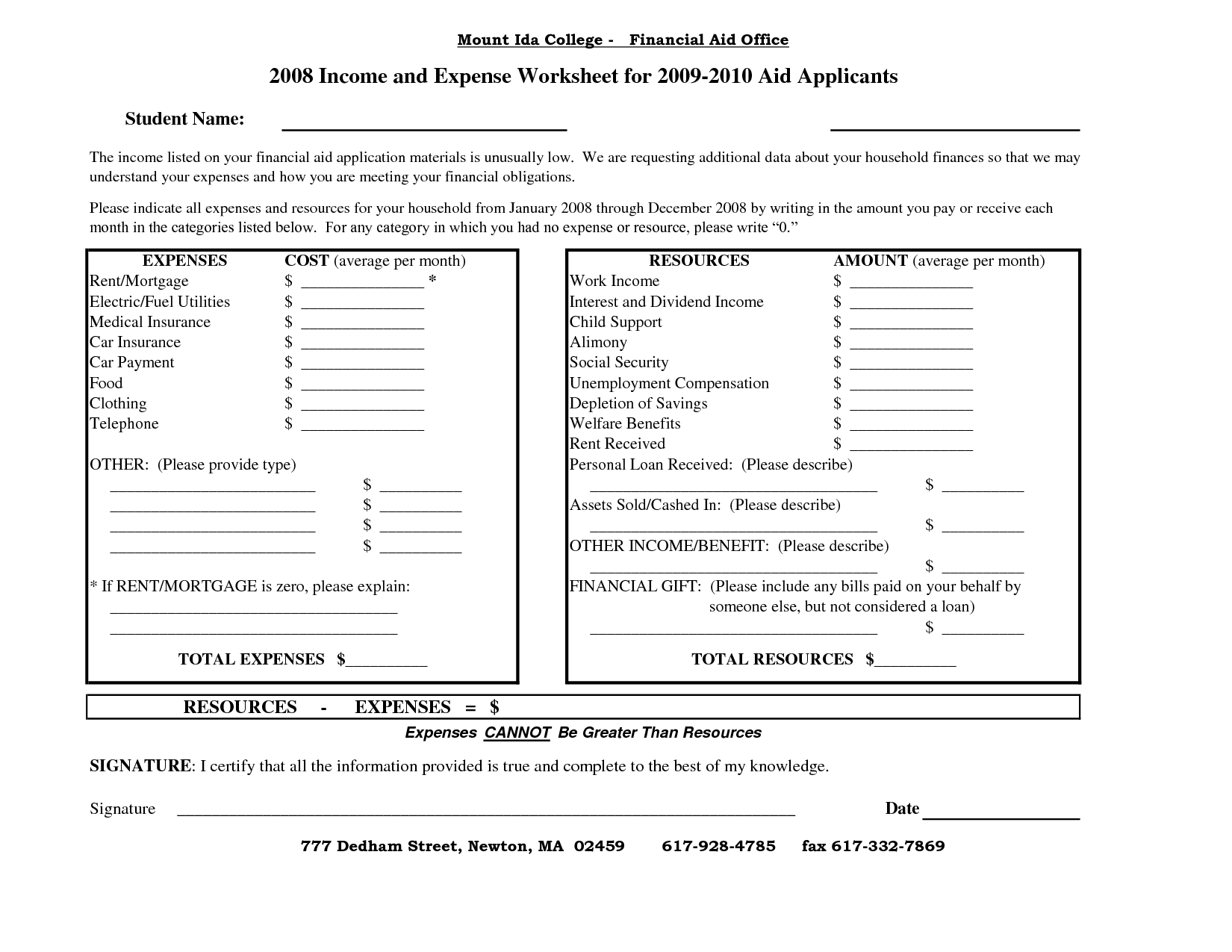

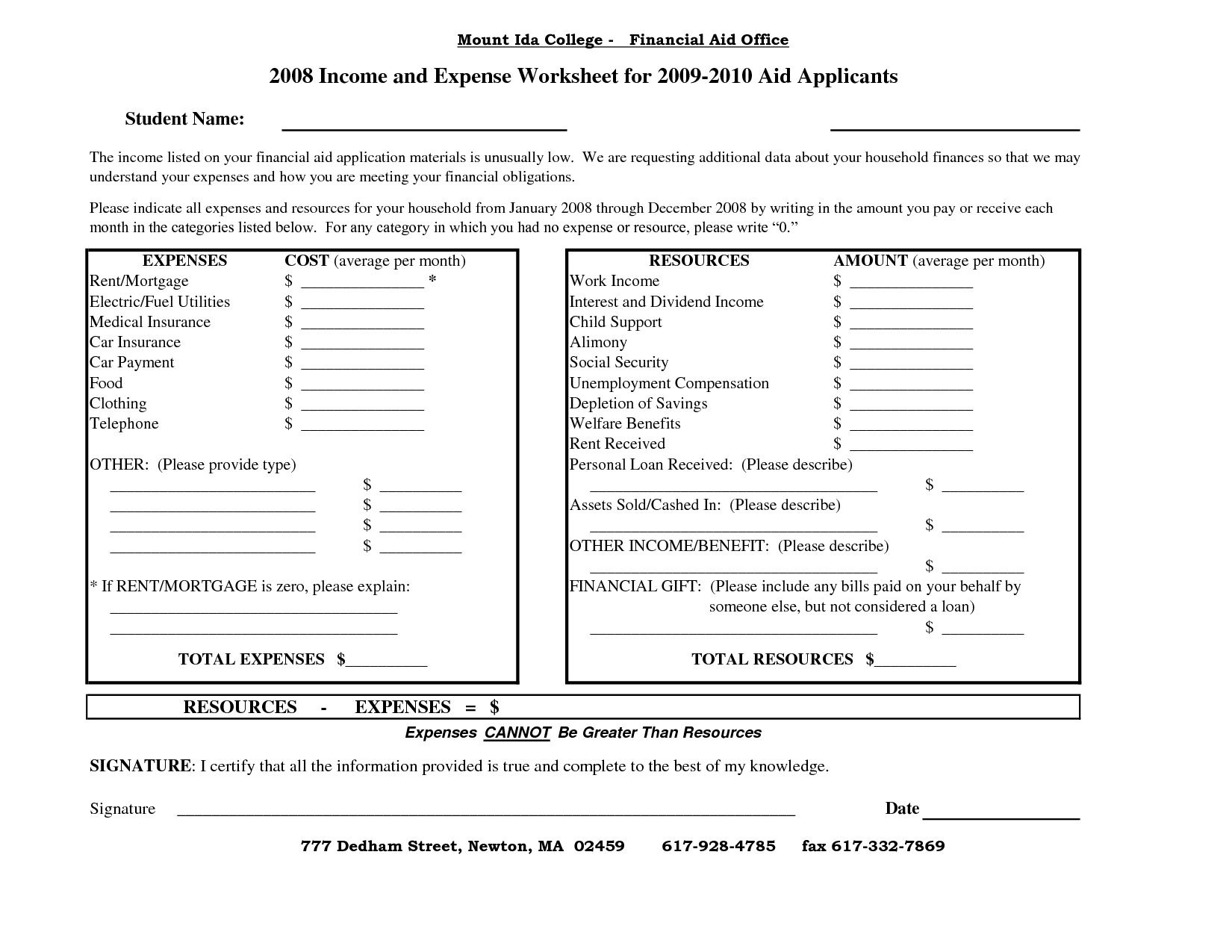

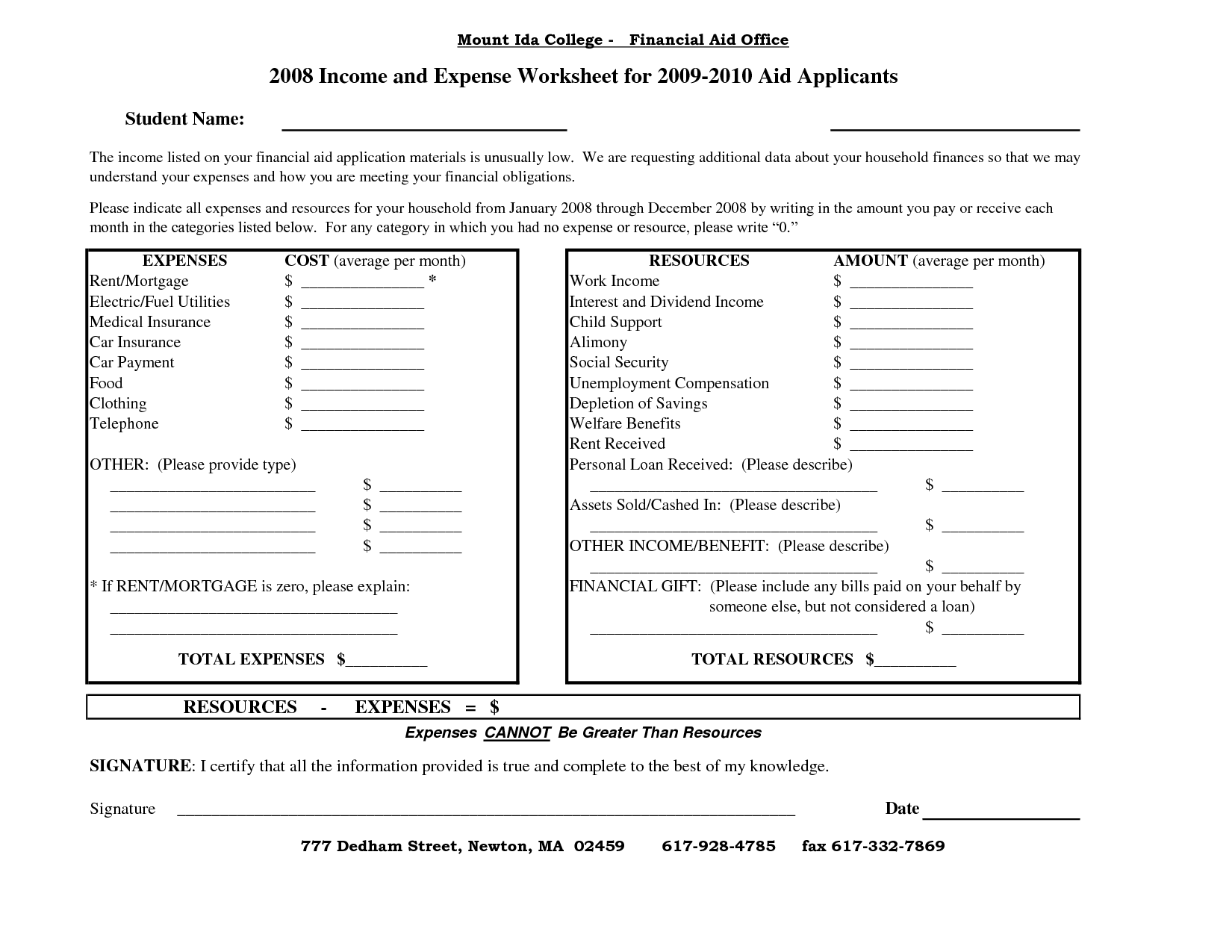

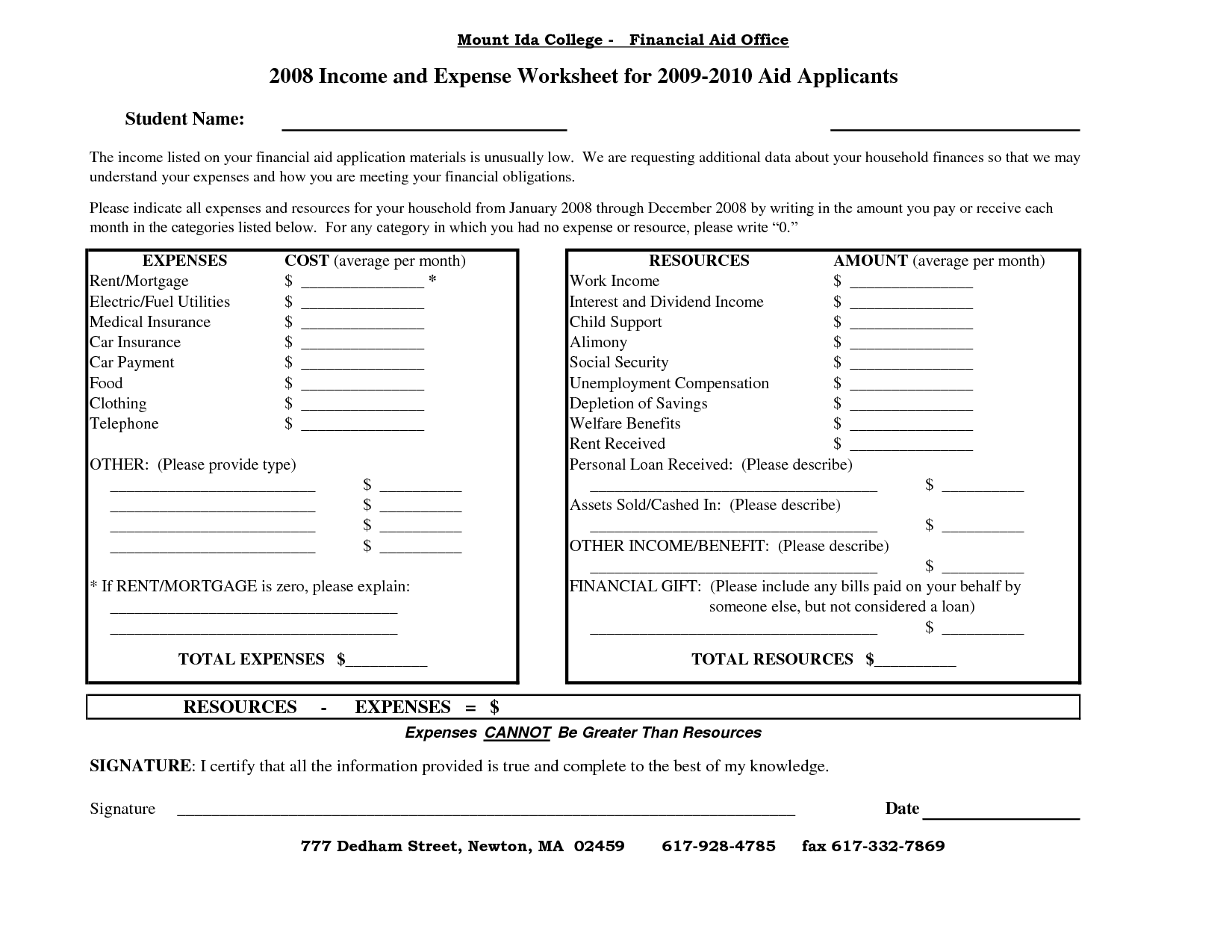

- Business Income and Expense Worksheet

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a budget?

A budget is a financial plan that outlines an individual's or organization's anticipated income and expenses over a specific period, usually monthly or annually. It helps in managing finances by setting limits on spending, saving for future goals, and ensuring that money is allocated efficiently. Budgets are essential for controlling money flow, making informed financial decisions, and working towards financial stability.

Why is it important to use a budget?

Using a budget is important because it helps individuals and businesses to track their income and expenses, making it easier to manage finances effectively. A budget allows for better planning, setting financial goals, and making informed decisions about spending and saving. It also helps to identify areas where there may be overspending or opportunities to cut costs, ultimately leading to financial stability and achieving long-term objectives.

How can a budget help with financial planning?

A budget provides a detailed breakdown of income and expenses, allowing individuals to track their cash flow and identify areas where they can save or cut costs. By creating and sticking to a budget, individuals can prioritize their spending, set financial goals, and allocate funds towards savings and investments, ultimately helping them to plan for short and long-term financial needs with greater control and clarity.

How do you create a budget?

To create a budget, start by listing all sources of income and all expenses. Categorize expenses into fixed (like rent) and variable (like groceries). Set financial goals and prioritize spending based on these goals. Allocate a portion of income towards savings and an emergency fund. Track spending regularly to ensure you're staying within budget. Adjust the budget as needed to meet financial goals and maintain financial stability.

What are the key elements to include in a budget?

Key elements to include in a budget are income sources, expenses (fixed and variable), savings goals, debt payments, emergency fund allocation, and any other financial goals or priorities. It is important to track and analyze these elements regularly to ensure financial stability and make adjustments as needed.

How often should a budget be reviewed and updated?

A budget should ideally be reviewed and updated on a regular basis, such as monthly or quarterly, depending on individual circumstances and financial goals. Regular reviews help to track progress, adjust for changes in income or expenses, and ensure that financial goals are being met. Additionally, major life events or economic shifts may also warrant more frequent budget reviews and updates.

What are some common budgeting techniques or strategies?

Some common budgeting techniques or strategies include zero-based budgeting, the 50/30/20 rule, envelope system, pay yourself first approach, and using budgeting apps or software for tracking expenses and income. Zero-based budgeting requires allocating every dollar to a specific category, the 50/30/20 rule suggests dividing income into needs, wants, and savings categories, the envelope system involves using cash for budgeted categories, the pay yourself first approach prioritizes saving first before spending, and budgeting apps or software help in monitoring and adjusting finances effectively.

How can a budget help with saving money?

A budget can help with saving money by providing a clear overview of income and expenses, allowing individuals to track where their money is going and identify areas where they can cut back or prioritize saving. By setting specific savings goals within the budget, individuals can allocate a portion of their income towards savings each month, ensuring that they are consistently building their savings over time. Additionally, a budget can help prevent overspending by creating boundaries and increasing awareness of spending habits, ultimately leading to more mindful and intentional financial decisions that support long-term saving goals.

How can a budget help in reducing debt?

Creating a budget can help in reducing debt by allowing individuals to track their income and expenses, prioritize debt payments, and identify areas where they can cut back on spending to free up more money to put towards paying off debt. By setting a budget and sticking to it, individuals can avoid overspending, make consistent payments towards their debt, and gradually reduce their overall debt burden over time.

What are some tips for effectively using a budget to achieve financial goals?

To effectively use a budget to achieve financial goals, start by setting specific, measurable, achievable, relevant, and time-bound (SMART) goals. Track your income and expenses to create a realistic budget, ensuring you allocate funds toward your goals. Regularly review and adjust your budget as needed, prioritizing spending on essential items and cutting back on non-essential costs. Building an emergency fund and automating savings can help you stay on track with your budget and financial goals. Lastly, seek professional advice or resources for additional support in managing your finances efficiently.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments