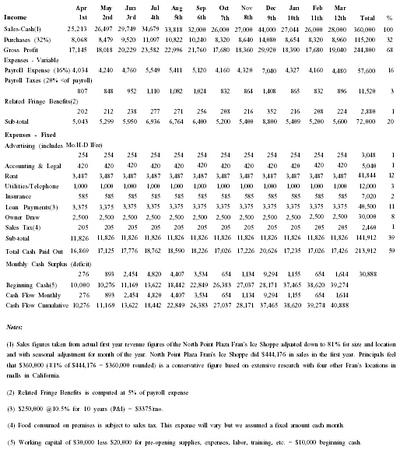

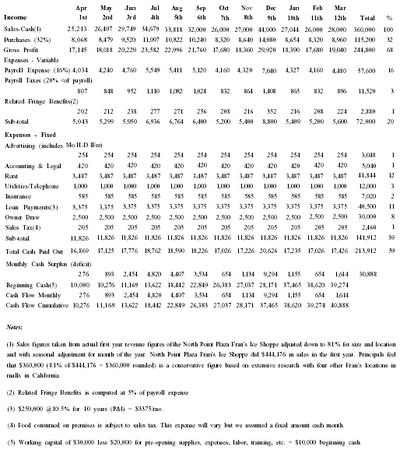

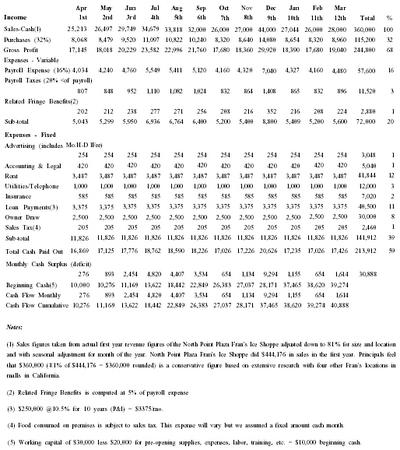

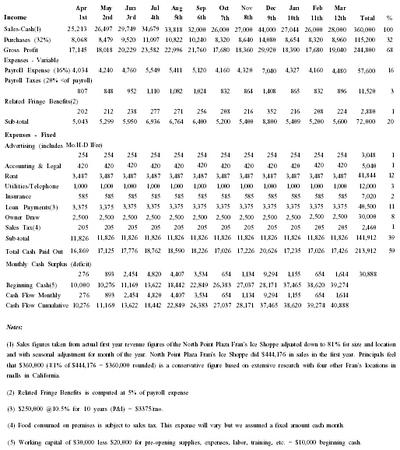

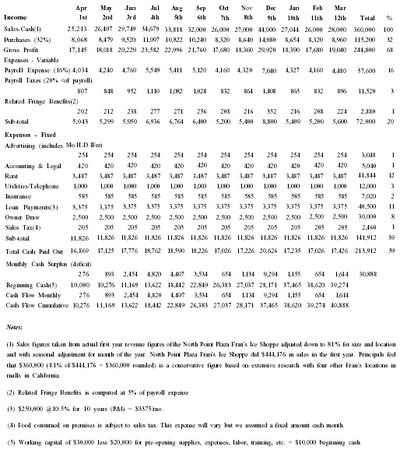

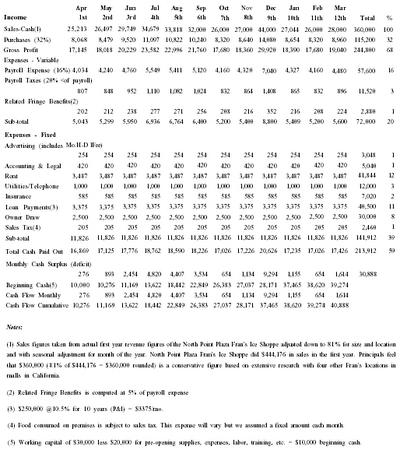

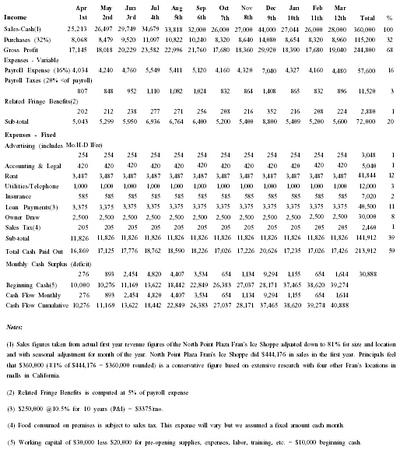

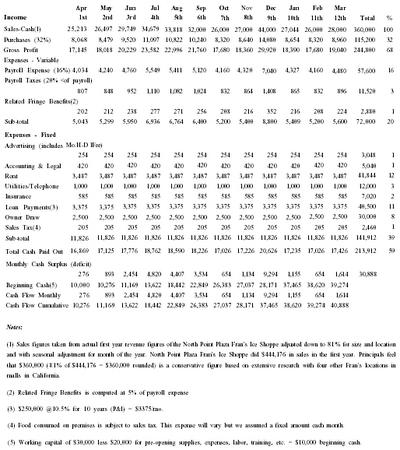

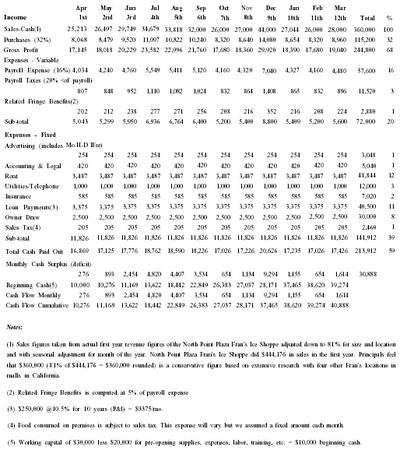

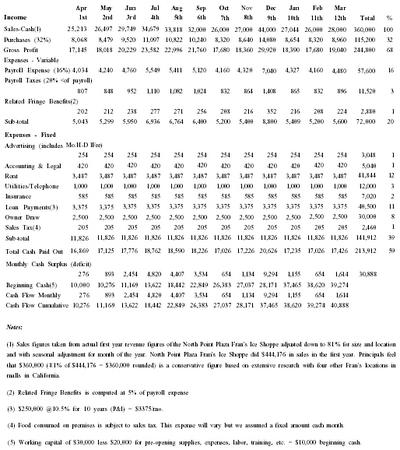

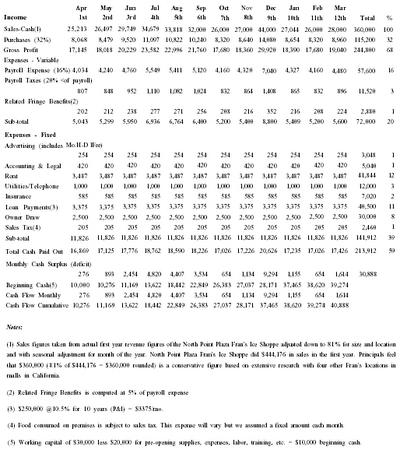

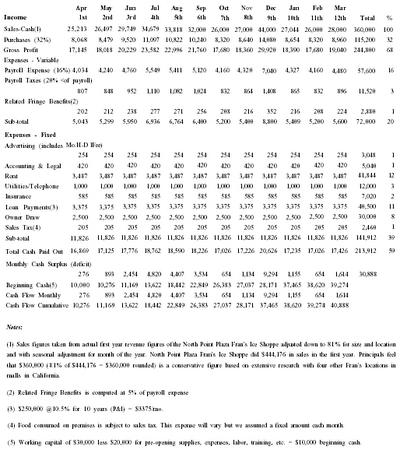

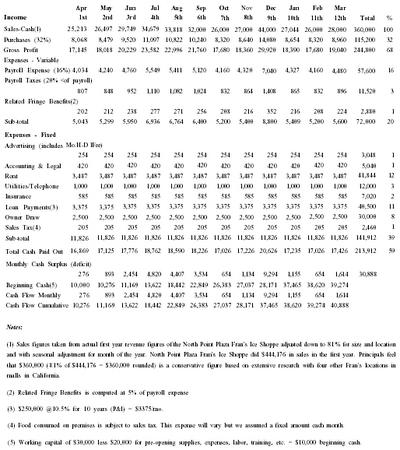

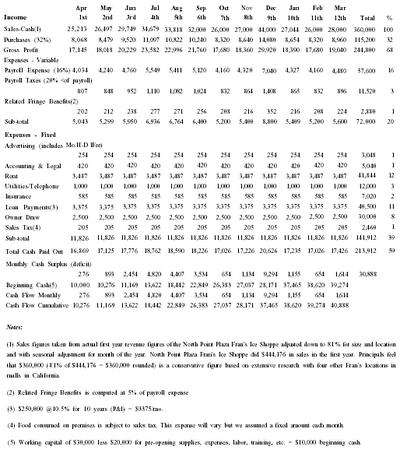

12 Month Cash Flow Worksheet

Are you a small business owner or entrepreneur seeking a comprehensive tool to track your finances? Look no further than the 12 Month Cash Flow Worksheet. This invaluable resource allows you to meticulously record and monitor your income and expenses over the course of a year, enabling you to make informed financial decisions and plan for the future. Whether you are looking to manage your company's finances more effectively or simply want to gain a clearer understanding of your personal budget, this worksheet offers an entity and subject-focused approach to help you achieve your financial goals.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

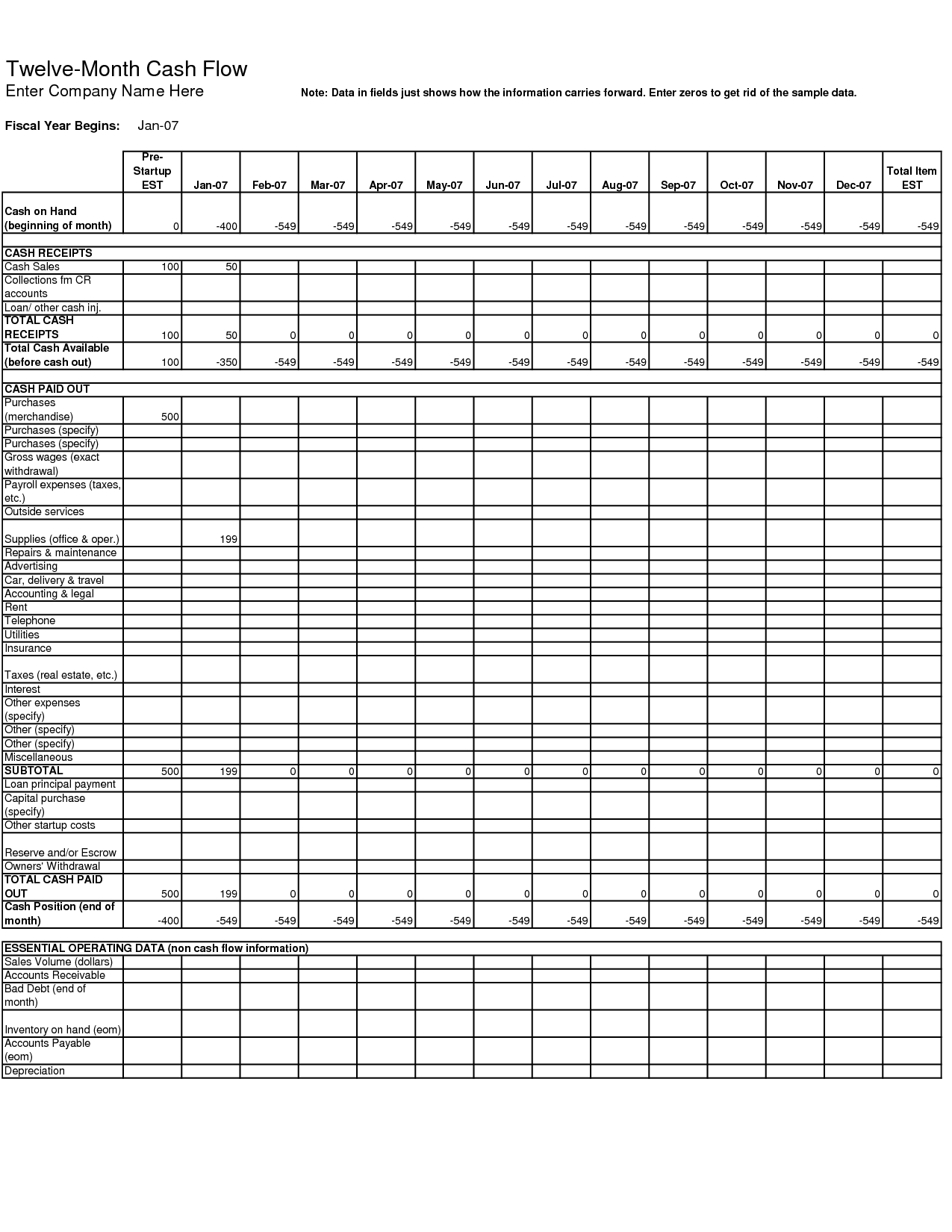

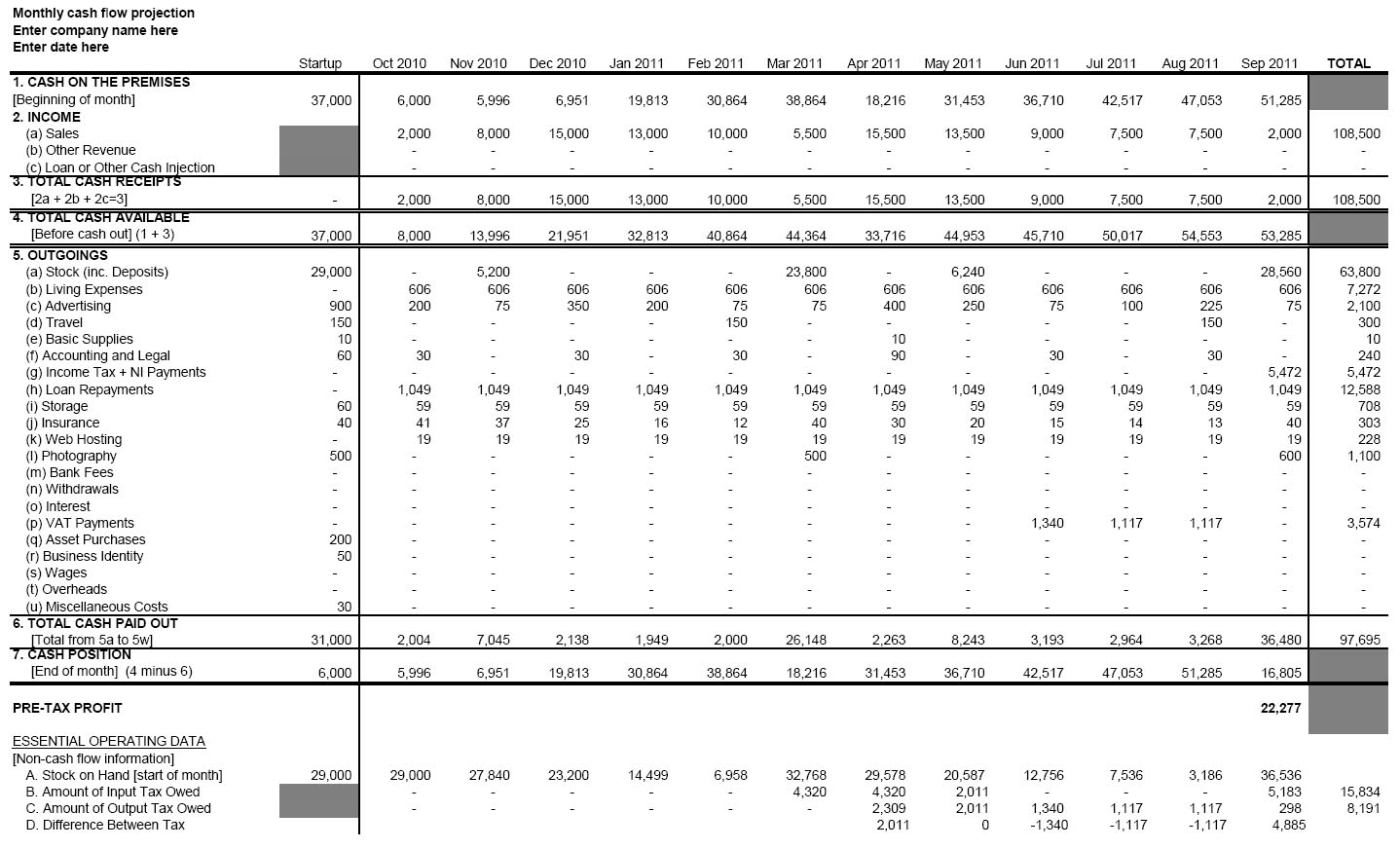

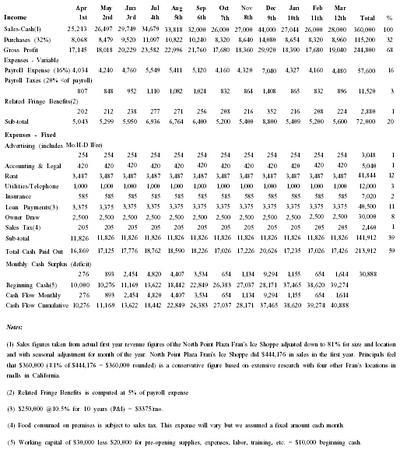

What is a 12 Month Cash Flow Worksheet?

A 12 Month Cash Flow Worksheet is a financial tool that helps individuals or businesses track and manage their incoming and outgoing cash flow over the course of a year. It typically includes sections for listing monthly income sources, such as salaries or revenue, as well as monthly expenses like rent, utilities, and other costs. By monitoring and analyzing this information, users can gain insights into their financial health, identify potential cash flow issues, and make informed decisions to improve their financial situation.

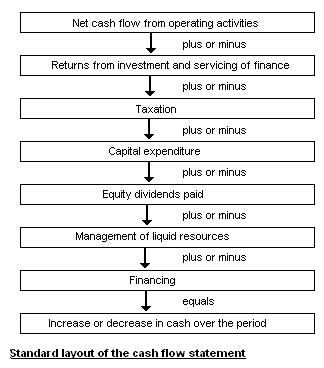

What is the purpose of creating a 12 Month Cash Flow Worksheet?

The purpose of creating a 12 Month Cash Flow Worksheet is to track and monitor a business's inflows and outflows of cash over a 12-month period. It helps in forecasting liquidity, identifying trends, managing expenses, and ensuring that the business has enough cash to cover its obligations. By having a clear picture of the cash flow, businesses can make informed decisions, plan for the future, and ensure financial stability.

What information should be included in a 12 Month Cash Flow Worksheet?

A 12 Month Cash Flow Worksheet should include details on monthly income sources, such as sales revenue, investments, loans, etc., as well as monthly expenses like rent, utilities, employee wages, and other operational costs. It should also factor in non-operational income and expenses, such as one-time or sporadic payments. Additionally, it should include the opening balance, ending balance, and cash flow for each month to give a comprehensive view of the cash position and ensure effective financial planning and management over the course of a year.

How can a 12 Month Cash Flow Worksheet benefit a business or individual?

A 12 Month Cash Flow Worksheet can benefit a business or individual by providing a comprehensive overview of their expected income and expenses over the upcoming year. It allows for better planning and budgeting, aiding in the identification of potential cash flow issues and helping to make informed financial decisions based on a clear understanding of their financial position. By tracking and projecting cash flow in advance, businesses and individuals can better manage their finances, optimize resource allocation, and prepare for any fluctuations or downturns in income.

What are the key components of a 12 Month Cash Flow Worksheet?

A 12 Month Cash Flow Worksheet typically includes detailed sections for projected revenue, expenses, and net cash flow for each month of the year. It also factors in funding sources, such as loans or investments, as well as any anticipated one-time cash infusions or outflows. Additionally, it may incorporate sensitivity analysis to account for potential fluctuations in income or expenses, and track actual financial performance against projections to facilitate regular monitoring and adjustment of the cash flow strategy.

How can a 12 Month Cash Flow Worksheet help track and manage expenses?

A 12 Month Cash Flow Worksheet can help track and manage expenses by providing a comprehensive overview of income sources, fixed expenses, variable expenses, and savings goals over a year-long period. By detailing expected inflows and outflows on a monthly basis, individuals can anticipate cash shortages, identify potential areas for cost-cutting, prioritize spending, and ensure financial stability. Regularly updating and reviewing the worksheet allows for better financial planning, decision-making, and adjustment to changing circumstances, ultimately helping to achieve financial goals and stay on track with budgeting.

What role does a 12 Month Cash Flow Worksheet play in financial planning?

A 12 Month Cash Flow Worksheet plays a crucial role in financial planning by helping individuals or businesses track and manage their cash inflows and outflows over a set period of time. This tool provides a clear overview of anticipated revenues and expenses, allowing for better decision-making, budgeting, and identifying potential cash flow issues. By regularly updating and analyzing the data in the worksheet, it enables effective forecasting, ensuring financial stability and the ability to achieve financial goals.

How can a 12 Month Cash Flow Worksheet assist in identifying trends or patterns in income and expenses?

A 12 Month Cash Flow Worksheet allows for a comprehensive overview of income and expenses over a year-long period, enabling the identification of trends or patterns in financial flows. By inputting data for each month, individuals or businesses can track variations in income and expenses, pinpointing consistent revenue streams or cost fluctuations. Analyzing these trends can help in making informed decisions, such as adjusting budgets, forecasting future cash flows, or identifying areas for cost-cutting or revenue growth. Ultimately, the worksheet provides a visual representation that aids in understanding financial patterns and making proactive financial decisions.

How often should a 12 Month Cash Flow Worksheet be updated or reviewed?

A 12 Month Cash Flow Worksheet should ideally be updated and reviewed on a monthly basis to ensure accuracy and effectiveness in managing finances. Regular monthly reviews can help in identifying any potential issues, monitoring cash flow patterns, and making timely adjustments to financial strategies or budgets as needed.

What are some potential challenges or pitfalls to watch out for when using a 12 Month Cash Flow Worksheet?

Some potential challenges or pitfalls to watch out for when using a 12 Month Cash Flow Worksheet include overlooking variable expenses, underestimating or overestimating income, failing to account for seasonality in revenue, not updating the worksheet regularly with actual data, ignoring potential cash flow fluctuations, and not building in a buffer for unexpected expenses or revenue shortfalls. It is important to review and adjust the worksheet frequently to ensure accuracy and to make informed financial decisions.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments