Blank Personal Budget Worksheet

Are you in need of a simple and effective tool to help you manage your finances? Look no further than the Blank Personal Budget Worksheet. This straightforward worksheet serves as an entity to track your income and expenses, allowing you to take control of your financial well-being. Whether you are a student, a professional, or a stay-at-home parent, this personal budget worksheet is the perfect subject to assist you in achieving your financial goals.

Table of Images 👆

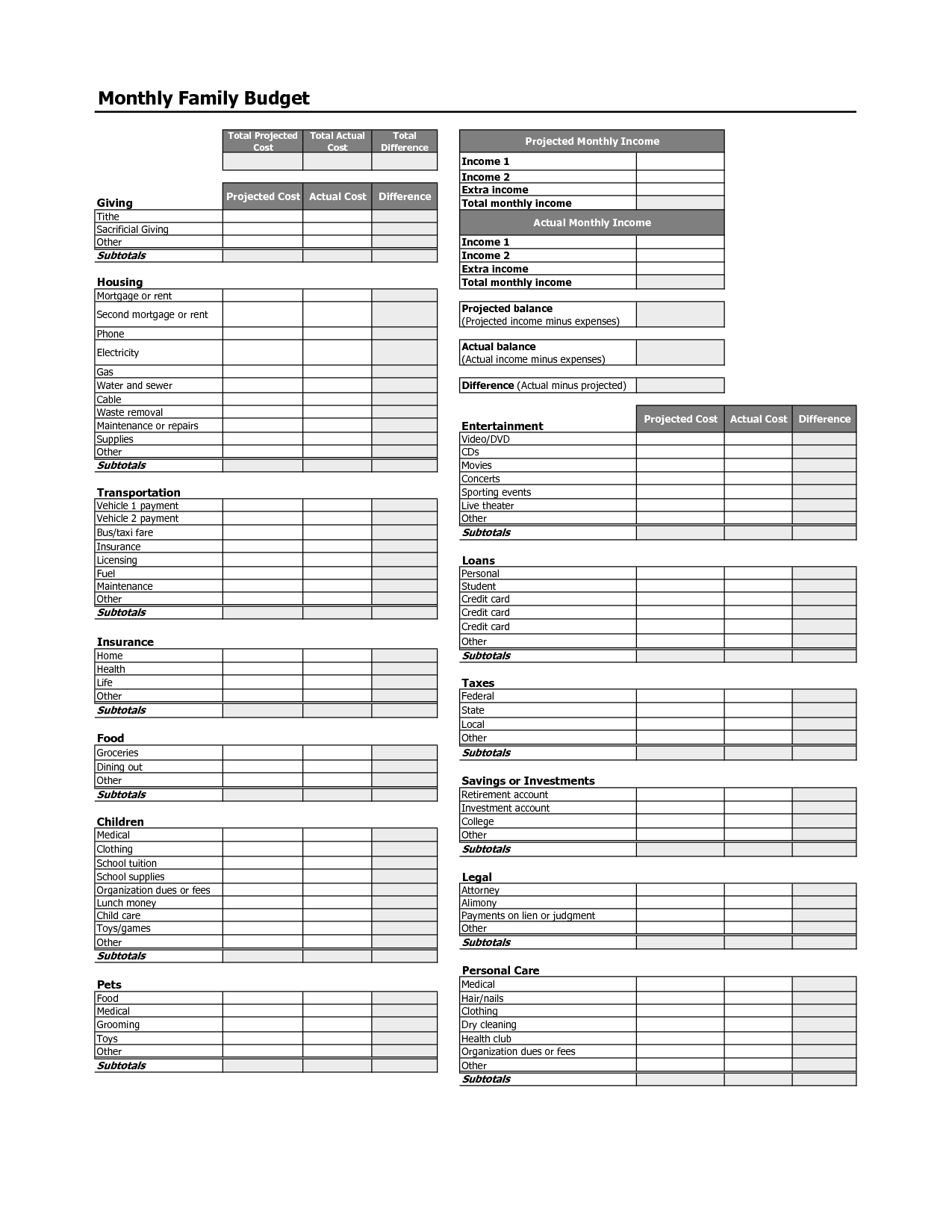

- Printable Family Budget Worksheet

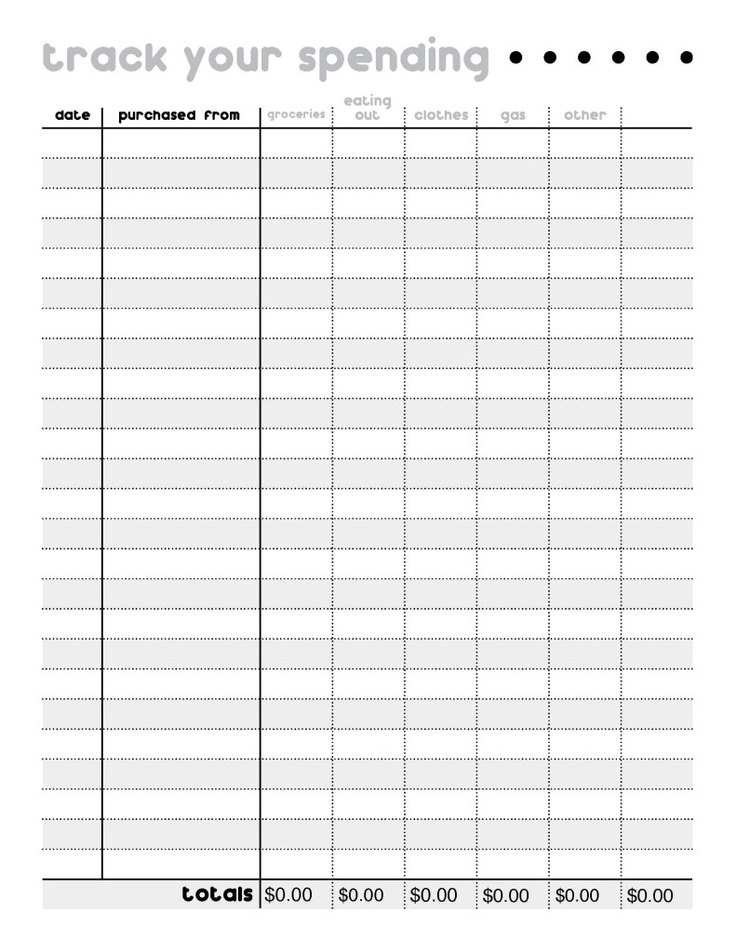

- Printable Spending Worksheet

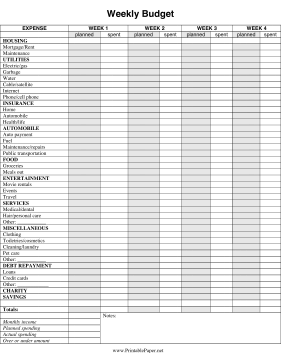

- Free Printable Weekly Budget Template

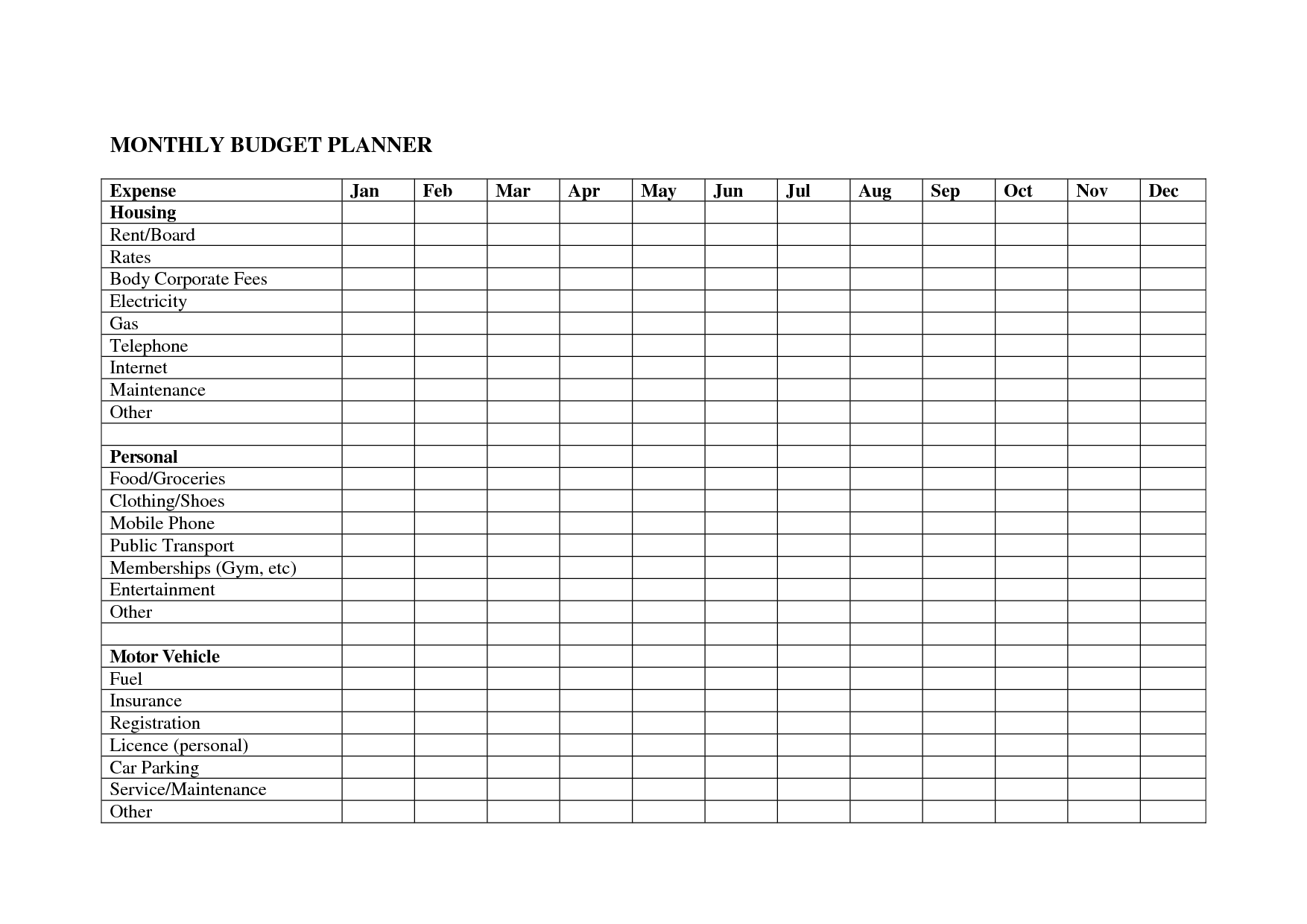

- Blank Monthly Budget Chart

- Blank Monthly Budget Spreadsheet

- Free Printable Budget Worksheets

- Sample Personal Budget Worksheet

- Printable Monthly Household Expense Worksheet

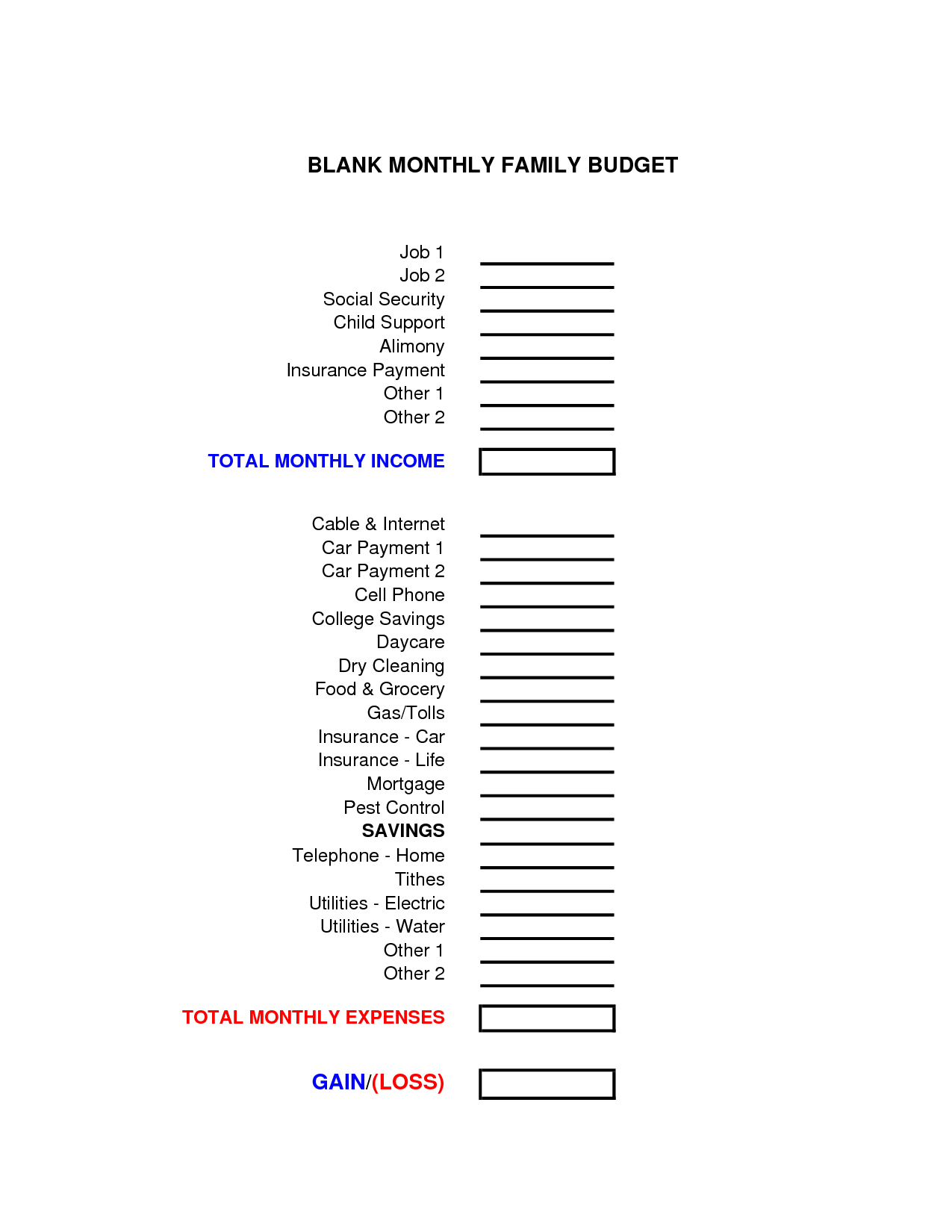

- Blank Monthly Family Budget

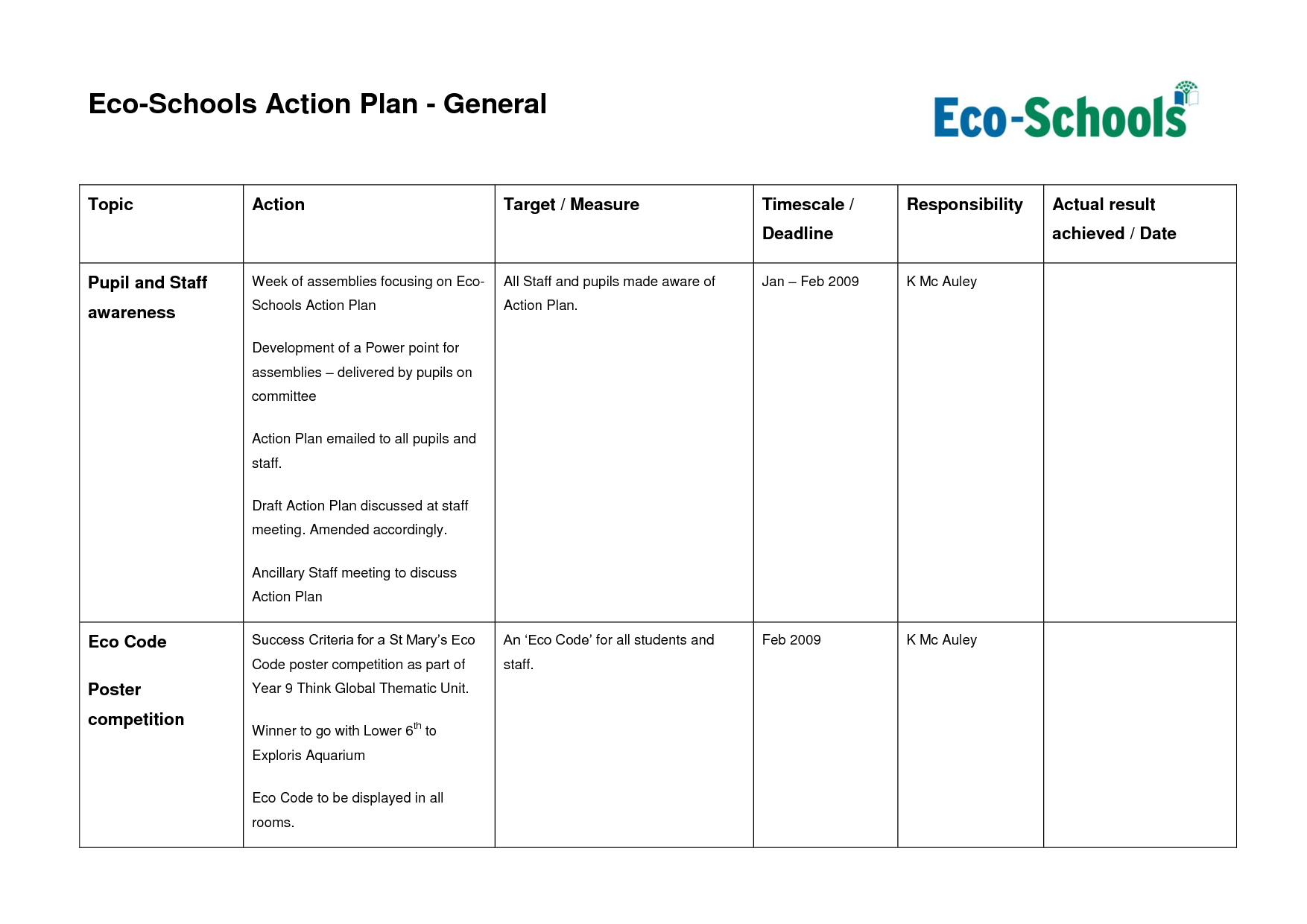

- School Action Plan Template

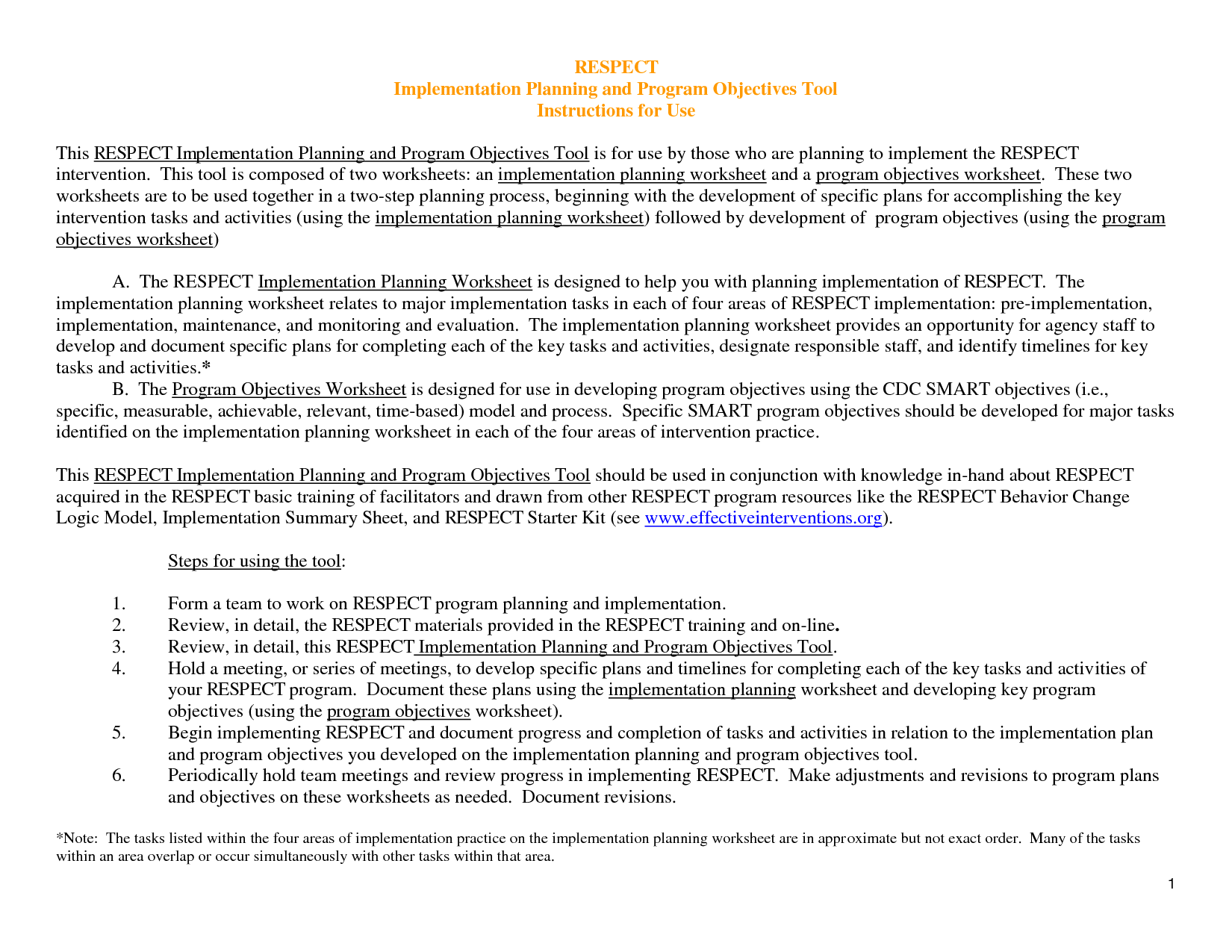

- Printable Worksheets On Respect

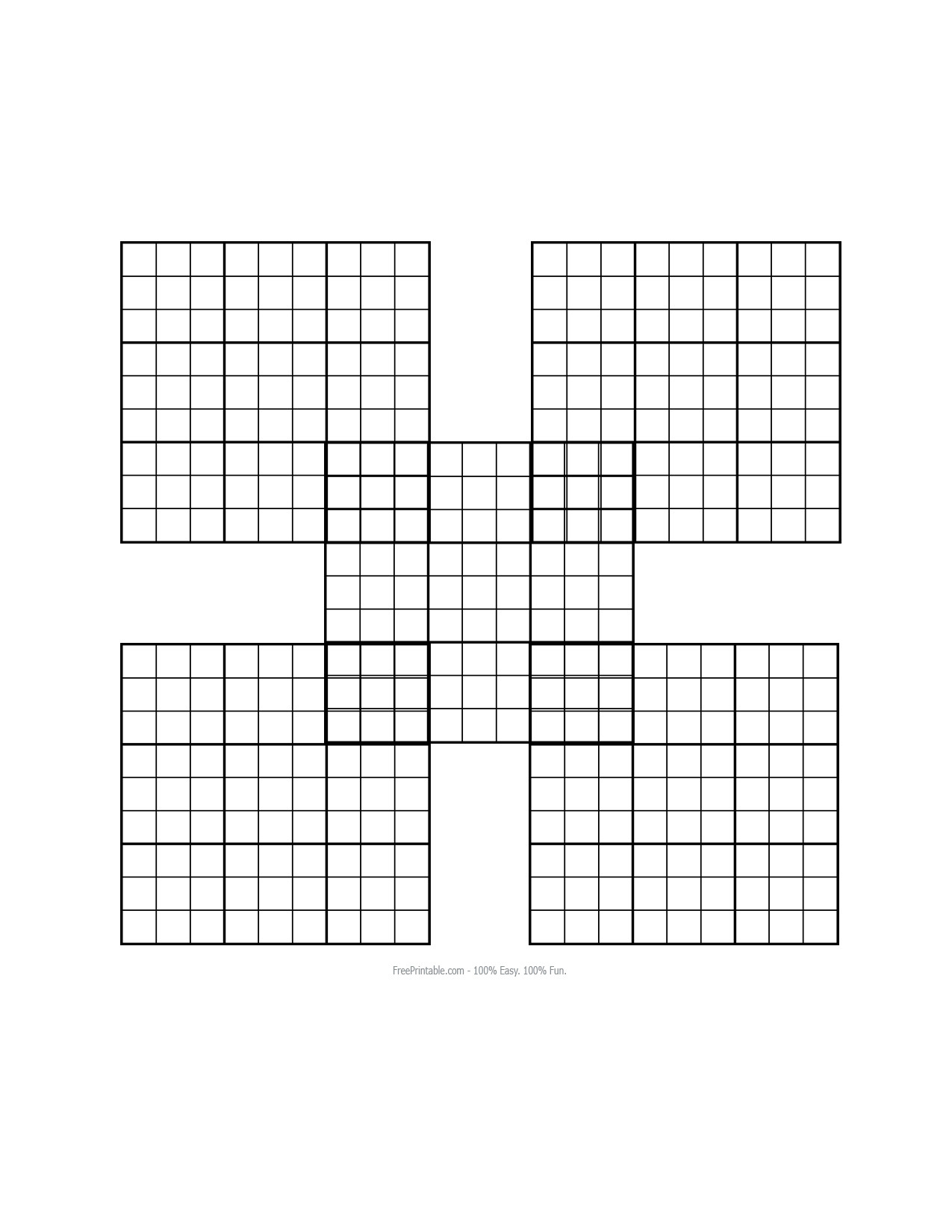

- Free Printable Blank Sudoku Grids

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a Personal Budget Worksheet?

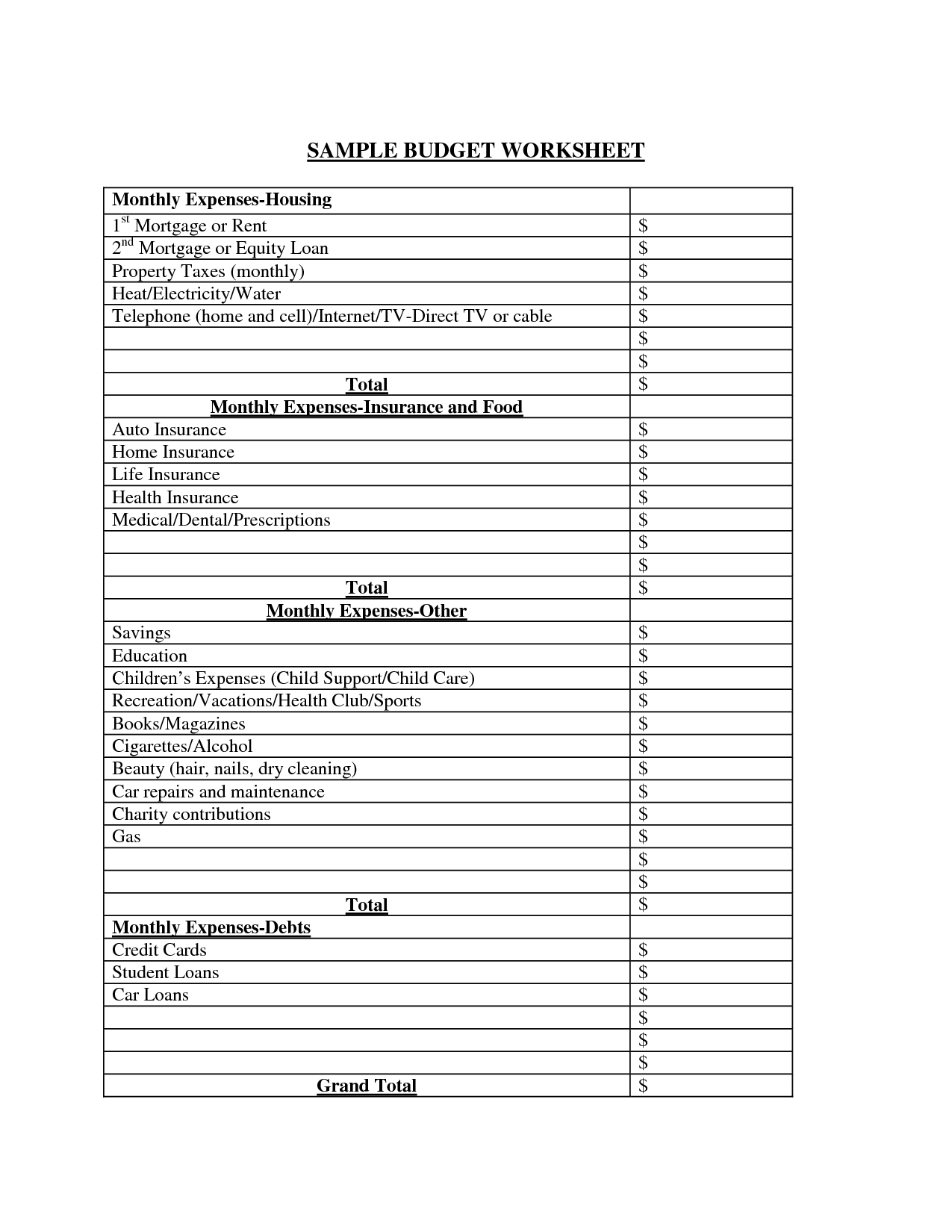

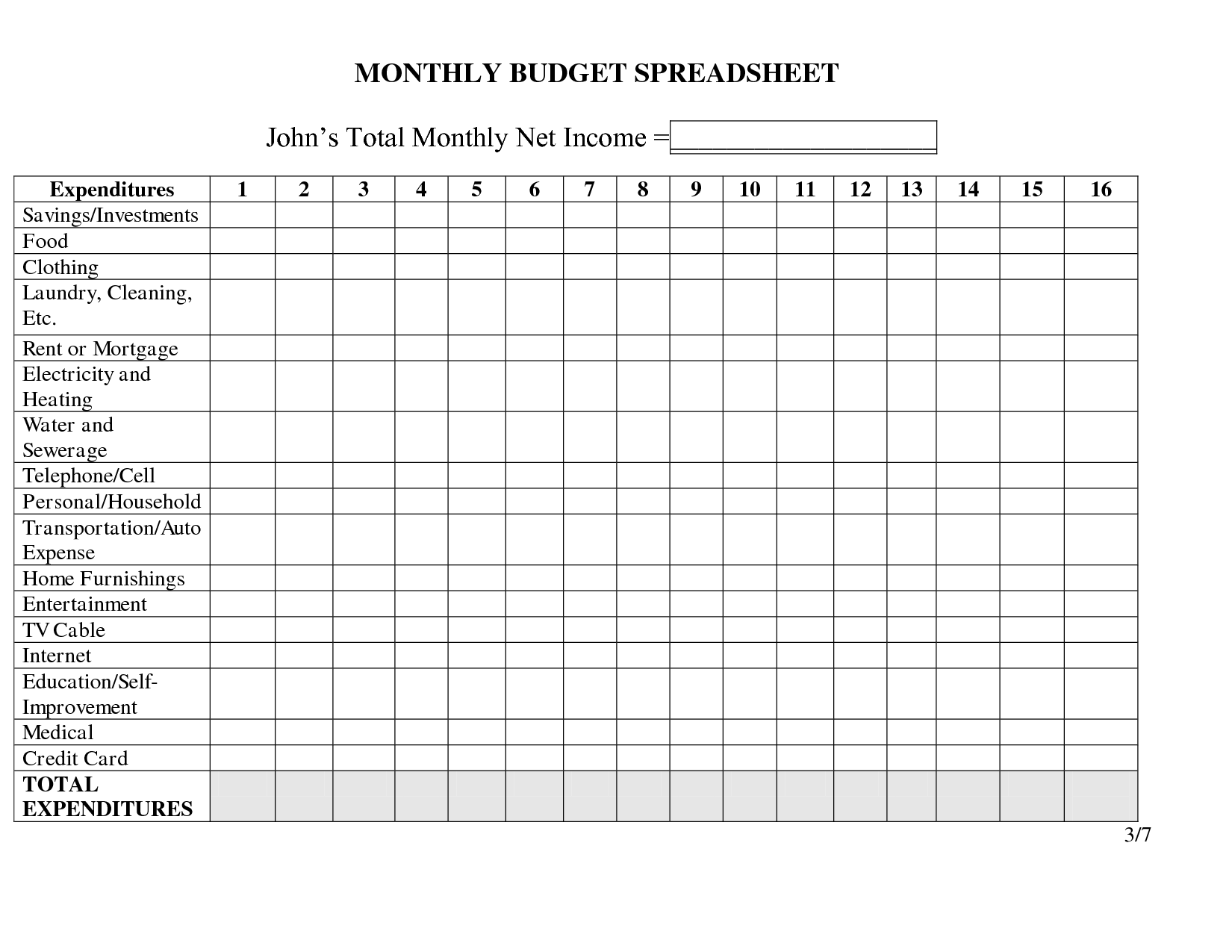

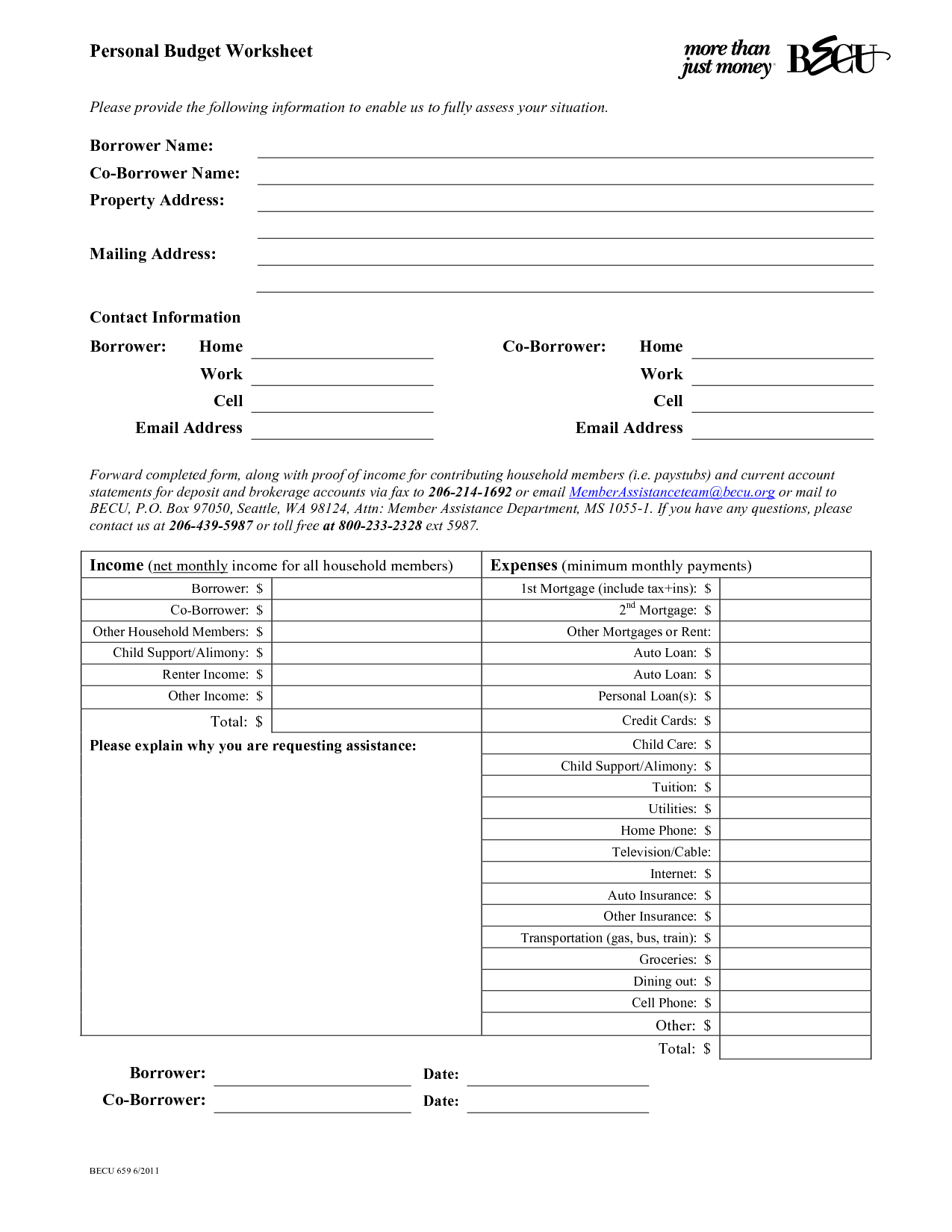

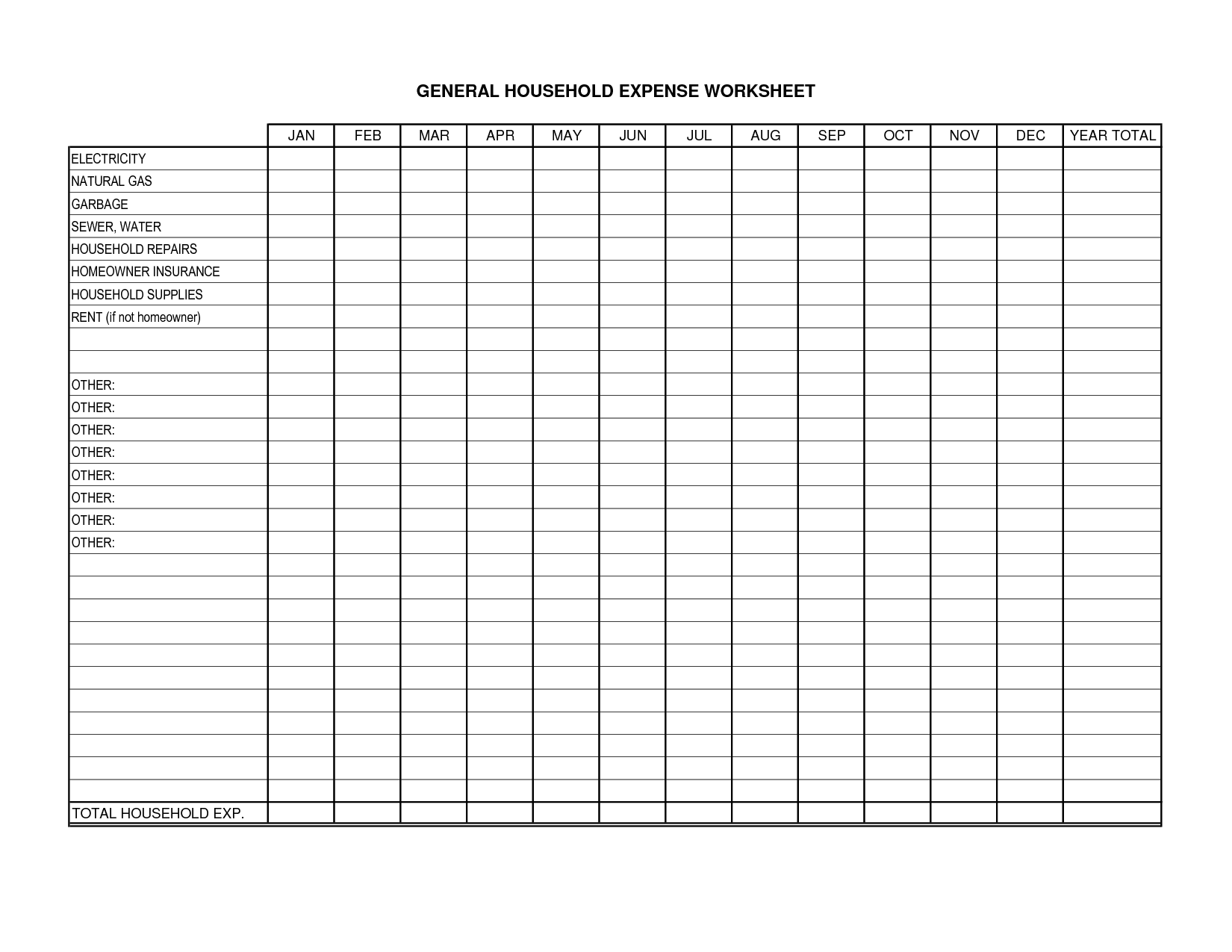

A Personal Budget Worksheet is a tool used to track income and expenses in order to create a detailed financial plan. It typically includes categories for income sources, fixed expenses, variable expenses, savings, and debt payments. By documenting and categorizing all financial transactions, individuals can monitor spending habits, identify areas for improvement, and work towards achieving their financial goals.

How can the Personal Budget Worksheet help me manage my finances?

The Personal Budget Worksheet can help you manage your finances by providing a structured overview of your income and expenses. It allows you to track where your money is being spent and identify areas where you can potentially cut back or save. By creating and sticking to a budget using the worksheet, you can prioritize your spending, allocate funds appropriately, and work towards achieving your financial goals.

What are the key categories included in the Personal Budget Worksheet?

The key categories included in a Personal Budget Worksheet typically consist of income, expenses, savings, debt, and miscellaneous. Income includes sources of money coming in, expenses cover regular expenses like utilities, groceries, and rent/mortgage, savings tracks funds set aside for future goals, debt shows any outstanding loans or credit card balances, and miscellaneous covers any additional expenses that may not fit into the other categories. These categories help individuals organize their finances and gain insight into their overall financial health.

How do I determine my monthly income on the Personal Budget Worksheet?

To determine your monthly income on the Personal Budget Worksheet, you need to calculate the total of all your sources of income for the month. This includes your salary, bonuses, any side hustle income, investment income, or other sources of money coming in. Make sure to input accurate figures for each income source to calculate your total monthly income accurately.

How do I track my monthly expenses on the Personal Budget Worksheet?

To track your monthly expenses on the Personal Budget Worksheet, start by listing all your expenses in the corresponding categories provided, such as housing, utilities, groceries, transportation, etc. Record the amount of each expense incurred for the month in the appropriate column. Sum up all your expenses to get your total monthly spending. Compare this total with your monthly income to see if you are within your budget or if adjustments need to be made. Update your expenses regularly to track your spending habits and make informed financial decisions.

What is the purpose of having a separate section for savings on the Personal Budget Worksheet?

The purpose of having a separate section for savings on the Personal Budget Worksheet is to emphasize the importance of setting aside money for future goals and unforeseen expenses. By allocating a specific portion of one's income to savings, individuals can build financial security, create an emergency fund, and work towards achieving long-term objectives such as buying a house, funding education, or planning for retirement. Separating savings on the budget worksheet helps individuals prioritize saving as a key component of their overall financial plan.

How can the Personal Budget Worksheet help me identify areas where I can cut back on expenses?

The Personal Budget Worksheet can help you identify areas where you can cut back on expenses by providing a clear overview of your income and expenses. By categorizing and tracking your spending, you can see where the majority of your money is going and pinpoint areas where you may be overspending. This visibility allows you to make informed decisions about where you can trim costs or make adjustments to your budget to allocate money more efficiently, ultimately helping you identify areas where you can cut back on expenses.

What is the benefit of regularly updating and reviewing the Personal Budget Worksheet?

Regularly updating and reviewing the Personal Budget Worksheet helps to track and manage expenses accurately, identify trends or areas for improvement, set realistic financial goals, and maintain financial discipline. It provides a clear overview of the individual's financial health and aids in making informed decisions about spending, saving, and investing, ultimately contributing to better financial well-being and stability.

How can I ensure accuracy when filling out the Personal Budget Worksheet?

To ensure accuracy when filling out the Personal Budget Worksheet, it's important to diligently track all sources of income and expenses, including both fixed and variable costs. Keep detailed records of your spending habits and review them regularly to ensure they align with your budget. Double-check all calculations and be thorough when categorizing expenses to avoid missing any items. It can also be helpful to update the worksheet regularly and make adjustments as needed to reflect any changes in your financial situation.

Are there any additional tips or guidelines for effectively utilizing the Personal Budget Worksheet?

Some additional tips for effectively utilizing the Personal Budget Worksheet include regularly updating the worksheet to ensure it accurately reflects your income and expenses, setting specific financial goals to track progress, organizing expenses into categories for better visibility, and reviewing the budget periodically to make necessary adjustments. Additionally, consider seeking advice from a financial advisor to optimize your budgeting efforts and achieve your financial objectives.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments