Bi- Weekly Budget Worksheet

If you find yourself searching for a practical tool to help you manage your finances efficiently, a bi-weekly budget worksheet might be just what you need. This user-friendly and customizable resource allows you to track your income and expenses, providing a clear view of your financial situation. Whether you are a college student, a family on a tight budget, or simply someone looking to gain better control over their financial commitments, a bi-weekly budget worksheet can help you stay on top of your finances.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a bi-weekly budget worksheet?

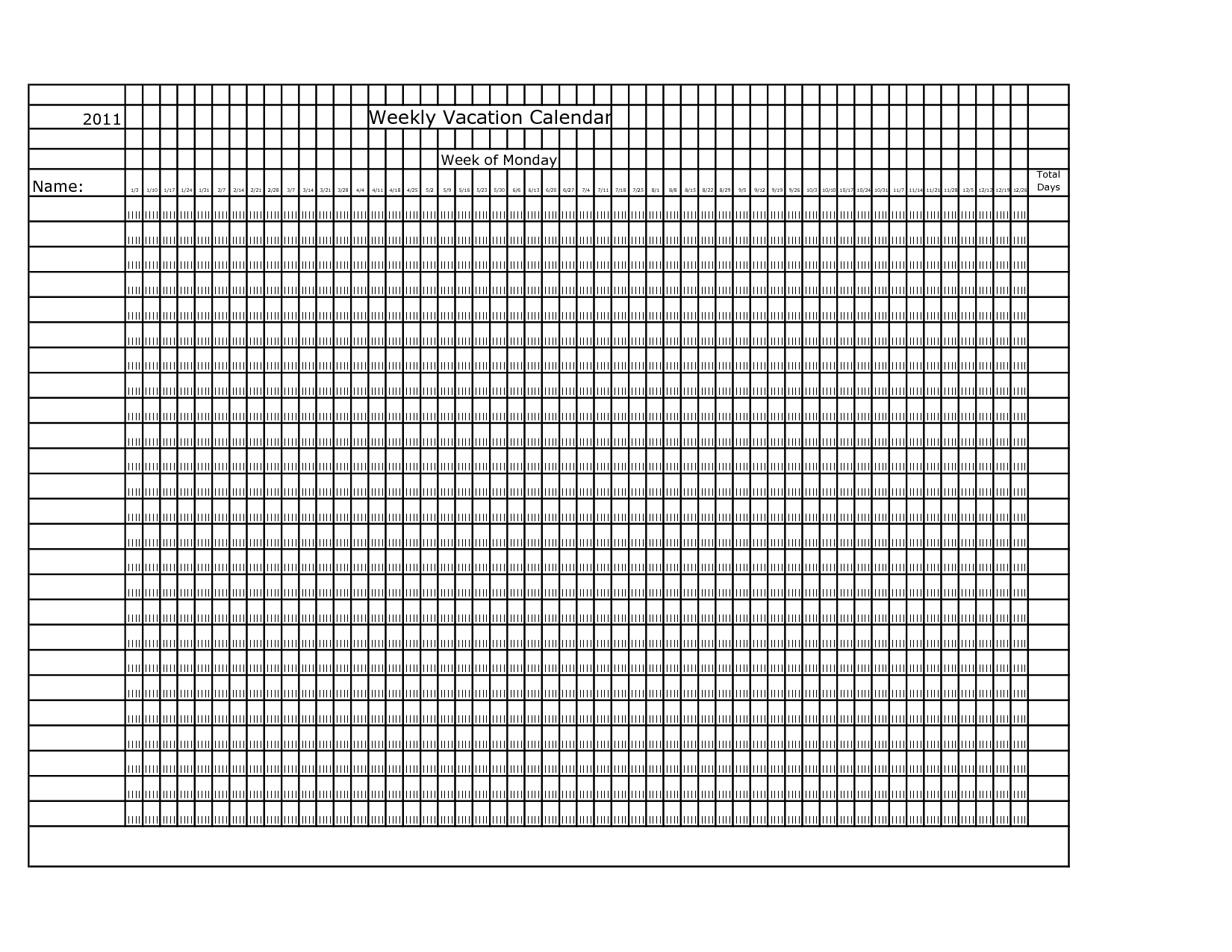

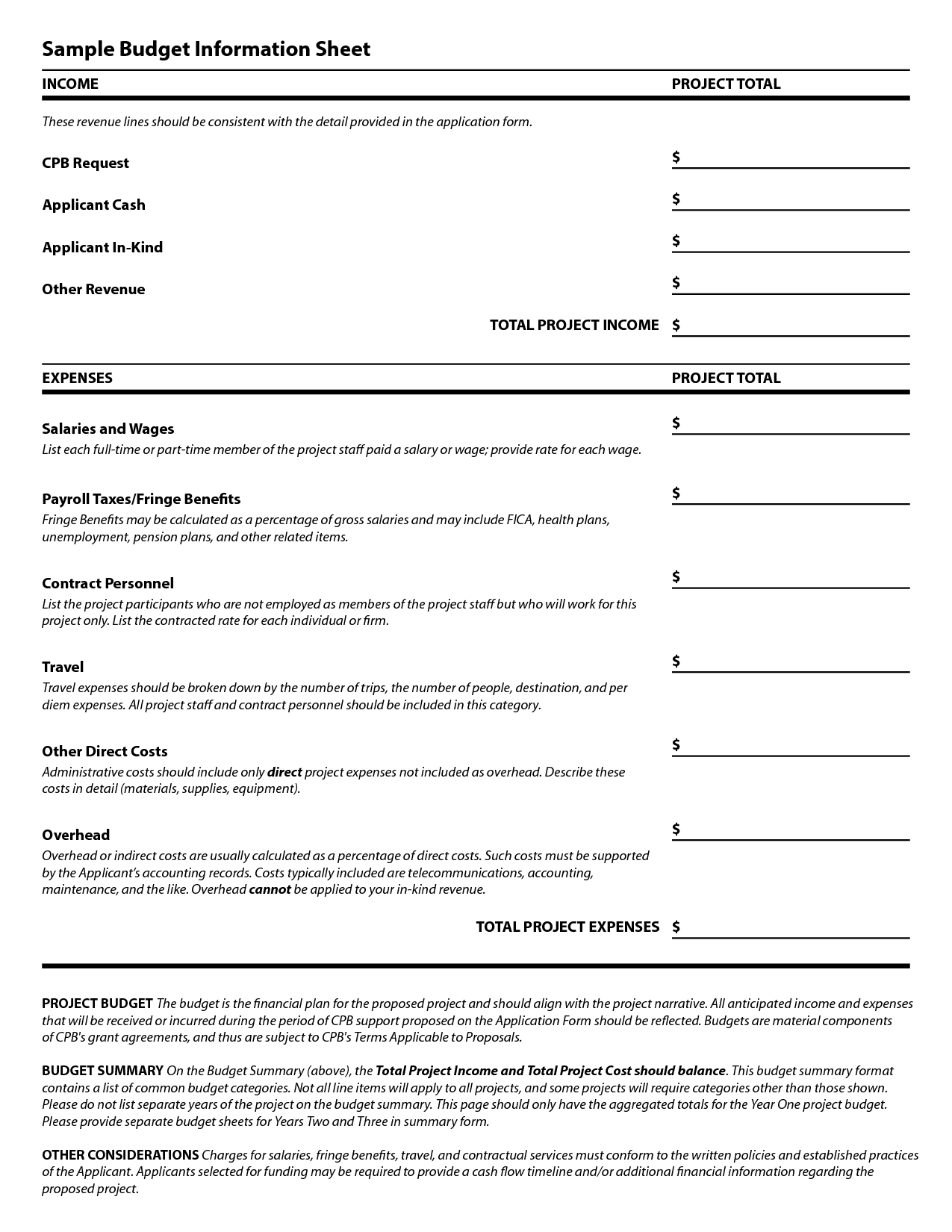

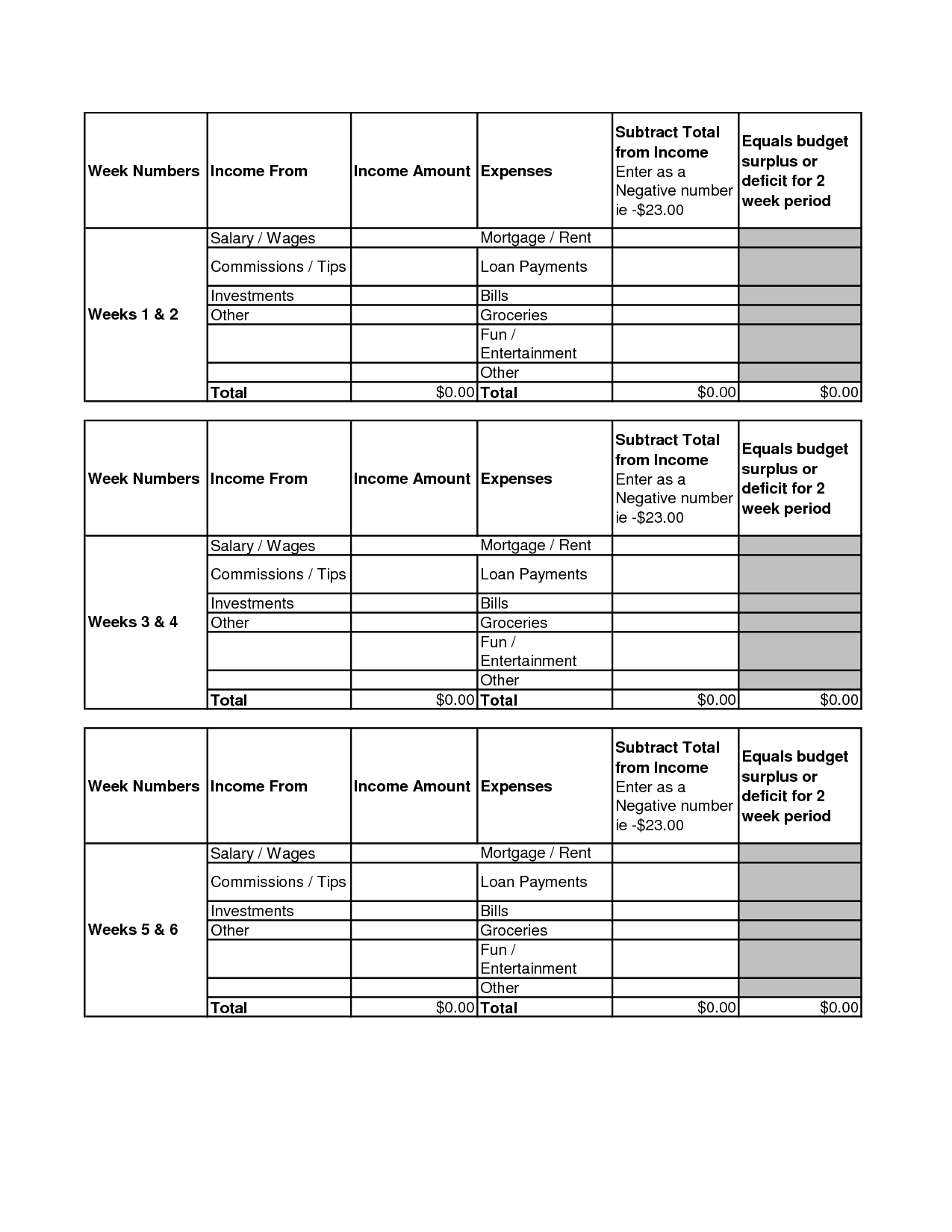

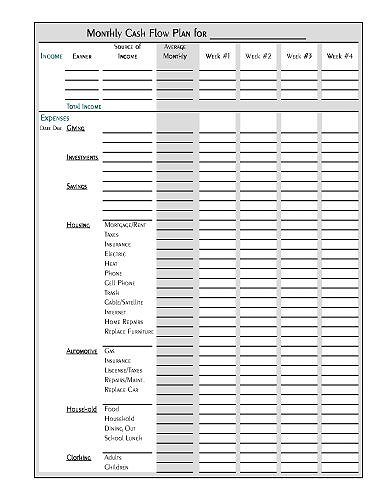

A bi-weekly budget worksheet is a tool used to track income and expenses every two weeks. It helps individuals organize their finances by detailing sources of income, planned expenses, and savings goals for each pay period. This worksheet calculates a total budget for the two-week period, allowing individuals to manage their money effectively and ensure they are meeting their financial goals.

How can a bi-weekly budget worksheet help with financial planning?

A bi-weekly budget worksheet can help with financial planning by providing a clear overview of income and expenses over a two-week period, allowing for better tracking and management of finances. By regularly updating and reviewing the worksheet, individuals can identify any patterns or trends in their spending, set realistic financial goals, and make adjustments as needed to stay on track with their budget. This tool can also help in prioritizing expenses, avoiding overspending, and saving for future expenses or goals, ultimately leading to better financial stability and decision-making.

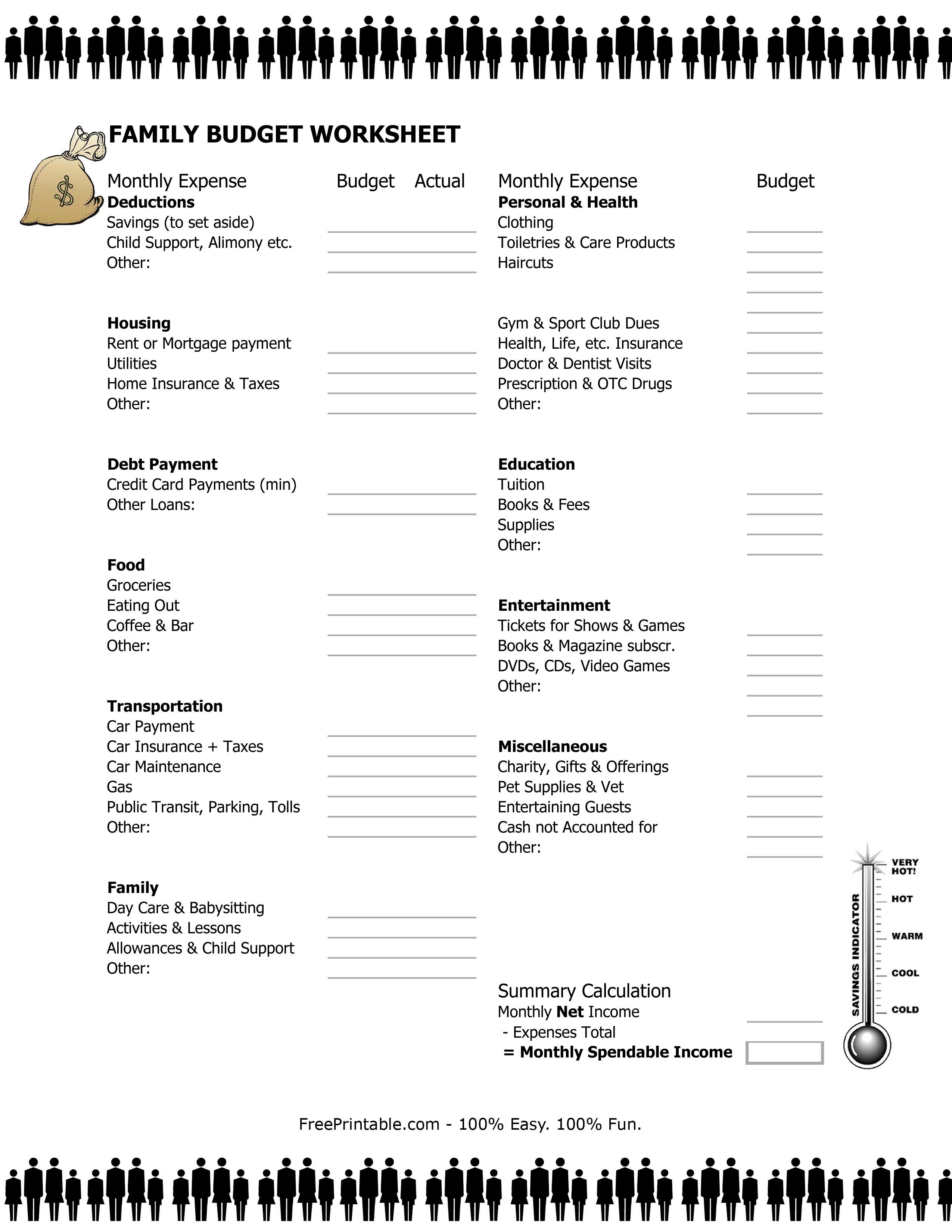

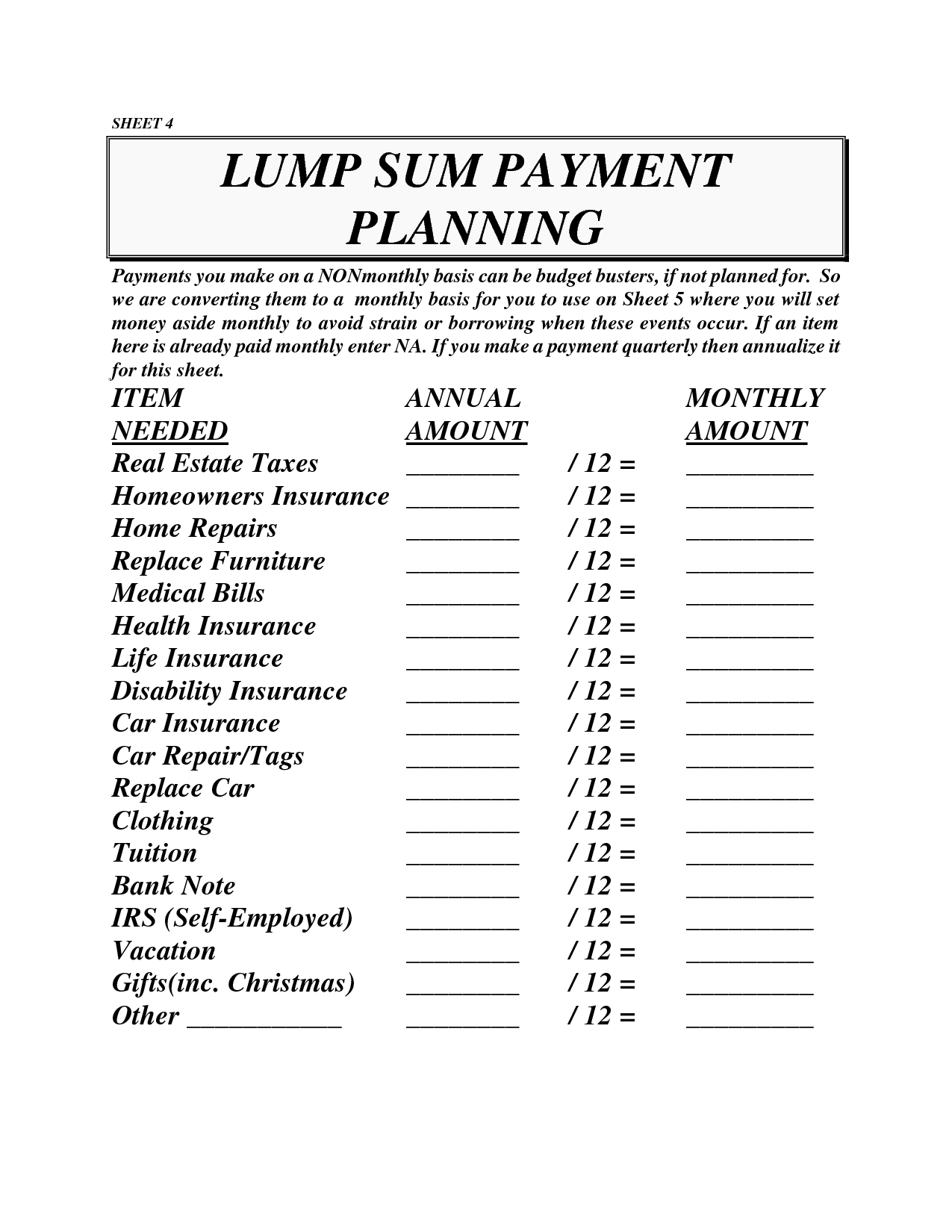

What are the common sections included in a bi-weekly budget worksheet?

Common sections included in a bi-weekly budget worksheet are income (including salary and any additional sources), fixed expenses (such as rent, utilities, and loan payments), variable expenses (like groceries, gas, and entertainment), savings goals, and a section for tracking actual spending against the budgeted amounts. Some worksheets also have sections for debt repayment, emergency fund contributions, and miscellaneous expenses.

How do you track your income and expenses using a bi-weekly budget worksheet?

To track your income and expenses using a bi-weekly budget worksheet, you should list all sources of income for each bi-weekly period at the top of the sheet. Next, create categories for your expenses such as groceries, utilities, transportation, and savings. Record all expenses under the relevant category, ensuring that you deduct them from your total income. Regularly update the worksheet with new transactions and compare your actual spending to your budgeted amounts to make adjustments as needed. Additionally, consider using spreadsheet software or budgeting apps to streamline the process and track your financial progress more efficiently.

What are the advantages of using a bi-weekly budget worksheet over a monthly budget worksheet?

Using a bi-weekly budget worksheet offers several advantages over a monthly budget worksheet, such as better cash flow management since it aligns more closely with pay periods, allowing for more frequent adjustments and course corrections, increased visibility into spending patterns on a shorter timeframe, easier identification of potential financial issues or savings opportunities sooner, and a more detailed understanding of where money is going, leading to more effective budgeting decisions and ultimately better financial control.

Can a bi-weekly budget worksheet be customized to fit personal financial goals?

Yes, a bi-weekly budget worksheet can be customized to fit personal financial goals by adjusting income, expenses, savings, and other categories according to individual needs and priorities. By clearly outlining financial objectives and allocating funds accordingly, the worksheet can help track progress and make informed decisions to achieve specific financial goals over time.

How does a bi-weekly budget worksheet assist in identifying areas of excessive spending?

A bi-weekly budget worksheet assists in identifying areas of excessive spending by helping individuals track their expenses more frequently. By recording every expense bi-weekly, individuals can easily see patterns and trends in their spending habits. This allows them to pinpoint areas where they are overspending and make necessary adjustments to stay within their budget.

Is it possible to save money more efficiently with the help of a bi-weekly budget worksheet?

Yes, it is possible to save money more efficiently with the help of a bi-weekly budget worksheet. By tracking your income and expenses every two weeks, you can have a clearer understanding of your financial situation and make better decisions on where to cut costs and save money. This regular monitoring can help you stay on track with your savings goals and make adjustments as needed to ensure you are meeting your financial targets.

How does a bi-weekly budget worksheet contribute to maintaining financial discipline?

A bi-weekly budget worksheet contributes to maintaining financial discipline by providing a clear and organized overview of income and expenses every two weeks. It helps individuals track their spending, prioritize financial goals, and avoid overspending by setting limits and sticking to them. By regularly reviewing and updating the budget worksheet, individuals can make informed financial decisions, adjust their spending habits, and stay on track with saving and investing goals, ultimately leading to better financial discipline and stability.

Are there any specific tips to maximize the effectiveness of a bi-weekly budget worksheet?

To maximize the effectiveness of a bi-weekly budget worksheet, it is important to stay organized by regularly updating your expenses and income, categorize your expenses to identify areas where you can cut back, set realistic financial goals, and track your progress towards those goals. Additionally, it is beneficial to review your budget frequently to make adjustments as needed and ensure you are staying on track with your finances.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments