2012 Federal Information Worksheet

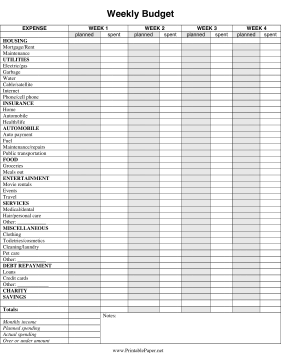

The 2012 Federal Information Worksheet is a valuable resource for individuals and businesses seeking to better understand their tax obligations and maximize their financial savings. This comprehensive worksheet provides a clear and organized breakdown of all the necessary information and documentation required for accurately completing federal tax forms. Whether you are an individual taxpayer or a small business owner, this worksheet serves as an essential tool in helping you navigate through the complex world of tax preparation.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is the purpose of the 2012 Federal Information Worksheet?

The purpose of the 2012 Federal Information Worksheet is to gather specific information such as income, deductions, credits, and other relevant details to accurately complete and file federal income tax returns for the tax year 2012. It helps in ensuring that individuals provide the Internal Revenue Service (IRS) with all the necessary information needed to determine their tax liability and potential refunds for that particular tax year.

Who is required to complete the 2012 Federal Information Worksheet?

Individuals who have income from rental properties, partnerships, S corporations, estates, trusts, and real estate mortgage investment conduits are required to complete the 2012 Federal Information Worksheet.

How can one obtain a copy of the 2012 Federal Information Worksheet?

To obtain a copy of the 2012 Federal Information Worksheet, you can contact the Internal Revenue Service (IRS) directly. The IRS provides access to past tax forms and worksheets on their website or through their customer service line. You may also visit a local IRS office or tax preparation service for assistance in obtaining a copy of the specific worksheet you need.

When is the deadline for submitting the completed worksheet?

The deadline for submitting the completed worksheet is next Friday at 5:00 PM.

What information is requested on the 2012 Federal Information Worksheet?

The 2012 Federal Information Worksheet typically requests information related to personal and financial details such as income, deductions, credits, and other pertinent tax-related information for the tax year 2012. This form assists individuals in accurately filling out their federal income tax returns by providing a summary of key information needed for reporting to the Internal Revenue Service (IRS) for that specific tax year.

Are there any penalties for not completing or submitting the worksheet?

Yes, there may be penalties for not completing or submitting a worksheet, depending on the specific guidelines set by the instructor or organization. These penalties could include deductions in grades, missed credits, or other consequences for failing to meet the requirements within the designated timeframe. It is important to communicate with your instructor or supervisor if you are unable to complete or submit the worksheet on time to discuss any potential consequences or make alternative arrangements.

Are there any specific instructions on how to fill out the 2012 Federal Information Worksheet?

Yes, there are specific instructions on how to fill out the 2012 Federal Information Worksheet provided by the IRS. You can refer to the official IRS website or the instructions accompanying the worksheet for guidelines on accurately completing the form. It is important to carefully follow these instructions to ensure accurate reporting of your federal tax information for the year 2012.

Can the worksheet be completed electronically or is it only accepted as a hard copy?

Unfortunately, the worksheet can only be completed electronically, and it is not accepted as a hard copy.

Are there any changes or updates from previous versions of the Federal Information Worksheet?

As an AI language model, I do not have real-time information on specific documents like the Federal Information Worksheet. It is recommended to directly consult the latest version of the Federal Information Worksheet or relevant authorities for any changes or updates from previous versions.

What is the purpose of providing this information to the federal government?

The purpose of providing information to the federal government is to ensure compliance with laws and regulations, facilitate transparency and accountability, support decision-making, allocate resources effectively, and protect the well-being and interests of the public. Gathering accurate data and insights allows the government to better serve its citizens, address societal challenges, and uphold the rule of law.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments