Bi-Weekly Budget Worksheet

Are you in need of a helpful tool to keep your finances in check? Look no further than the Bi-Weekly Budget Worksheet. This simple and practical tool empowers individuals and families to effectively track and manage their expenses and income on a bi-weekly basis. Designed specifically for those who are seeking a clear and organized way to stay on top of their financial responsibilities, this worksheet provides a reliable method for keeping tabs on your financial well-being.

Table of Images 👆

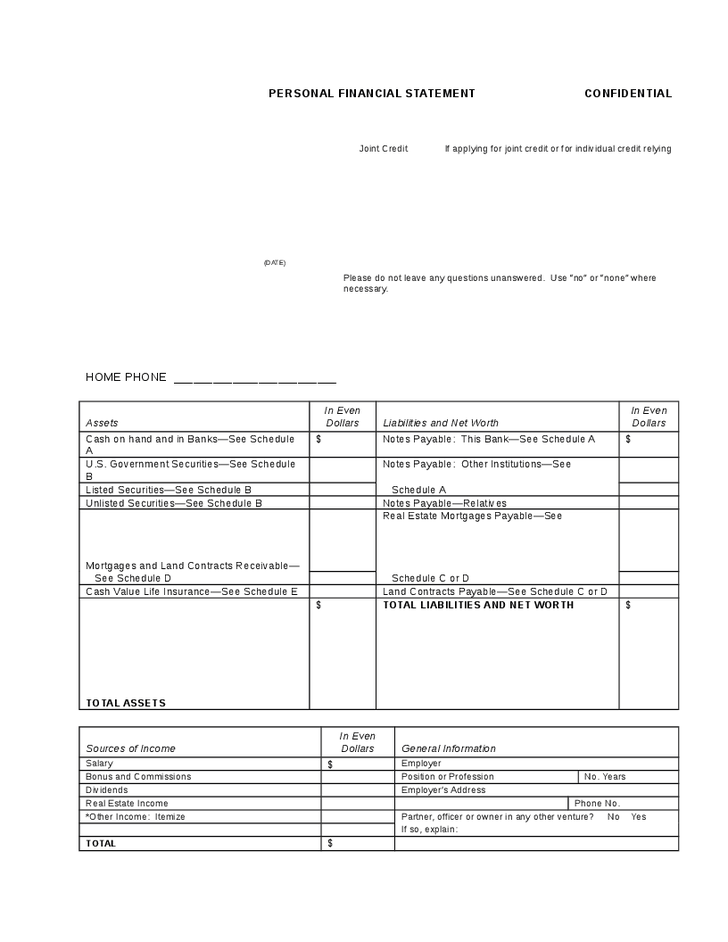

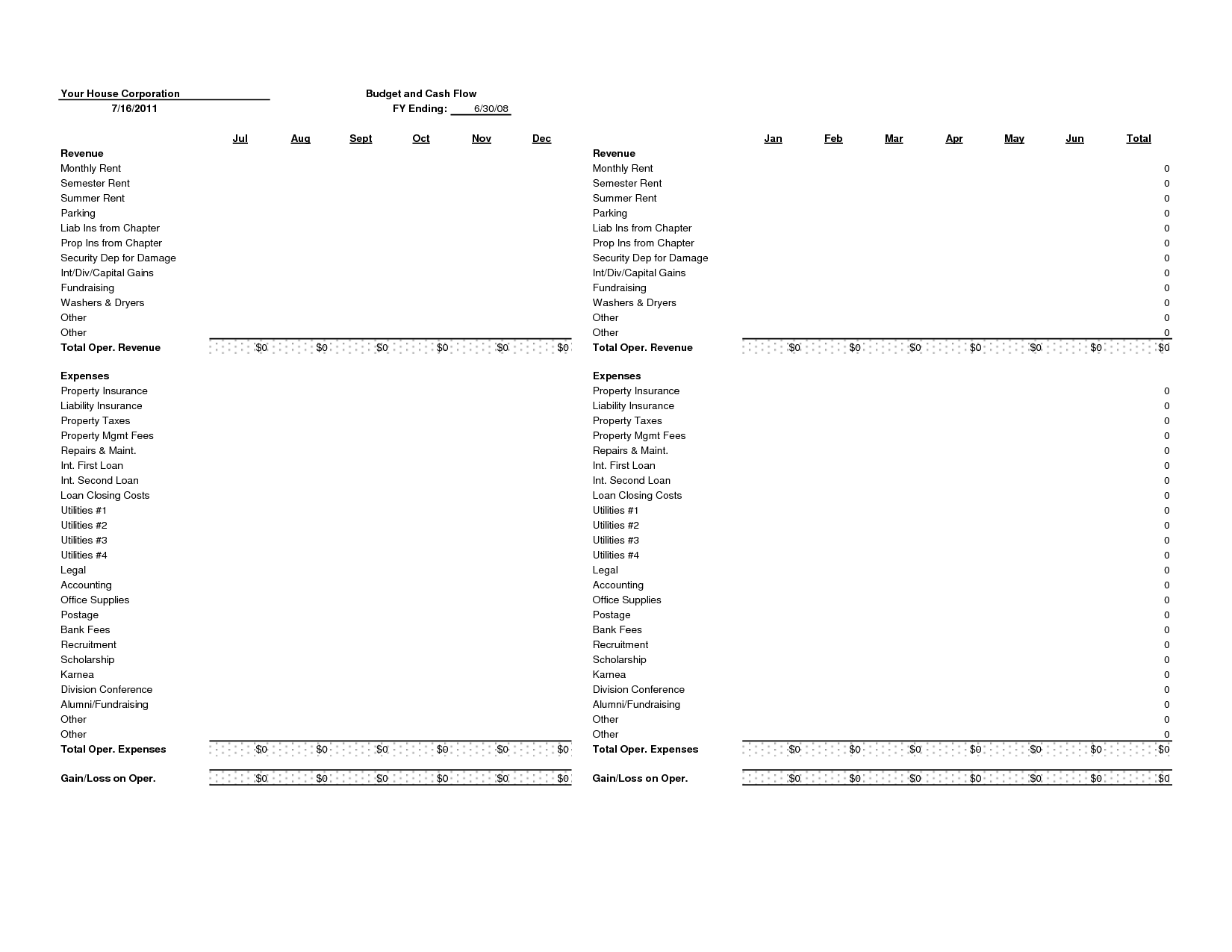

- Personal Financial Statement Template

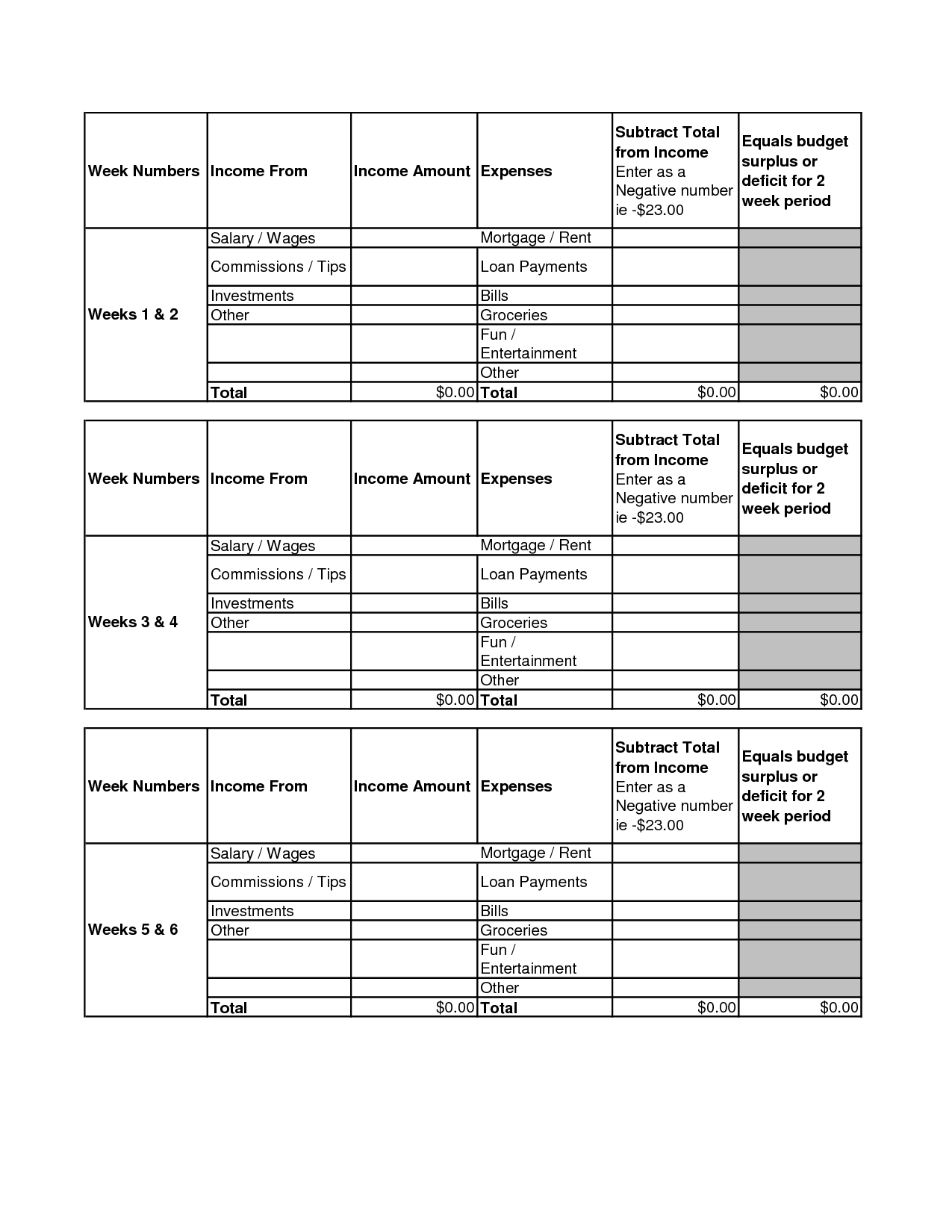

- Weekly Budget Worksheet Template

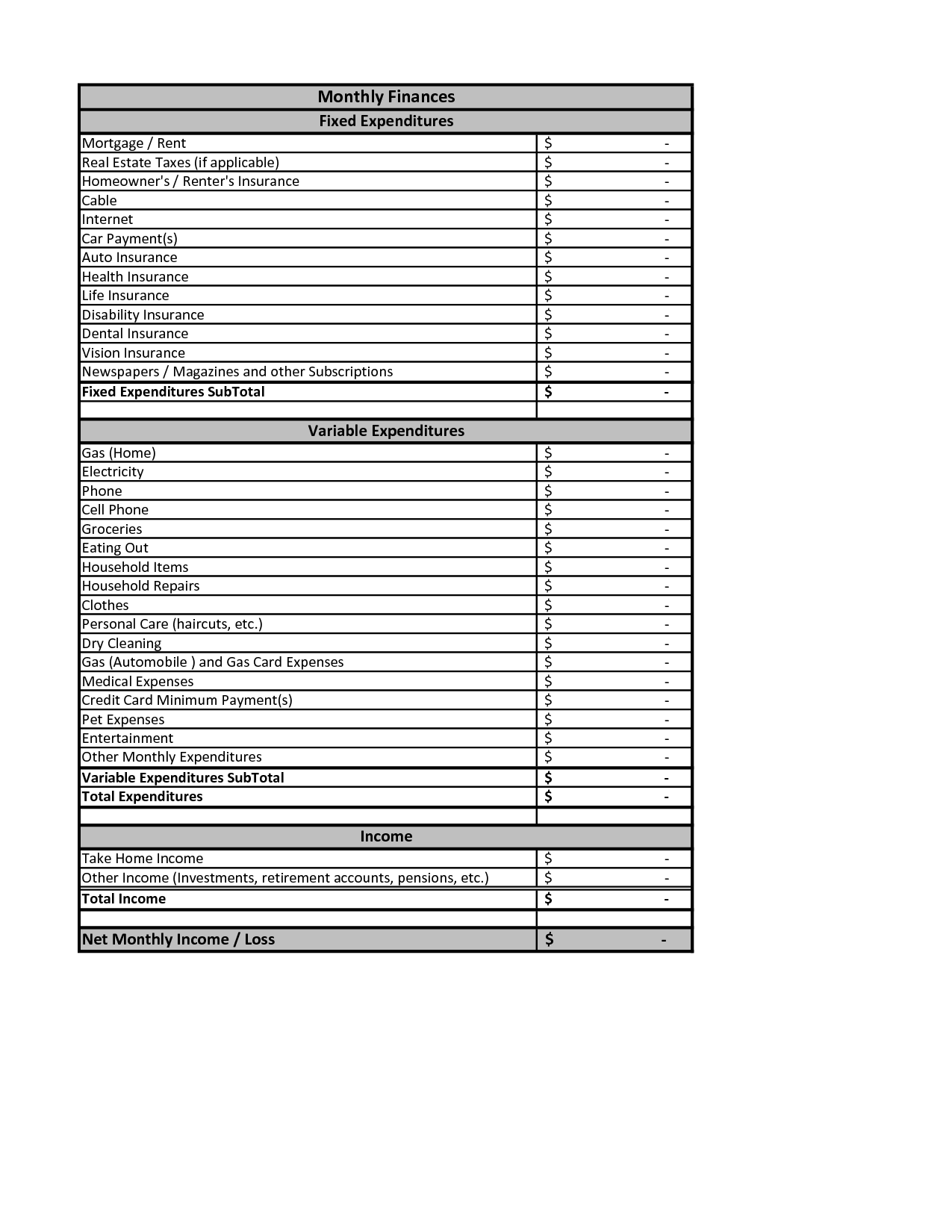

- Personal Financial Worksheet

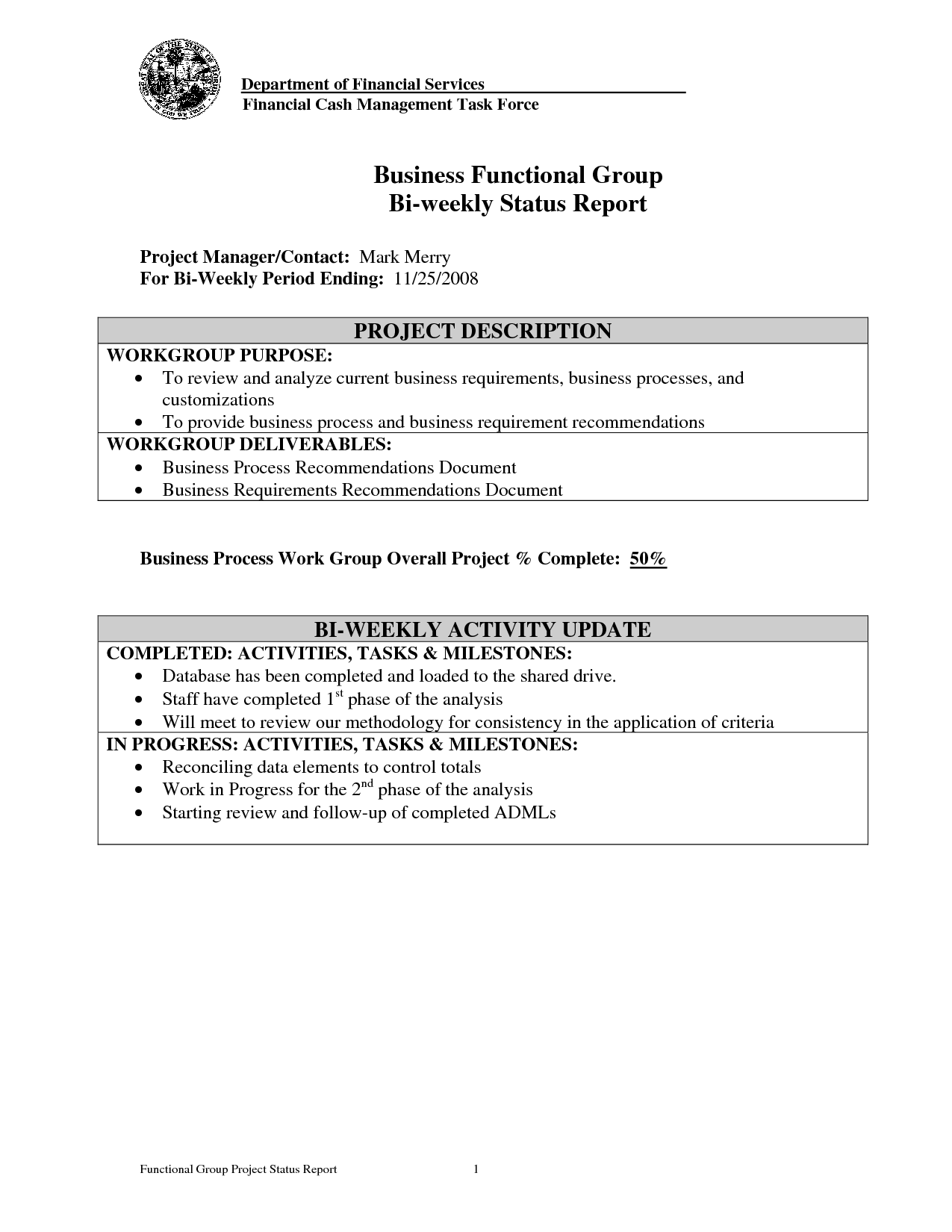

- Weekly Executive Status Report Template

- Personal Cash Flow Budget Worksheet

- Budget Planning Cartoons

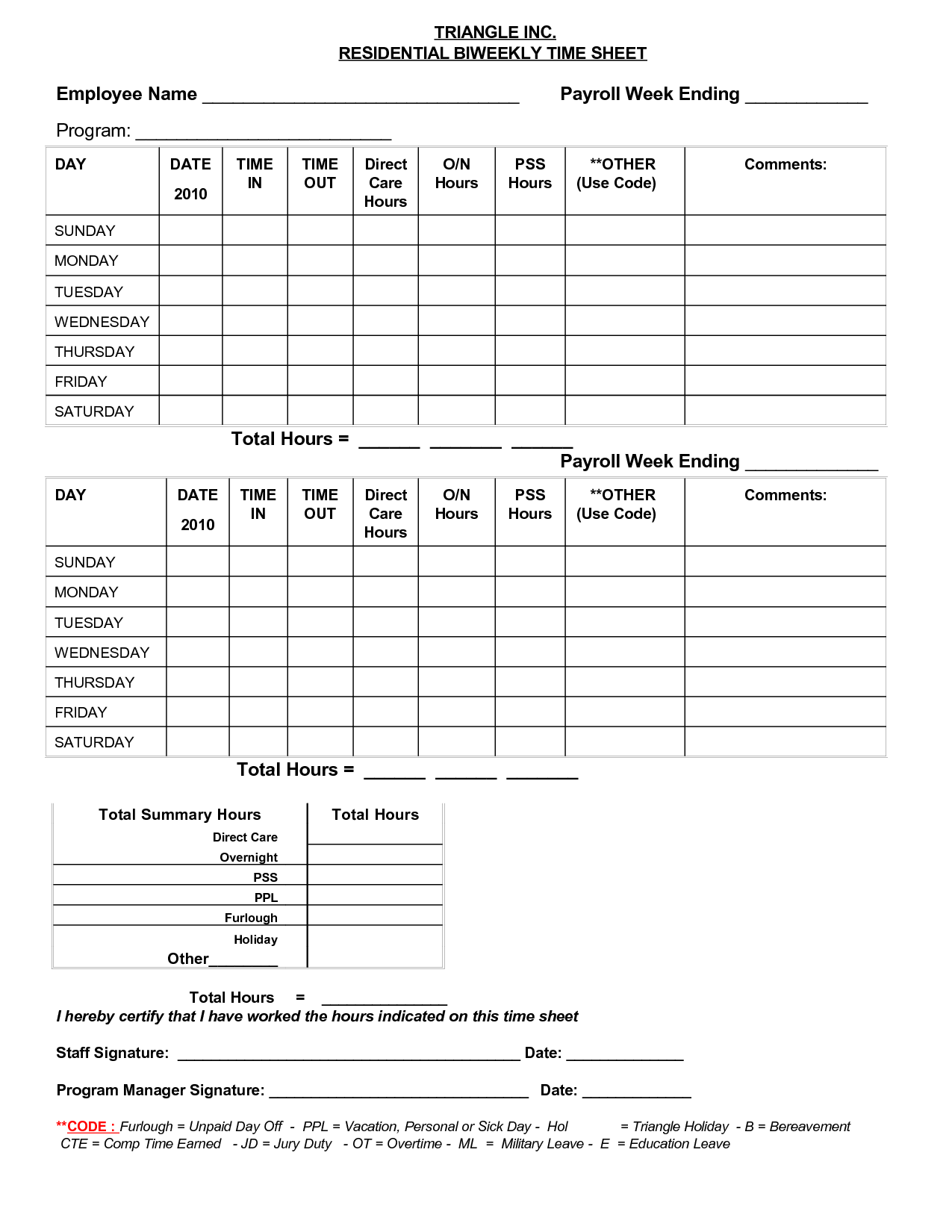

- Free Printable Bi-Weekly Time Sheets

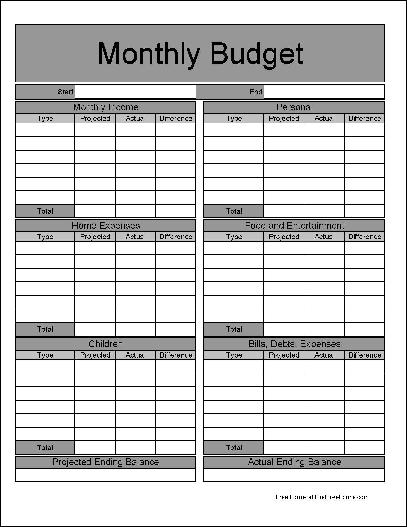

- Free Printable Monthly Budget Forms

- Printable Blank Sheet Music

- Exercise Planner Template

- Cute Dinosaur Coloring Pages for Kids

- Subcontractor Pay Stub Template

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a Bi-Weekly Budget Worksheet?

A Bi-Weekly Budget Worksheet is a tool used to track and manage finances on a two-week basis. It typically includes columns for income, expenses, savings, and debt payments, allowing individuals to allocate funds accordingly and stay organized with their financial goals. This worksheet helps individuals plan ahead, ensure they are living within their means, and make adjustments as needed to reach their financial objectives.

How does a Bi-Weekly Budget Worksheet help with financial planning?

A Bi-Weekly Budget Worksheet helps with financial planning by providing a structured framework to track income, expenses, and savings on a regular basis. It allows individuals to see their financial inflows and outflows bi-weekly, making it easier to manage their money effectively, stay organized, and make adjustments as needed. By creating a budget and sticking to it, individuals can better plan for future expenses, save for goals, and maintain control over their financial situation.

What are the main components of a Bi-Weekly Budget Worksheet?

A bi-weekly budget worksheet typically includes sections for income sources, expenses, savings goals, debt payments, and a summary of overall financial health such as a balance sheet or net worth calculation. It helps individuals track their cash flow, set financial goals, and make informed decisions about their spending and saving habits.

How do you calculate your income on a Bi-Weekly Budget Worksheet?

To calculate your income on a bi-weekly budget worksheet, add up all sources of income received in a two-week period, whether it's from salaries, wages, tips, bonuses, or other sources. Include any additional income such as rental income, interest, or freelance work. Make sure to account for any deductions or withholdings such as taxes, retirement contributions, or healthcare premiums to determine your net income for the bi-weekly period that will be used in your budget planning.

How can you track your expenses using a Bi-Weekly Budget Worksheet?

To track your expenses using a Bi-Weekly Budget Worksheet, start by listing all sources of income at the top of the sheet. Then, categorize your expenses such as groceries, utilities, housing, transportation, and entertainment. Allocate a specific amount or percentage of your income for each expense category. As you incur expenses, record them in their respective categories on the worksheet and subtract the amount from the allocated budget. Regularly reviewing and updating the worksheet will help you stay on track with your spending and make adjustments as needed to align with your financial goals.

What are some common categories for expenses on a Bi-Weekly Budget Worksheet?

Common categories for expenses on a bi-weekly budget worksheet include housing (rent or mortgage), utilities (electricity, gas, water), transportation (car payment, gas, insurance), groceries, dining out, entertainment, personal care (such as haircuts or toiletries), savings (emergency fund, retirement), debt payments (credit card, student loans), and miscellaneous expenses (gifts, pet care). It is important to tailor these categories to your specific financial situation and needs.

How do you prioritize your expenses on a Bi-Weekly Budget Worksheet?

When prioritizing expenses on a Bi-Weekly Budget Worksheet, start by listing all essential expenses such as rent or mortgage, utilities, groceries, and transportation costs. Allocate a portion for savings and emergency funds. Then, categorize discretionary expenses like entertainment or dining out and allocate funds accordingly. Keep track of due dates for bills and prioritize them accordingly. Adjust as needed to ensure you cover essentials while also saving and managing discretionary spending within your means.

How can a Bi-Weekly Budget Worksheet help with saving goals?

A bi-weekly budget worksheet can help with saving goals by providing a structured way to track income and expenses on a regular basis. By clearly outlining where money is being spent and setting aside a portion for savings each pay period, individuals can better monitor their financial habits and make adjustments as needed to reach their saving goals. This tool enables people to prioritize saving as a consistent part of their budget, leading to more disciplined and successful saving strategies.

How often should you review and update your Bi-Weekly Budget Worksheet?

It is recommended to review and update your Bi-Weekly Budget Worksheet at least once a month. This allows you to track changes in your expenses, income, and savings goals, and make necessary adjustments to stay on track with your financial objectives. Regularly reviewing and updating your budget helps ensure that it remains accurate and effective in helping you manage your finances efficiently.

Are there any common pitfalls to avoid when using a Bi-Weekly Budget Worksheet?

Some common pitfalls to avoid when using a Bi-Weekly Budget Worksheet include failing to include all sources of income, not accurately tracking expenses, underestimating variable expenses, neglecting to adjust the budget when circumstances change, and not regularly reviewing and adjusting the budget to stay on track with financial goals. It is important to be diligent in updating and following the budget to ensure its effectiveness in managing finances efficiently.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments